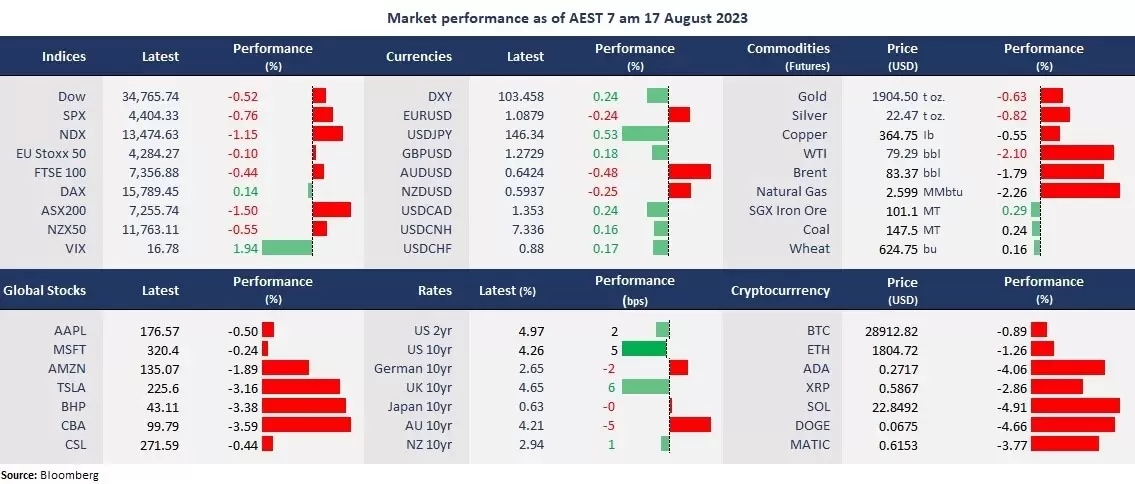

US stocks fell for the second straight trading day after the Fed’s minutes showed that more rate hikes could be on the table if sticky inflation persists. The hawkish narrative pushed the US bond yields higher, with the 10-year Treasury yield hitting a 15-year high of 4.27%. Inflation woes and jumping bond yields rattle equities, taking Wall Street into a correction phase after a stellar bull run in the first half of the year.

The recent resilient US economic data offers evidence for a “soft landing” or “no landing” scenario and strengthens the odds of higher for longer interest rates, sending the USD to a two-month high and crashing Asian currencies, with the Japanese Yen weakening to the lowest against the US dollar since November 2022. Commodities were also hit by a firmed USD, with crude oil slumping for the third straight trading day and spot gold tumbling to under 1,900 at a five-month low.

In Asia, China’s rate cuts did not save its stocks from downturns as economic concerns continued to weigh on sentiment, with the Hang Seng Index falling to a year-low level on Wednesday. Central banks in the APAC region started turning dovish, with the RBA signaling a peaking rate and the RBNZ pausing hikes for the second consecutive time. However, the sharp decline in Yen may trigger an intervention of the BOJ.

Futures point to a lower open across Asia. The Nikkei 225 futures were down 0.24%, the ASX 200 futures slid 0.25%, and the Hang Seng Index futures fell 1.56%.

Price movers:

- 10 out of 11 sectors finished lower in the S&P 500, with Consumer Discretionary, Communication Services, and Real Estate, leading losses, down 1.27%, 1.21%, and 1.20%, respectively. Utilities is the only sector that ended in the green, up 0.46%.

- Tesla cut prices further in China amid fierce competition and weak demands. The EV maker slashed prices of Model S and Model X cars by 54,000 yuan and 62,000 yuan, respectively. The price cuts may further press on its profit after reporting the lowest margin in the second quarter.

- The Chinese tech giant, Tencent, reported a surge in profit in the second quarter due to a surge in its advertising business. But the pace of growth missed the market’s expectations. Tencent’s revenue was 149.21 billion yuan (US$20.46 billion), lower than an expected 151.73 billion yuan, up 11% year on year. Profit attributable to equity holders is 26.17 billion yuan, short of an estimated 33.42 billion yuan, but surging 42% from a year ago. Tencent’s gaming division sees tepid recovery due to regulatory strains. The company also said it would launch its proprietary foundational AI model later this year.

- The British Pound strengthened following cooling inflation data in the UK. The country’s July CPI printed at 6.8%, in line with expectations, but core CPI stayed unchanged at 6.9%, higher than the consensus of 6.8%, which could promote the BOE to continue its hiking cycle.

- WTI futures fell below $80 per barrel, extending the third-day losing streak. While China sees weakening demands due to the recent economic woes, the US oil producers are expected to accelerate outputs to fight for market shares amid OPEC+’s production cuts. Traders may re-assess demand and supply balances which caused the oil market’s pullback from the multi-week rally.

- Coinbase’s share rose 3% before cutting gains after winning approval to offer crypto futures trading in the US. The crypto exchange can now offer bitcoin and ether futures to retail clients in the US. However, this did not offer a bullish push to the cryptocurrencies as Bitcoin fell below 29,000.

ASX and NZX announcements/news:

- Telstra Group Limited (ASX: TLS)’s profit rose 13% to A$2.051 billion for FY23. The full-year revenue was A$22.702 billion, up 6.7%. The interim dividend is 8.5 cents per share, bringing the full-year amount to 17 cents per share, up 3% from a year ago.

- Origin Energy Limited (ASX: ORG)’s 2023 fully-year revenue rose 14% to A$16.48 billion, with a dividend of 20 cents per share, fully franked. Underlying net profit rose to A$747 million, compared with $407 million in FY22. Higher earnings were seen from Energy Markets, Octopus Energy, and Integrated Gas.

Today’s agenda:

- New Zealand’s Q2 PPI

- Japan’s trade balance for June

- Australian employment for July

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.