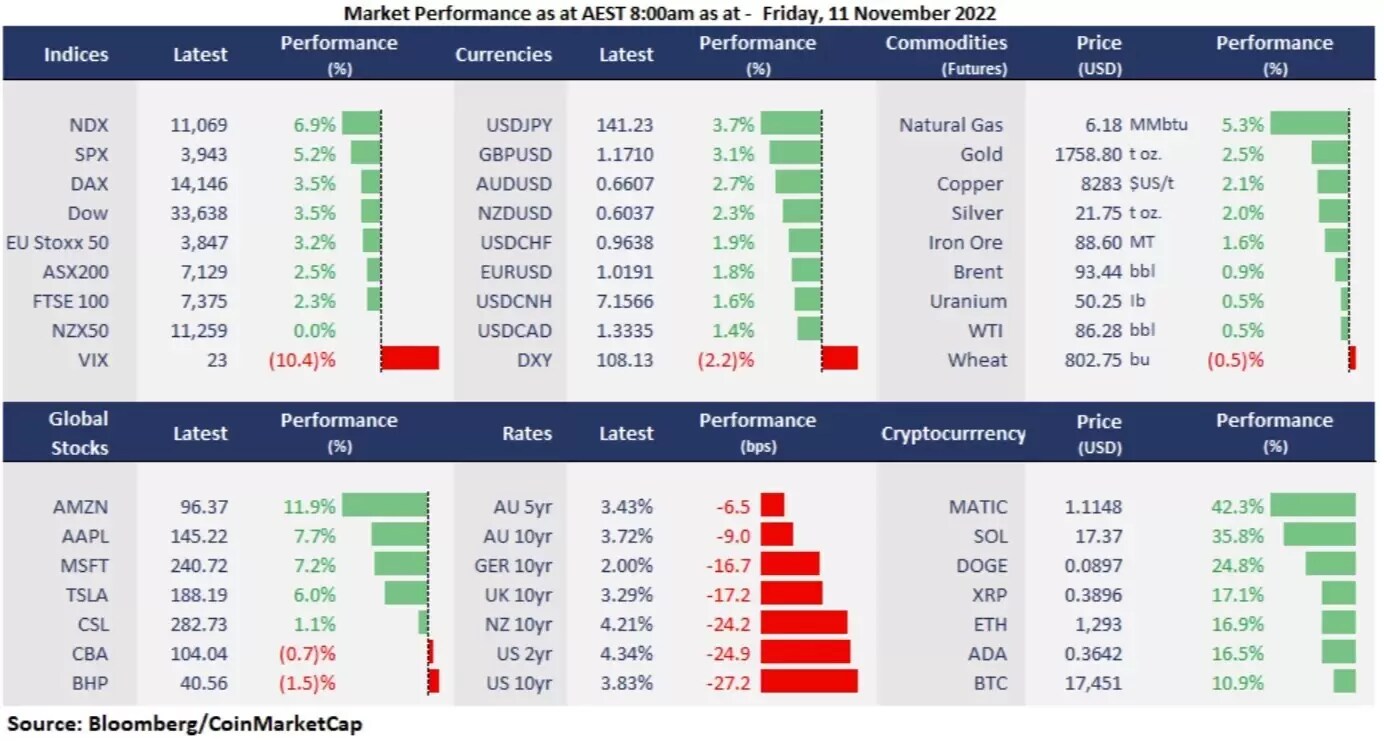

Wall Street soared on the cooler-than-expected US October CPI data, which printed at 7.7% year on year, well below an estimated 8.0 %, also a sharp decline from 8.2% in September. The Core CPI came to 6.3% annually, lower than an expected 6.5%, falling from 6.6% the prior month. It is the first time that both headline inflation and core inflation cooled from the prior reading since the Fed started the rate hike cycle in March. The data sparked intense dip-buys in risk assets, sending the tech-heavy index, Nasdaq soring 7.4% as the US 2-year bond yield sharply declined 30 basis points to 4.33%, which is the most sensitive to the Fed funds rates, suggesting that a smaller scale of a 50-bps rate hike is on the table in December. The US 10-year bond yields also plummeted to a one-month low of 3.83% from 4.10% a day ago. Since the next Fed policy meeting is a month away, the rebounding optimism may stay till more signals from the Reserve bank by then.

- Dow soared 1,200 points, having had the best day in more than two years, consolidating above the 200-day moving average. All 11 sectors in the S&P 500 rose strongly, with growth sectors leading gains. Both Consumer discretionary jumped 7.7%, and Technology surged 8.3%, while Communication services rose 6.3%. Meta-cap tech giants all rebounded sharply, with Amazon, Meta platforms, and Nvidia all up more than 10%. Apple and Microsoft both rose more than 8%. Alphabet and Tesla rose more than 7%. The energy sector, however, lagged broad gains, only up by 1.7%.

- Rivian’s shares jumped 17% on positive guidance. Despite a miss on both EPS and revenue expectations, reporting at $1.57 and $536 million, respectively, the EV maker reaffirmed its 25,000 vehicles production target for 2022, while planning to spend less to improve the profit margin in the fourth quarter.

- USD/JPY plunged more than 4% to a two-month low amid a sharp retreat in the US dollar and bond yields. The pair had its biggest drop since March 2020 during the pandemic time, testing on key support of the 10-day moving average around 140.40.

- Cryptocurrencies rebounded sharply from the last two day’s plunge, amid broad optimism. Bitcoin rebounded 10%, to 17,500 from the day low of below 16,000, and Ethereum rallied more than 17% to the 1,300 level from just above 1,100.

- Asian equity markets are set to jump following the Wall Street rally. ASX futures were up 2.41%, Nikkei 225 futures rose 1.86% and Hang Seng Index futures surged 4.62%.

- Gold futures had a major break out of the pivotal resistance of 1,738, up 2.9% to almost a three-month high, due to a softened US dollar and bond yields. The precious metal has potentially reversed its downtrend since March, heading to the next possible long target of 1,800.

- Crude oil lagged broad gains as energy prices have been positively correlated with inflation and rates. Fundamentally, a large build of the US inventory data and Beijing’s reiteration to stick to Covid-zero policy are major bearish factors of the oil markets.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.