US stocks finished lower but bounced off session lows as bond yields continued to decline, buffering the drop in equities, and sending the US dollar down. Investors are reassessing the Fed policy path and China’s rapid reopening progress, leading the wavering movements on Wall Street. The 10-year US bond yield fell to 3.41% from 3.53% a day ago, to the lowest seen in mid-September, suggesting that traders believe a slowdown in the Fed’s rate hikes amid signs of cooling inflation. The drop in the US dollar again lifted the other major currencies and gold prices. However, crude prices continued to slump on sluggish demand outlooks. But the recession fears seem to mute as China accelerates its pace on easing Covid controls, ruling out 10 new relaxation rules on Wednesday, boosting China growth sensitive resource prices, typically in industrial metals, such as copper.

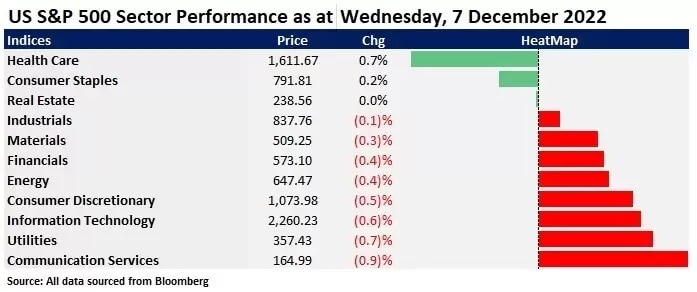

- Three major US benchmark indices fell for the third straight trading day but managed to finish above the recent key support levels. 8 out of 11 sectors in the S&P 500 closed in red, with communication services leading losses, down nearly 1%. The defensive stocks, including Consumer Staples, and Healthcare were higher, up 0.3% and 0.8%, respectively. Real Estate also finished positively.

- Apple shares continued to tumble amid demand concerns. According to Murata Manufacturing Co, Apple is expected to trim the production of the iPhone 14 further on a weakened demand outlook. The iPhone maker suffered from the Covid rout from its major Chinese factory last month, which may reduce the production of 6 million units of the iPhone 14.

- The Canadian dollar was flat against the USD after a widely expected 50 bps rate hike by the Bank of Canada. The bank also signalled the rate hike cycle may have come to an end. CAD is under pressure recently due to a slump in oil prices.

- Gold prices regained ground as the US dollar softened. The gold futures rebounded back to 1,800, which is a short-term resistance level, confluence with the 200-day moving average.

- Crude oil extended losses, tumbling for the fourth straight trading day, to a fresh year-low due to a larger-than-expected build in gasoline inventory, while the weekly draw in crude is higher than estimated. From a tactical perspective, crude prices have been positively correlated with inflation and rates. Now that the inflationary pressure is cooling, oil futures followed the slide in bond yields.

- Asian equity markets are set to open mixed. ASX futures were down 0.18%, Nikkei 225 futures fell 0.25% and Hang Seng Index futures rose 0.86%.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.