If the Bank of England were hoping for better news on the inflation front with the release of the March CPI numbers, then they didn’t get it today when the headline number fell back to 10.1% from 10.4%. This was less than expected and also the seventh successive month that headline CPI has remained in double figures.

While the Bank of England may have been the first of the main central banks to start hiking rates at the end of 2021, their timidity in pushing rates higher since then appears to have created a situation that has meant inflation is likely to remain higher for longer. Contrast their position with that of the Federal Reserve, which started hiking over three months later and where headline rates are higher.

Core inflation also remained higher in the UK, staying at 6.2% instead of being expected to fall back to 6%. Once again it is the hard-pressed consumer that is bearing the brunt along with high services level inflation. Food prices increased again, rising from 18.2% to 19.2% in March, while household services and restaurant prices also stayed high at 11.6% and 11.3% respectively, although both were lower than in February. On the plus side transport only accounted for a 1% rise in March, with fuel prices falling year on year.

Earlier this week the latest wage growth numbers showed little signs of a slowdown there, and is it any wonder as average hourly earnings remained steady for the three months to February at 6.6%?

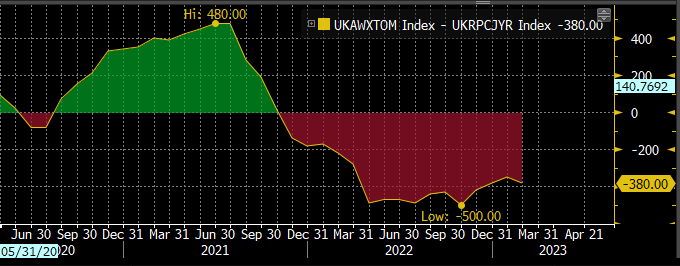

Bank of England governor Andrew Bailey has said on several occasions that the MPC expects inflation to cool and that the country needs to be careful about a wage-price spiral. This comes across as somewhat tone-deaf when inflation is averaging over 10% a month and wages have lagged CPI since October 2021, as can be seen from the chart below, where there is currently a 380bp gap between average wages and headline inflation.

Wages vs CPI since June 2020

One factor that explains the resilience of the UK economy recently is how wages managed to outperform inflation in the leadup to the rise in energy prices that started to manifest itself at the end of 2021, helping to build a bit of a buffer as prices began surging. Nonetheless, all this talk of a wage-price spiral is a red herring and a complete distraction when headline inflation is still well above the level of average wage growth. The Bank of England needs to worry less about wages and get on with its core job of controlling inflation.

It strains credibility that there remains a minority cohort on the MPC who believe that rates have risen far enough and the next move is likely to be a rate cut. While that cohort will reduce in July when Silvana Tenreyro leaves the MPC, it doesn’t change the fact that the central bank has failed in its primary function of getting on top of inflation.

There does seem to be the beginnings of an acknowledgment from some members of the MPC that inflation could be much stickier, after Bank of England chief economist Huw Pill said that UK inflation was proving to be much harder to bring under control than anticipated, in comments made earlier this month. Sadly, this isn’t news to people who have been watching the UK economy over the years, and feeling the effects in their pockets. Prices in the UK have always had a tendency to go up like a rocket and come down like a feather, and it appears that is what is playing out right now.

Today’s inflation numbers mean that its more likely than not that we’ll see another 25bps rate hike from the Bank of England when they next meet in May, which will probably keep us in line with the US Federal Reserve, who are also expected to raise rates at the same time.

As a result of today's data, UK 2 and 5-year gilt yields have pushed higher, although they are still below their highs for the year, while the pound edged higher, although it still hasn't managed to crack the 1.2500 area against the US dollar with any conviction. More importantly, it's unlikely that inflation will fall quickly given the further price rises consumers are seeing this month in the form of higher council tax bills, as well as other utilities like broadband and mobile phone charges which have gone up in line with RPI.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.