When Snap first came to market earlier this year, it was a little difficult to separate the hyperbole from the facts in terms of market enthusiasm for a company that wasn’t, and still isn’t any closer to making a profit.

With a valuation of over $20bn you could be forgiven for thinking that there would be some indication that the company had any prospect of ever making a profit.

In 2016 the company lost $514m and in March, Snap Inc management admitted in a filing that the company might never become profitable. Snap certainly wouldn’t be the first company to struggle in terms of profitability, you only have to look at Twitter's struggles to realise that, but in the longer term investors still need to see evidence of progress, and so far this seems rather thin on the ground.

It isn’t helped by the fact that its main revenue stream is being cannibalised by Facebook’s Instagram stories feature, which was updated in March to replicate a good chunk of Snapchat's functionality. This adaptation has helped Facebook’s Instagram become more popular than Snapchat in a very short period of time. The demographics also help play a part in this growth as most of Snapchat users will more than likely also have a Facebook profile, meaning that these sorts of adaptations mean that Snapchat is likely to be used that much less. In its latest profit update Facebook didn’t split out how much of its new revenue was down to its Instagram app, but nonetheless its version of Snapchat stories now has more daily users at 250m, and it’s only been running for a year.

Snap needs to come up with something different and it has only recently started selling its wireless camera “Spectacles” on Amazon. This device, which records 10-30 seconds of video, and sends it to the app on your phone costs about $130. Unfortunately for Snap the costs of making them currently come in higher than that, and they haven’t exactly been flying off the shelves, with revenues of $8m in its last earnings report.

There has been some talk that the company is looking at drone technology after reportedly acquiring Ctrl Me Robotics last year, and might be looking at further acquisitions in this area, with talk of a bid for Chinese drone maker Zero Zero for up to $200m doing the rounds.

Looking at the most recent numbers the company is likely to continue to haemorrhage cash; the company posted a loss of $370m in 2015, and a loss of $514m in 2016. This was despite a huge rise in revenues from $58.6m in 2015 to $404.4m in 2016.

It is true that innovation can be expensive, just ask Amazon, but investors normally want to see some kind of return on their investment.

The shareholder structure doesn’t inspire confidence either with shareholders holding no voting rights in the context of the wider direction of the business.

This automatically means that it won’t be eligible for entry into the S&P500 after recent changes in the rules governing companies that list on the index with respect to voting rights.

It is important not to underestimate what this means, and with the FTSE Russell also saying it won’t include the company in its index, it means that tracker funds which buy shares that track major indices won’t be buying the shares any time soon.

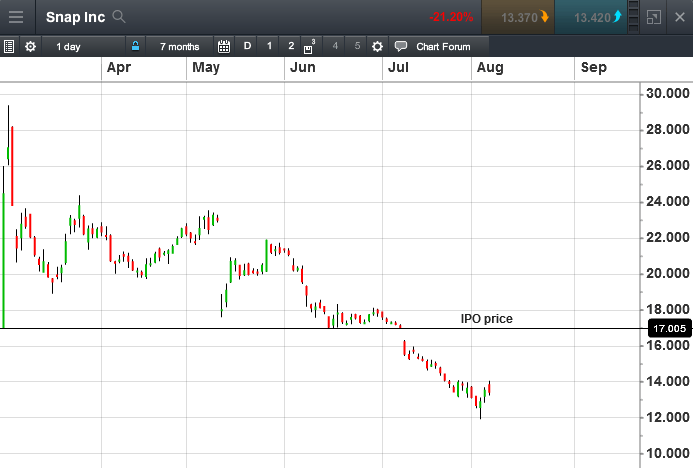

This, along with the recent expiry of the share price lock up is likely to exert further downward pressure on the value of the business, which we've seen has already seen the shares drift down signficantly below their IPO price.

It is true that Snapchat’s digital advertising revenue has grown quickly with the amount of revenue it has been able to generate from each daily user tripling in the fourth quarter of 2016, however its narrow demographic between the ages of 18-24, and rising evidence that its user growth could be starting to plateau is a worry.

Time will tell, but one thing is clear, the company will certainly need a lot more ad revenue as well as daily users, to justify a multibillion dollar valuation, despite the high profile celebrity usage that gives the application such a high level of visibility on social media.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.