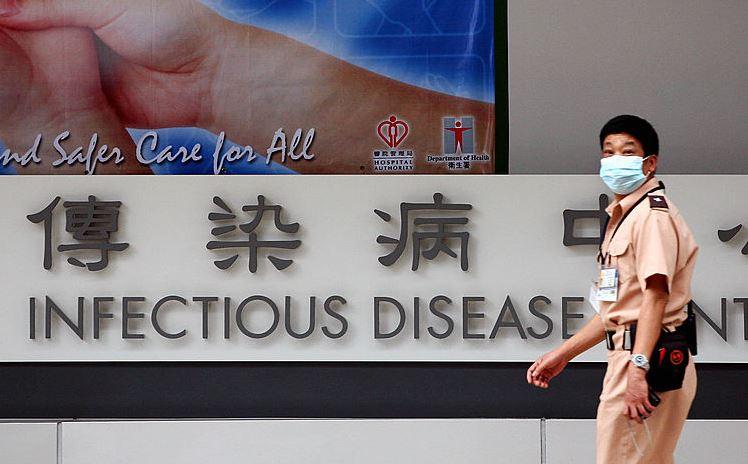

Risk assets fell in overnight trading as investors became increasingly concerned about the outbreak of a new coronavirus. Authorities in China extended the New Year holidays as the death toll climbed to 80 people. European and US shares tanked, base metals and oil fell 2%-3%, and gold hit six-year highs as panic infected trading.

Currency markets came to life. The New Zealand, Canadian, Singapore and Australian dollars swung lower as commodity markets tumbled. The Japanese Yen lifted as investors repatriated funds and traders sought safe haven. Bonds rallied again. Cryptocurrencies slid, contradicting the idea that they may offer a new alternative to gold and bonds in times of economic trouble.

Asia Pacific share futures markets are flashing red. Logic suggests last week’s pre-emptive falls in the CSI 300 index will limit losses today, but a slump of 3% in overnight trading indicates logic may be sidelined. Nikkei futures fell 2%, and Australian investors are looking at an 89-point stumble at this morning’s open.

The general pessimism defied other news. Stronger US activity indices and more solid company reports had little impact overnight. Imminent US durable goods and Australian inflation data may fly under the radar as investors around the world re-price portfolio tail risk in the light of the coronavirus.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.