With US markets subdued this week because of the Thanksgiving holiday, we’d like to share a big-picture, Elliott Wave view of gold that may interest both short-term traders and long-term investors. We also provide an update on the crude oil forecast we made last week, which is working well.

Gold has sunk to lower supports. The monthly futures chart, below, shows a possible path forward, based on our technical analysis. In this view, the decline from the 2020 high is the structural counterpart to the decline from 2011 to 2015, and could be of a similar magnitude. In other words, downward structure [c] may develop a relationship to the earlier downward structure [a], consisting of five sub-waves.

The below chart plots a speculative, downward price path through major Fibonacci and Gann-based supports. The zone near 1,601 (values represent US dollars/oz) and 1,545 might produce a bounce, but our model suggests that this area could break soon, with price then possibly going on to test support around 1,421 and perhaps even near 1,246.

Our gold forecast is also informed by our charting of other markets. Our cycles analysis of stocks, commodities, and the US Dollar Index suggests that a major inflection could take place around the middle of 2024. Tentatively, we are watching for a durable low in precious metals around then. Thus, our monthly chart for gold shows the market moving at an accelerated pace to finish tracing the remainder of sub-waves (iii), (iv) and (v) of the big downward structure [c] within the same time period.

Gold could be set to fluctuate

The high volatility implied by the path on the monthly chart, above, could create potential opportunities for nimble bulls and bears alike in the remainder of 2022 and the first few months of 2023. It also could provide longer-term investors with entry points near the lower price regions shown. After the expected 2023-2024 low is set, gold could climb to new highs later this decade.

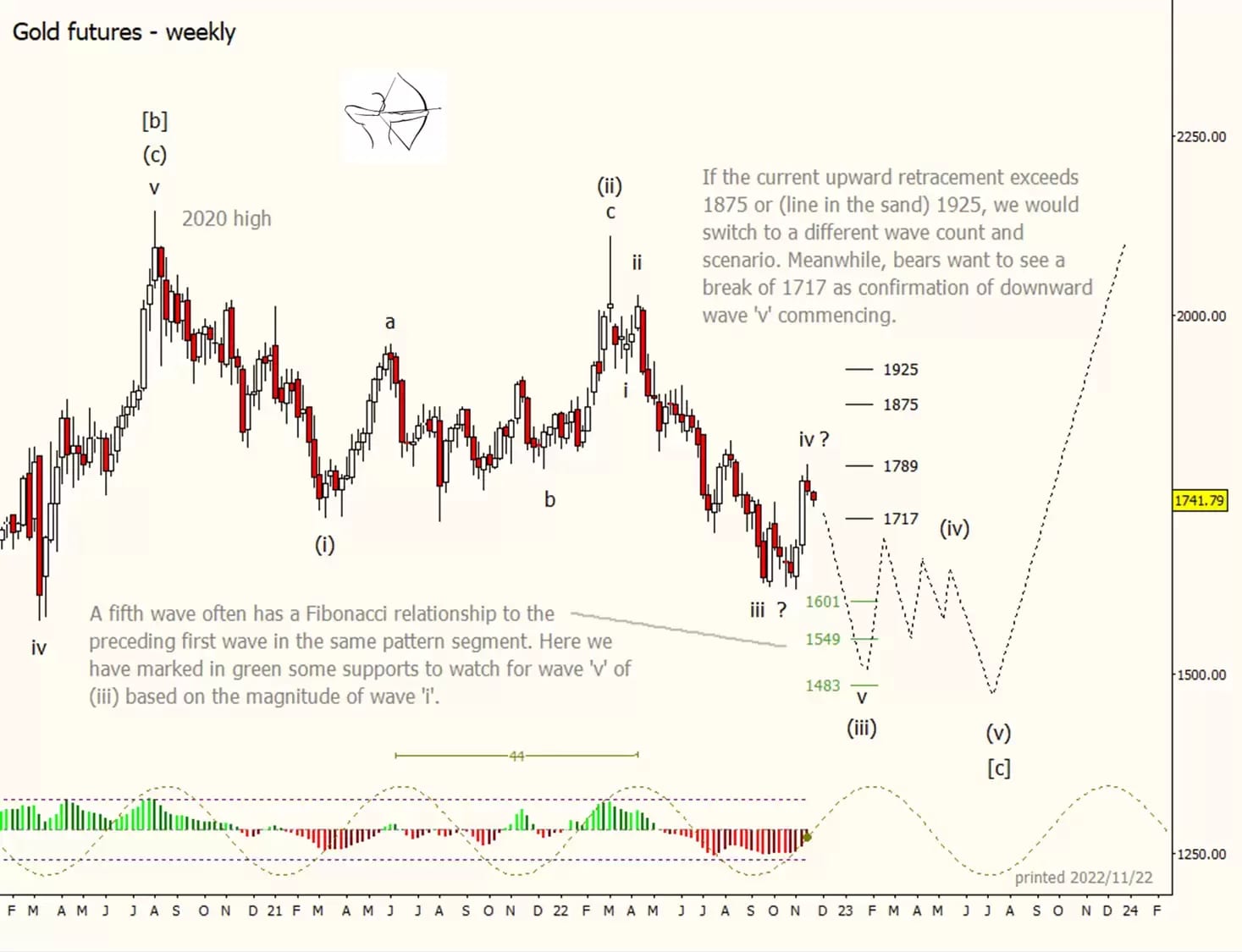

Stepping away from the big-picture view, our weekly chart, below, shows some targets to watch out for. It also highlights line-in-the-sand resistance levels that could feature in this scenario. With price coming down from the wave (ii) high in March, last week's high could meet the criteria for sub-wave 'iv' of (iii). So far, it appears that price was rejected by the Gann square-of-nine resistance level at 1,789.

As a fallback, price could retreat higher to test 1,875 or even 1,925 this year without disrupting the current wave count and forecast, but current signs point to that being less likely. Note the commodity channel index (CCI) momentum indicator on the weekly chart is approaching a test of its centre line from below, which might allow for a downward reversal soon. Gold bears may seek a break and weekly close beneath 1,717 as initial confirmation of the reversal.

If price breaks downward as expected, initial targets on the weekly and daily time frame could be around 1,601, 1,549 and 1,483, based on assumed Fibonacci relationships between the earlier wave 'i' and the developing wave 'v'. We will be able to fine-tune those targets as more price action becomes visible on daily and intraday scales.

A sweet treat for gold bears

Our daily chart, below, highlights the move that has delighted gold bears this year. The additional level of detail that comes with a daily time frame allows us to see five distinct sub-waves within downward wave 'iii'. Moreover, each wave caused price to travel far enough to open up potential trading opportunities. When an impulsive (five-wave) move spreads out like this, the wave is said to be extending. A similar phenomenon might be happening currently with crude oil prices, as we discuss below.

Factors pointing to a downturn from last week's high include the overbought condition shown by the CCI momentum indicator and the estimate by the Lomb periodogram that the market is coming out of a cyclical high on the daily time frame.

Is WTI crude set to dip?

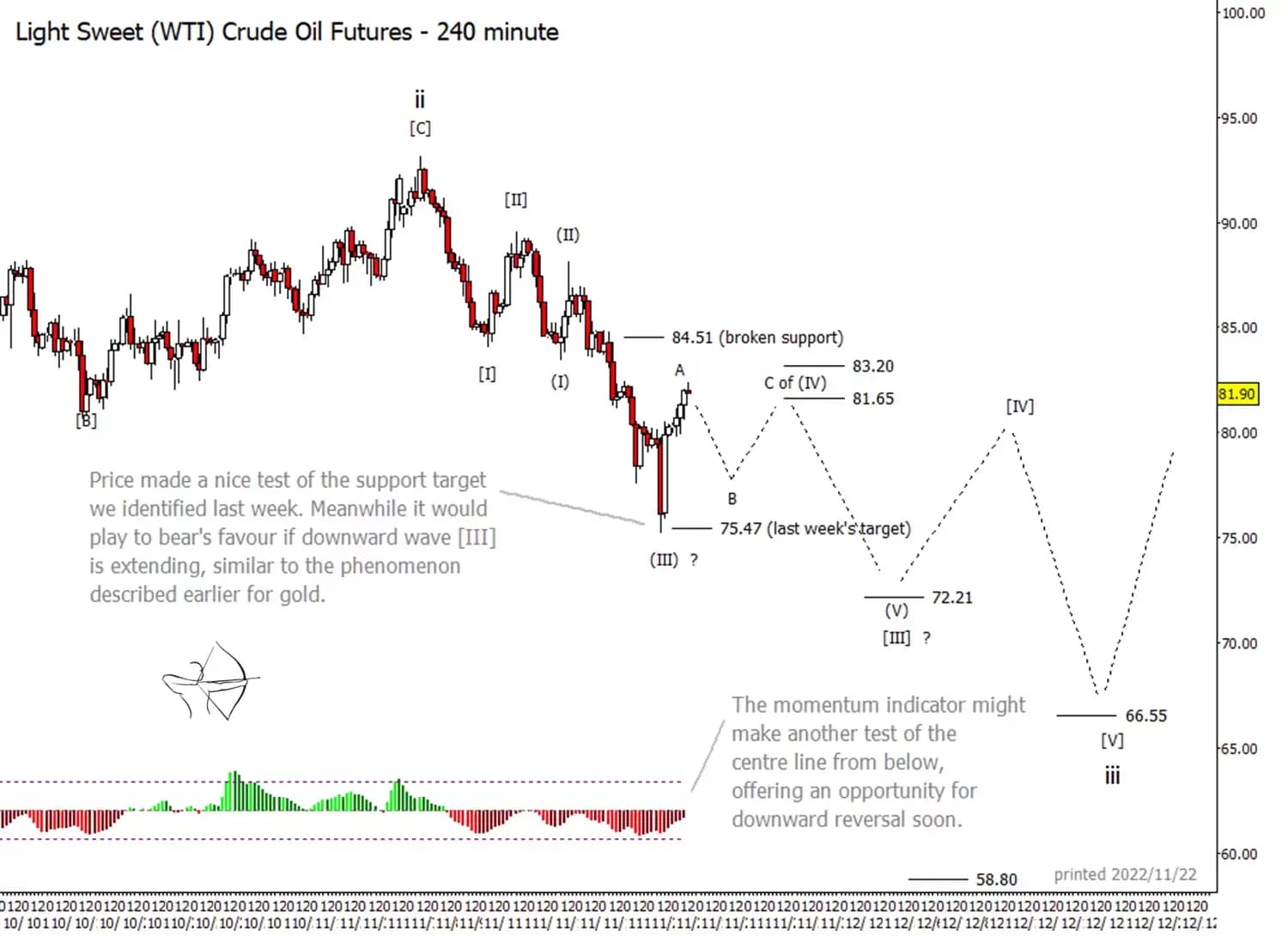

The phenomenon of an extending impulse wave that we described for gold might also be happening currently with West Texas Intermediate (WTI) crude oil prices. The support target we cited last week at $75.47 made for a good exit for bears who entered at a higher level. It also created a possible countertrend upward trade for agile traders.

However as the wave extends, it becomes difficult to be certain where the structures of each magnitude begin and end. Trading an impulsive wave that is extending can be a tricky but potentially rewarding prospect. There is more than one way to count the developing move in crude oil, even though most of the possible counts lend the advantage to bears.

In the remaining weeks of this year, we would like to see crude oil stay beneath $83.20, even though action might be somewhat sideways and choppy during the rest of November. Later tests of more important supports at $72.21 and $66.55 could represent key levels for bears.

For more technical analysis from Trading On The Mark, follow them on . Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.