After the declines of recent weeks, gold and US oil benchmark West Texas Intermediate (WTI) may experience sideways movement, or even upward corrections, in the near term. This could be an environment in which nimble traders might look for counter-trend trades, while slower commodity bears might view the next one to two weeks as a setup for stronger downward moves in late March and April.

After our previous post on gold and crude oil, the precious metal sank to $1,862 an ounce, in line with our forecast. It then continued lower than we expected, moving down to current levels around $1,810. Our next support level near $1,840 would also have been a good place to exit a short trade.

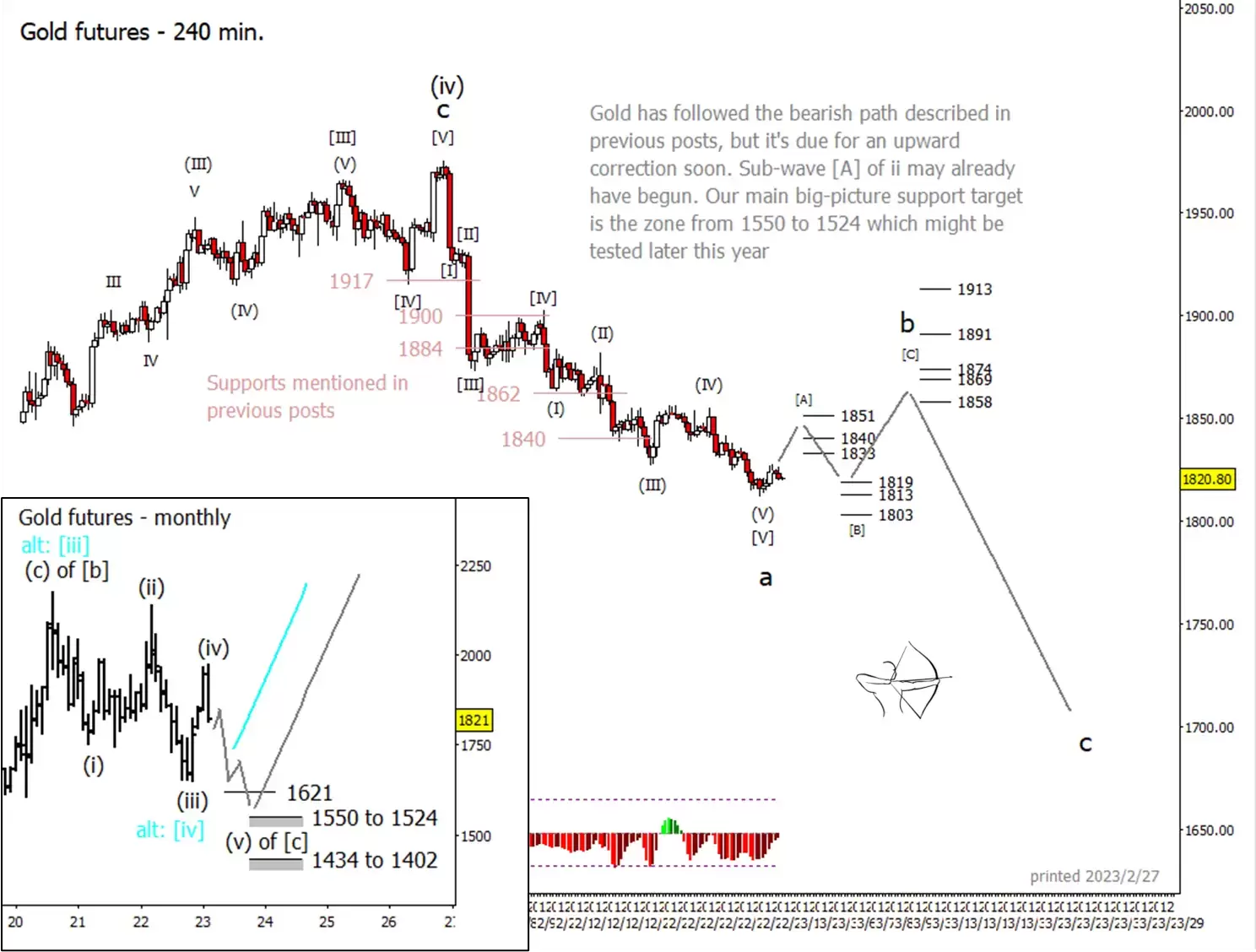

Based on our analysis, gold appears oversold. According to Elliott Wave theory, it's possible to count five completed waves in the downward pattern that should comprise wave 'a' on the 240-minute chart below. We believe the fifth wave subdivided as it extended lower.

Next, we look for signs of a sideways or upward correction that should consist of three small waves. It might already have begun.

Gold could climb higher before next downward move

If price has found its footing, then nearby targets for the first move up include $1,835, $1,840, and $1,851. That should precede a correction within a correction, as small wave [B] tries to test one of the supports shown. Keep in mind that wave [B] can reach a little bit lower than the previous low, so $1,803 could be a valid target for the dip.

We think the pending wave 'b' is likely to make a shallow upward retrace into the territory covered since the wave (iv) high, and our preferred target zone is between $1,858 and $1,874, as shown on the chart below. However wave 'b' can reach considerably higher without invalidating the wave count.

After the corrective pattern 'b' is complete, we expect a fairly strong downward wave 'c' of (v) of [ii] with a preferred target zone of $1,550 to $1,524 to finish the decline.

Is crude oil set to rise then fall?

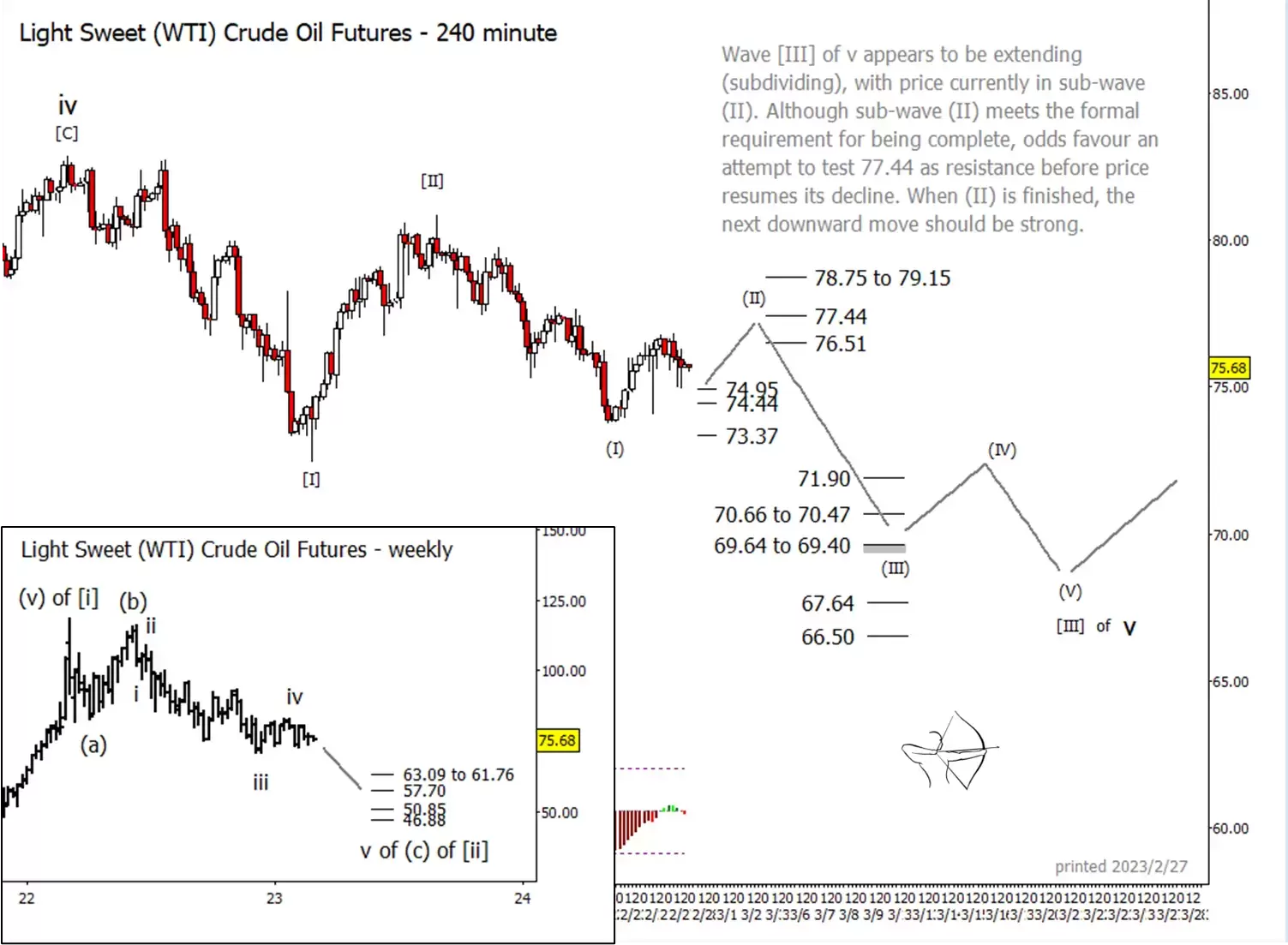

WTI is tracing a formation similar to gold's in the near term, although it may be a little bit ahead of gold in the maturity of its correction. The danger here is that many market participants may see last week's higher low as an indication of a bullish reversal. However, we believe that the higher low instead represented the first sub-wave of a bigger downward pattern. This would be consistent with the idea of middle wave [III] extending and subdividing in a manner similar to what happened with gold.

This week we're watching for support starting at $74.95 a barrel and possibly including $74.44 and $73.37. From there, we'd like to see the corrective wave (II) finish closer to the area of $77.44 or the zone near $79.00, as labelled on the chart below.

The next downward phase should be fairly strong, as it would represent the third (middle) wave inside a larger third wave. Our preliminary target for that move includes the area from $70.66 to $70.47 and the area from $69.64 to $69.40, as labelled on the 240-minute chart above.

Taking a weekly view, our preferred support area for the completion of the entire decline is near $57.70, with other possible supports extending from $63.09 down to $46.88 as indicated on the small sub-chart above.

For more technical analysis from Trading On The Mark, follow them on . Trading On The Mark's views and findings are their own, and should not be relied upon as the basis of a trading or investment decision. Pricing is indicative. Past performance is not a reliable indicator of future results.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.