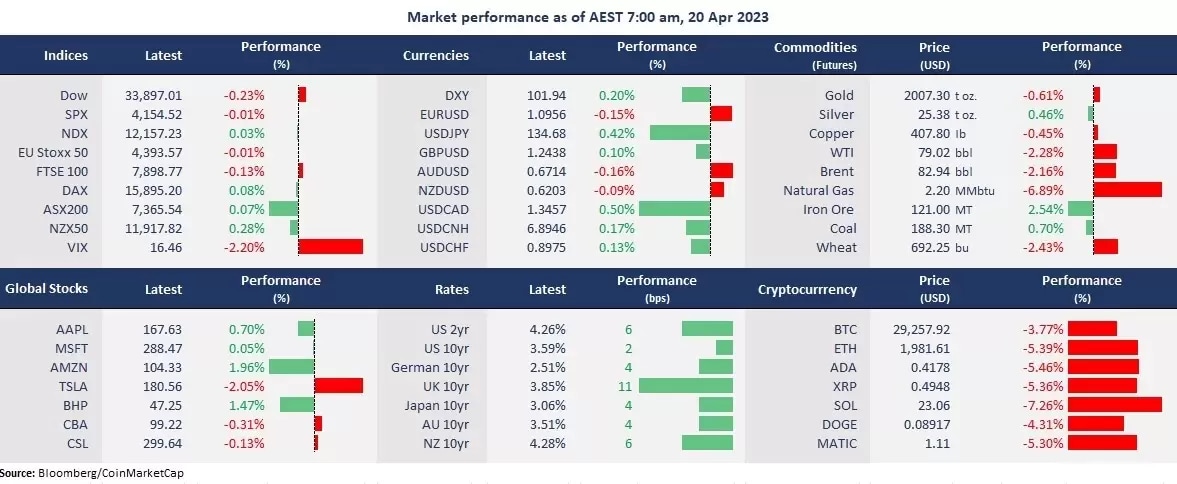

Wall Street finished mixed amid companies’ mixed earnings results. Dow fell 0.23%, the S&P 500 was flat, and Nasdaq rose slightly. While Netflix fell 4% due to a miss on revenue expectations, Morgan Stanley’s shares finished slightly higher as the bank beat estimates in both earnings and revenue despite a drop in profit. Tesla’s share slipped amid its first-quarter earnings reporting, which showed that the EV giant’s profit margin was hit by price cuts, with the gross margin falling to 19.3% or a 21% decline from a year ago.

Rates continued to climb, with the 2-year US bond yields rising to 4.26%, the highest since 15 March, as markets priced in another rate hike by the Fed in May. The US dollar strengthened against most other major currencies and sent commodities down, with crude prices falling 2%, and gold futures slid to just above 2,000.

Asian markets are set to open mixed. The ASX 200 futures were down 0.09%, the Hang Seng Index futures were up 0.40%, and Nikkei 225 futures slipped 0.14%.

Price movers:

- 7 out of the 11 sectors in the S&P 500 finished lower, with telecommunication stocks leading gains, down 0.74%. The technology sector fell 0.13% as growth stocks lost steam amid the earnings season. While banking stocks rose for the third trading day following positive big bank earnings, lifting the financial sector higher, up 0.22%. Utilities, real estate, and healthcare also ended in the green.

- Tesla’s share fell 4% in after-hours trading following its first-quarter earnings reports. The EV maker reported earnings per share at $0.85, in line with the expectation, down more than 20% from a year ago. The revenue came to $23.33 billion, weaker than an expected $23. 56 billion, up 24% year on year. Its total GAAP gross margin was up 19.3%, a sharp decline from 29.1 % in the first quarter of last year.

- Morgan Stanley’s shares were up 0.5% amid better-than-expected earnings reports. The bank reported earnings per share at $1.7, down 15.8% from a year ago but higher than an estimated $1.63. Revenue was at $14.5 billion, down 2% annually, but beat the expectation of $13.97.

- UK’s March CPI stayed high, printing at 10.1% year on year, slightly down from 10.4% in February but well above the consensus of 9.8%, and sending the UK 10-year bond yields 11 basis points higher. Sticky inflation may promote the Bank of England to continue raising rates, possibly another 25 bps, and bring the interest rate to 4.50% in the next meeting.

- Gold futures slipped again amid strengthened USD. With bond yields moving higher again, gold is most likely to continue to retreat. A breakdown below 2,000 may take it down to the 50-day moving average of around 1,920.

- The WTI crude oil futures fell under $80 again, as oil markets were hit by the strong dollar and deteriorating economic outlook despite a larger-than-expected draw in the US inventories. The US economy stalled in recent weeks, with hiring and inflation slowing and access to credit narrowing, according to Fed’s Beige Book.

- Cryptocurrencies pulled back from the recent highs due to a risk appetite abated. Bitcoin fell under 30,000, and Ethereum slipped below 2,000, both of which are at a one-week low after reaching 10-month highs.

ASX and NZX announcements/news:

- Silk Laser Australia is in talks with Wesfarmers for a potential $169 million takeover offer. The clinic chain was offered $3.15 a share, or a 30% premium to the market price of $2.42 on Wednesday.

Today’s agenda:

- The New Zealand Q1 CPI. Consensus calls for a 6.9% increase year over year, which is lower than the current 7.2% from the fourth quarter 2022.

- Australian NAB business confidence.

- RBA Governor Philip Lowe speaks.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.