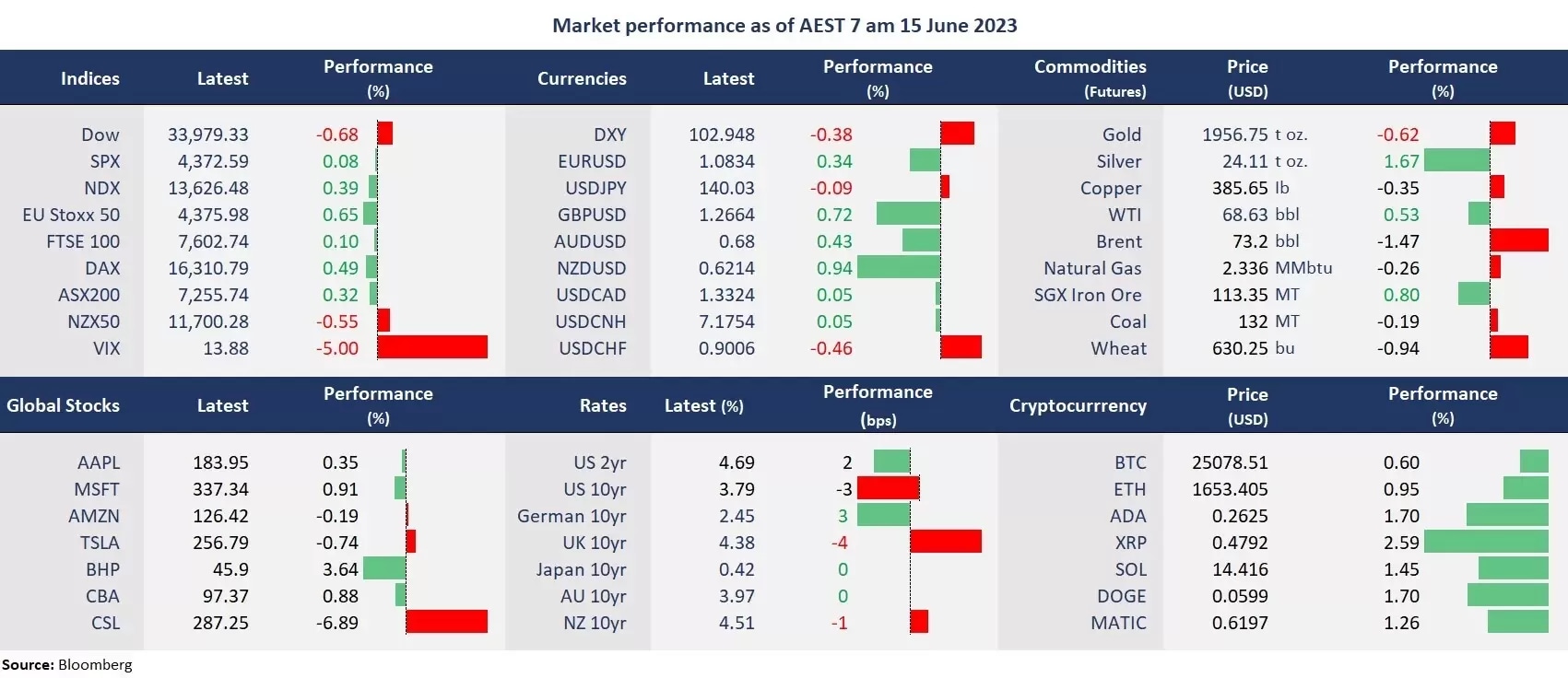

Wall Street bounced off a session low and finished mixed following Fed’s rate hike pause as the reserve bank suspended the hiking campaign but signalled more increases to come in the coming months. The continuous tech rally lifted both Nasdaq and the S&P 500, while Dow ended in the red, dragged by energy and financial stocks.

The dot plot is now projecting the peak rate to hit 5.6% by the year-end from the current 5%-5.25%. The stock markets did not react to the hawkish stance, with the Volatility Index falling 5% to 13.88, suggesting “risk-on” was still taking the lead. AI-powered chipmakers’ stocks continued the frenzy moves, with Nvidia, Broadcom, Intel, and Oracle, all up more than 4%. Nvidia again booked its dominant position in the semiconductor market, hitting a US$1.06 trillion market cap, officially joining the trillion-tech club.

In the meantime, bond markets may tell a different story. The US 2-year bond yield climbed higher, while the yield on the 10-year note drifted lower, deepening the yield curve, implying deteriorated economic outlook and a foreseeable economic recession. The indication can also be seen in the divergent movements at the sector level in the S&P 500, with cyclical sectors underperforming their growth stock peers.

Asian markets are set to open higher as optimism towards the Chinese government’s further stimulus policy offered a lift in material stocks, leading the ASX 200 higher on Wednesday. ASX 200 futures were up 0.28%, Nikkei 225 advancing 0.15%, and Hang Seng Index futures up 1.4%.

Price movers:

- 4 out of 11 sectors in the S&P 500 finished higher, with Technology and consumer staples leading gains, up 1.14% and 0.56%, respectively. While Energy and Healthcare were lagging in broad markets, down more than 1%. Tesla snapped a 13-day winning streak, down 0.74%.

- Nvidia’s shares jumped 4.8% to 430 at a fresh record high, hitting a market cap of US$1.06 trillion, surpassing Tesla and Berkshire Hathaway and becoming the fifth largest company following Apple, Microsoft, Alphabet, and Amazon.

- US dollar fell against most other major currencies amid the Fed’s rate hike pause. The dollar index fell about 0.31% to just above 103 at a one-month low. Commodity currencies, such as the Australian dollar and the New Zealand dollar remained in the uptrend this month, reflecting optimism toward China’s rebound.

- Crude oil fell after the one-day rebound following Fed’s “higher for longer” rate reiteration as the US economic woes overtook the Chinese policy optimism again. The WTI futures were down 1.5% to below US$70 per barrel.

ASX and NZX announcements/news:

No Major announcement.

Today’s agenda:

- New Zealand Q1 GDP

- Australian employment change

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.