Risk sentiment recovered swiftly amid positive economic data and cheerful big tech earnings as the Fed signaled a possible rate hike pause and looked for a “soft landing” rather than a hard recession in its policy meeting last week. Regional banks’ rout seems to be settled after JPMorgan took over First Republic, but the recent practice of big banks buying off troubled smaller financial institutions is likely to spread risks into the wider banking system.

Last Friday, the strong job data and Apple’s better-than-expected earnings buoyed Wall Street, offsetting most losses early in the week. However, Dow and the S&P 500 still finished the week in the red, while Nasdaq edged higher. This week, the US inflation data will be closely watched, providing clues for the Fed’s next move in June.

Notably, the Chinese stock market outperformed its US and European peers last week as risk-off may have shifted funds into the policy-supported economy. A slew of Chinese economic data, including trade balance, new yuan loans, CPI, and PPI, will be released, gauging the world-second-largest economic recovery.

Coming to the southern atmosphere, the Australian budget and New Zealand inflation expectations will also be in the spotlight for local investors.

What are we watching?

- US dollar declines: The king dollar fell amid the regional bank’s crisis and Fed’s rhetoric for a possible rate hike pause. The dollar index may continue its downtrend once breaking down below the 100 mark.

- Bond yields are facing downside pressure: The US bond yields were on the decline after the Fed signaled a possible pause in rate hikes. Fed funds futures are pricing in a rate cut commencing in September, according to the CME Fed Watch Tool.

- Gold retreated from an all-time high: Gold prices fell from an all-time high of above 2,070. The drop was mostly due to a technical correction as a “triple-top” pattern surfaced from a technical perspective. The weakness in the USD will most likely continue to support the upside momentum in the long haul.

- WTI futures rebounded above $70: A softened US dollar and recovered risk sentiment supported a sharp rebound in oil markets, with WTI futures bouncing back to above $70. The oil prices swung widely in the last week due to volatility in risk assets. China’s economic data may play a key role in oil prices this week.

- Cryptocurrencies are on the rise: Crypto markets continued climbing amid the recent economic event as signs of relaxation in liquidity and a weakened US dollar supported the alternative investment asset class.

Australian markets

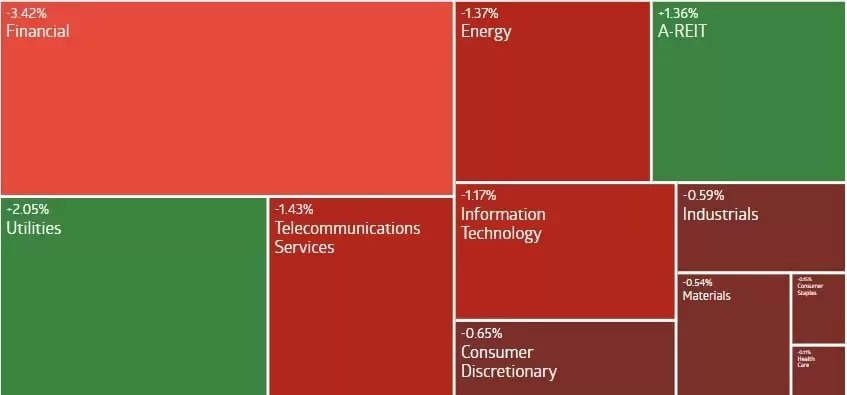

The ASX 200 was under pressure after the RBA surprisingly raised the OCR by another 25 basis points and signaled more rate hikes to come. Banking stocks slumped due to the contagious effect of the US regional banks. The utility was the best performer as being seen as a defensive sector. The upcoming Australian budget may support green energy sectors if the government provides more subsidies to the industry.

Economic Calendar (8 May – 12 May)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.