Global markets deepened losses amid bond jitters and China’s economic woes last week. Wall Street slumped further as tech giants continued to retreat, while the US 10-year bond yields hit a 16-year high after the July Fed meeting minutes showed that it would likely maintain the hiking cycle. In the S&P 500, the technology sector led broad losses, down almost 8% month-to-date, while Energy was the only sector in the green. Inflation woes returned to markets and sent the USD higher. In such a volatile time, Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium can be critical for the market’s sentiment as stubborn hawkish rhetoric could crash risk assets further. On the earnings front, Nvidia’s second-quarter earnings will be in the spotlight after Morgan Stanley’s “Top Pick” comment, which caused a 7% jump in its shares last week.

China’s economic woes are another major issue for the global markets after its largest private fund manager missed coupon payments and the troubled developer, Evergrande, filed for bankruptcy. Weak economic data also added to the pessimism. Market players will continue to monitor the progress of the government’s intervention in the Yuan exchange rate and the shadow banking debt restructuring. This week, the PBOC will decide on its key policy rates, the 1-year and 5-year Loan Prime Rates. Baidu’s quarterly earnings will continue to gauge Chinese tech giants’ AI development.

The Australian stock market finished the week in the red, impacted by Wall Street’s slump and the selloff on the Chinese stock markets. Its mining stocks dragged on the ASX, with Rio Tinto falling for the third straight week following disappointing full-year earnings results. The biggest miner, BHP, is set to report its 2023 full-year performance.

What are we watching?

- Bond yields continue to climb: The US 10-year bond yield rose for the fifth straight week to the highest since 2007 after the Fed meeting minutes showed that it could continue tightening monetary policy as inflation risk lingered.

- Energy stocks outperform: A rebound in oil prices led the energy sector in the S&P 500 to gain about 15% from the low in June. Inflation trades may have returned to markets amid the sector rotation.

- Chinese stock markets sink: Chinese stock markets extended losses, with the Hang Seng Index falling for the third straight week to the lowest since November 2022. Its property woes may have a contagion impact on global markets, sparking risk-off sentiment.

- Gold under pressure: Gold prices slid for the third straight week amid a strengthened USD and surging bond yields. Spot gold price fell below key support of 1,900, approaching further support of 1,860.

- Bitcoin crashes: Bitcoin posted the worst weekly performance since November 2022 amid market volatility. Fed’s hawkish rhetoric and China’s uncertainties may have sparked the selloff. The largest digital coin fell about 11% for the week, approaching key support of the 50-day moving average of 23,500.

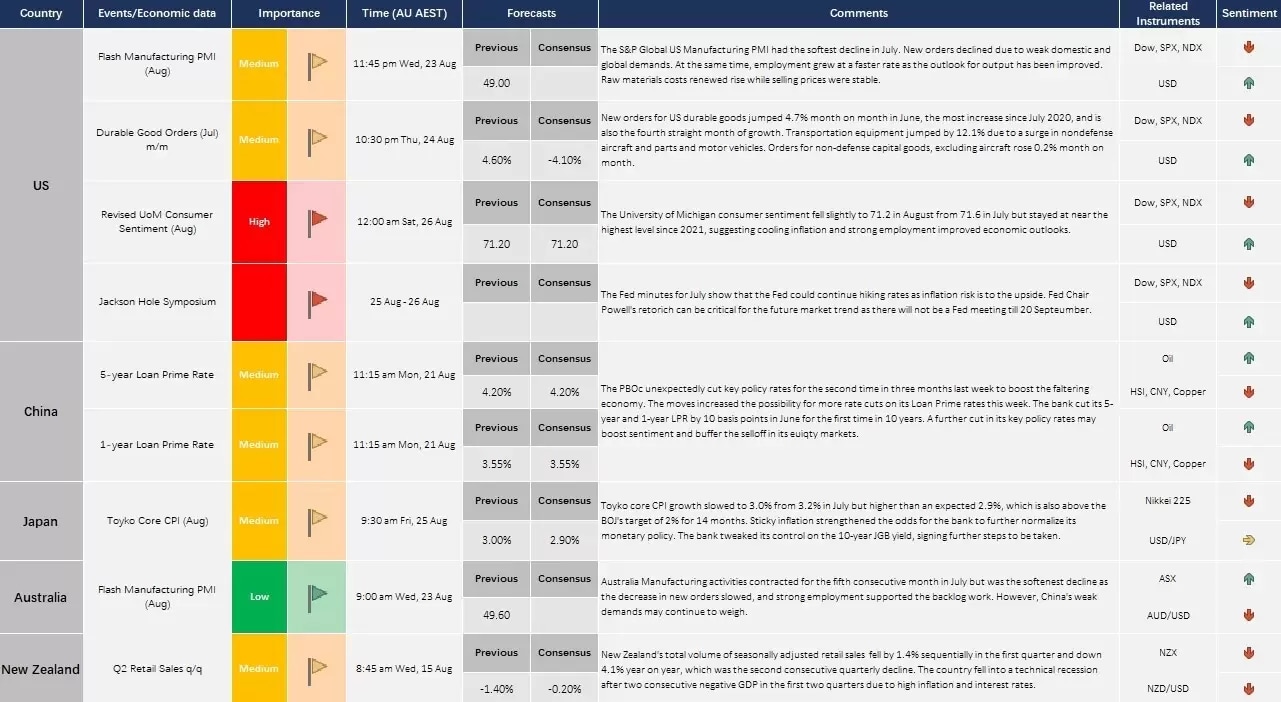

Economic Calendar (21 Aug – 26 Aug)

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.