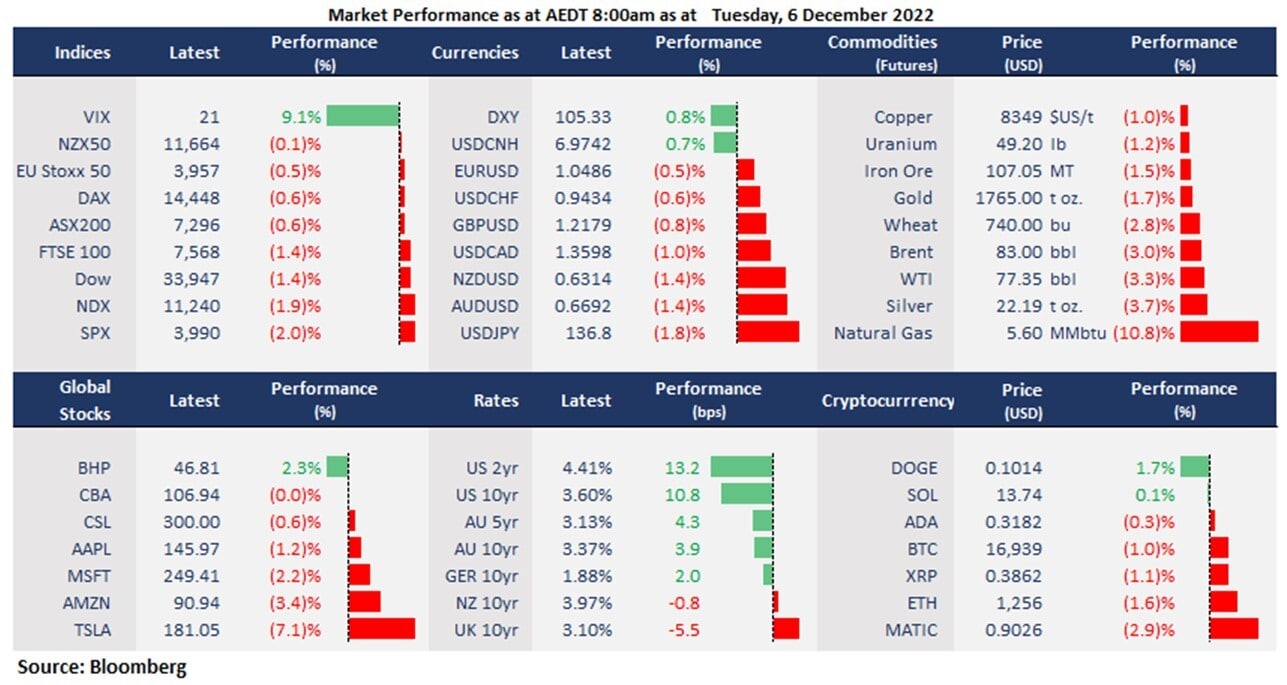

Wall Street’s rebound lost steam as strong economic data dashes hopes for a dovish Fed, sending bond yields higher. Following better-than-expected US November job data, the ISM manufacturing PMI came to 56.5, better than an estimated 53.4, also higher than 54.4 in the prior month. The US 10-year bond yield rose to 3.60% from 3.49% overnight, while the US 2-year bond yield rose to 4.39% from 4.28% a day ago. The inversion between the two benchmark bond yields deepened further to -79, worsening the recessionary risks.

Give the re-ramp in rates, the US dollar index rebounded against the other major currencies, pressing on commodity markets, with both oil and gold retreating sharply from recent highs.

In today’s Asian session, the RBA rate decision will be on closely watch, with an expectation for another dovish 25-bps hike. Also, China’s reopening optimism continued to push Chinese tech shares higher in the US session, combating the broad market’s drop.

- S&P 500 fell below 4,000 and finished under the 100-day moving average. All the 11 sectors finished lower, with Consumer Discretionary, Energy, Material, and Financials leading losses, all down between 2.5% to 2.9%. The defensive sectors, including Utilities, Consumer Staples, and Healthcare were relatively stronger but all fell about 1%.

- Tesla shares slumped 7% on news that the company cuts production in China due to sluggish demand. The EV maker will cut Model Y by 20% in Shanghai’s factory in December after a record delivery of 100,291 cars in November. Swiss is also reportedly to ban electric cars due to shortage in electricity supply.

- Apple shares slid 1% on a report that its sales dropped 11% in November due to the Covid outbreak in its major Chinese factory Foxconn. The Covid rout may reduce Apple’s production for its iPhone Pro units by 6 million, according to Bloomberg news from last week.

- Gold futures sharply retreated from the 5-month high due to a jump in the US dollar and bond yields. The precious metal fell about $30 per ounce, falling back below the 200-day moving average, with a near term support at around 1,728.

- Crude oil slumped 3% as recession worries returned after the US strong economic data reignited “higher-for-longer” Fed’s rate path. While the G7+ Australia’s price cap on Russia’s oil may not have a major impact on its price, China’s reopening optimism and EU’s energy supply shortage could continue to provide bullish factors to the oil markets.

- Chinese Yuan jumped as major cities, such as Beijing, further eased covid restrictions. USD/CNY fell below pivotal support of 7 on Monday, forming a head and shoulder top pattern, heading to a potential short target of 6.75 from a technical perspective.

- Asian equity markets are set to open lower. ASX futures were down 0.75%, Nikkei 225 futures fell 0.65% and Hang Seng Index futures fell 2.08%.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.