In the first half of the year, the US tech stocks’ outperformance amazed global markets, with Nasdaq posting the best first-half-year gain on record, up 31% due to the AI-powered rally. This was not only due to the AI-fuelled rally, but also a potentially oversold market as tech stocks experienced a brutal 2022, with the so-called FAANG shedding about US$3 trillion of their market value. There have been notable trends in the stock markets in the past six months. Firstly, growth stocks were in a swift bull run, while the cyclical sectors were sideways. Secondly, the big caps were on a sharp rally, while the small caps were lagging. Will these trends continue to prevail in the US markets in the second half? In this article, we follow three mainstream trends, the Fed rate hike path, an economic cycle, and sector rotation, to discuss possible trends brewing into the second half.

Fed is close to ending the rate hike cycle

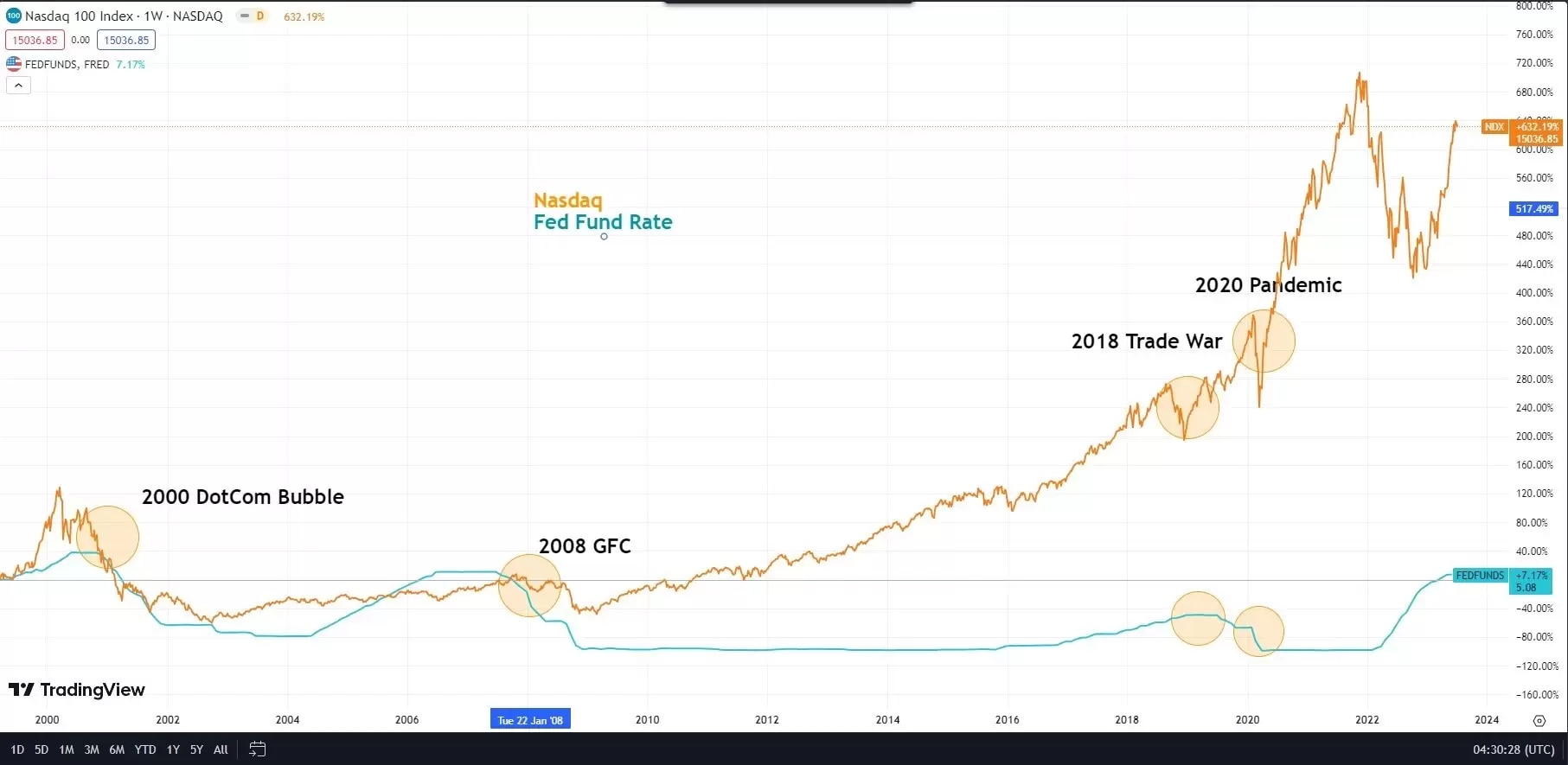

The reserve bank paused raising the interest rate for the first time after ten consecutive increases in June, reconsidering its rate hike path as recessionary risks mounted. Despite a consistent rhetoric hawkish tone, the Fed is nearly ending a 15-month-long rate hike journey. According to the CME Fed watch tool, the Fed will only raise the interest rate one more time in July, peaking at 5.25% and 5.50%. The US headline CPI cooled for the 11 consecutive month to 4% in May due to Fed’s aggressive rate hikes. While inflation was on a promising trend for the Fed to end the rate hike campaign, the regional banking rout in March has warned of increasing risks to the wider banking system. The Fed may have to consider the rippling effect of small banks’ failure as a “bank-run” event will severely impact the broader economy.

The historical implication is that markets tended to crash during a Fed’s hold or cut cycle. This increases the risk of a market correction, as shown in the below chart.

Stagflation approaches and recession risks increase

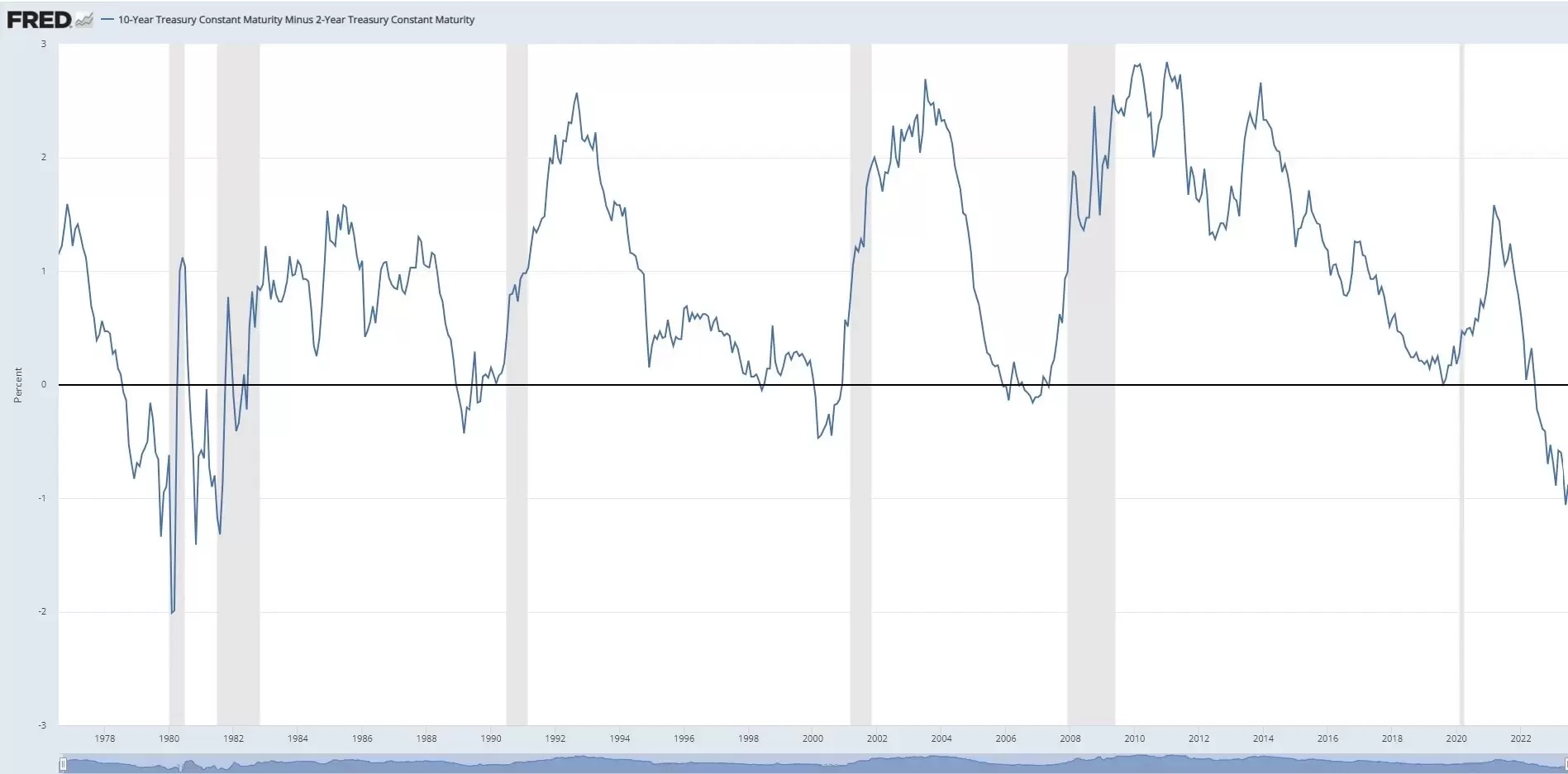

Despite some recent resilient economic data, the economic outlook stayed gloomy as the Fed’s aggressive tightening measures have lagging effects on the economy. The economic activities of the US manufacturer have been contracting for eight consecutive months since November 2022, the longest stretch since the GFC in 2008. The current Fed’s cycle of rate hikes is the longest stretch since the 1980s when an economic recession was incurred by aggressive rate hikes due to an energy crisis, which is very similar to the current economic cycle. In addition, the yield on the US 10-year and the 2-year Treasury has stayed inverted since June 2022, usually pointing to an economic recession, as indicated in the below chart.

Source: Federal Reserve Bank of St. Louis, Fred (shaded areas indicate US recessions)

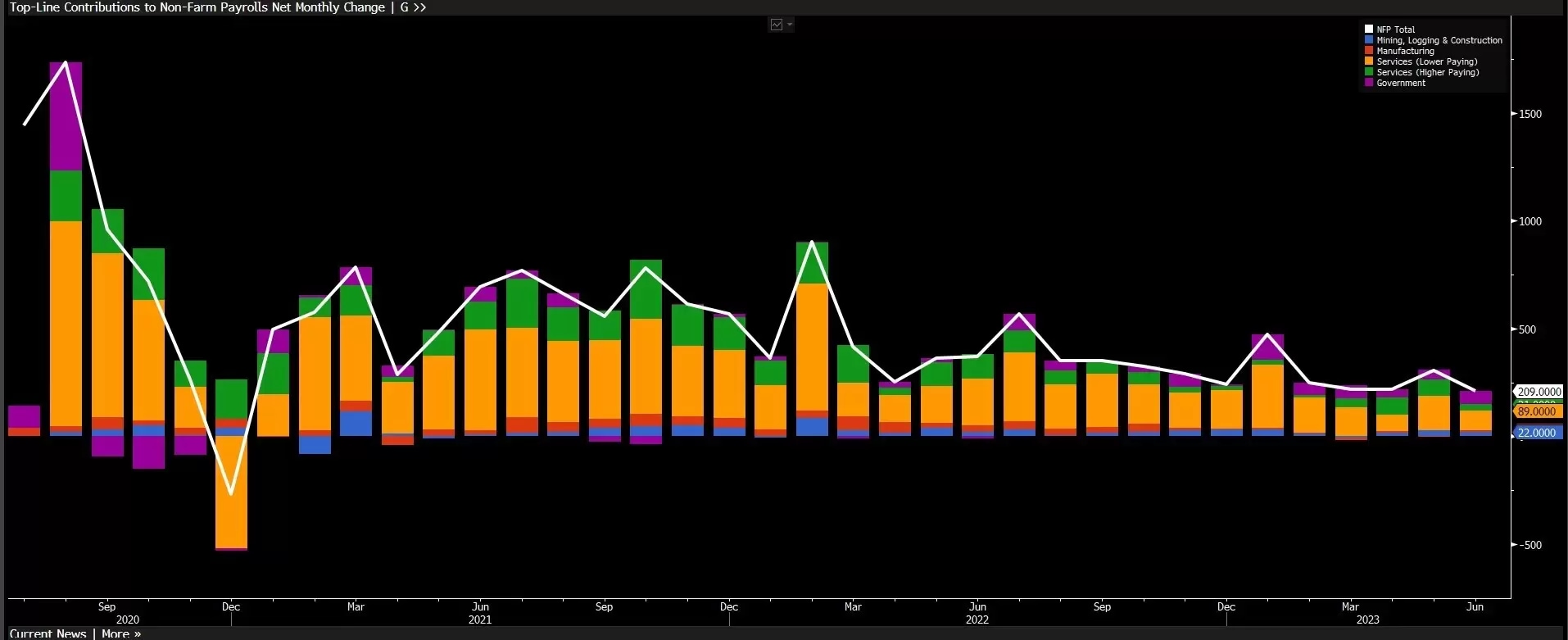

The latest non-farm payroll data showed that the US added 209,000 new jobs in June, the lowest since January 2022. The new employment growth has been in a downturn since February 2022, indicating labour markets have actually been cooling since the Fed started the aggressive rate hikes, though the unemployment rate stayed at a historically low level.

At the same time, a technical recession occurred after the two consecutive negative quarterly GDP growth in 2022. Despite a rebound in the first quarter of this year, the pace of growth slowed from 2021 in the post-pandemic era. With inflation staying relatively high at 4%, the economic cycle may turn to the long-talked “stagflation” era in the year's second half.

Sector rotation: growth & cyclical stocks vs. defensive sectors

The AI-led tech rally has lost some steam as these sectors may have been overbought, and investors were also rebalancing their positions ahead of the US second-quarter earnings season. The 11 sectors in the S&P 500 can usually be divided into three categories: growth sectors, which represent high-growing stocks, such as Technology (XLK) and Communication Services (XLC); Cyclical sectors, which are heavily dependent on industrials activity and sensitive to the economic cycle, such as Industrial (XLI), Materials (XLB), Financial (XLF), energy (XLE) and Consumer Discretionary (XLY). Defensive sectors often endure an economic downturn as they include industries such as Utilities (XLU), Consumer Staples (XLP), and Healthcare (XLV) that tend to be stable and less affected by the economic cycle or external events.

In the first half of the year, three sectors significantly outperformed broad markets: Technology, Communication Services, and Consumer Discretionary, as these sectors were mega-cap tech companies concentrated, fuelled by an oversold market and the AI heat. However, the rest of the markets were far left behind, indicating the rally was not backed by a positive economic outlook.

S&P 500 sector six-month performance

In addition, the rally on Wall Street was buoyed mainly by big-cap tech stocks, as indicated in the below chart, while the more economic growth-sensitive index, the Dow Jones Industrial Average, underperformed significantly compared to the tech-heavy index, Nasdaq. As discussed above, the US economy will likely slow down further and approach the stagflation cycle. The sector rotation may reshuffle as investors seek defensive sectors, such as Consumer Staples, Utilities, and Real Estate, for safety. The typical big-cap stocks are retailers such as Walmart, Procter & Gamble, and Coca-Cola.

US Mega Cap six-month performance

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.