In the world of cryptocurrency, where change is the only constant, 2023 has emerged as a year of significant recovery and transformation. Let’s break down three central themes to get you up to speed on the year thus far.

Navigating the Aftermath of 2022

At the start of this year, the crypto market was grappling with the aftermath of a tumultuous period. Investors were subject to substantial losses.

2022 unveiled the inherent risks within cryptocurrency markets and exposed fraudulent activities. At the heart of this narrative was the collapse of Terra over three days in May 2022, erasing a staggering $50 billion in valuation. Terra, once the third-largest cryptocurrency ecosystem, stood only behind Bitcoin and Ethereum in market capitalisation.

This collapse was the precursor to a series of significant market disruptions, including the demise of Celsius in July and, notably, BlockFi and FTX in November. For FTX, the high-profile trial of founder and CEO, Sam Bankman-Fried, hit mainstream news recently as many investors grapple with substantial losses.

The underlying causes of these collapses were complex, often stemming from mismanagement of client funds. A recurring theme was the risks associated with crypto lending and the practice of rehypothecating assets. Put simply, rehypothecation entails the utilisation of your cryptocurrency holdings by third parties for their own financial activities, such as trading or leveraging additional assets.

Regulatory Crossroads: Commodity vs Security

In June, the U.S. Securities and Exchange Commission (SEC) made headlines by taking legal action against both Binance and Coinbase, alleging the sale of unregistered securities. Subsequently, in July, a federal court reached a pivotal decision in the SEC's dispute with Ripple Labs concerning the classification of the XRP token. The court's ruling deemed XRP not to be a security when sold to the public, marking a significant turning point. However, the SEC has pursued an appeal, and the legal process remains in progress. These high-profile cases are important because they could influence how cryptocurrencies are regulated.

Key to grasping this debate are two terms: "security" and "commodity." A security typically represents ownership or interests in a company or investment, like a stock in Apple. If you make an investment where you expect a profit from the collaborative efforts of others, then it is likely a security. Commodities on the other hand typically refer to physical goods or raw materials like oil, wheat or gold. Commodities are interchangeable with other goods of the same type and tend to have industry standards around grading and measurement.

While the classification of a cryptocurrency as a security is not necessarily a bad thing it does introduce potential risks. If a cryptocurrency was to be treated like a stock, it could mean they have to abide by the same rules. This likely means obtaining official licenses, going through a registration procedure, and adhering to various legal and reporting responsibilities.

For cryptocurrency endeavours that have previously operated with relative autonomy, this regulatory shift may curtail their growth prospects and could result in delisting from exchanges. Commodity regulations are notably less stringent, presenting an appealing framework for cryptocurrencies to argue their inclusion within. Investors will be closely observing the outcomes of prominent cases in the months ahead.

The Bitcoin ETF: Paving the Way for Mainstream Adoption

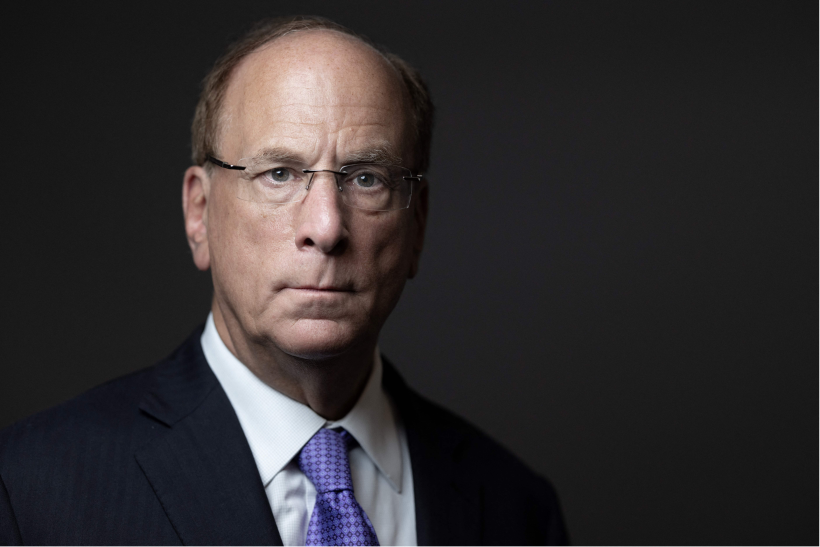

In July, there was a significant development as BlackRock, along with several other large asset managers filed (or resubmitted filings after previous rejections) for a Spot Bitcoin ETF. This is particularly noteworthy considering that BlackRock's CEO had previously made a statement characterising Bitcoin as an "index for money laundering.” A spot Bitcoin ETF would be structured to closely track the price movements of Bitcoin with every share backed by physical Bitcoin in a 1:1 ratio.

The prevailing question on everyone's mind is: When will it arrive? Two Bloomberg ETF analysts (Eric Balchunas and James Seyffart) have estimated a 75% likelihood that the United States will have a spot Bitcoin ETF in place by the conclusion of 2023. According to Bitcoin.com, the cryptocurrency industry is expected to witness its inaugural Bitcoin ETF sometime between mid-October and mid-March 2024.

The ETF could have a large impact on Bitcoin price dynamics. The potential approval of a Bitcoin ETF could trigger an influx of capital into Bitcoin, potentially propelling the price upwards. Several factors contribute to this outlook. Firstly, an ETF operating on traditional financial infrastructure would make Bitcoin more accessible to investors through their brokers, removing the need to navigate cryptocurrency exchanges or self-custody. Additionally, it may open the door for entities such as pension funds, which previously encountered complexities and public relations challenges, to seamlessly gain exposure to the asset.

Whether or not a Bitcoin ETF is approved soon, applications from major players such as BlackRock, VanEck, and Fidelity serve as indicators of institutional endorsement for the asset class. Before this, only a handful of companies, like MicroStrategy, Tesla, and Block, had included Bitcoin in their financial holdings, to varying degrees. In the coming months, the focus will be on the SEC as investors eagerly anticipate their decision and brace for any developments.

Conclusion

Amid legal battles, regulatory changes, and the potential Bitcoin ETF, the crypto space maintains its familiar blend of uncertainty and promise. As investors navigate the ever-evolving realm of cryptocurrency in 2023, one thing is certain: the story is far from over.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.