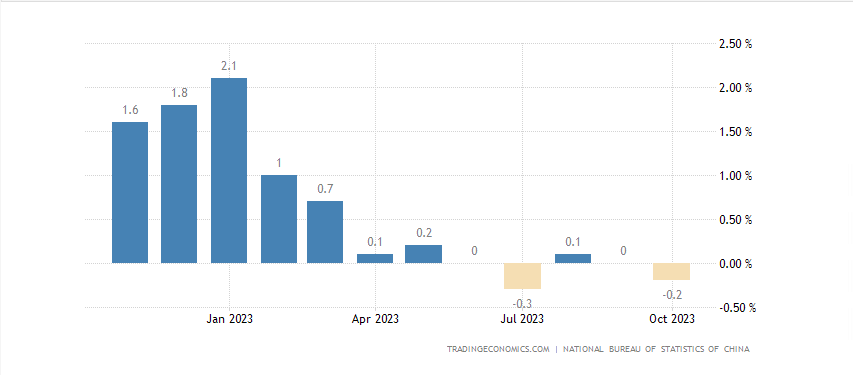

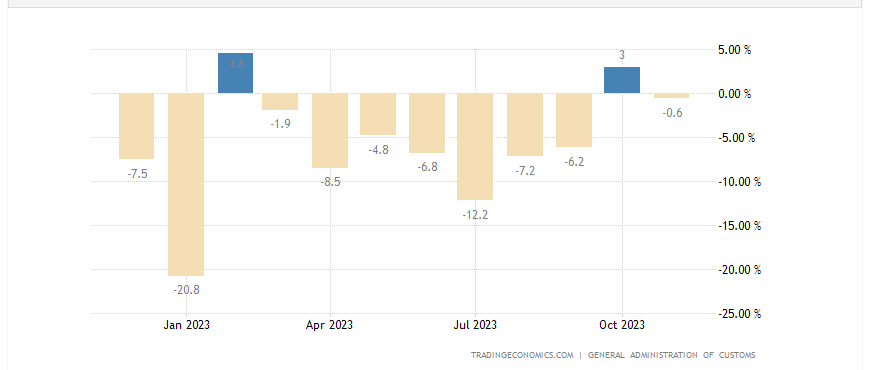

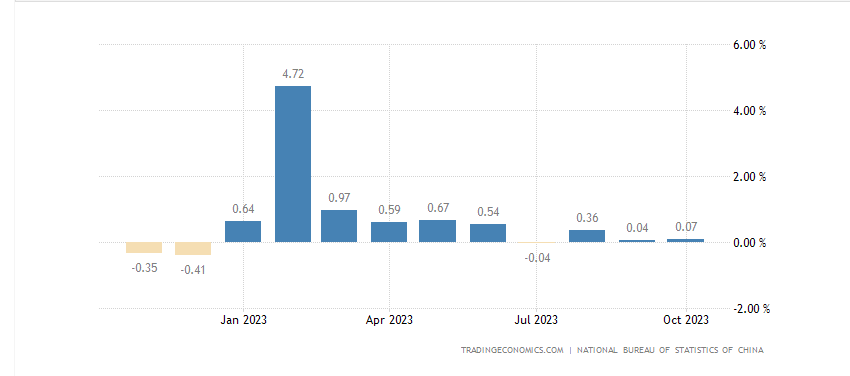

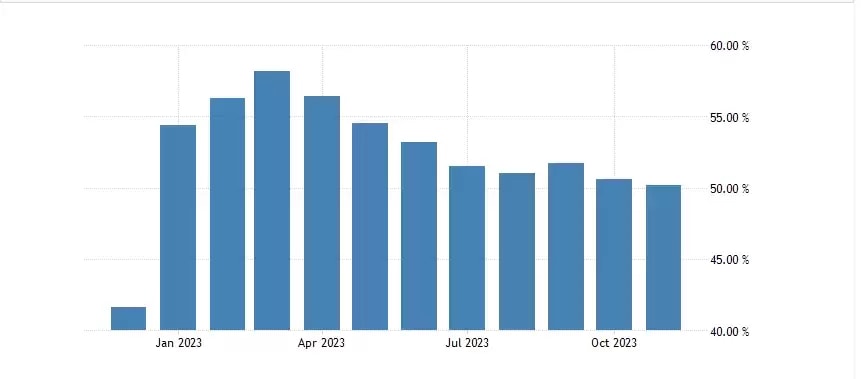

Compared with other major stock indices across the globe, China’s stock market features overall underperformance in 2023. Following the removal of COVID-19 lockdown measures, China’s economic rebound has fallen short of the high expectations. In the second quarter, the momentum of economic recovery faltered: the CPI slipped below 0, and imports were on a continuous decline, while the real estate market and Services PMI were both going downhill.

China’s Headline CPI YoY. Source: TradingEconomics

China’s Imports YoY in US Dollar Terms. Source: TradingEconomics

China’s House Price Index MoM. Source: TradingEconomics

The Official NBS Non-Manufacturing PMI in China. Source: TradingEconomics

China’s stock market also floundered throughout the year. In the first four months of 2023, the SSE Composite Index hit its high-water mark of 3418.95, propelled by the high expectations for economic recovery and the revaluation of state-owned enterprises (SOEs) after the lifting of COVID-19 restrictive measures.

However, the stock market made a U-turn in May, diving below the 3000 mark twice, with the weakening economic fundamentals and the widening bond yield spread between China and the US.

Later in July, the Politburo released the signal of “stimulating the capital market,” followed by a constellation of favorable policies jointly introduced by multiple government departments to bolster the financial market, including lowering stamp duty, regulating shareholder reduction, slowing down the pace of IPOs, and reducing the minimum margin ratio of financing.

Nonetheless, the positive impact of these policy moves was rather short-lived. After coming off the opening highs on August 28, stock prices were again dragged into a secular decline, with the SSE 50 Index and the CSI 300 Index sliding to record lows since last November. The sustained downward pressure was most keenly felt by the consumer goods, new energy, and pharmaceutical sectors. The CSI 500 and CSI 1000, two small-cap indices, have remained relatively stable despite their structural weakness.

Similarly, Hong Kong stocks also experienced a prolonged decrease since February, with the Hang Seng Index falling from its high of 22,700 at the end of January to around 16,160 in November, hitting a new low since November of last year.

The Hang Seng Tech Index has gone through overall fluctuations since February yet remains relatively stable compared to the Hang Seng Index. This is mainly reflected in the rebounding overall performance of gaming players such as Tencent and NetEase after the loosening of the approval process for new game releases. In particular, boosted by several popular game titles, NetEase's stock price has continued to rise.

In contrast, Tencent has been in a weak consolidation phase due to fewer new game releases and the slow growth in its domestic gaming business. However, other e-commerce stocks, such as JD.com and Alibaba, have not been doing well due to the sluggish domestic demand. The price of Xiaomi, on the other hand, has gone off the charts in the fourth quarter as domestically produced chips went viral.

The Hang Seng Tech Index has demonstrated overall volatility due to the varied performances among different constituents, while the Hang Seng Index, plagued by real estate and financial stocks, etc., is still on a downward trend with no clear sign of a turnaround in sight.

Will China’s stock market take a turn for the better in 2024?

The Chinese market

At present, the latest economic data released in China still reflects an extended cool-down on the demand side, manifested in tepid property sales, flagging consumer spending, and slowing trade data. We still need to wait and see whether the policies set out at the end of this year's Central Economic Work Conference can have a positive impact in 2024. Moreover, it is projected that China will continue to maintain its loose monetary policies, possibly implementing further reserve requirement ratio cuts and interest rate reductions, mainly to complement the one trillion yuan special bonds issued to resolve local governments’ debt risks. These sovereign bonds are mainly used for the construction of local infrastructure in a bid to drive the growth of related industries and stimulate domestic demand.

We should pay attention to whether the increased leverage adopted by local governments can drive up the leverage on the enterprise and resident sides to facilitate corporate financing and expansion, which will beef up employment and thereby increase household income. This could lead to increased willingness for households to take out loans and consequently turn the real estate market around. A rebound in property prices can then lead to more positive consumer sentiment, potentially creating a virtuous cycle to shore up the stock market.

The global market

The bond yield spread between China and the US is closely related to the performance of China’s stock market, as illustrated in the chart below.

In 2017, the yield on the 10-year government bonds in China was on a continuous rise, with the CSI 300 Index edging up throughout the year, while that in the US witnessed an opposite trend.

In 2018, Chinese bond yields started an extended period of decrease, with a year-round drop in the CSI 300 Index, whilst US bond yields recorded a continued rise. From 2019 to 2021, both Chinese and US bond yields went downhill, with the latter experiencing a more drastic decline. The bond yields in China bottomed out in April 2020 and continued its upward trend until the end of the year. Overall, the CSI 300 Index saw an upward trend from early 2019 to the end of 2020.

US bond yields stabilized at the end of 2020 and picked up the pace of their rise in 2021, while bond yields in China sustained their decline, and the CSI 300 Index entered a prolonged downturn in February 2021.

The aggressive rate hikes implemented by the Federal Reserve in 2022 contributed to the inverted spread between Chinese and US bond yields, and the CSI 300 Index has been stuck in a downward trend up to this day.

China 10-Year Government Bond Yield (yellow) vs US 10-Year Government Bond Yield (blue) vs CSI 300 Index (light blue). Source: Tradingview, CMC Markets (December 8)

As things stand now, the market has reached a consensus in its expectation that the Federal Reserve has ended the rate-hike cycle, which prompted the 10-year US bond yield to fall off its highs. Two scenarios may unravel in 2024. In the first scenario, the US economy will cool down, with the continuous shrinkage of the inflation rate. It is also likely that the Federal Reserve will adopt rate cuts, suppressing the US bond yields. In the meantime, the policies to stabilize growth introduced by the Chinese authorities will bring the economy back on its feet.

With the absence of additional policy moves to stimulate the economy, the bond yields in China will stabilize and pick up again, narrowing down the spread between China and the US and therefore presenting opportunities for the structural increase of China’s stock market.

To sum up, China’s stock market could present structural opportunities for investors next year. Yet considering the worsening expectations for the global economy, there is only a remote chance of a bull run in the Chinese markets, with a higher likelihood of structural fluctuations.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.