Fashion stocks

Tracking the trend: Which fashion shares are in vogue?

From high-end to high street, a range of fashion stocks are available to trade on our platform. Our offering includes LVMH, Burberry, Gap, and Zara parent company Inditex, to name but a few. Read on as we run the rule over some of the stock market’s most stylish names.

First, a quick note on the statistics we used. The data we’ve cited below was drawn from the London Stock Exchange, Nasdaq, Yahoo Finance and Google Finance, and was correct as of 2 January 2025.

High-end fashion stocks

Although there isn’t a strict definition of what constitutes ‘high-end’ or ‘luxury’ in the fashion industry, one thing that unites the following companies is that they offer a limited range of products at a premium price point. You’d also be hard pressed to find their stores on high streets beyond the world’s major cities.

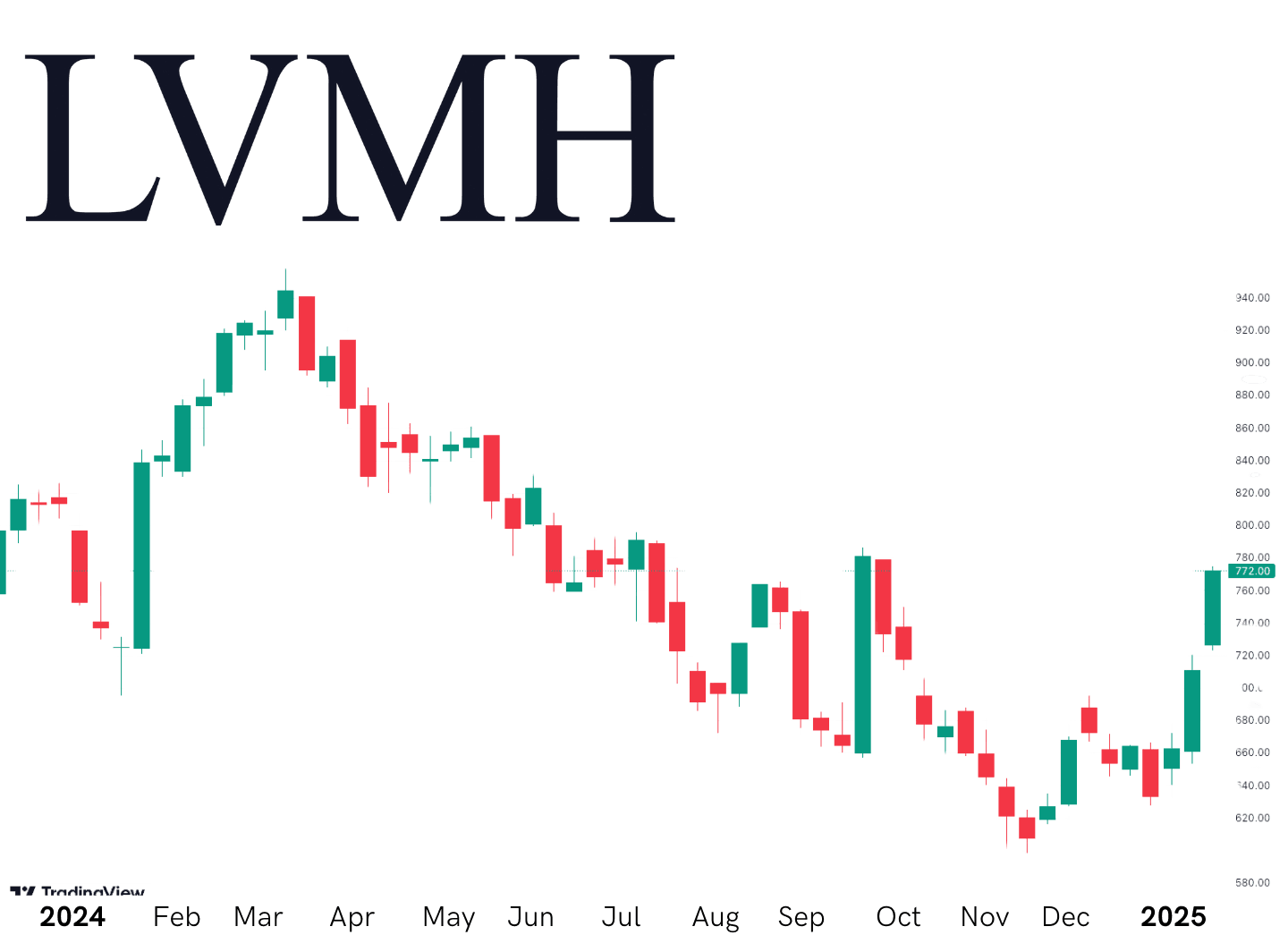

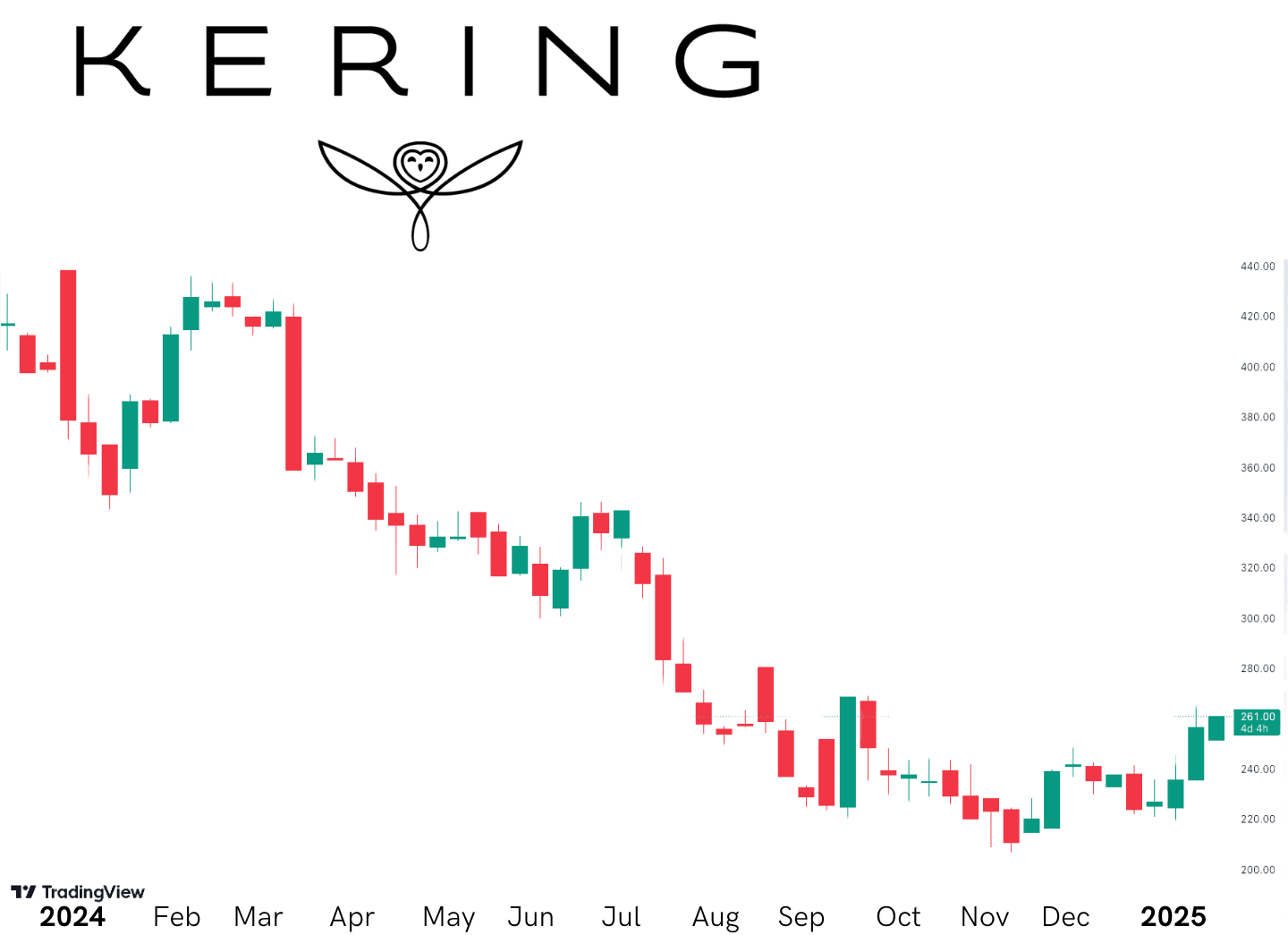

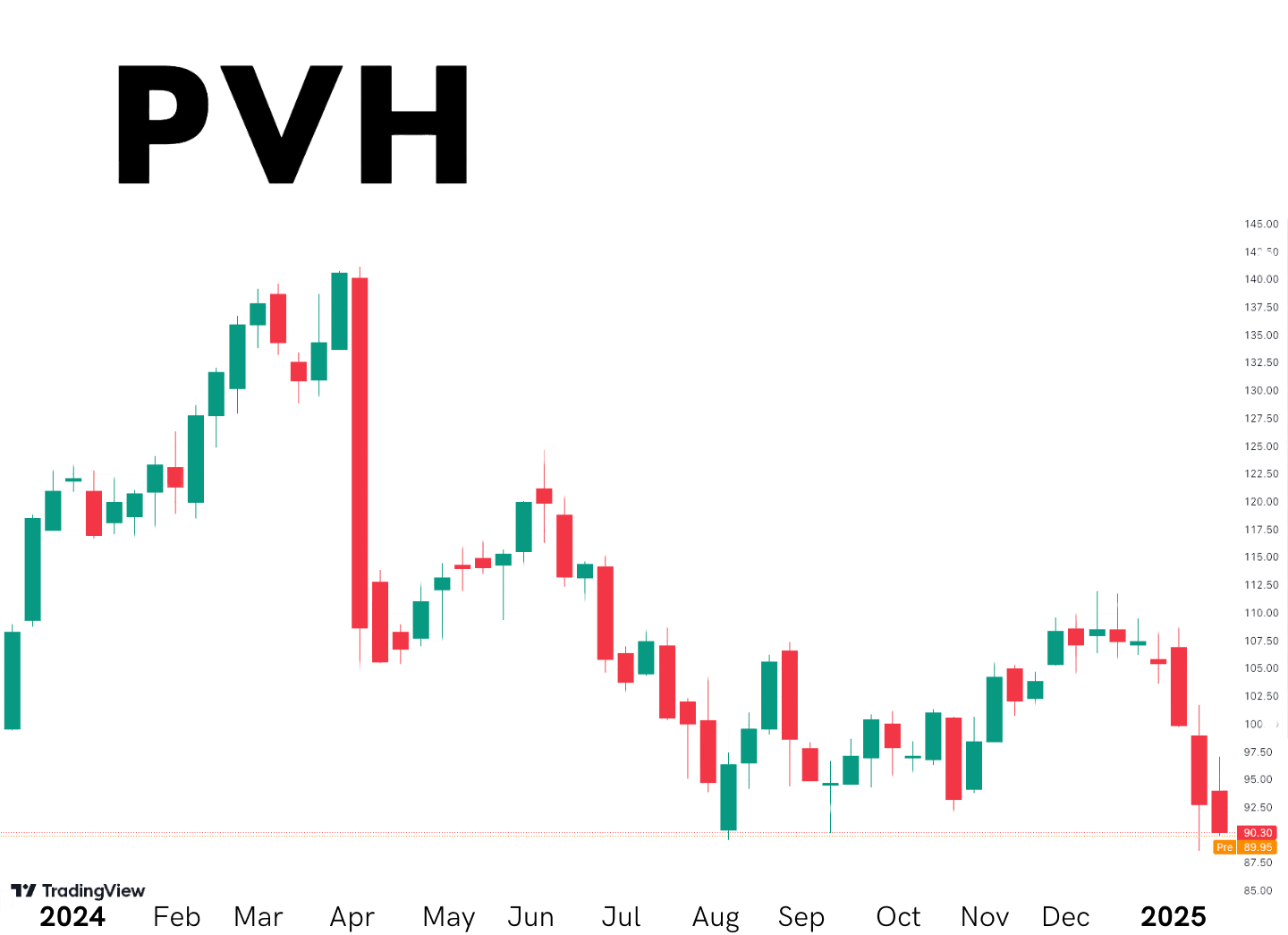

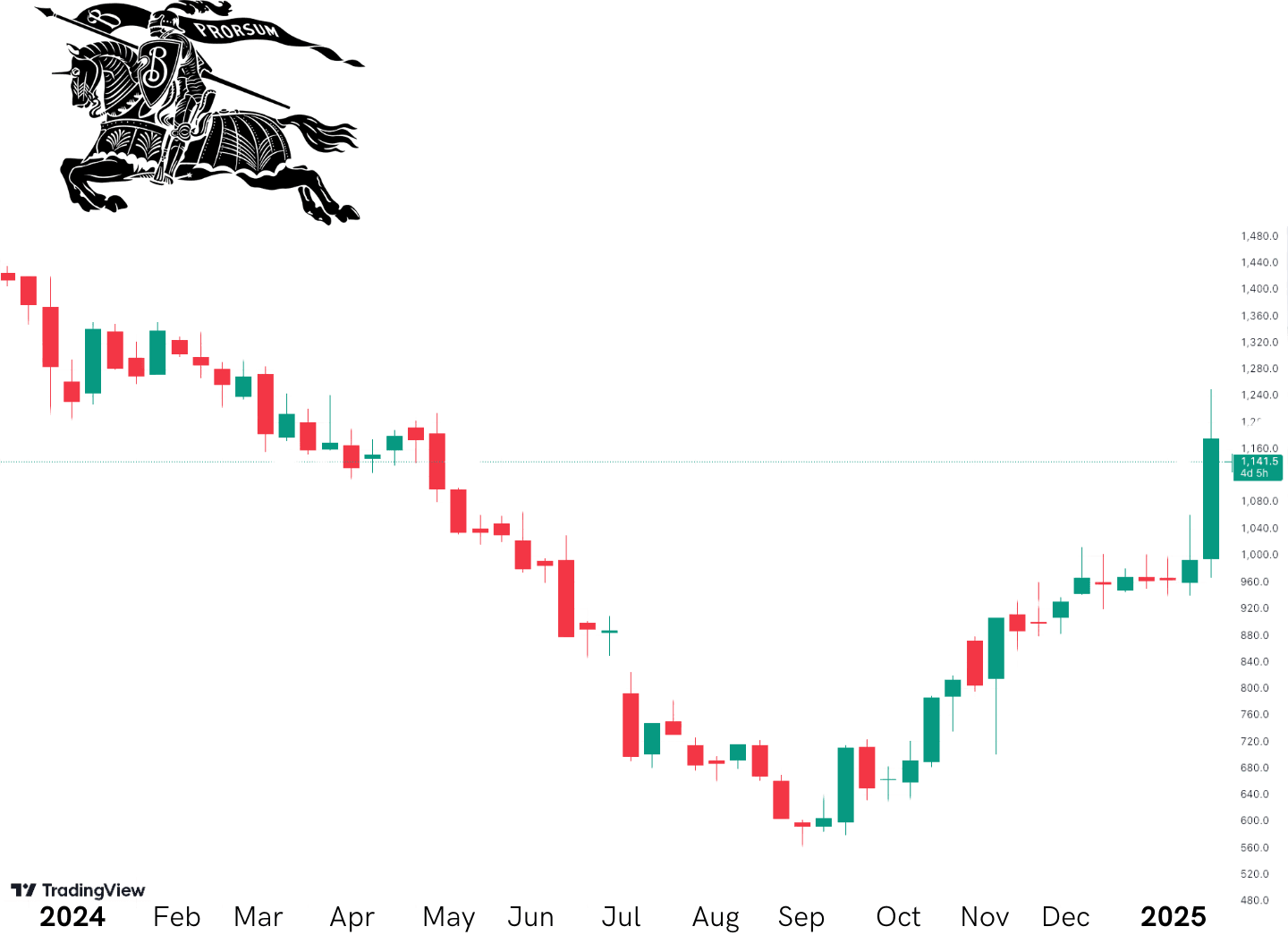

Interestingly, all of the luxury goods companies profiled below saw their share prices decline in 2024, partly due to weakening demand in key markets such as China, where consumers made cutbacks amid tightening economic conditions.

High street fashion stocks

High street fashion labels are easily accessible to the masses. The items they sell are typically manufactured in the hundreds of thousands or even millions, and their price tags range from affordable to somewhat expensive.

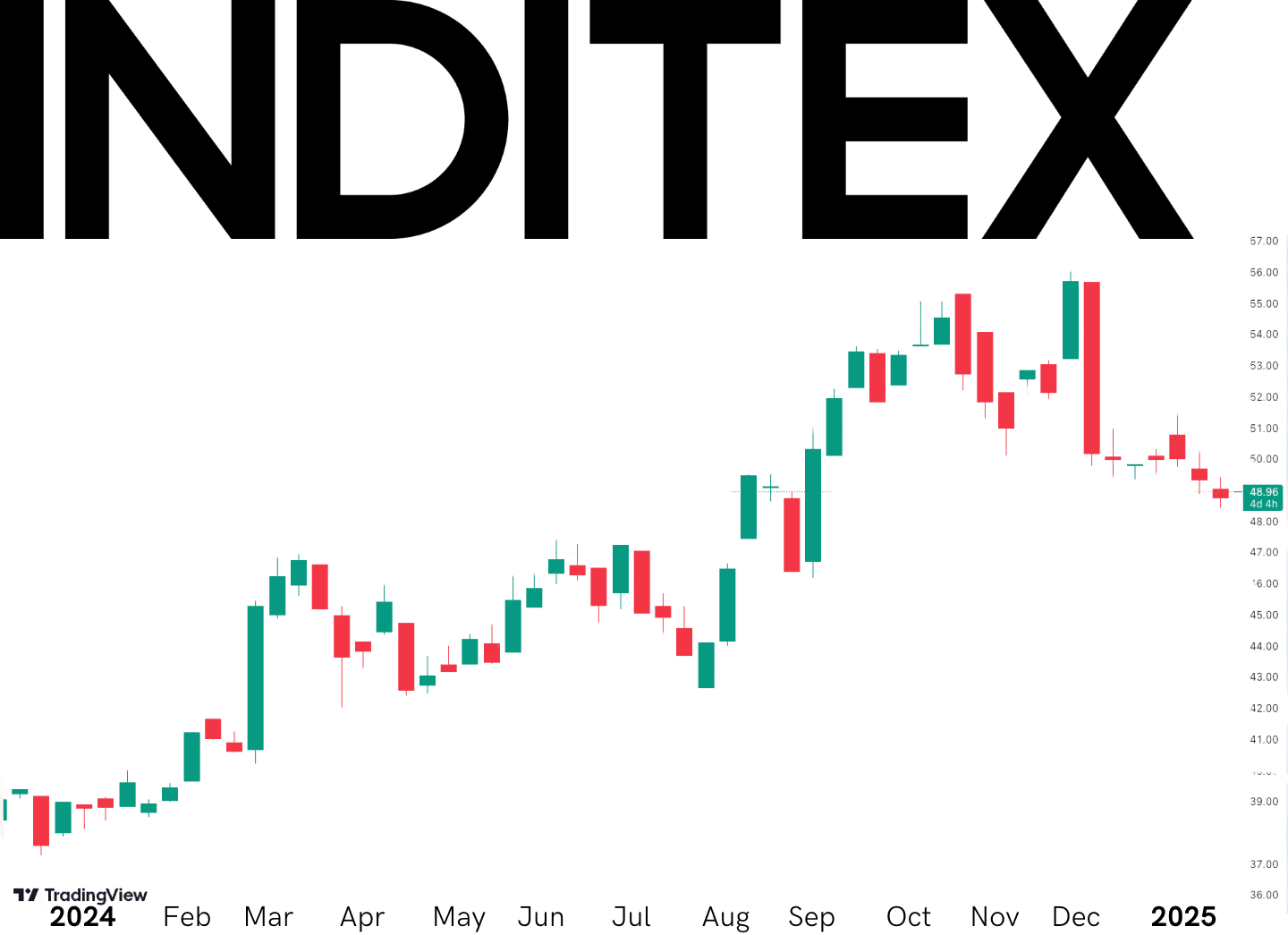

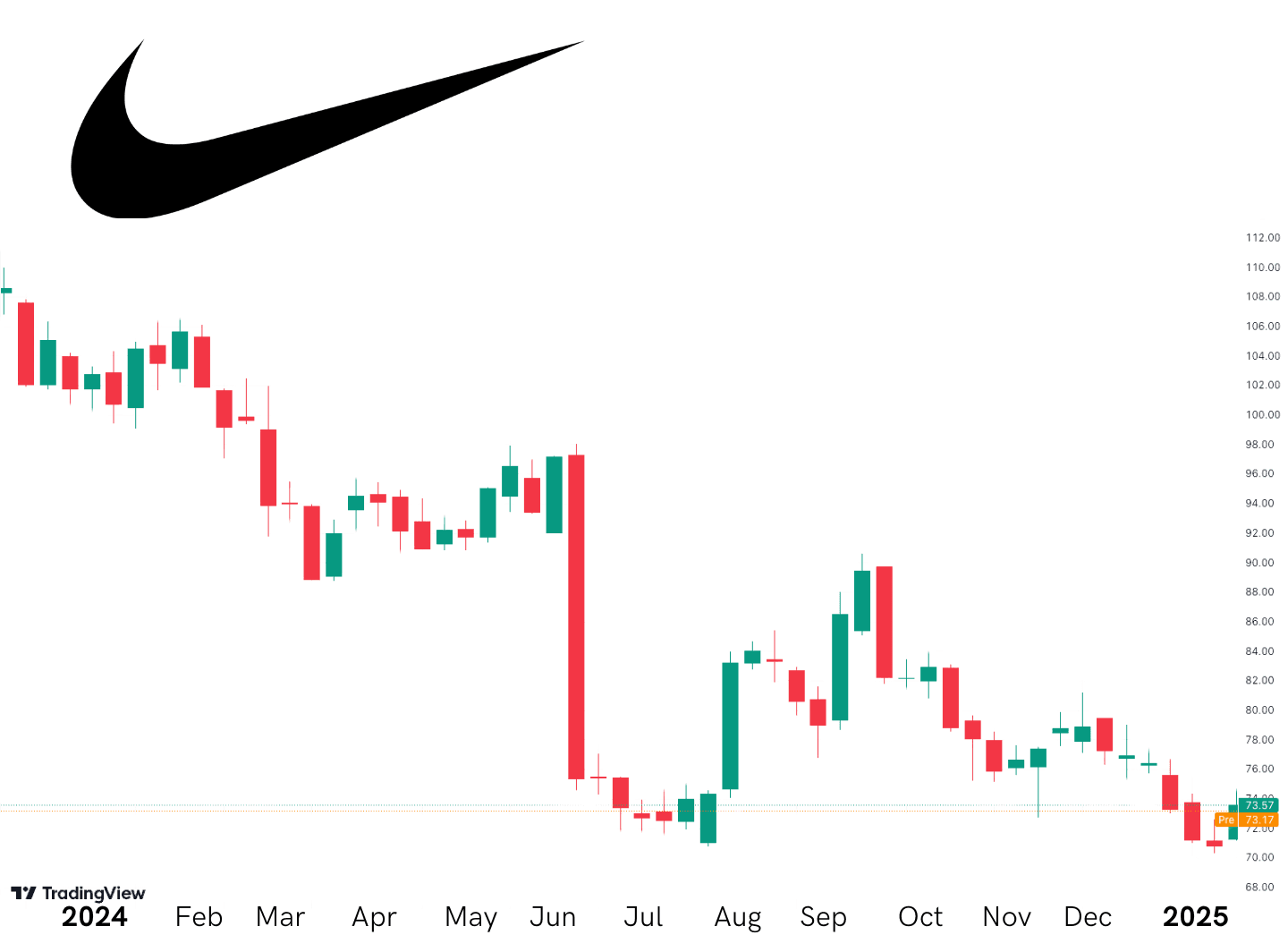

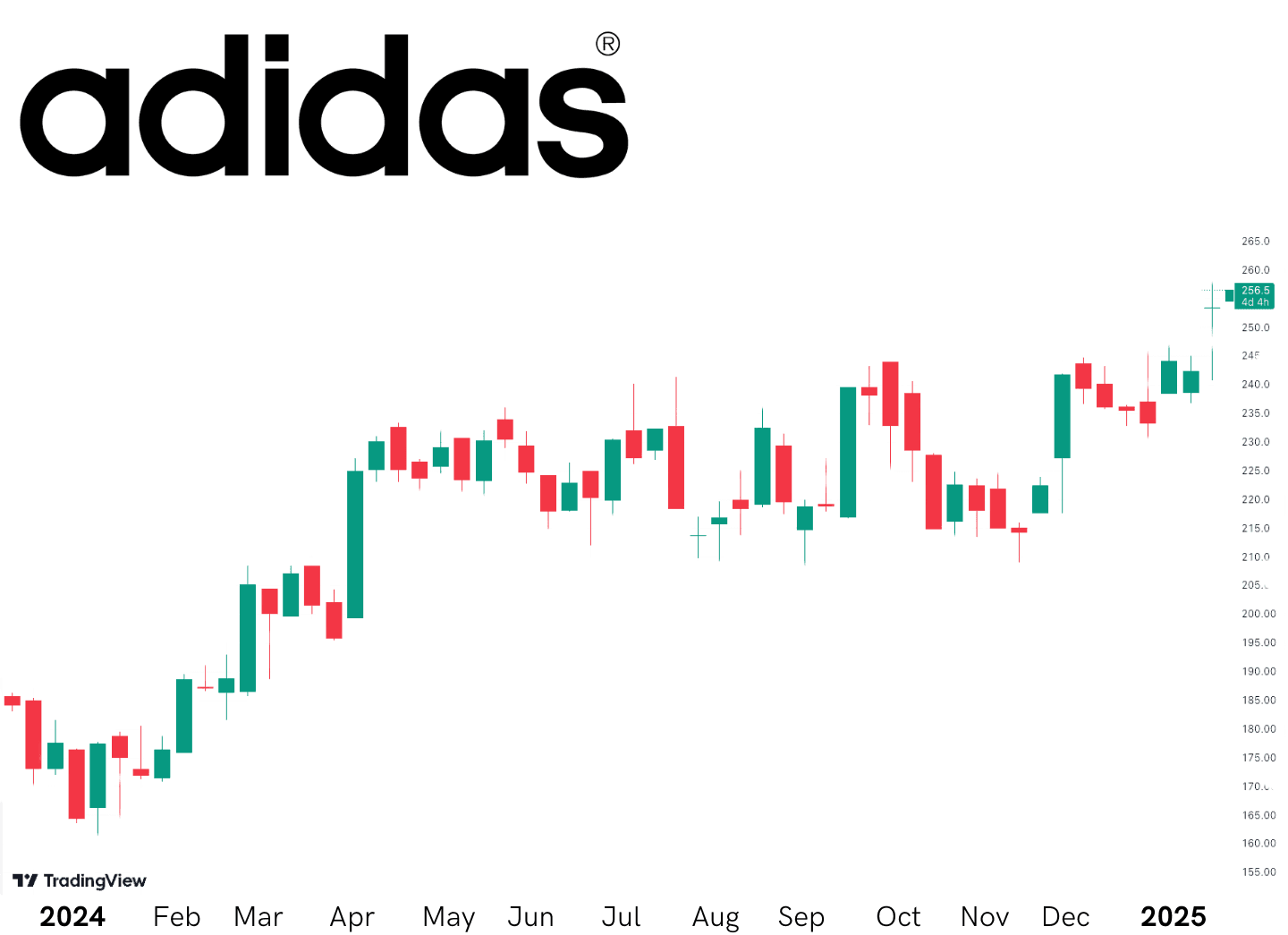

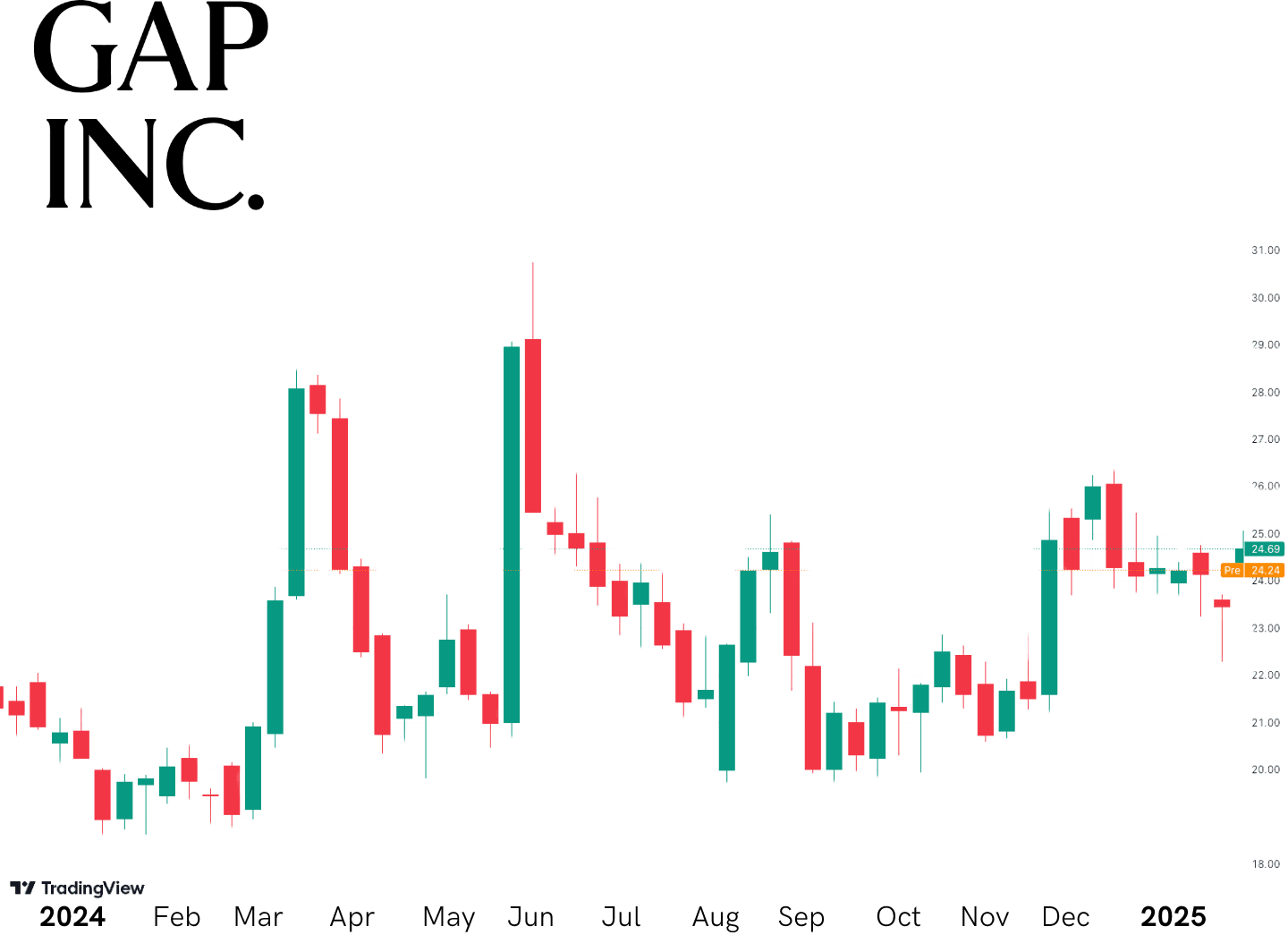

It’s notable that three of the companies in this section – Inditex, Adidas and Gap – were among the few fashion labels whose shares made gains in 2024.

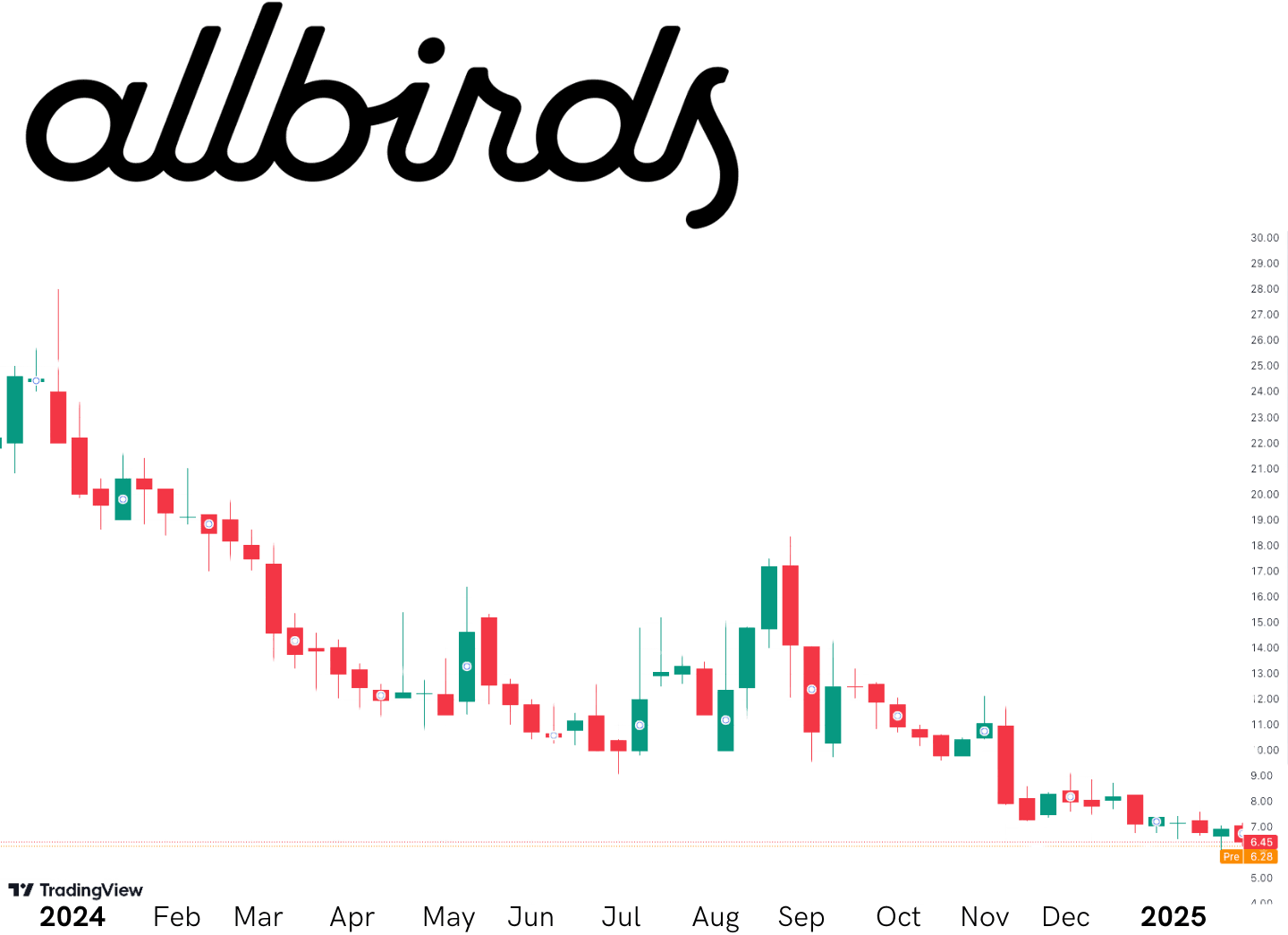

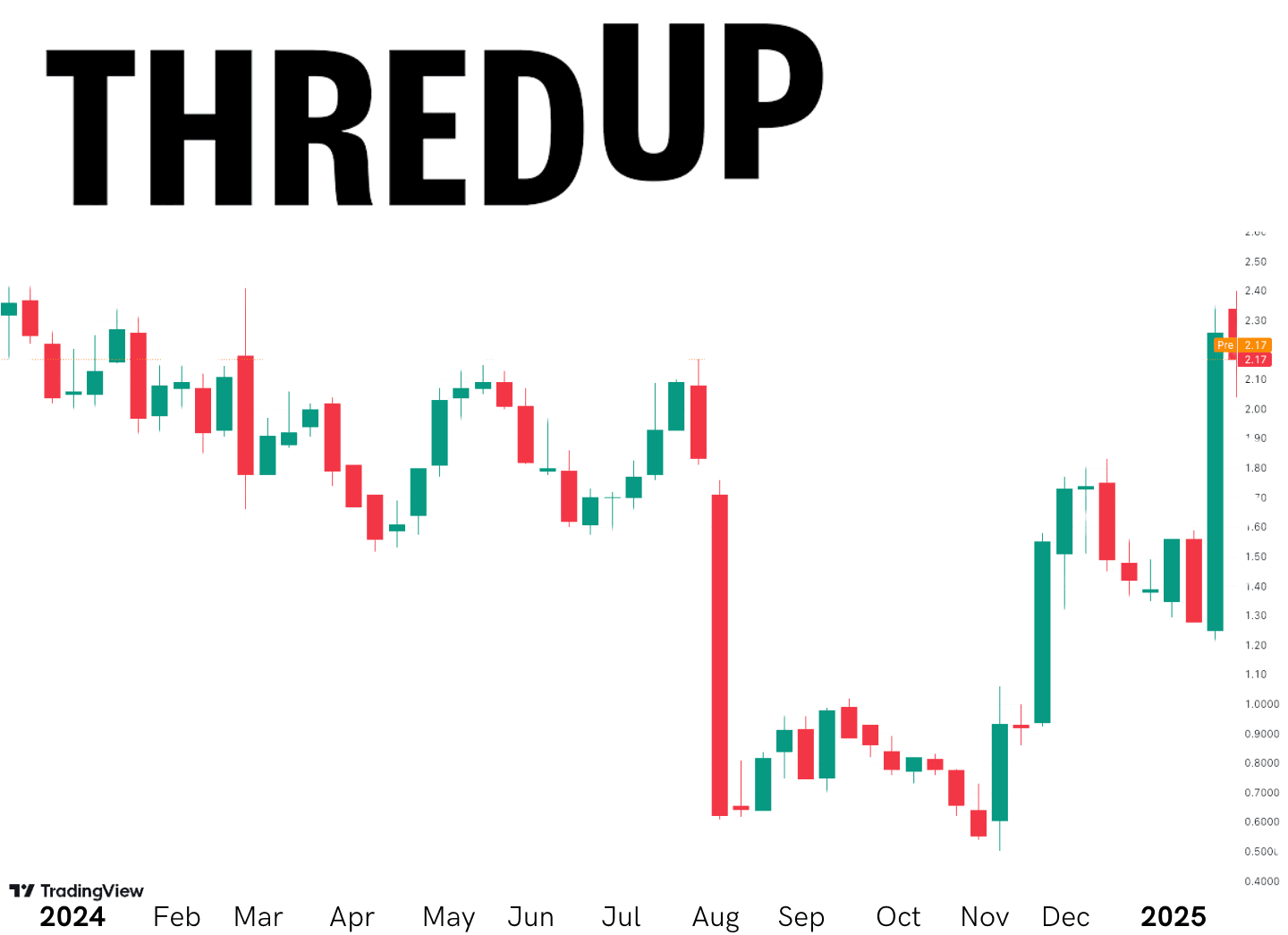

Sustainable fashion stocks

The global sustainable fashion market was valued at $7.8bn in 2023 and is expected to exceed $33bn by 2030, according to research from Coherent Market Insights, as reported by Yahoo Finance on 8 April 2024. Sustainable fashion refers to products made from environmentally friendly materials through sustainable, responsible processes – for example, clothing made from organic cotton, recycled fabrics, or plant-based textiles that use less water and chemicals than traditional materials.

Two famous names in this space, profiled below, saw their share prices tumble in 2024.

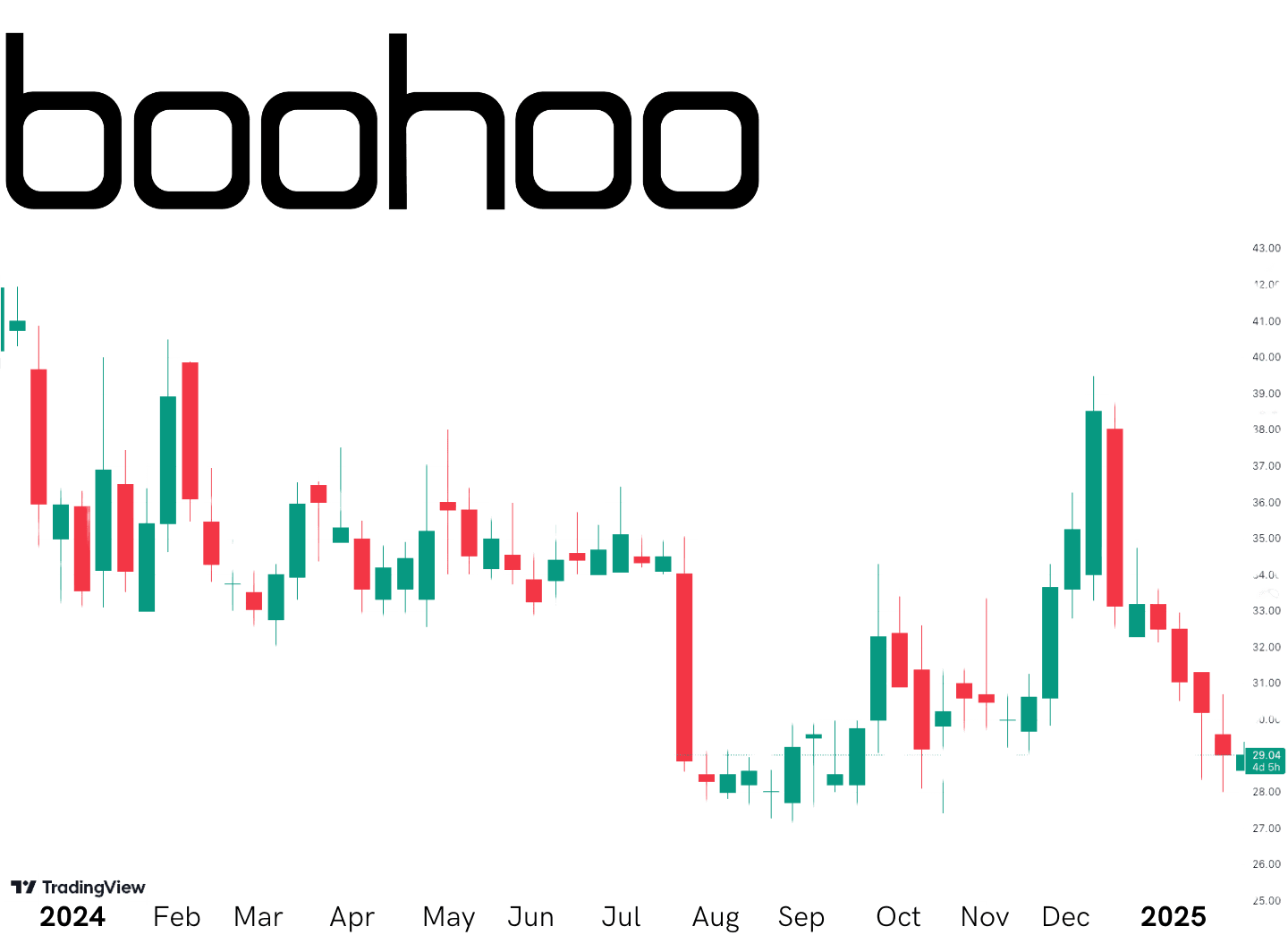

Online fashion retailers

Online retailers have been taking market share from high-street stores over the last two decades. However, even as younger consumers lean towards online shopping, businesses in this area aren’t immune from downswings.

Although the Asos stock price made gains in 2024, shares of both Asos and Boohoo have tanked since their pandemic-era highs of 2020 to 2021, when coronavirus lockdowns boosted demand for online orders and helped to inflate the two companies’ market valuations.

Where next for fashion stocks?

Our look at major fashion stocks reveals that 2024 was a mixed year for the industry. What might the future bring? It seems likely that, over the long term, the shift away from bricks-and-mortar stores towards online fashion retailers will continue. However, the question of which stocks will benefit from this evolution in shopping habits is still up for debate, as traditional retailers continue to improve their online offering and develop tie-ins with the new breed of internet-based retailers.

The shift from ‘fast’ fashion towards more ethical and sustainable (and pricier) practices may also continue, but in a continuing cost-of-living crisis the pace of this change could slow. At the same time, high-end brands have proved resilient and adaptable in the past, and the share prices of luxury goods makers such as LVMH and Burberry could bounce back. For companies with large market caps, the share-price dips of 2024 may be interpreted as a buying opportunity by some traders, while others may be wary of further declines.

One thing which seems certain, however, is that industry-watchers will be keeping close tabs on how the coming year plays out. As ever in fashion, nothing stands still for long. Trends come and go. That’s as true for fashion stocks as it is for the catwalk.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

How to trade shares

Learn the essential steps to start trading shares, from researching companies to placing your first trade.

What is share trading?

Explore how share trading works and how you can buy and sell shares of publicly listed companies.