Open a forex demo account

Discover forex trading and spread bet or trade CFDs on over 330 forex pairs, at home or on the go.

KEY BENEFITS

FCA regulated

Segregated funds

FTSE 250 group

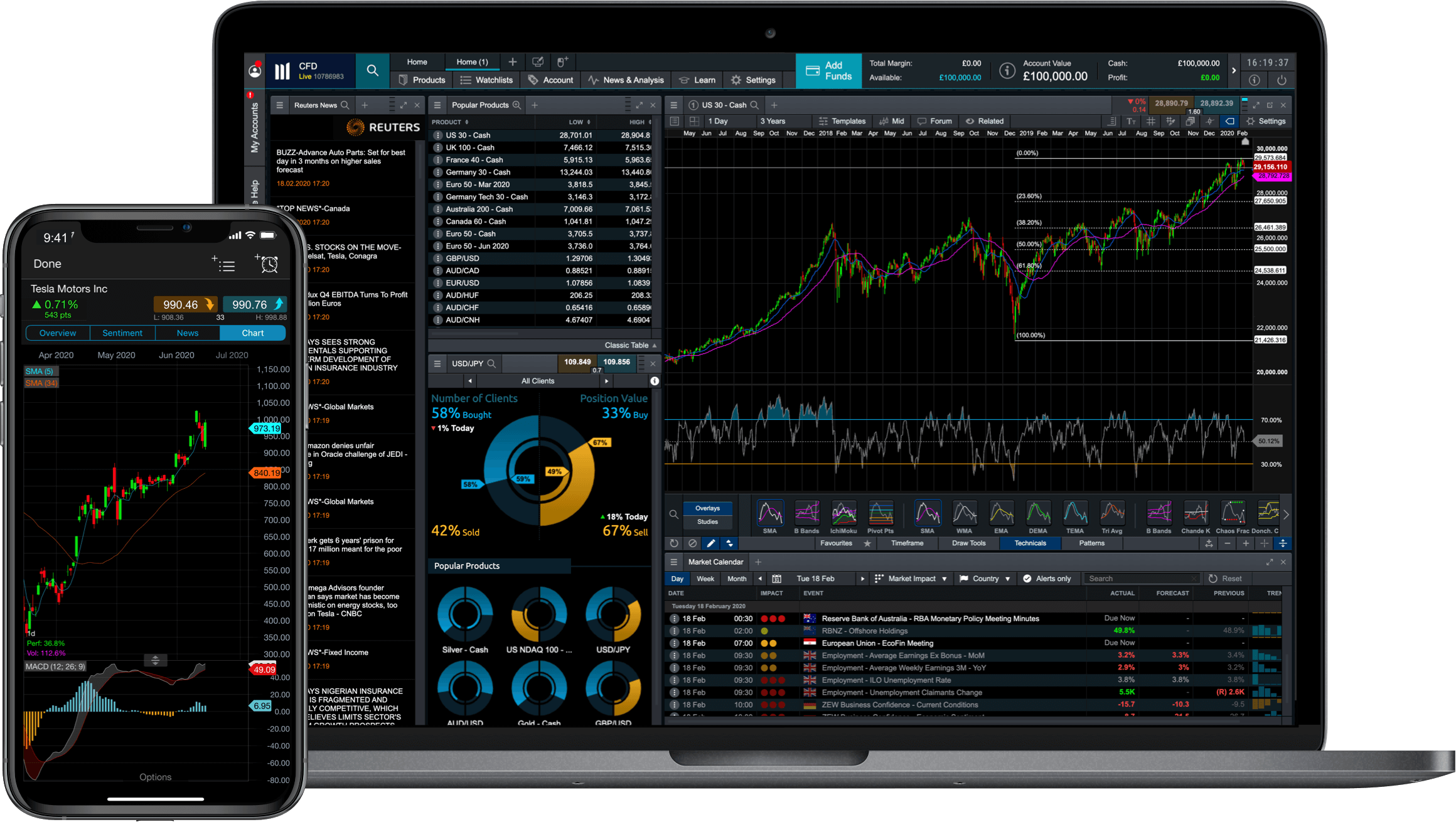

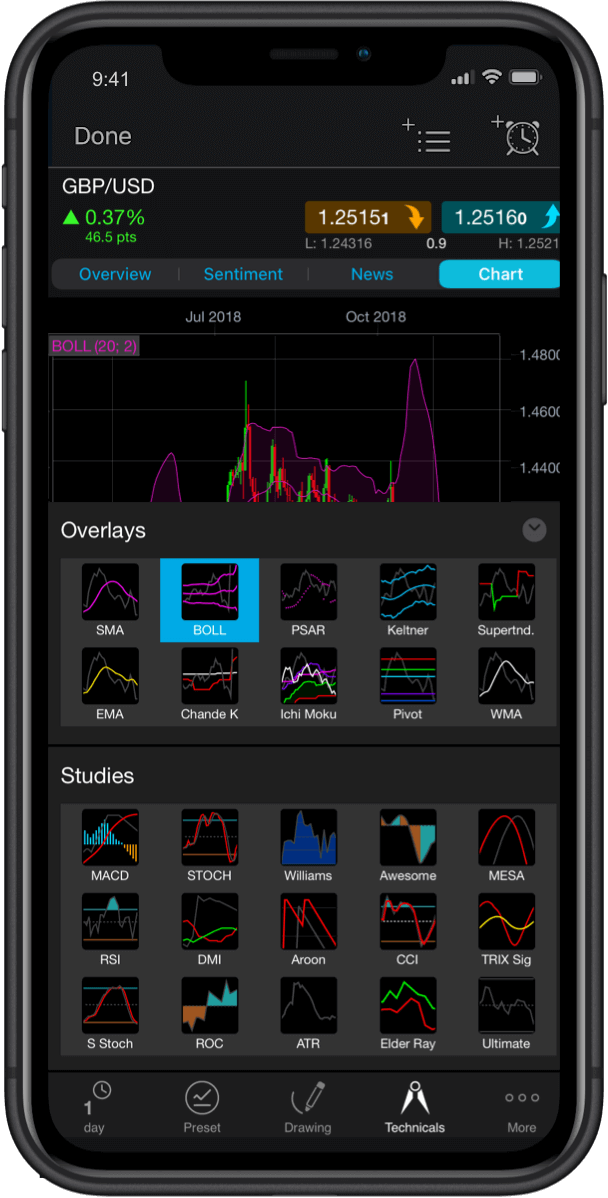

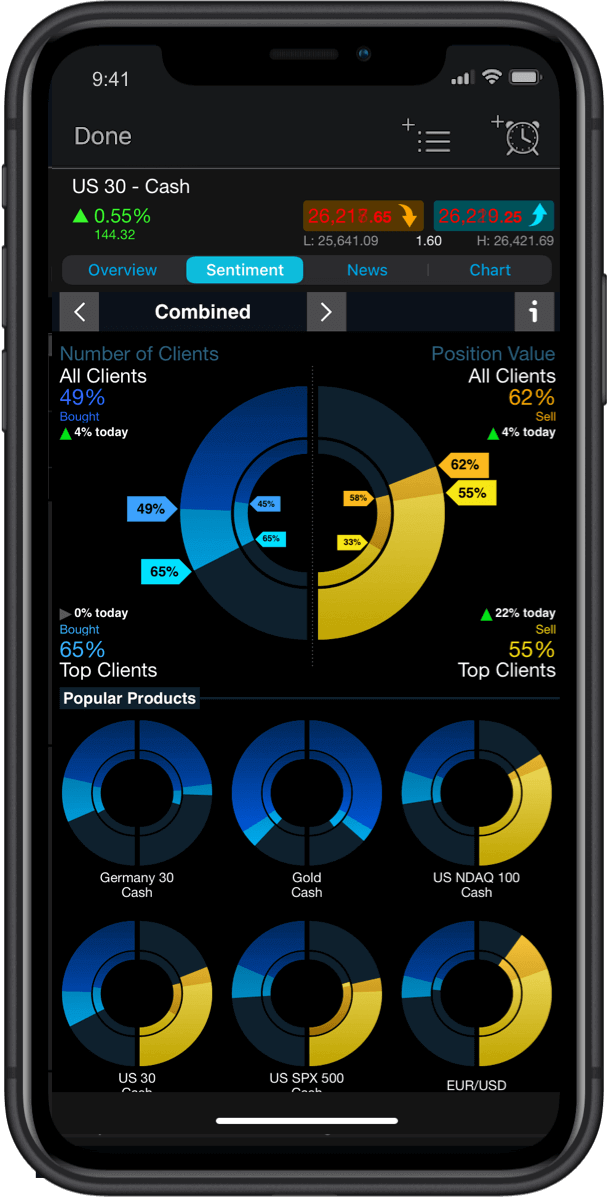

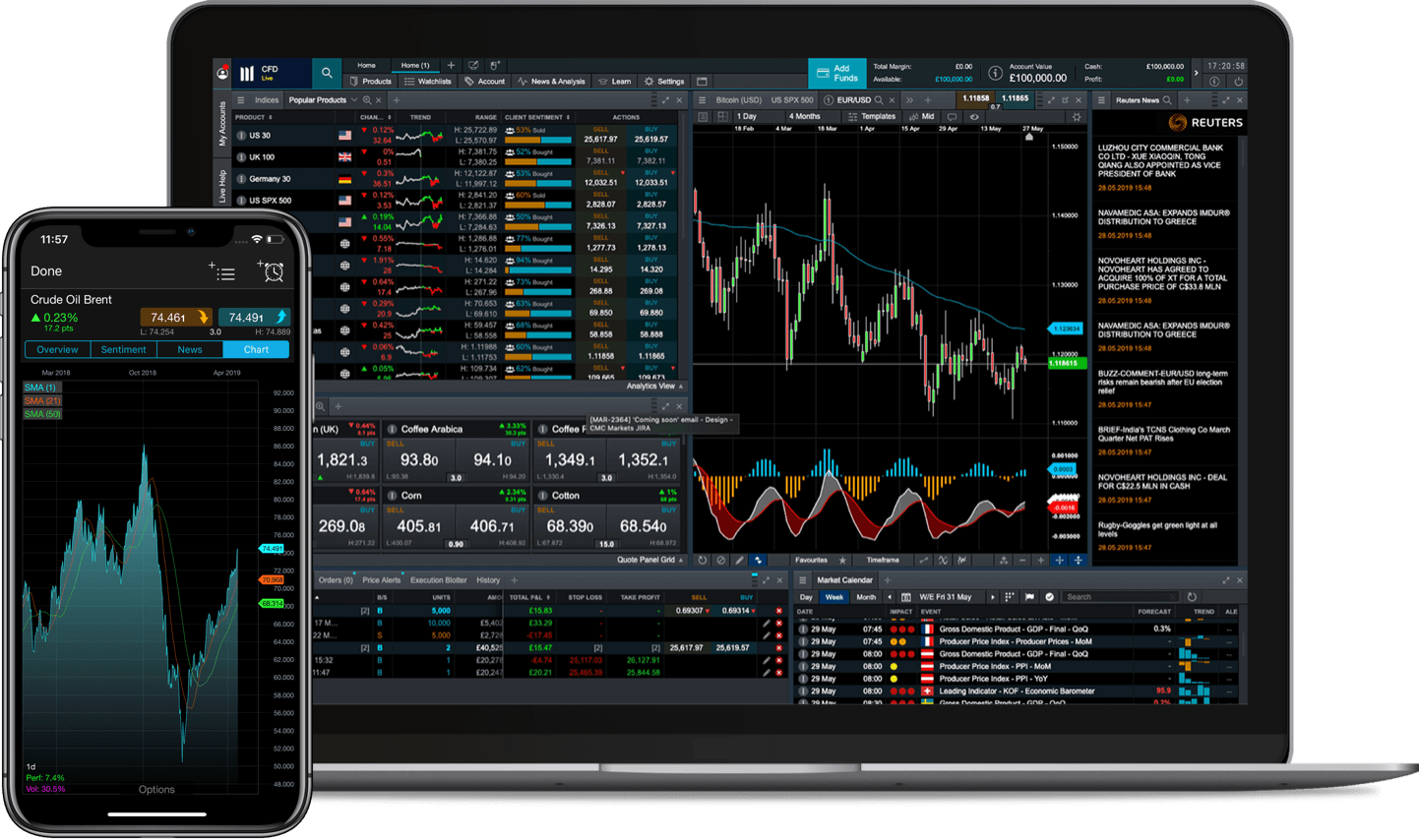

Spread bet and trade CFDs on forex on our award-winning platform

Fast execution, precise charting and accurate insights are vital to your success as a forex trader. Our trading platform was built with forex trading in mind, and you can get a feel for the platform, risk-free, with your forex demo account.

What is forex trading?

Forex trading is the simultaneous buying and selling of the world’s currencies on a decentralised global market.

One of the largest and most liquid financial markets in the world, its total average turnover per day is reported to exceed $5trn.

The forex market is not based in a central location or exchange so is open to trade 24 hours a day, from Sunday night through to Friday night.

Why spread bet and trade CFDs on forex with CMC Markets?

Dedicated customer service

Over 35 years' industry experience

FTSE 250 group

FAQS

What do I get with a forex demo account?

You get access to nearly all the same features as you would in our live account, except you won’t be trading with real money. A forex trading demo account is an excellent way to practise forex trading risk-free, with £10,000 of virtual funds. Alternatively, open a live forex account to get started straight away.

Which forex instruments can I trade?

You can trade on over 330 forex pairs, including major crosses like EUR/USD, GBP/USD and AUD/USD, as well as minor and emerging currencies. Learn more about forex currency pairs.

What is the minimum trade size for forex?

You can spread bet from £0.30/point on EUR/USD, GBP/USD, USD/JPY and AUD/USD, and £0.40/point on EUR/GBP. You can see the minimum trade size for all instruments on our Next Generation platform, in the ‘Product Overview’ under ‘Betting and Position Limits’.

What are your spread and margin rates on a forex demo account?

Our spreads start from 0.7pts on major FX pairs like EUR/USD, USD/JPY and AUD/USD. Spreads on GBP/USD start from 0.9pts, and from 1.1pts on EUR/GBP. Margin rates for our most popular forex pairs start from 3.34%, which is the percentage of the total trade value that you need to put forward to open a position. Learn more about margin trading.

What are the main risks of forex trading?

Trading on the foreign exchange market can expose a trader to risks. For example, spreads between the buy and sell prices of popular forex pairs are among the tightest, so even small price fluctuations can incur larger-than-expected profits or losses. Learn how to manage risks in trading.