Trade with the UK’s No.1 Spread betting account ¹

Spread bet on rising or falling financial markets

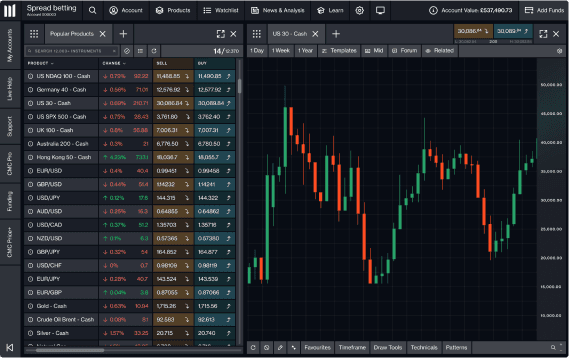

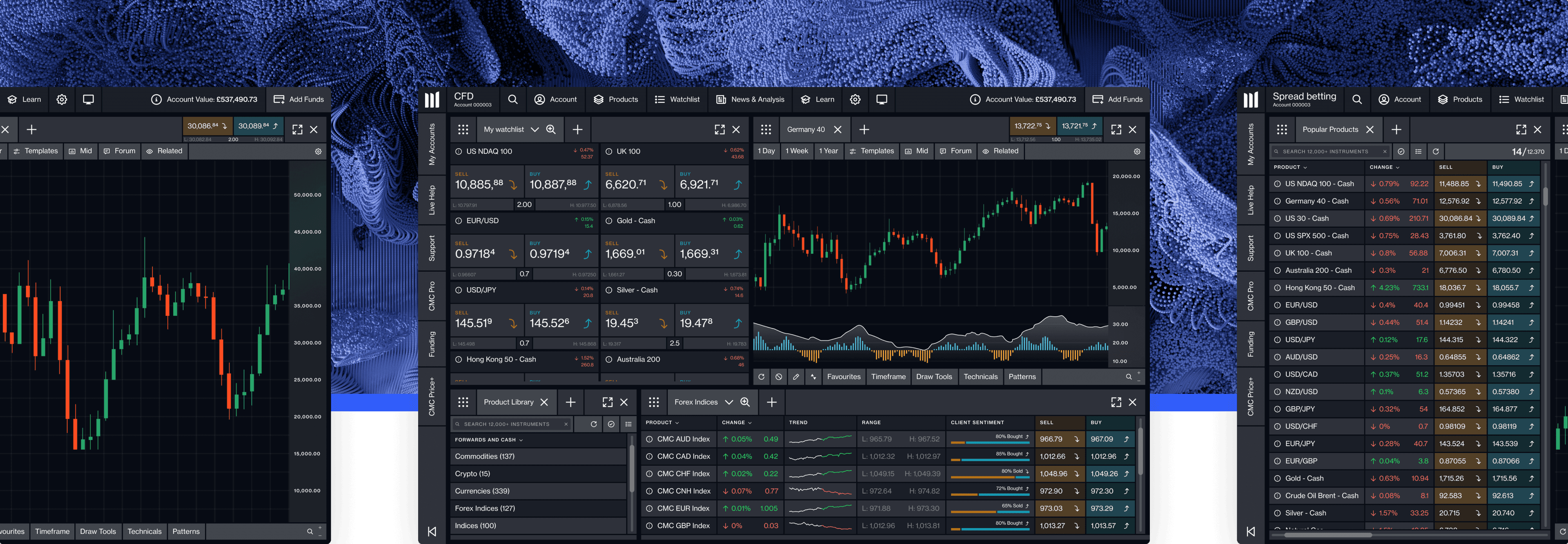

- Trade 12,000 instruments across forex, indices, commodities, shares, ETFs, and more

Enjoy tight spreads, no hidden fees, and tax-free profits²

Access advanced tools for precise charting

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

Why spread bet with us?

There's no capital gains tax or stamp duty to pay on any profits you make from spread betting in the UK.

Deposit from just 3.34% of the full value of your position to open a trade. Leverage amplifies any profits or losses equally, and can increase the risk of losing money rapidly.

Start spread betting on US stocks without currency conversion fees (other fees may apply).

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

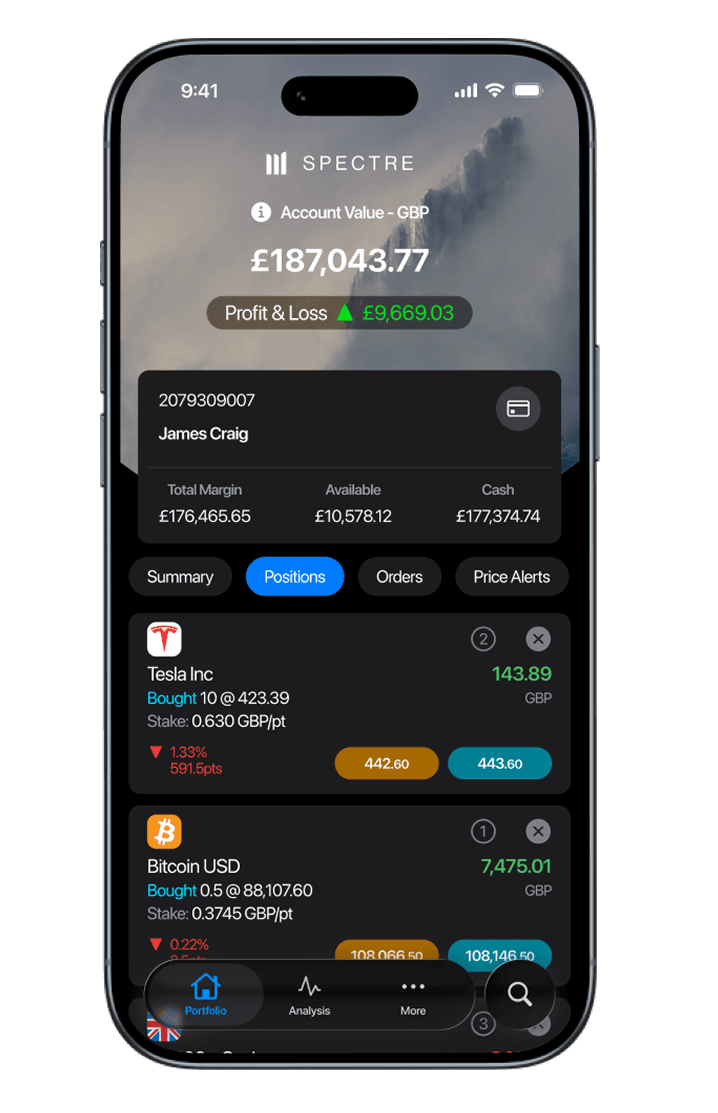

The new way to trade tax-free*

For professional clients only. CMC Spectre offers unlimited tax-free trading*, helping you keep more of your returns.

No financing costs

No capital gains tax

No margin calls

*Tax treatment depends on individual circumstances. Professional clients only. Capital at risk.

Understand our spread betting costs

The two main costs associated with spread betting are the margin and spread:

Margin – the initial deposit, representing a fraction of the total trade value, which acts as collateral to open positions.

Spread – the difference between the buying and selling price of an instrument.

instrument | min spread | margin rate | price | day | week | Trend |

|---|---|---|---|---|---|---|

Pricing is indicative only. Past performance is not a reliable indicator of future results.

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND | HOLDING COST BUY | HOLDING COST SELL |

|---|---|---|---|---|---|---|---|---|

INSTRUMENT | MIN SPREAD | MARGIN RATE | PRICE | DAY | WEEK | TREND |

|---|---|---|---|---|---|---|

What is spread betting?

What do our customers say about trading with us?

How we support our traders

You can contact us whenever the markets are open, from Sunday night to Friday night, when our experienced customer service team will be happy to help.

Our free educational resources cover everything from the stock markets to the intricacies of spread betting.

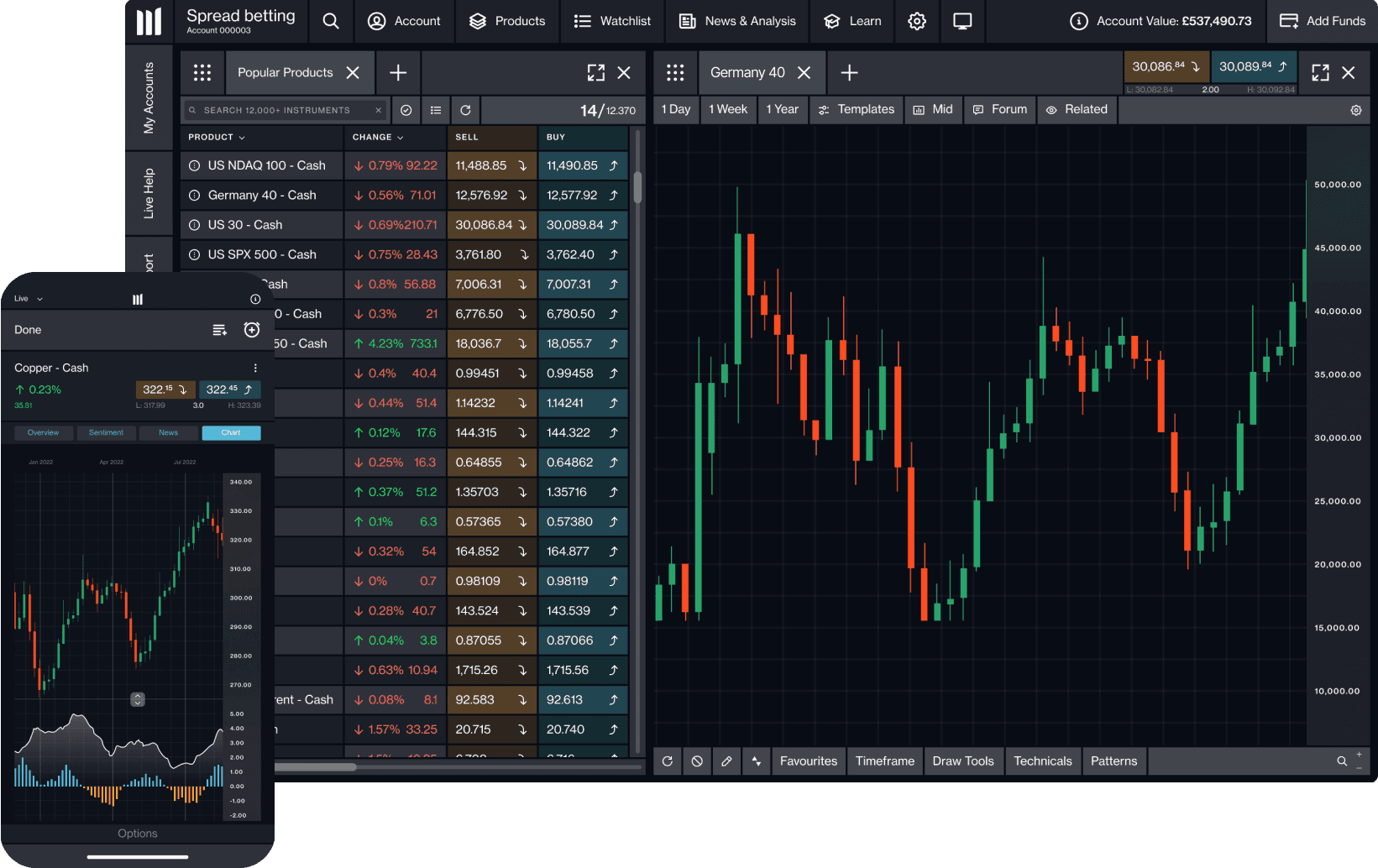

Platforms to suit every trader

You can open an equities, spread betting or CFD account to trade on our proprietary web-based trading platform and native app. If you open a CFD account, you can choose to link it to TradingView.

To spread bet or trade CFDs on MetaTrader 4, you'll need to create a separate account. This account doesn't provide access to TradingView. Note: on MT4, you can trade on forex, indices and commodities, but not shares, ETFs, rates or bonds.

Learn more about the platforms we offer below.

ForexBrokers.com Awards

Web platform

We've invested over £100m into our proprietary platform, creating pioneering technology to suit all styles of trading.

ADVFN International Financial Awards

Mobile app

Get the functionality of our web platform in your pocket, with mobile-optimised charting, full order-ticket features and real-time alerts.

Spread bet or trade CFDs on MT4

MetaTrader 4 (MT4)

Trade on one of the world's most popular platforms, and access our free premium MT4 indicators and Expert Advisors.

FAQs

Why not start with our introduction to spread betting guide? Find out what spread betting is, how it works, and view our short video.

Spread betting on shares differs from the traditional investment approach of buying and owning shares. For one thing, you don't own the shares when spread betting; instead, you're taking a view on which direction the share price will move. Any profits you make when spread betting are tax-free, and there's no stamp duty to pay, unlike traditional investing.

Another key difference is that you can utilise leverage, which means you only need to put up a set percentage of the full value of the trade, with an initial deposit, known as margin. This increases your exposure, but also means that any profit or loss you make is magnified, relative to the share's price fluctuations. Find more about spread betting

All financial trading and investing involves an element of risk, no matter how robust your trading strategy. Financial markets can be unpredictable and volatile. This means that your trade could go against you, so it's important to manage your risk carefully. As part of a trading plan, you should only risk a small percentage of your overall capital with each trade.

Highly volatile markets can lead to market gapping, or slippage, where prices suddenly gap. However, you can guard against this by adding a guaranteed stop-loss order (GSLO) to your trade. There is a cost for using a GSLO, but it's refunded in full if it's not triggered while your position remains open.

It's also important to note that you can't lose more than your account value as a retail trader, because your account is covered by negative balance protection.

You can practise trading with our demo account, which comes with £10,000 virtual funds. Find out if your ideas and strategies work in a test environment, before trading for real. Learn more about managing your riskSpread betting and CFD trading are leveraged products that allow you to take a view on a huge number of financial markets. They can provide similar economic benefits to investing directly in the underlying markets, for example when you might purchase shares in a listed company, or physical gold.

There are many similarities between the two products, although CFDs are treated differently for taxation. View our spread betting versus CFD trading article to learn more about the similarities and differences between these two popular forms of derivatives trading.

There's no cost to open a live trading account with us. You can also view prices and use tools such as charts, Reuters news, or Morningstar quantitative research equity reports, free of charge. You'll need to deposit funds in your account to place a trade.

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC, and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, also make a contribution to our overall revenue.

Dive deeper

What is spread betting?

Dig deeper into what spread betting is and understand how it works.

Spread betting vs CFD trading

Discover the differences between spread betting and CFD trading, and find out which is best for you.

Ready to get started?

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.

2 Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.