Open a trading account

Open a trading account online to access our feature-rich yet intuitive, award-winning trading platform*. We're regularly developing and enhancing our platform's features and tools, to give you the best possible support in your trading journey.

GET STARTED

1. Complete a simple application form.

2. Receive verification. After submitting the form, you will get a response from us within 60 seconds.**

3. Fund your account and choose from over 12,000 financial instruments.

FCA regulated

Segregated funds

FTSE 250 group

Switching to a CMC Markets trading account

Our powerful trading platform and mobile apps, competitive spreads and 34+ years’ experience are just some of the reasons why clients choose to join us. Learn more about switching to CMC Markets.

Why create a trading account with CMC Markets?

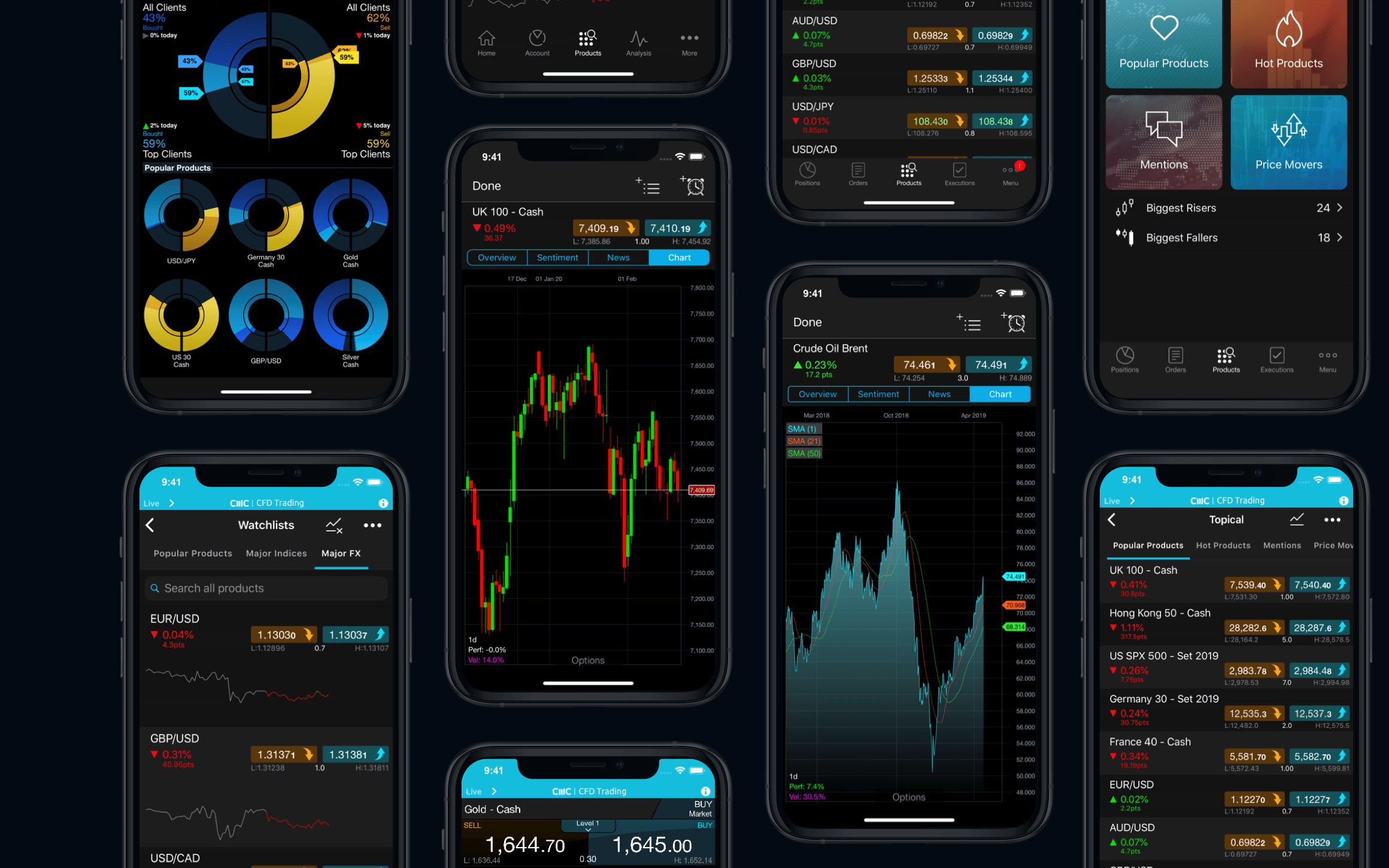

Enhanced mobile trading

Experience enhanced mobile trading with an app you can customise to suit your trading style, so you can keep track of the markets that matter to you and stay informed on the go.

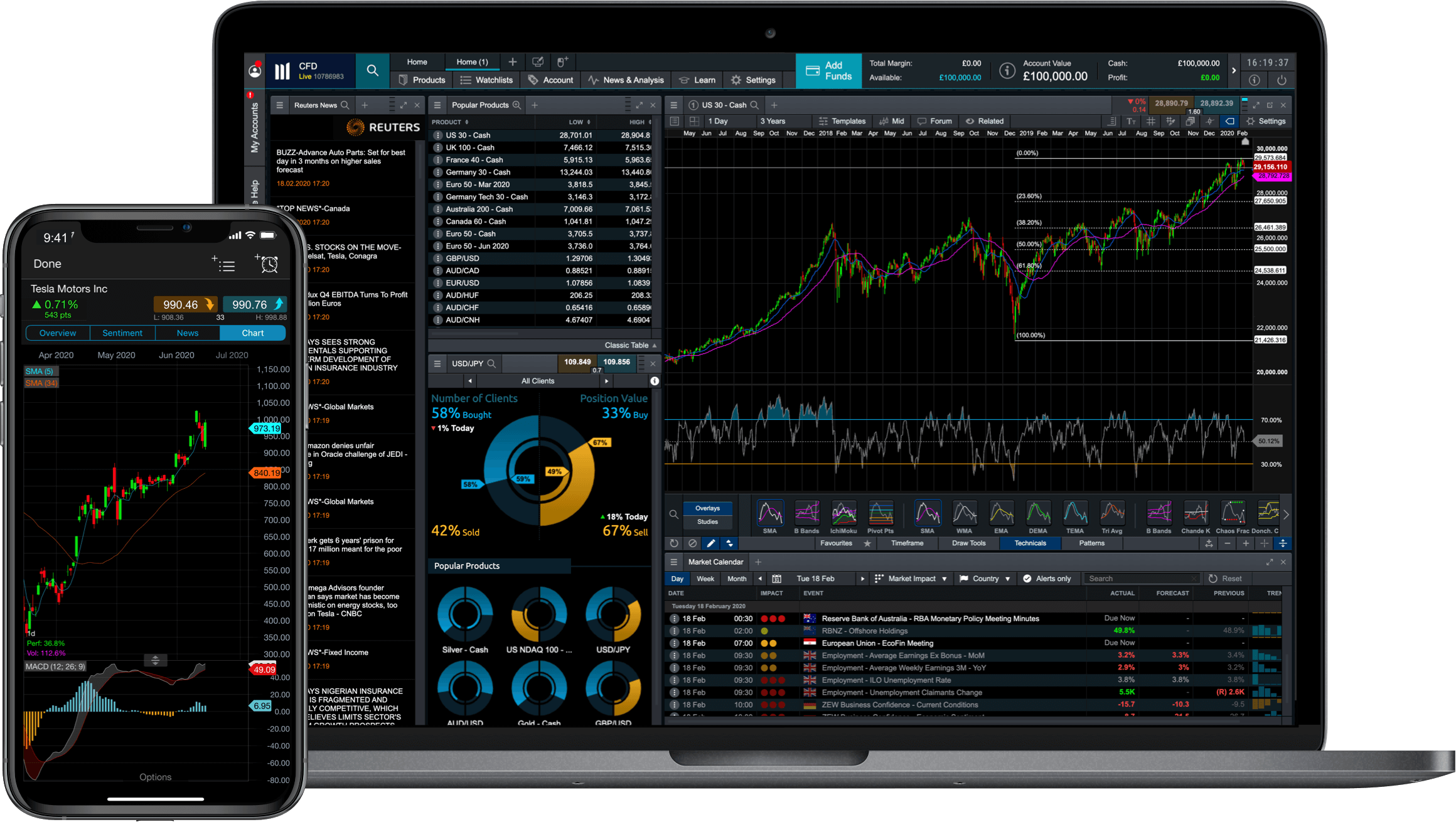

Intuitive platform

Our unique online trading platform has already won multiple awards and we’re continually working on creating new functionality, products and trading tools to enhance your trading experience.

Over 34 years' experience

Since launching in 1989, we’ve become one of the world's leading spread betting and CFD trading providers. When you trade with us, you're trading with an industry pioneer.

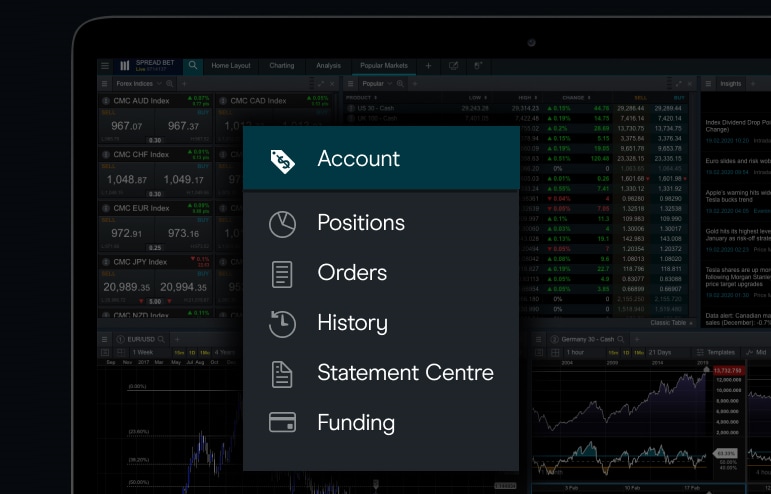

Explore our platform guides

Browse the wide range of trading tools, charting features and order types available on our web-based trading platform, with our video platform guides.

Trade on over 12,000 financial instruments

With a vast selection of financial instruments to choose from, you could focus on trading a specific currency pair or metal, or diversify and trade across multiple asset classes like indices and shares. Explore financial instruments that you can trade on with your live CMC Markets trading account.

Pricing is indicative. Past performance is not a reliable indicator of future results.

Funding your online trading account

You can sign into your account as soon as your application has been successful and you have confirmed your registered email address via the verification link sent to you. However, you won’t be able to place a trade unless there are sufficient funds in your account to open a position.

Read our funding your trading account FAQs.

No.1 Web-based Platform

ForexBrokers.com Awards

Best Mobile Trading Platform

ADVFN International Financial Awards

Best CFD Provider

Online Money Awards

No.1 Platform Technology

ForexBrokers.com Awards

FAQS

How do I open a trading account?

To open a trading account, simply complete our application form. If successful, you will then receive a verification email, and you can then fund your account and begin trading.

What features do I get with a CMC Markets trading account?

There are a vast range of tools and features on our trading platform, designed to give you the best possible chance of success. Explore our platform guides.

What details do I need to provide when opening a trading account?

When applying for a trading account with us, you will need to provide a scanned copy or clear photograph of a valid UK photo driving licence that shows your current address, or a passport or ID card. Learn more about documentation to provide when opening a trading account.

Can I switch to a CMC Markets trading account?

Yes, you can switch to a CMC Markets trading account. Learn how to switch to a CMC Markets account, and some of the features and benefits.