Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Monzo IPO

How to trade Monzo’s IPO

British online neo-bank Monzo is planning an IPO which may take place in late 2021 or early 2022, so continue reading to find out everything you need to know about Monzo’s IPO and how you can get involved.

2021/2022

Monzo IPO date

£1.24bn+

Monzo’s valuation

£67.2bn

Monzo’s 2020 revenue

When is Monzo’s IPO date?

Monzo hasn’t released an official IPO date as of yet, but it could happen anytime in 2021 or 2022. This comes after a number of other fintech competitors released plans to debut on the stock market or carried out fundraising rounds this year, including Wise, Stripe and Revolut.

Browse our article on upcoming IPOs to find which other companies are planning a listing. You can also sign up below using your email address to receive alerts on when the stock is going live on our award-winning platform*.

Monzo’s potential share price and valuation

Along with the date, a share price has not yet been estimated. The company will most likely be listing on the London Stock Exchange, given that it is a British-founded and based company.

The company was previously valued at £2bn in 2019 after a round of funding, giving it ‘unicorn’ status in the UK. However, following a difficult year due to Covid-19, its valuation dropped to £1.24bn, despite raising another £60m. CEO TS Anil believes that this figure is undervalued and Monzo could be worth a lot more upon listing.

How to trade Monzo’s IPO

1. Register for an account

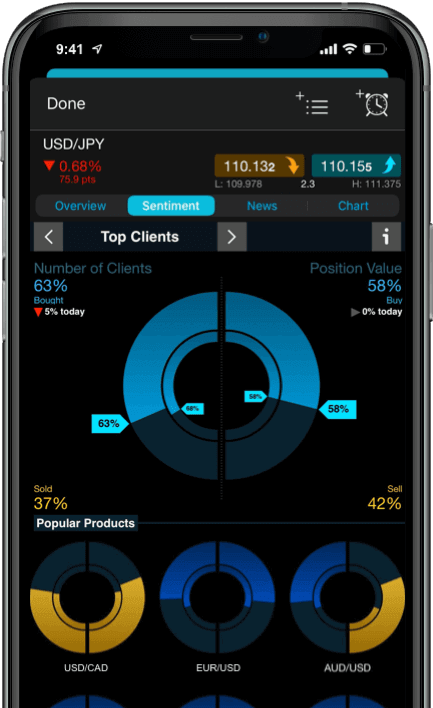

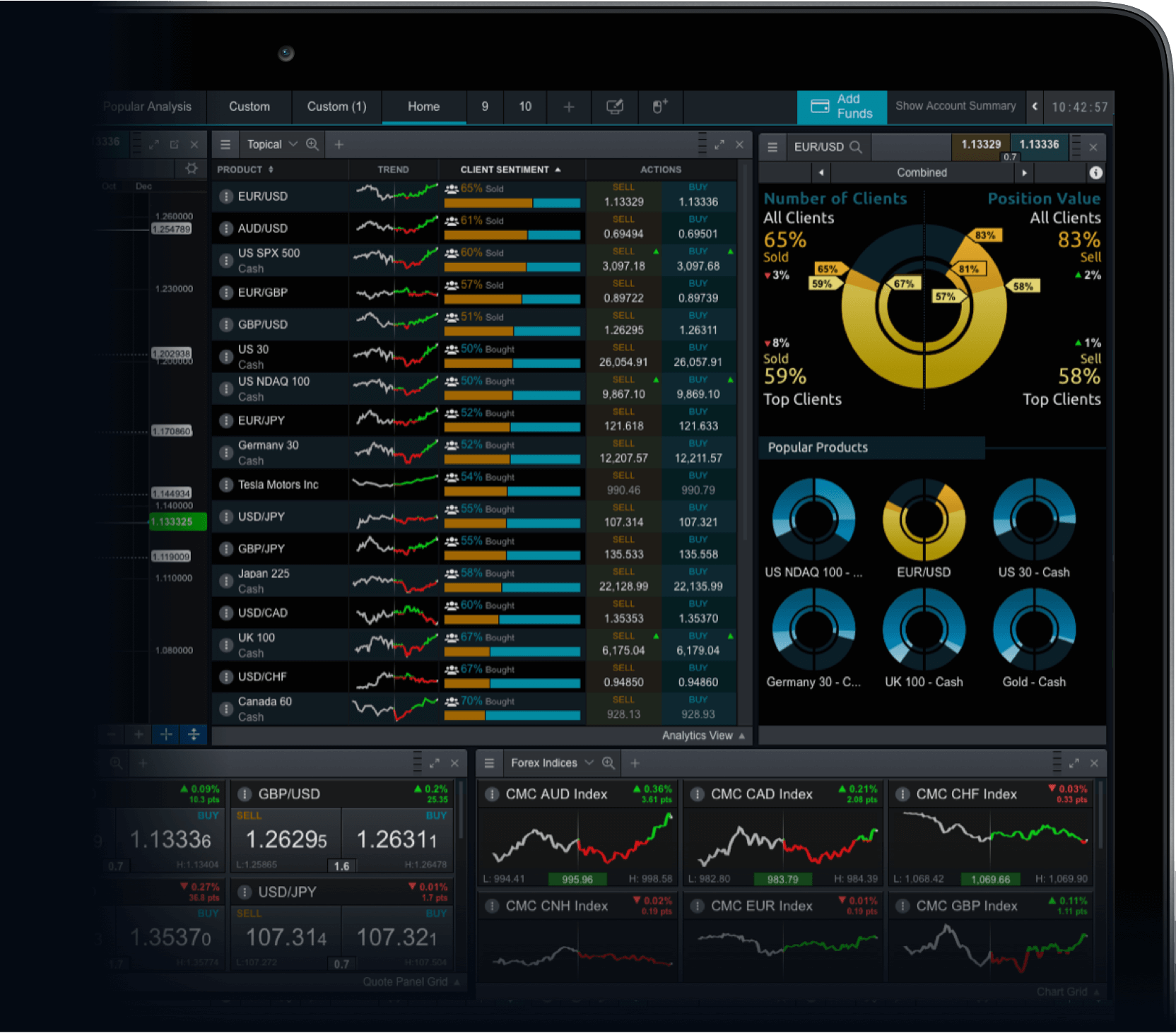

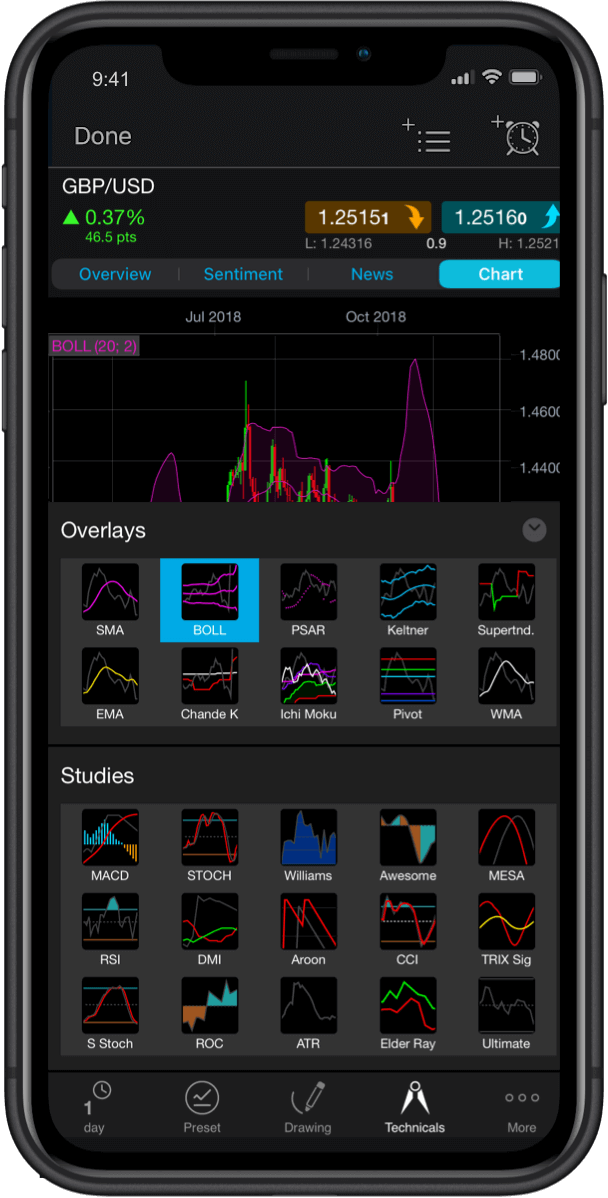

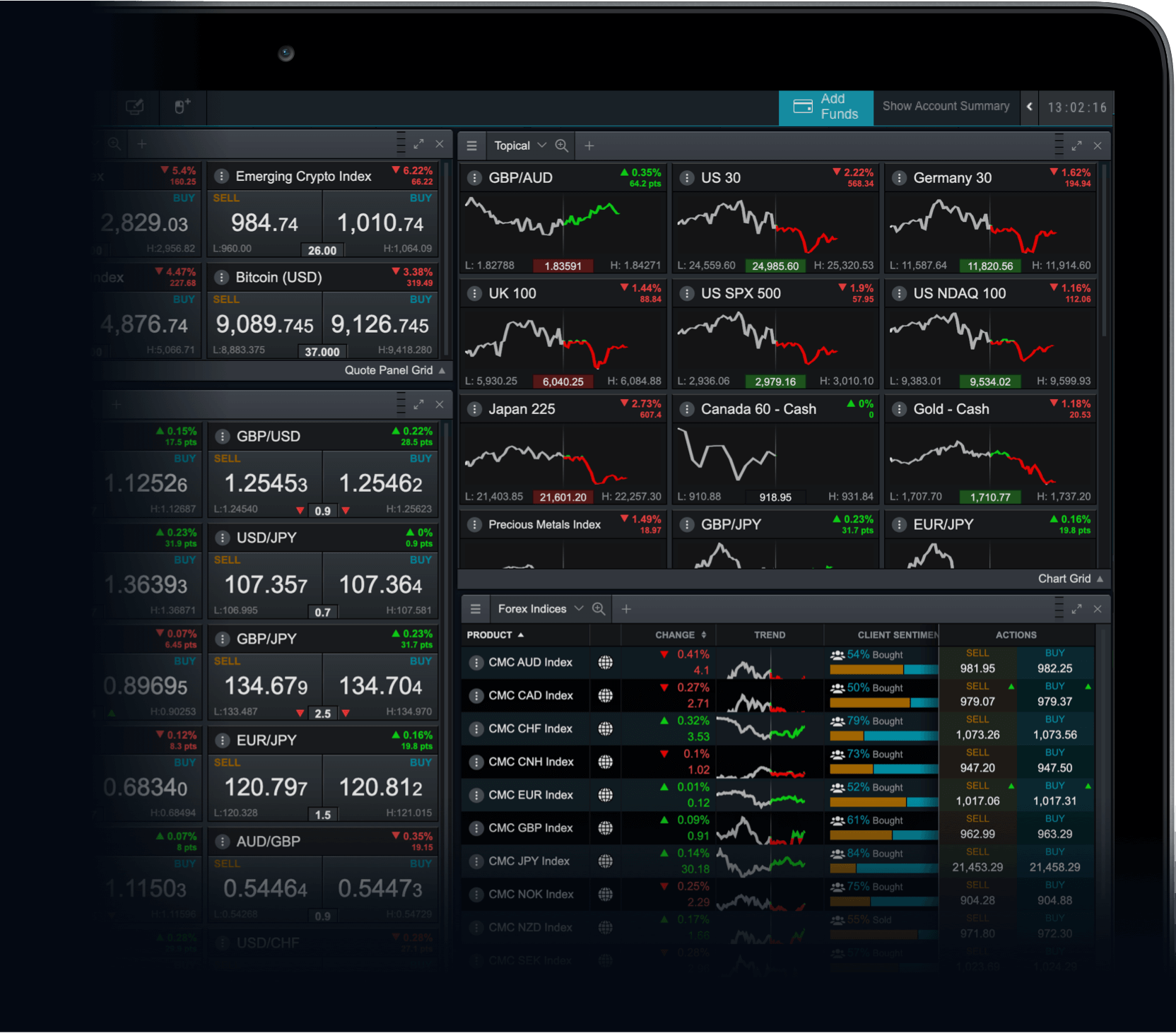

You will access 10,000 shares on our Next Generation trading platform, which will include Monzo’s new listing.

2. Choose your product

Decide whether to spread bet tax-free** or trade CFDs on Monzo’s IPO.

3. Pick a strategy

You can either open a long position if you think that Monzo’s value will increase, or a short position if you think its value will fall. Please note that some trading restrictions may apply on initial trading.

4. Apply risk-management tools

Stop-losses are an effective tool to close you out of volatile positions and keep losses to a minimum.

How is Monzo performing financially?

According to Monzo’s 2020 annual report, the company generated £67.2m in revenue, which is a 237% increase from the previous year’s figures of £19.7m. Monzo’s customer base also jumped from 1.6 million to 3.9 million, helping to quadruple the company’s operating income from £9m to £36m.

However, Monzo has seen numerous highs and lows over the pandemic period. In the same financial year, it closed down its office in Las Vegas, resulting in a loss of 165 staff, which was reflected back in the UK with hundreds of redundancies and furloughs. The company’s annual post-tax loss doubled in 2020 to £113.8m.

Despite these setbacks, CEO TS Anil has stated in an interview with Sifted that he expects the company to become profitable in 2022. These types of neo-banks can be seen as disruptive to the retail banking sector, as they fight for customer space and market share against traditional banks.

What is appealing about Monzo’s IPO?

Who are Monzo’s competitors?

Some of Monzo’s main competitors within the online banking sector include Revolut, Monese, N26, Stripe and Starling Bank. However, none of these companies are yet publicly traded, so Monzo will have a competitive edge when it goes live. Some of these are said to be in talks about going public, so keep an eye out for updates, as this could have an effect on Monzo’s share price and valuation. Read our analysis of the upcoming Stripe IPO.

Monzo could be seen as lagging slightly behind some of its competitors. The Financial Times recently reported that London-based rivals Starling Bank and Revolut have been profitable since October 2020 and this is expected to continue, whereas Monzo’s board does not expect this for another half year at least. In particular, Revolut’s carried out a fundraising round in July 2021 of £575m from SoftBank and Tiger Global, superseding Monzo as the UK’s most valuable fintech with an estimated valuation of £24bn.

Companies that are publicly listed within the wider online payments sector include PayPal [PYPL], Wise [WISE] and Square [SQ]. All of these stocks are available on our platform and can be traded with a spread betting or CFD trading account while you’re waiting for Monzo’s listing to become live.

What are the risks of trading on Monzo?

No.1 Web-based Platform

ForexBrokers.com

Best CFD Provider of the Year

Shares Awards

Best Spread Betting Provider

The City of London Wealth Management Awards

FAQ

How can I trade on Monzo shares?

To start trading on Monzo shares, open an account and choose whether you want to spread bet or trade CFDs.

How can I get notified when Monzo’s IPO is due?

Enter your email address in the sign-up module towards the top of the page to receive notifications about Monzo’s IPO. Alternatively, you can set up trading alerts on your account to be notified via desktop or mobile device when Monzo stock is live on our platform.

What other UK tech companies are due an IPO?

View our list of exciting UK tech stocks to watch right now, including start-up companies like Hopin, Revolut and Onfido that are in talks to debut on the stock market at some point this year.