Planned Platform Maintenance: Our platforms will undergo essential planned maintenance from approximately 6pm to 8:30pm AEDT on Saturday 14 March. During this time, the CMC Markets and the MT4 platforms will be unavailable, and you will not be able to access your account. If you hold cryptocurrency positions, please consider managing positions in advance to avoid potential close-out.

React early to market movements, breaking news and global events that impact the world's most influential companies.

Go long or short on 250+ US stocks*, nearly 24 hours a day, 5 days a week:

Manage your existing positions between trading sessions

Access our full range of order types for a seamless trading experience

Get extended access to 250+ stocks, including the Magnificent Seven

* Spreads may widen dependent on liquidity and market volatility

Join 1 million investors powered by an award-winning platform

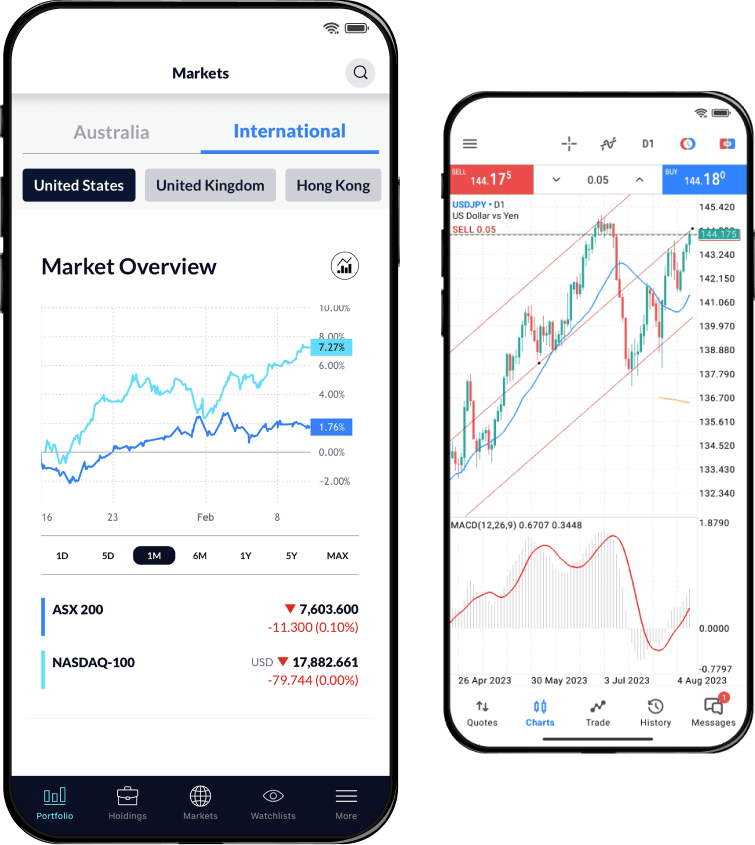

Discover why we're one of Australia's favourite platforms for share investing and CFD trading. With a world of international stocks and ETFs available to invest in, or trade with leverage on CFDs and Forex.

1,000,000+

clients globally`30+

years' experience45,000+

stocks and ETFs to invest12,000+

global instruments to trade

Diversify your portfolio

Pick your path between CFD and Stockbroking along with 1 million investors.

Start your share investing journey with Australia's favourite non-bank broker. Get access to 45,000+ stocks and ETFs from the ASX and 15 international markets. The choice is yours.

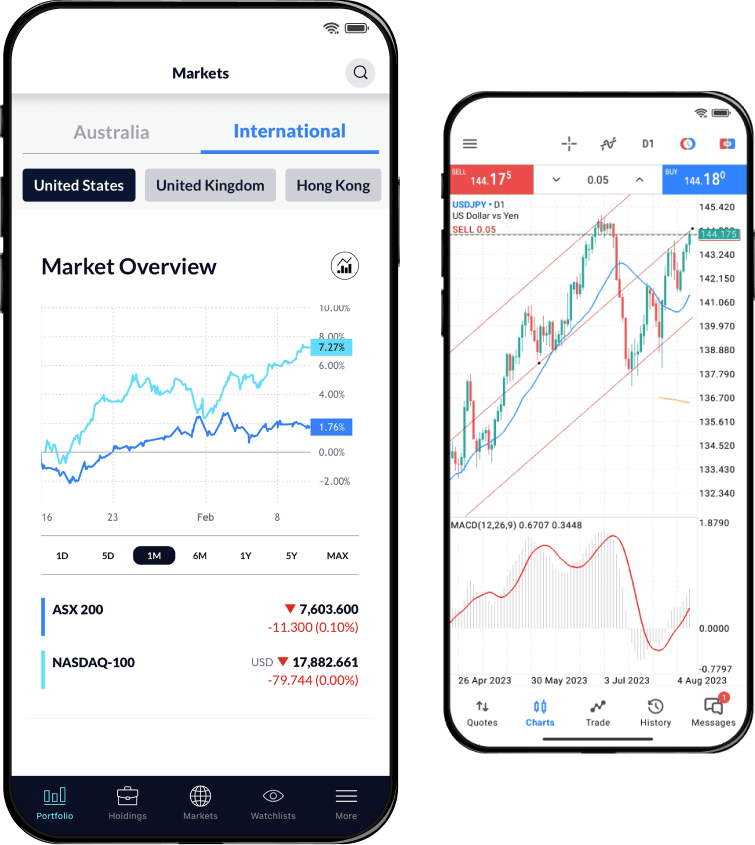

Trade CFDs on more than 12,000 instruments across global markets with confidence. Including Forex, Indices, Commodities, Cryptocurrencies and more.

Why trade with CMC Markets?

- Our focus is youWe're always looking for ways to improve your trading experience

- Value for moneyKeep your trading costs down with competitive spreads and low margins

- Intuitive platforms

Trade on our user-friendly, custom-built platform and dedicated mobile apps

Trade on our user-friendly, custom-built platform and dedicated mobile apps - Multiple award-winnersOver 50 platform and service awards worldwide in the last two years

Elevate your trading with in-depth guidance and insights.

- Share investing knowledge hubLearn Share Investing

From understanding the basics to advanced orders and diversification strategies, learn it all in our knowledge hub. Plus, keep up to date with the latest market insights from our expert analysis panel.

- CFD trading knowledge hubLearn CFD trading

Learn to trade CFDs, understand the risks and advantages of CFD trading, view examples and learn CFD trading strategies.

30+ years of industry experience.

1,000,000+ global clients.

Winner 2023

#1 web platform

ForexBrokers

Winner 2011-2025

Broker of the Year

Canstar

Winner 2024

Best for CFDs & Portfolio Insights

WeMoney

Winner 2024

#1 web platform

Best for Foreign Exchange Trading