Trade CFDs on more than 12,000 instruments across global markets with confidence. Including Forex, Indices, Commodities, Cryptocurrencies, Shares and more. We're dedicated to creating the best in-class trading platform, designed for the active CFD trader.

What CFD instruments can you trade with CMC Markets?

- Forex CFD

Learn More About Forex

Learn More About ForexAccess 300+ FX pairs on the CMC Markets Platform, or 175+ pairs on MetaTrader 4. And trade CFDs with competitive spreads from 0.0 pips* with our FX Active account.

- Index CFDs

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More About Indices

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More About Indices - Commodity CFD

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More About Commodities

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More About Commodities - Crypto CFD

Learn More About Crypto CFDs

Learn More About Crypto CFDsTrade popular cryptocurrency CFDs, including Bitcoin, Ethereum, and a range of altcoins like XRP and Cardano.

- Shares CFD

Learn More About Shares

Learn More About SharesTrade CFDs over 10,000 shares across 24 global markets with tight spreads and lightning-fast execution.

- Treasuries

Learn More About Treasuries

Learn More About TreasuriesTrade on 47 government bond and interest-rate instruments with leverage including the US T-Bond, US T-Note 5 YR, and US T-Note 10 YR.

*Available for FX Active accounts only. Commission is charged at 0.0025% per transaction. View the T&Cs here.

Find your favourite

Use the search box below to find your favourite instruments from over 12,000 instruments

Product |

|---|

- |

- |

- |

- |

- |

- |

- |

- |

Min spread | Buy | Day | Week | Trend |

|---|---|---|---|---|

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% |

Explore all of our CFD trading platforms

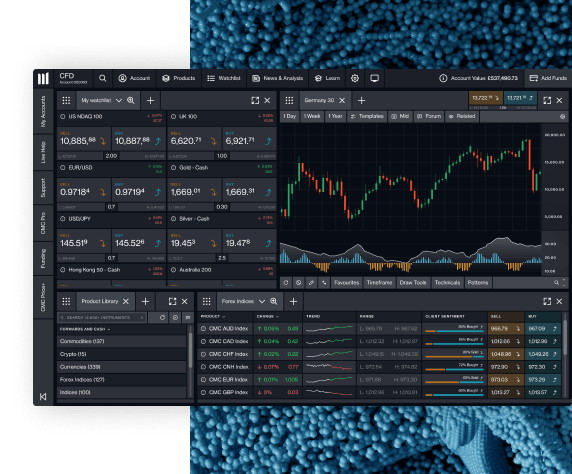

- CMC web platform

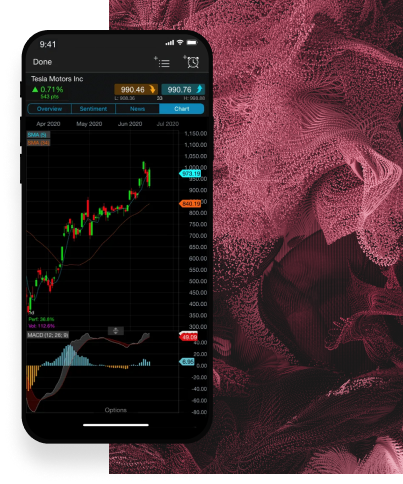

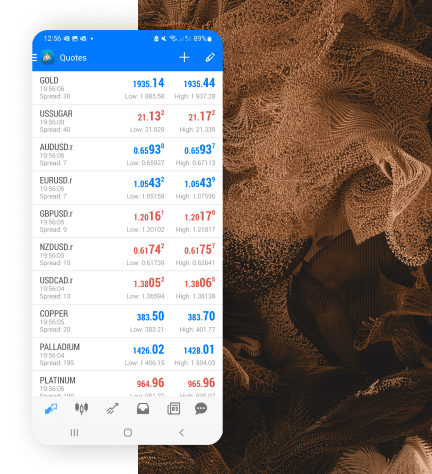

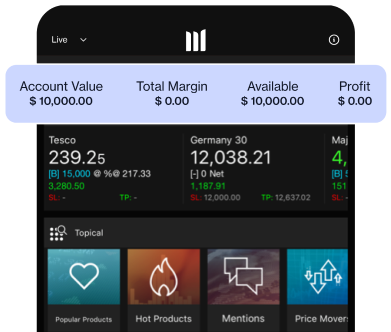

- CMC mobile app

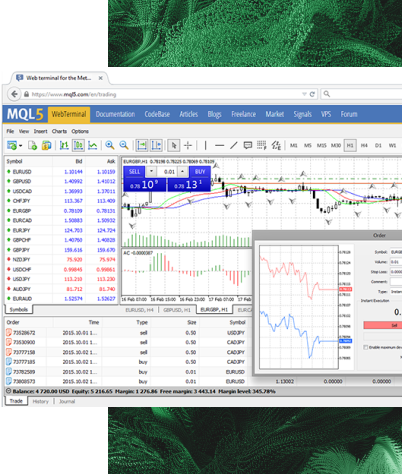

- MetaTrader 4 (MT4)

- MetaTrader 4 (MT4) WebTrader

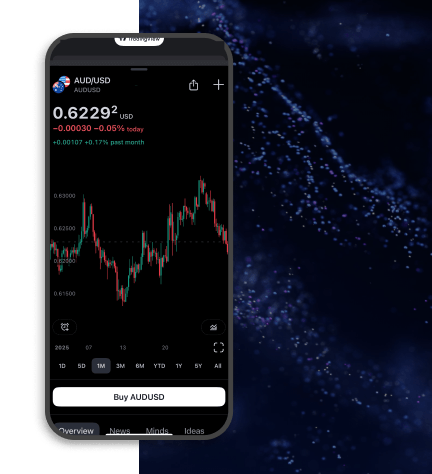

- TradingView

Discover an award-winning CFD trading experience on our CMC Markets Platform.

Trade CFDs with tight spreads on over 12,000 instruments

Minimal slippage with ultra-fast execution speed

100% automated execution

Australia's leading

premium trading provider

For high-volume or professional traders, explore our exclusive ALPHA account services.

Priority support

Exclusive offerings & event invitations

Tailored research

Check your eligibility today to access priority support, tailored one-to-one services and exclusive product offerings.

Learn the art of CFD trading

- What is CFD trading and how does it work?Learn More

A contract for difference, or CFD, is a financial derivative product that pays the difference in settlement price between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities.

- Essential CFD calculations: margins, P&L, and moreLearn More

When you're starting out with CFD trading, the calculations can seem overwhelming. Here, we’ll begin by breaking down two key calculations: how to work out your margin and your profit and loss (P&L).

- Advantages & risks of CFD tradingLearn More

Learn about some of the advantages of CFD trading. Contracts for difference (CFDs) are a type of derivative product that allow you to trade using leverage within the financial markets, including on indices, forex, commodities and shares.

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best for CFDs

WeMoney

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers

New to trading CFDs?

Frequently asked questions

A contract for difference (CFD) is a derivative product which enables you to trade on the price movements of underlying financial assets (such as forex, indices, commodities, shares and treasuries).

A CFD is an agreement to exchange the difference in the value of an asset from the time the contract is opened until the time it's closed. With a CFD, you never actually own the asset or instrument you have chosen to trade, but you can still benefit if the market moves in your favour, or make a loss should the market move against you. Learn more about CFD trading

The main difference between CFD trading and share trading is that you don't own the underlying share when you trade on a share CFD. With CFDs, you never actually buy or sell the underlying asset that you've chosen to trade, but you can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional share trading you enter a contract to exchange the legal ownership of the shares for money, and you own this equity.

When trading CFDs, it's important to understand the risks associated with financial trading in general, as well as the risks that are specific to trading CFDs. The main risks associated with trading CFDs relate to trading with leverage, account close-out, market volatility and market gapping. Read more on the risks of CFD trading.

When trading CFDs, it’s important to understand the risks associated with financial trading in general, as well as the risks that are specific to trading CFDs. The main risks associated with trading CFDs relate to trading with leverage, account close-out, market volatility and and market gapping. Find out more

Our learn section offers a comprehensive introduction to trading CFDs. From understanding leverage to trading CFDs examples, risk-management tips, developing an effective trading CFDs strategy and more. Visit our CFD knowledge hub

Stay on top of breaking economic news events and discover what's moving the financial markets with commentary, video and webinars from our global market analysts. Read more on our market news and analysis sections.