Whatever position you take, redefine your trading strategy on our award-winning CMC Markets Platform.

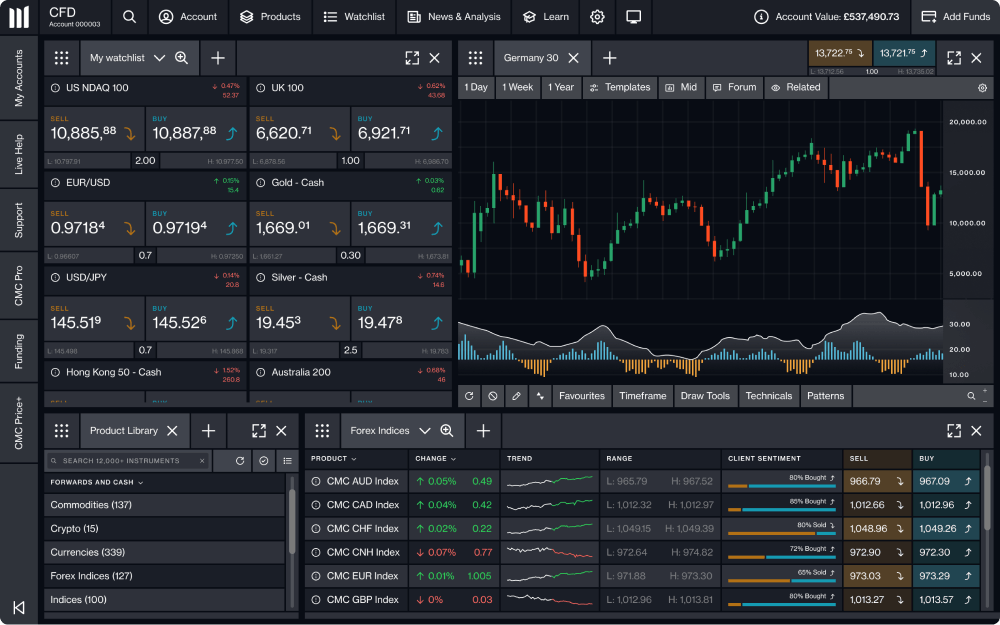

Combining institutional-grade features and security, with lighting-fast execution and best-in-class analysis, access over 12,000 instruments and trade your way.

CMC Platform

What can I trade?

- Forex

Learn More

Learn MoreAccess 300+ FX pairs on our CMC Markets Platform, or 175+ pairs on MetaTrader 4. And trade with competitive spreads from 0.0 pips* with our FX Active account.

- Indices

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More - Commodities

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More - Crypto

Trade popular cryptocurrencies, including Bitcoin and Ethereum plus a range of alt coins like TRON and NEO.Learn More

Trade popular cryptocurrencies, including Bitcoin and Ethereum plus a range of alt coins like TRON and NEO.Learn More - Shares

Trade over 10,000 shares across 24 global markets with tight spreads and lightning-fast execution.Learn More

Trade over 10,000 shares across 24 global markets with tight spreads and lightning-fast execution.Learn More

*Available for FX Active accounts only. Commission is charged at 0.0025% per transaction. View the T&Cs here.

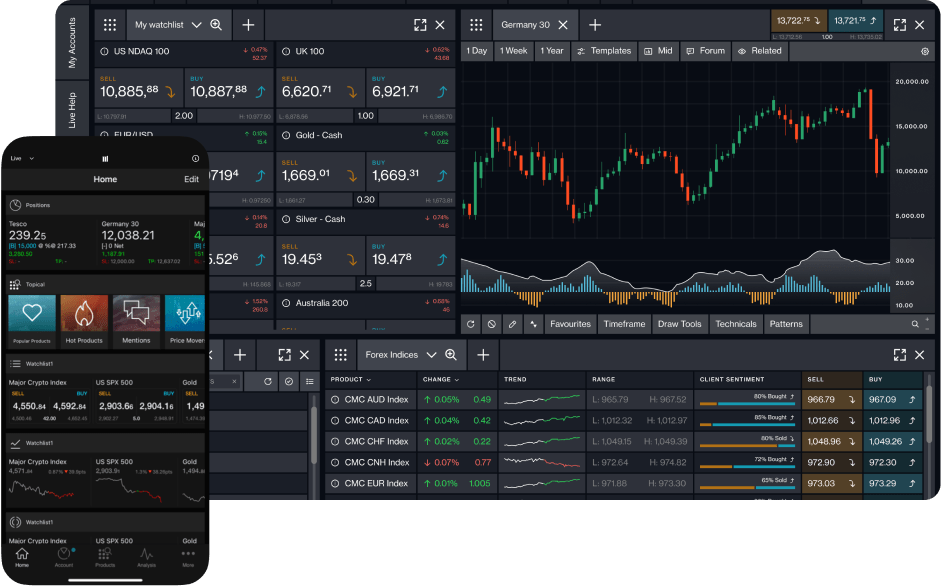

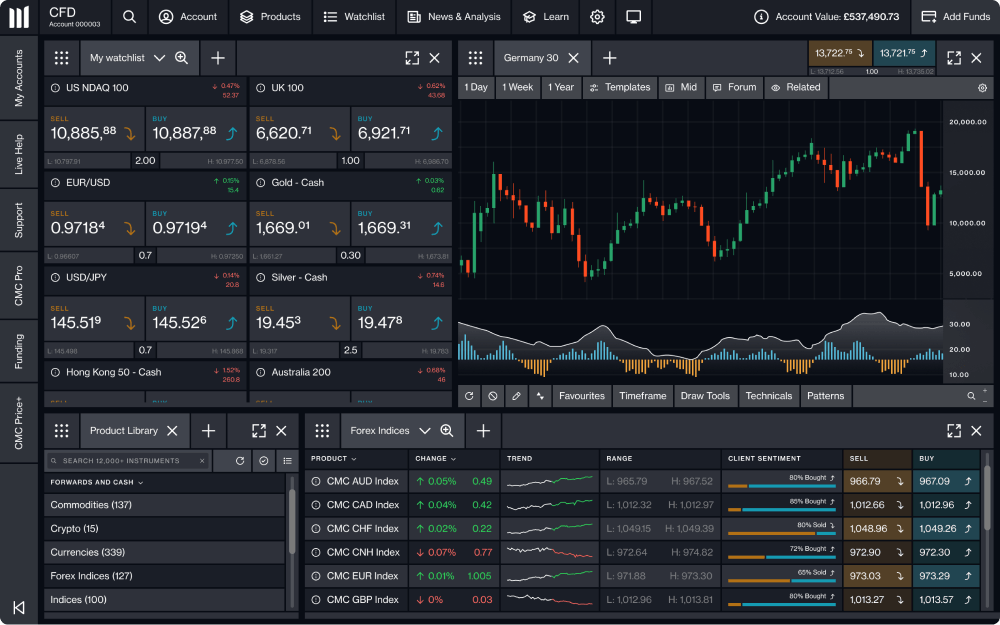

A powerful feature-rich trading experience

We are dedicated to creating the best-in-class trading platform, designed for the active trader.

Our layouts, charts and technical indicators are all customisable.

12 different chart types (the popular line, OHLC and candlestick charts, plus more advanced charts such as kagi, line break and renko charts).

Over 115 indicators, 70 chart patterns and over 35 drawing tools.

Scan for common technical patterns and view the price projection target area on the chart.

With ID verification built in and funding via debit or credit card, PayID or bank transfer, the process couldn't be easier.

Trade on over 12,000 instruments, including over 300 forex instruments, indices, commodities, cryptocurrencies and dozens more.

- Transparent pricingWe crunch 225m prices every day, from up to 14 feeds.

- Minimal slippageWith fully automated, lightning-fast execution in 0.040 seconds**

- 99.95%+ platform stability^We consistently achieve core platform uptime, allowing you to focus on your trading.

- 100% automated executionOur platform provides fast, 100% automated execution.

**0.040 seconds CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2023-31 March 2024. ^Core platform uptime, CMC Markets financial year 1 April 2023-31 March 2024.

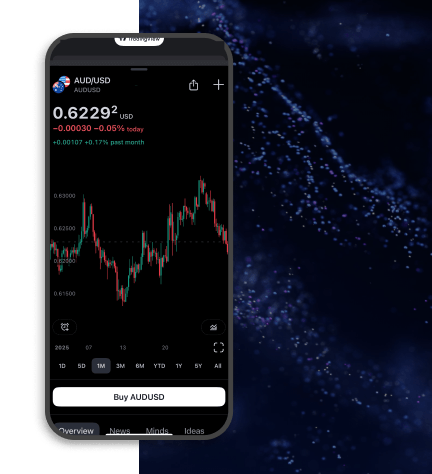

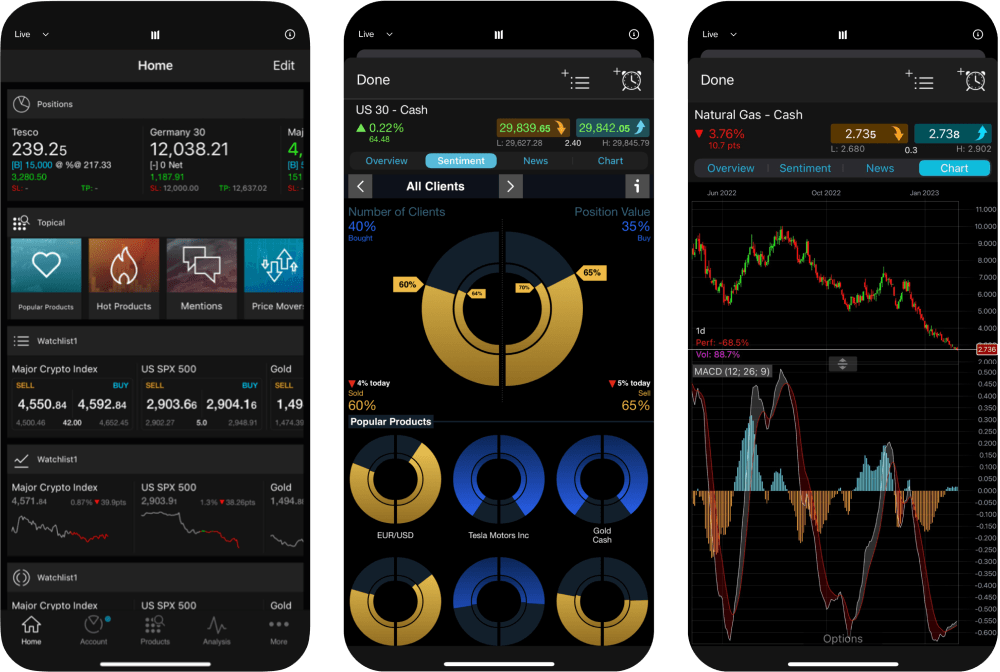

Total control, even when you’re on the move

Get the web platform in your pocket: open, close or modify trades with ease and explore our full range of markets on our mobile trading apps. Trade anytime, anywhere.

Our intuitive mobile trading app puts the power of the web platform in your pocket.

Trade CFDs 24 hours a day on popular instruments like AUD/USD and Gold. From commodities to indices, to ETFs, we've got it.

Advanced order ticketing, mobile-optimised charting and over 40 technical indicators and drawing tools.

Set up alerts via push, SMS or email, so you never miss an important market event, price alert or order notification.

Tools built with your success in mind

We know a successful trader is a happy trader, which is why we constantly developing tools designed to give you the best possible chance of success.

Explore our platforms

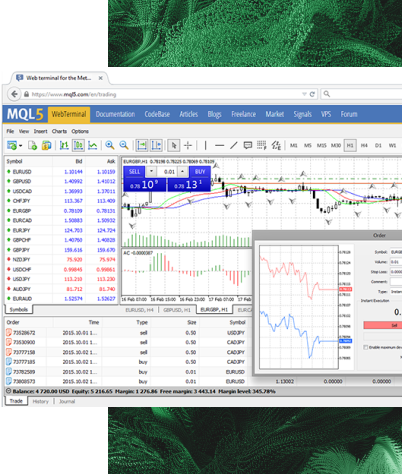

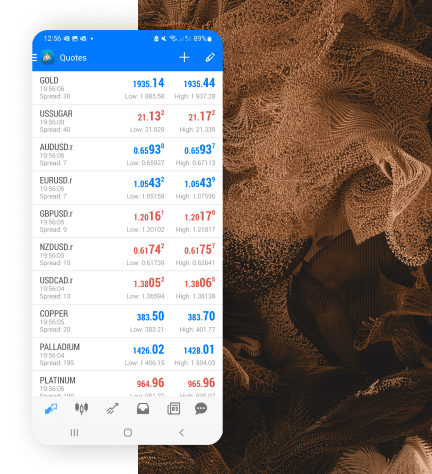

- MetaTrader 4 (MT4)

- MetaTrader 4 (MT4) WebTrader

- TradingView

Trade on the world's most popular trading platform.

Automate your trading with algorithms

Enjoy a wide range of chart types and tools

Customise your trading with add-ons that suit your style

CMC Markets Platform

Frequently asked questions

You are able to do this, unless you have added a guaranteed stop-loss order to your trade.

To enable this feature, you will need to deactivate 'Account Netting.' Go to 'Account Settings' and then un-tick the box which says 'Enable Account Netting for this Account.'

From 16 November 2024, with Account Netting disabled, you will be charged margin in addition to fees (namely holding costs) on both sides of the trade.

Please note that shorting certain instruments may not be permitted - check the 'Product Overview' for confirmation.

We make important improvements to our mobile apps to enhance your trading experience. The new version ensures you have access to the latest functionalities.

We will be making an important update to the way margin is charged, which requires you to download a new version of our mobile app. This change will come into effect from 16 November 2024 and recommend that you download the new app version prior to this date to avoid any disruptions to your trading.

To learn how to use the CMC Markets Platform, check out the CMC Markets Platform Video Tutorial. It covers platform setup, charting tools, trading basics, and mobile trading to streamline your experience.

We use the internationally accepted security system SSL (Secure Sockets Layer) for all account functionalities, including fund deposits and withdrawals. This system is automatic and you will receive an instant notification if your browser does not support it.

No. You are only able to access your account through either the website or your mobile device at any one time. If you attempt to log in to both platforms at the same time you will be disconnected from your previous session.

The CMC Markets app is currently available for download on Apple's iPhone and iPad, and Android devices. You can also log in to the platform using any Windows phone via the web browser on your device.