October brought no shortage of positive catalysts. A Trump trade deal with China, a US rate cut, and an Australia–US critical minerals agreement were just a few. Yet despite the momentum, the ASX 200 finished the month only slightly higher, rising 0.4%. The US markets performed more strongly, with the S&P 500 gaining 2.3%. The Nasdaq Composite did even better, jumping 4.7% and posting its seventh consecutive month of gains. Popular stocks among clients, EOS and DroneShield, were two of the worst ASX performers in October. Both saw sharp pullbacks. Even so, they remain the number one and two top-performing ASX stocks in 2025 so far by a significant margin. As always, here are three developments that could move the needle in the month ahead.

- Market News

- Market outlook

- Monthly Outlook: Gold, Layoffs, Minerals

Monthly Outlook: Gold, Layoffs, Minerals

- 1.Nations get in line for gold

- 2.Is AI to blame for the job cuts?

- 3.Investors chase minerals boom

Nations get in line for gold

Gold began 2025 trading around US$2,600 per ounce. By 21 October, it had surged 66% to US$4,381, pushing the notional value of the global gold market above US$30 trillion. For context, that is more than the combined market capitalisation of the world’s 10 largest companies. Since that peak, however, gold has pulled back by roughly 10%, now trading around US$4,000.

October saw a sharp uptick in gold trading activity among our client base, building on a year of already solid demand. During the month, both the GOLD and PMGOLD ETFs ranked among the top 10 most traded products by trade count among CMC Invest clients. It was the first time either product had appeared in the top 10 in 2025. The other major beneficiaries of the gold trend this year have been Australian gold miners, which have also been popular among CMC clients. Pantoro (PNR), Catalyst Metals (CYL), Regis Resources (RRL) and Genesis Minerals (GMD) have each delivered returns within the range of two to four times gold’s gain this year.

Gold demand is primarily driven by three key forces: jewellery manufacturing (around 50%), investment demand (20–30%), and central bank buying (20–30%). In recent years, central bank demand has become an increasingly important part of this mix, fuelled by rising geopolitical tensions, declining trust in the global financial system, and mounting concerns over sovereign debt. A key turning point came in early 2022 when Russia invaded Ukraine. In response, the United States and its allies imposed sweeping sanctions. Russian banks were cut off from the SWIFT payment system, and around $300 billion of the country’s foreign reserves were frozen. For many central banks, particularly those not closely aligned with the United States, it was a wake-up call. Foreign assets held in another country’s currency are ultimately under that country's control and can be frozen or seized. This is not the case with gold, which can be held securely in a nation’s own vaults.

For nations and individuals alike, gold also serves as protection against the consequences of US fiscal policy. When the United States runs large deficits or expands the money supply, the dollar can weaken and foreign-held reserves lose value. Gold helps reduce that exposure. Unlike fiat currencies, which can be created at will, gold has a relatively constrained supply, increasing by only around 1% per year through mining.

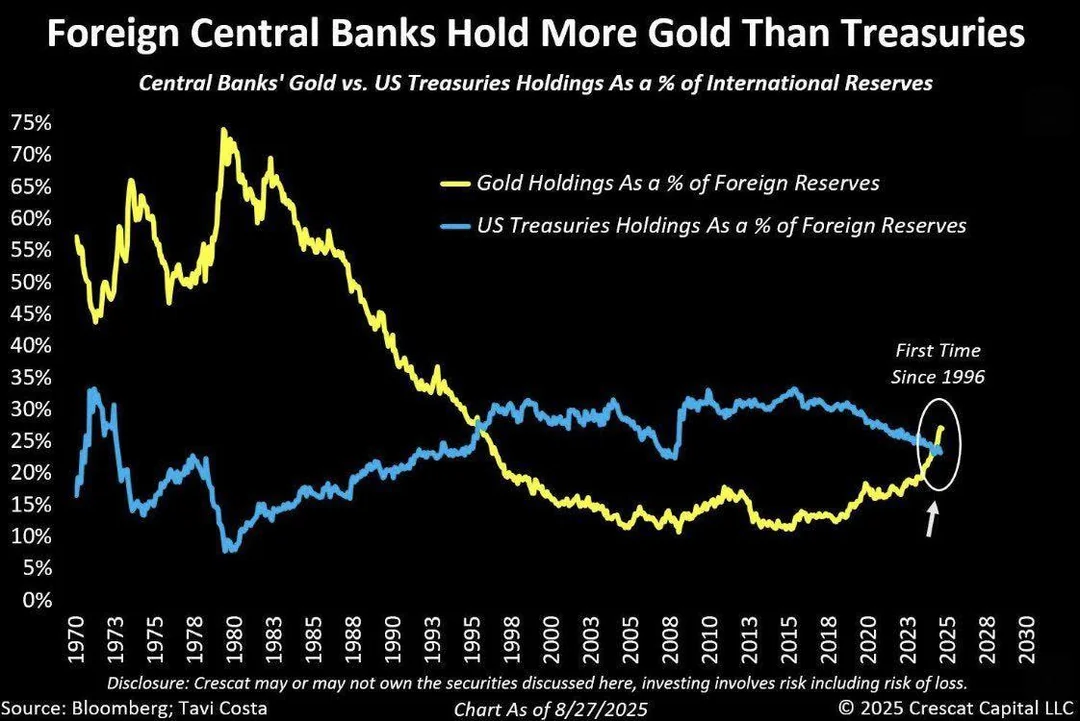

This shift is already showing up in the data. For the first time since 1996, central banks now hold more gold than US Treasuries in their reserves. This is not just a hedge. It reflects a broader move away from reliance on the dollar and toward gold as a more secure and politically neutral store of value.

Another key driver of gold’s recent strength has been the decline in US interest rates. The Fed has cut rates twice this cycle, in September and again in October. This shift has supported gold’s upward move, as the metal typically performs well during periods of monetary easing. Historically, gold prices have risen about 6% in the two months after the Fed begins cutting rates. Why is this the case? Generally speaking, when interest rates fall, the return you get from savings accounts and government bonds also drops. Gold doesn’t earn interest, so when those other options are paying less, holding gold doesn’t feel like as much of a sacrifice and can start to seem more attractive than before. Another key reason is that rate cuts usually come during times of economic weakness or rising inflation. In those moments of uncertainty, investors often turn to gold as a safe haven.

Looking ahead, major banks are racing to lift their forecasts. Goldman Sachs has increased its December 2026 gold price target from $4,300 to $4,900 per ounce, citing strong ETF flows and sustained central bank demand. Morgan Stanley now projects gold at $4,500 by mid-2026. HSBC expects a 2025 average of $4,600, with potential spikes towards $5,000 in the first half of 2026. Bank of America has raised its target to $5,000 for 2026, pointing to policy uncertainty and surging investor flows. J.P. Morgan forecasts a Q4 2026 average of $5,055, with longer-term projections reaching $6,000 by 2028 if current dynamics hold.

Still, the rally is not without risks, as the recent pullback has shown. A stronger-than-expected US dollar or a more hawkish Fed could weigh on momentum, especially if interest rates remain elevated. On the physical side, jewellery demand is already showing signs of fatigue. According to recent data, India recorded its weakest third quarter for jewellery consumption since 2020. This reflects a degree of weakening demand, as high prices make it harder for everyday buyers to afford the same amount of gold, particularly in emerging markets where gold serves both cultural and financial purposes.

Gold will be closely watched through year-end and into 2026. While some see opportunity in the rally, others view it as a warning sign of a more difficult period ahead. Either way, when it’s flashing on investor screens, gold’s message shouldn’t be ignored.

Is AI to blame for the job cuts?

Layoffs are surging across Big Tech and global firms, sparking fresh debate over the extent of AI’s role in the cuts. Those in the “we’ve got a problem” camp point to explicit statements from companies that AI is a factor in recent layoffs. Salesforce cut 4,000 customer service roles, saying AI agents had started doing the work. Accenture laid off more than 11,000 employees in just three months, citing the need to exit those who couldn’t be retrained for AI-related roles. Lufthansa plans to cut 4,000 jobs by 2030 as part of a strategy to improve efficiency through AI.

In the “nothing to worry about” camp are executives arguing the layoffs have less to do with machines and more to do with business cycles. Some executives say this is still about overhiring during the pandemic boom. Amazon is one example. It is preparing to cut up to 30,000 corporate jobs. But when asked about recent layoffs, CEO Andy Jassy said: “The announcement that we made a few days ago was not really financially driven. And it's not even really AI driven, not right now at least. It's important to be lean. It's important to be flat, and it's important to move fast.”

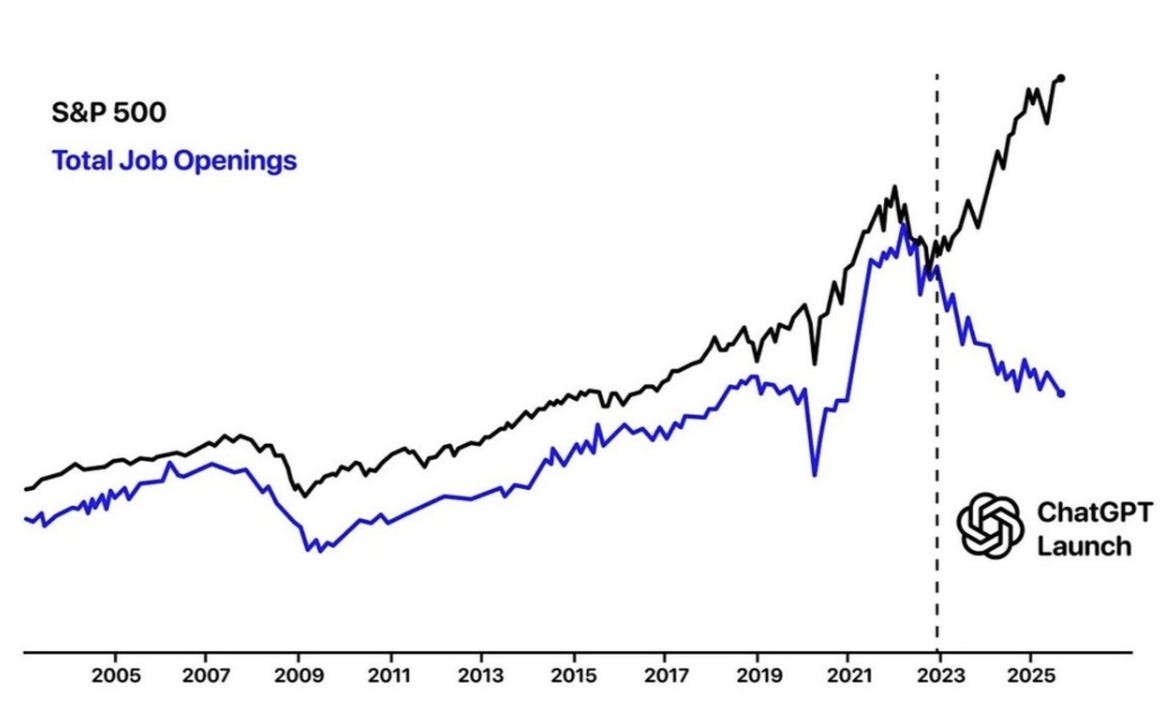

Job cuts make headlines. But sometimes the more important signal is what companies are not doing: hiring. A chart making the rounds on social media recently shows a stark split. Since ChatGPT launched in November 2022, the S&P 500 has surged more than 70%. But during the same period, US job openings have fallen by roughly 30%. The chart has earned a fitting name: the scariest chart in the world. Job openings peaked at 11.5 million in March 2022, the highest level in over two decades of data. By August 2025, that number had dropped to 7.18 million. Historically, job openings have tracked with stock market performance. That relationship appears to be breaking down.

Source: Chartr

Some commentators, like Derek Thompson, argue that monetary policy is actually the main culprit. The Fed had already begun tightening before ChatGPT entered the scene. Capital was getting more expensive, and hiring was already slowing. Others point to tariffs and global growth concerns. But AI is undeniably changing how companies think about headcount. Even when it isn’t the stated reason for layoffs, the speed of its development and the uncertainty around its impact are giving firms pause. Many are holding back on hiring or raising the bar for bringing in new people. Shopify’s CEO recently told staff that if they want more headcount, they will need to prove the jobs cannot be done by AI.

While headlines zeroed in on job cuts, the AI trade kept gaining ground in October. AMD (AMD:US), Micron (MU:US), and Teradyne (TER:US) were the top three performers across the S&P 500, Nasdaq, and Dow. In late October, Nvidia (NVDA:US) became the first company to hit a $5 trillion market cap. So, is AI driving the layoff wave? Not entirely. There’s still a fog around AI’s true impact, but as it lifts, both investors and workers may need to brace for some hard truths. In the meantime, one thing is clear. Companies powering the AI boom are reaping the rewards.

Investors chase minerals boom

In October, rare earths took centre stage after Australia and the United States signed the Critical Minerals and Rare Earths Framework in Washington, committing over US$2 billion to strengthen supply chains for materials vital to clean energy, defence, and advanced manufacturing. We covered the full story here. Aimed at reducing reliance on China, the agreement includes funding, stockpiling, and offtake support for projects such as Arafura Rare Earths’ Nolans project and Alcoa’s Wagerup gallium initiative. Market enthusiasm surged, with Arafura (ARU) climbing more than 100% before falling 40%. By month-end, Arafura ranked as the sixth most traded stock by trade count among retail investors on the CMC Invest platform in October. Arafura and Lynas (LYC) were also the top two most added to watchlists, showing traders are keeping a close eye on both heading into November. Adjacent to the rare earths narrative, semiconductor company Weebit Nano (WBT) also stood out as a top ASX performer in October, reflecting the broader market momentum across semiconductors, AI, and robotics.

Ready to explore international markets?

CMC Invest is your home for international investment, with over 45,000 stocks and ETFs at your fingertips. Get $0 brokerage on all securities from the US, UK, Canada, and Japan (FX spreads apply).

Plus, you can now trade single units of popular stocks like Apple or Tesla.

To view or trade international stocks, log in to your CMC Invest account.

Don’t have an account? Sign up now to begin.

Disclaimer: This article provides general information only. It has been prepared without taking account of your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any financial instruments, or as a recommendation and/or investment advice. It does not intend to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any financial instruments. You should consider your objectives, financial situation and needs before acting on the information in this article. CMC Markets believes that the information in this article is correct, and any opinions and conclusions are reasonably held or made on information available at the time of its compilation, but no representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this article. CMC Markets is under no obligation to, and does not, update or keep current the information contained in this article. Neither CMC Markets nor any of its affiliates or subsidiaries accepts liability for loss or damage arising out of the use of all or any part of this article. Any opinions or conclusions set forth in this article are subject to change without notice and may differ or be contrary to the opinions or conclusions expressed by any other members of CMC Markets.