September was one of the most action-packed months of 2025, marked by corporate power plays and headlines that moved markets. Key moments included a US rate cut, Elon Musk purchasing $1 billion of Tesla [TSLA:US] stock, DroneShield [DRO] and Electro Optic Systems [EOS] smashing through record highs, NVIDIA [NVDA:US] committing $5 billion to Intel [INTC:US], and the completion of a $14 billion TikTok deal. The S&P 500 gained 3.5% and the Nasdaq advanced 5.6%, while the S&P/ASX 200 fell 1.4%. Looking ahead, October is shaping up as a month of inflection points. Volatile price swings in recent weeks, coupled with unresolved macro uncertainties, leave investors with plenty to weigh before making their next move.

- Market News

- Market outlook

- Monthly Outlook: AI, CSL, Opendoor

Monthly Outlook: AI, CSL, Opendoor

- 1.AI bubble debate reignites as valuations soar

- 2.CSL’s $200 health check

- 3.Open Army marches higher

AI bubble debate reignites as valuations soar

September was a bumper month for AI-linked names, with hardware and semiconductor supply chain stocks surging on renewed optimism. Western Digital [WDC:US], Seagate [STX:US], Micron [MU:US], Intel [INTC:US], Tesla [TSLA:US], and ASML [ASML:US] all gained between 30% and 50%. Others, including Applied Materials [AMAT:US], Oracle [ORCL:US], Palantir [PLTR:US], Super Micro Computer [SMCI:US], Alphabet [GOOGL:US], and Caterpillar [CAT:US], rose 10% to 30%.

The recent momentum has reignited a long-running debate. Are we in an AI investing bubble, or is this just the start of a multi-decade boom? While few doubt AI’s transformative potential, the central issue is whether the current economics reflect underlying reality. Global AI spending is expected to reach $1.5 trillion this year, yet many pure-play AI firms remain deeply unprofitable. Further, a recent MIT study found that 95% of generative AI investments have produced no measurable return.

In the bullish camp, commentators such as Jordi Visser don’t see an AI investing bubble. While he acknowledges some speculative excess, he frames this moment as the early stage of a long-term, multi-phase transformation. As he put it: “Humanoids, compute & power shortages, and a breaking labour market, this isn’t hype, it’s the transition already underway.” Investor Peter Diamandis has taken a similar stance, saying: “AI is NOT a bubble... Instead it’s becoming the world’s new operating system. It is not a classic boom-and-bust cycle.” Venture capitalist Marc Andreessen has previously echoed these thoughts, describing AI as the foundation of a new economic era, where long-term returns will outweigh today’s costs and ultimately “save the world.”

From this perspective, the surge in infrastructure spending is not speculative but justified. Big Tech firms such as Microsoft, Amazon, Meta, and Alphabet collectively generated nearly $500 billion in operating cash flow over the past year, more than enough to cover the $88 billion in quarterly capital expenditure currently flowing into AI and cloud buildouts. Many bulls also reject comparisons with the dot-com bubble. Back then, investors chased hype around unproven technologies and distant promises of a digital future, rather than companies with meaningful adoption or revenue. Today, by contrast, AI is already being deployed and adopted at scale. In this view, capital is following real-world demand, not just a compelling story.

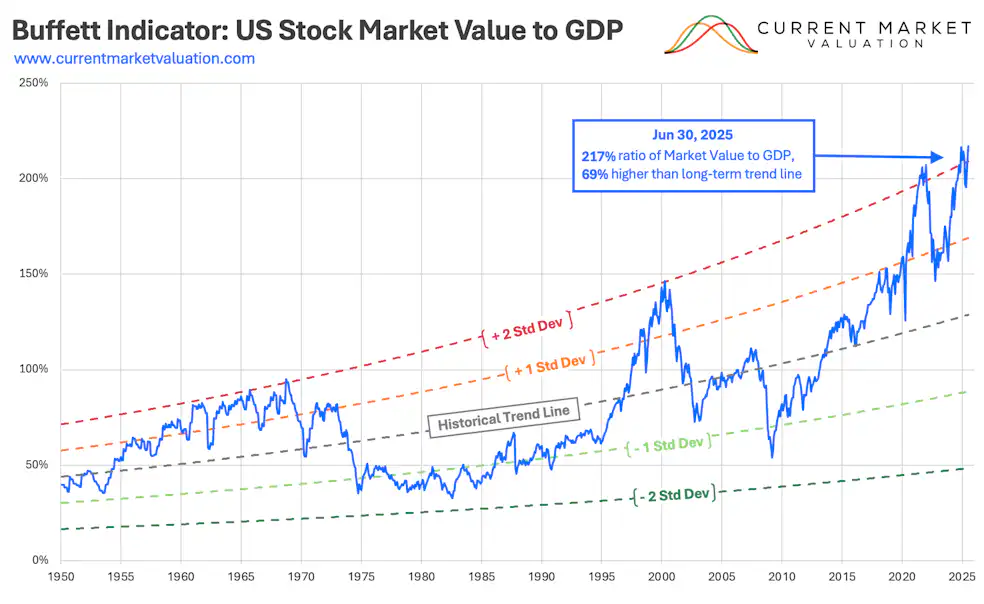

In contrast, the bearish camp is building its own case. David Einhorn has called current AI spending extreme and unsustainable, warning: “I’m sure it’s not zero, but there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.” He argues that infrastructure outlays of $500 billion to $1 trillion per year could lead to major capital losses if returns don’t materialise. Along these lines, analysts at Barclays have drawn parallels to the overbuild of dark fibre in the early 2000s. Jeremy Blum also sees a capex bust ahead, and macroeconomist Henrik Zeberg has offered a sweeping warning: “We are living through what may be the largest bubble in history, spanning artificial intelligence, megacap tech stocks and digital assets.” He points to extreme valuations, highlighted by the Buffett Indicator, and speculative euphoria as the clearest red flags.

Source: The Buffett Indicator as of June 30, 2025, www.currentmarketvaluation.com

A growing concern in AI is how much capital is circulating within a tight circle of companies rather than reaching broader adoption. Nvidia’s reported $100 billion investment in OpenAI is a prime example. Nvidia takes an equity stake in OpenAI, and OpenAI then plans to use the funds to build massive data centres powered by Nvidia GPUs. The effect is an appearance of strong numbers, even though much of the money is simply revolving among a handful of players. Critics argue this dynamic resembles vendor financing during the dot-com bubble, when companies propped up each other’s growth until the cycle collapsed. While vendor financing is common in many industries, the sheer scale and opacity of today’s AI spending make it far harder to judge whether genuine external demand is driving the boom.

Adding further fuel to the flames is the structural reality that major players in the AI space feel locked in a race. They appear convinced they must keep spending to avoid falling behind, chasing breakthroughs such as artificial general intelligence that have yet to materialise. On this point, Mark Zuckerberg recently noted that while “misspending a couple hundred billion dollars” on AI would be unfortunate, “the risk is higher on the other side.” He cautioned that if companies “build too slowly” and superintelligence arrives earlier than expected, they could be “out of position” in what he describes as “the most important technology that enables the most new products and innovation and value creation in history.”

At a broader level, the United States sees leadership in AI as a strategic priority in its rivalry with China, prompting it to channel investment into domestic players such as Intel. This "win-or-die" mentality, seemingly embraced by both companies and governments, injects existential urgency into the narrative. This kind of thinking can be a classic bubble red flag, as veteran investors like Howard Marks warn. When the belief takes hold that ‘there’s no price too high,’ rational valuation goes out the window, and that departure from reality can increase risks for investors.

Another concern is valuations and profitability. OpenAI’s financials are crucial to watch, given its status as the flagship of the AI boom. In the first half of 2025, the company generated $4.3 billion in revenue, primarily from subscriptions, but reported a $13.5 billion net loss. That included $6.7 billion in research and development, $2.5 billion in stock-based compensation, and $2.5 billion in cash burn. It is now seeking an additional $30 billion in funding. The company is currently valued at nearly $500 billion.

Source: National Bureau of Economic Research, How People Use ChatGPT. Weekly active ChatGPT users on consumer plans (Free, Plus, Pro), shown as point-in-time snapshots every six months from November 2022 to September 2025.

While ChatGPT’s 800 million weekly active users, 20 million paying subscribers, and growing enterprise uptake are impressive achievements in only a few years since its launch in November 2022, OpenAI’s long-term moat remains uncertain. Its business model may come under pressure as AI becomes more cost-efficient, and the field grows increasingly competitive. The rapid pace of change is particularly concerning given the company may still require a long-term horizon before breaking even.

Meanwhile, AI-led job losses are beginning to accelerate. Companies such as Accenture and Lufthansa have recently announced layoffs linked to AI automation. AI bulls may see this as early evidence of productivity gains, but for labour markets, the impact is already being felt. AI is no longer a distant promise. It is already reshaping markets, redirecting capital, and driving strategic decisions at every level. Whether the recent gains and potential future upside prove to rest on a solid foundation will ultimately depend less on today’s hype and more on the durability of profits and real business outcomes that follow.

CSL’s $200 health check

CSL [CSL] fell around 20% from mid to late August after an earnings announcement wiped more than $20 billion from its market value. As investors processed the news, CSL became one of the most heavily traded ASX stocks among the CMC Invest community in September. The $200 mark now shapes up as a key battleground between bulls and bears as we move into October.

Long considered one of the ASX’s most reliable blue-chip growth stories, CSL remains the seventh-largest company on the exchange, behind the major banks, Wesfarmers, and BHP. In its August results, the biopharmaceutical giant reported a 5% rise in revenue to US$15.6 billion and a 17% lift in net profit after tax to US$3.0 billion. Despite the solid numbers, markets quickly shifted focus toward strategic changes and, as always, future growth prospects.

The most significant development was CSL’s plan to demerge Seqirus, its vaccines arm, a move that could reshape the company’s profile. CSL also found itself in the tariff crosshairs after US President Donald Trump announced last week a 100% tariff on pharmaceutical exports to the US, effective 1 October, sparking a sell-off in biotech stocks. Investors warn CSL’s share price may remain under pressure amid regulatory uncertainty, even though the $96 billion biotech could ultimately be exempt. A CSL spokesperson said the company does not expect a material impact from the tariffs.

Healthcare more broadly has been a hotspot for volatility on the ASX in recent months. Alongside CSL, other actively traded names such as 4DMedical [4DX], Sonic Healthcare [SHL] and Telix Pharmaceuticals [TLX] have also experienced sharp swings both up and down, driven by company-specific catalysts and announcements. These stocks were also among the most watchlisted ASX stocks on the platform in September, keeping them firmly on investors’ radars as we head into October.

Open Army marches higher

Opendoor [OPEN:US] has emerged as one of 2025’s most surprising cult stocks, with trading activity surging dramatically in recent months. For the month of June, Opendoor [OPEN:US] ranked 733rd among international stocks traded by CMC Invest retail clients. By September, it had jumped to 8th spot.

That rise comes against a remarkable backdrop: Opendoor, a digital platform for residential real estate transactions, saw its market cap collapse from more than US$20 billion at its 2021 peak to less than US$500 million earlier this year. Yet from those lows, the stock has staged a blistering rebound, rising more than tenfold since June. The rally has been fuelled in part by a devoted band of retail investors known as the “Open Army,” a movement that began when hedge fund manager Eric Jackson called Opendoor his next potential “100-bagger.” These retail traders quickly rallied around the stock, creating a social-media-driven wave of momentum that has translated into one of the most eye-catching comebacks on Wall Street this year.

The cult following has been emboldened by a series of high-profile developments. Most notably, co-founder Keith Rabois returned to the board, and the company appointed Kaz Nejatian, a respected former Shopify executive, as its new CEO. Investors interpreted these moves as a decisive shift towards a more tech-driven strategy, with the potential to leverage AI and automation to improve the economics of its iBuying business model. Further credibility was added when trading giant Jane Street disclosed a near 6% stake, convincing many in the Open Army that institutional money was beginning to take the story seriously.

Despite the retail fervour, some critics argue that Opendoor’s fundamentals remain challenged. The company continues to post losses and operates in a capital-intensive sector with slim margins. Bulls argue that renewed leadership, growing scale, and AI-driven efficiencies could eventually move the company toward profitability, but the bear case points to its heavy reliance on sentiment, short squeeze dynamics, and speculative flows.

Opendoor now finds itself in the company of other stocks with devoted retail followings, including Robinhood [HOOD:US], Hims & Hers [HIMS:US], Palantir [PLTR:US], and Tesla [TSLA:US]. Like these names, Opendoor may be becoming more than just a stock, but rather a movement, with investors as committed to the story as to the balance sheet. The risk, as prior meme stocks have shown, is that such movements can be fragile. The question now is whether larger players and positive company developments will follow, or if the Open Army will be left holding the line alone.

Ready to explore international markets?

CMC Invest is your home for international investment, with over 45,000 stocks and ETFs at your fingertips. Get $0 brokerage on all securities from the US, UK, Canada, and Japan (FX spreads apply).

Plus, you can now trade single units of popular stocks like Apple or Tesla.

To view or trade international stocks, Log in to your CMC Invest account.

Don’t have an account? Sign up now to begin.

Disclaimer: This article provides general information only. It has been prepared without taking account of your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any financial instruments, or as a recommendation and/or investment advice. It does not intend to support an investment decision, and it should not be relied upon by you in evaluating the merits of investing in any financial instruments. You should consider your objectives, financial situation and needs before acting on the information in this article. CMC Markets believes that the information in this article is correct, and any opinions and conclusions are reasonably held or made on information available at the time of its compilation, but no representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this article. CMC Markets is under no obligation to, and does not, update or keep current the information contained in this article. Neither CMC Markets nor any of its affiliates or subsidiaries accepts liability for loss or damage arising out of the use of all or any part of this article. Any opinions or conclusions set forth in this article are subject to change without notice and may differ or be contrary to the opinions or conclusions expressed by any other members of CMC Markets.