Technical indicators demonstrate trend lines on a price chart. In particular, traders aim to identify support and resistance levels to see how an asset is fluctuating in price. Time is also a very important factor in choosing the right indicator, as profits and losses can exceed one another within a matter of seconds in a short-term trade, such as day trading. This is because day trading strategies aim to take advantage of small price movements by closing out the position before the end of the day.

There are two main types of technical indicators used for trading in MT4, which are known as leading and lagging indicators. When analysing a price chart for market trends, a leading indicator will inform traders before the new trend or reversal happens. On the other hand, a lagging indicator informs the trader of the new trend while it is happening in that moment. There are benefits and downsides to both of these types of MT4 indicators. For example, when accurately predicted, leading indicators can ensure profits for the trader.

However, it is not possible to have full consistency in pattern recognition, and can often mislead the trader into entering a market with unrealistic expectations. Lagging indicators only prompt the trader to open a position with full certainty of the market trend, which is a benefit over leading indicators. However, in reference to day trading above, you may lose out an initial period of profit by entering late to a trade.

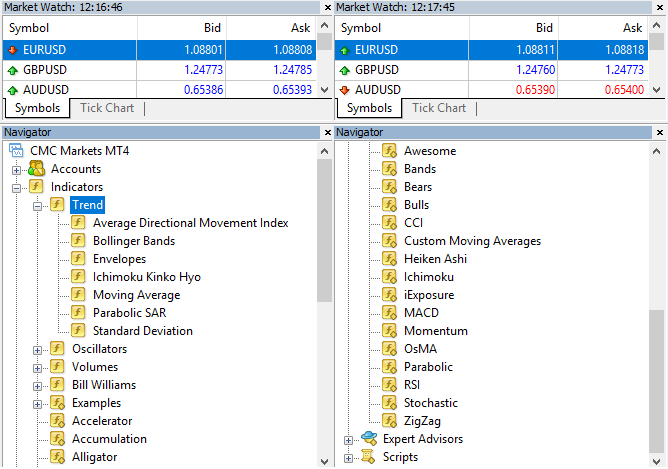

MT4 indicators using multiple timeframes are very useful for both long-term and short-term traders. This tool allows you to see the same standard indicators on the platform in separate windows across multiple timeframes. It can be used with the majority of forex technical indicators.