GSLOs: a video tutorial

Guaranteed stop-losses are available for most assets but not all, so please check our instruments page before opening a trade. Watch our video below for a tutorial on how to set guaranteed stop-loss orders.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A guaranteed stop-loss order (GSLO) is a type of risk management tool that works in the exact same way as a regular stop-loss, except for the fact that, for a premium charge, it guarantees to close you out of a trade at the price you specify, regardless of market volatility or gapping.

Guaranteed stop-losses are particularly useful when market conditions are volatile and prices can fluctuate suddenly from one level or another, without passing the level in-between. This is called price gapping or slippage, which can occur following major economic events and news announcements. It can also occur on weekends, where prices open at a significantly different level than the previous close.

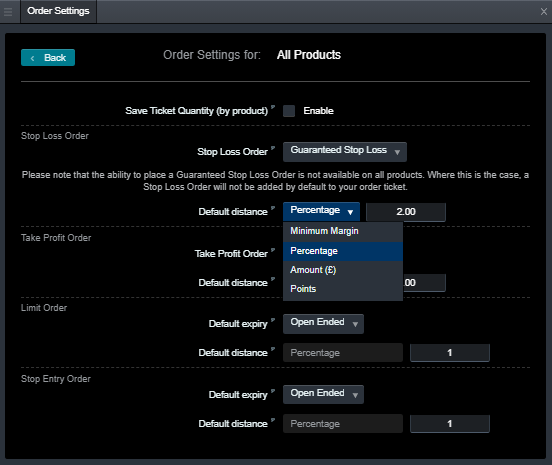

This article explains exactly what a guaranteed stop-loss order is, along with its various settings and how to set a GSLO on our online trading platform, Next Generation.

Guaranteed stop-losses are available for most assets but not all, so please check our instruments page before opening a trade. Watch our video below for a tutorial on how to set guaranteed stop-loss orders.

A guaranteed stop-loss order belongs alongside a traditional stop-loss order and a trailing stop-loss, all of which vary in the level of restriction. In particular, when placing a guaranteed stop-loss order, you need to follow certain rules and specifications. These include the following:

Traders are also able to place guaranteed stop-loss orders on their CFD positions (contracts for difference). CFDs are derivative products that enable you to trade on the price movements of the underlying financial asset without taking ownership.

Learn more about CFD trading or open a CFD demo account.

Here is an example of a guaranteed stop-loss in action. Let’s say that you want to go long on the UK 100 stock index and our current sell/buy price is 6694/6695. You decide to buy one unit at 6695. You are concerned about market volatility, so you decide to safeguard the trade by placing a GSLO at 6650 to limit your losses, should the market go against you. In this example, the cost of placing a GSLO on your unit is £1.

An unexpected economic event takes place in the form of interest rate cuts by the US Federal Reserve. This causes volatility within the market overnight, leading the UK 100 to gap by 90 points. The following morning, the index opens at 6604/6605.

As you had placed a guaranteed stop-loss order, your trade closed out at 6650, resulting in a loss of £45 (6695-6650 x 1).

If you hadn’t placed a guaranteed stop on your position, your trade would have closed at the next available price, which in this case was 6605. This means that you could have lost £90 (6695-6605 x 1).

Trades with a GSLO attached are displayed in an aggregate area in the ‘Positions’ tab underneath positions placed using a standard margin requirement. You have the ability to close or reduce all standard margin positions, close all prime margin positions or close all positions for a particular instrument. Alternatively, you can close out each position individually.

There are two possible close-out levels that can be applied to a trading account, depending on how your open positions are set up:

For ease of use, we display the cash value of these levels, rather than just a percentage, but you can still view the relevant close-out percentage levels for your account.

Our award-winning trading platform, Next Generation, comes with a range of execution and order types, including GSLOs, regular and trailing stop-losses and take-profit orders. We understand how important risk management is for your trading success, which is why we offer a diverse range of stop-loss orders.

What is a stop-loss order?

A stop-loss order is a market order that helps you manage your risk by closing a trade at a pre-determined price. It’s a risk-management tool and can be used to help you avoid excessive loss of capital. Besides a classic stop-loss order, trailing stop-loss orders and guaranteed stop-loss orders are also available.

What is a guaranteed stop-loss?

A guaranteed stop-loss order, or GSLO, works the same as a standard stop-loss order, but for a small fee, it guarantees to exit a trade at the exact price you want, regardless of market volatility or gapping. When market conditions are very volatile, market gapping (or slippage) can occur, which can result in your stop-loss order being triggered at a different price to what you have set. Therefore, using guaranteed stop-loss orders is recommended for regularly volatile markets that experience large price fluctuations.

What is a trailing stop loss?

A trailing stop-loss order is similar to a standard stop-loss order, but it moves with a positive trend movement, remaining at the distance specified when the order was placed, and will stay static during negative trend movements. A trailing stop loss can help a trader follow the classic mantra of ‘cut your losses and let your profit run’.

How do I set up a stop-loss order?

You can set up a stop-loss order when placing a trade on an order ticket. You can choose between a stop-loss, trailing stop-loss or guaranteed stop-loss order. Your choice of stop-loss order should be pre-determined in your risk-management strategy.

Why are you charged a premium if your guaranteed stop is triggered?

Guaranteed stop-losses will always be filled at the level that you specify, even if there is market gapping or slippage. Therefore, a fee will be triggered if the price hits your level, in order to ensure that your position closes out to minimise the risk of loss. If the GSLO is not triggered, the premium is refunded.