Investing your first $500 is less about chasing returns and more about learning the ropes. It is your first real step into the market, and chances are you will remember it more for the experience than the outcome.

How you invest that initial $500 will likely look very different to how you invest later on. That is normal. As your knowledge grows and your circumstances change, so will your approach. At this stage, the goal is progress, not perfection.

Starting out can feel daunting. The world is changing quickly, industries are evolving, and technologies like AI are reshaping how businesses operate. Financial markets are one way of making sense of these changes. They reflect expectations, decisions and uncertainty as they play out across businesses and industries.

This article will step you through how to think about investing your first $500, so you can start learning how investing works and begin engaging with the forces shaping the world around you.

Why are you investing?

Before you invest a cent, ask yourself: what is the point of this investment?

Some common (and completely valid) goals when making your first investment:

To learn how the market works – think of this like a training session. You are here to get hands-on experience with real stakes, but manageable ones.

To get off the sidelines – it is easy to overthink and wait. Investing a small amount helps you feel more connected to the market. It gives you a reason to pay attention.

To gauge your risk tolerance – whether you buy a single stock or a diversified ETF, your investment will move up and down. Learning to live with that volatility is valuable training. It helps you understand your emotional reactions and builds the mental resilience you need to stay invested over time.

To build a long-term habit – it is not about the $500 itself. It is about laying the groundwork for a consistent, disciplined approach to investing over time.

Your first investment might be small, but it can be the starting point for much broader financial goals. Maybe you want to build long-term wealth, generate passive income, save for a home or create more flexibility in your working life. Clear goals with timeframes can help you stay focused and make more intentional choices as you grow your portfolio.

It is also okay if your goals evolve. As your life changes and your investing knowledge grows, your priorities probably will too. The important thing is to get started with purpose, even if it is just $500.

Once you know why you’re investing, choosing what to invest in becomes much easier.

How to get started

Step 1: decide what to invest in

This is where the fun (and thinking) begins.

With $500, you have some options. The key is matching your choice to important factors like your goals, risk appetite and time horizon.

Individual stocks

Investing in single companies can be a good way to put your money into brands you know and believe in. Maybe it is a company you use every day, one you admire for its innovation or a business you have researched and think has long-term potential.

Just keep in mind that individual stocks can be volatile. Prices may move sharply based on company performance, market sentiment or global events. This is not necessarily a bad thing. It is part of the experience and can be a useful way to learn how markets behave.

Popular international stocks many first-time investors explore include Nvidia (NVDA), Amazon (AMZN) and Apple (AAPL). In the Australian market, household names like Commonwealth Bank (CBA), Woolworths Group (WOW) and BHP Group (BHP) are popular choices.

Exchange-traded funds (ETFs)

ETFs are a great way to get broad exposure with a single investment. They bundle together many different stocks, so you get instant diversification. That reduces the risk that comes with picking just one company.

Generally speaking, ETFs are also less volatile than individual shares. Because they hold multiple companies, the performance of any single stock has less impact on the overall value of the fund.

Some examples include:

A broad market ETF like IVV (which tracks the S&P 500) or VAS (which tracks the ASX 300)

A sector ETF like NDQ, which focuses on US tech stocks

A global ETF like VGS, which gives you diversified exposure to large companies across developed markets

Popular investments on CMC Invest

The investment universe is huge, and it’s completely normal to feel unsure about where to start.

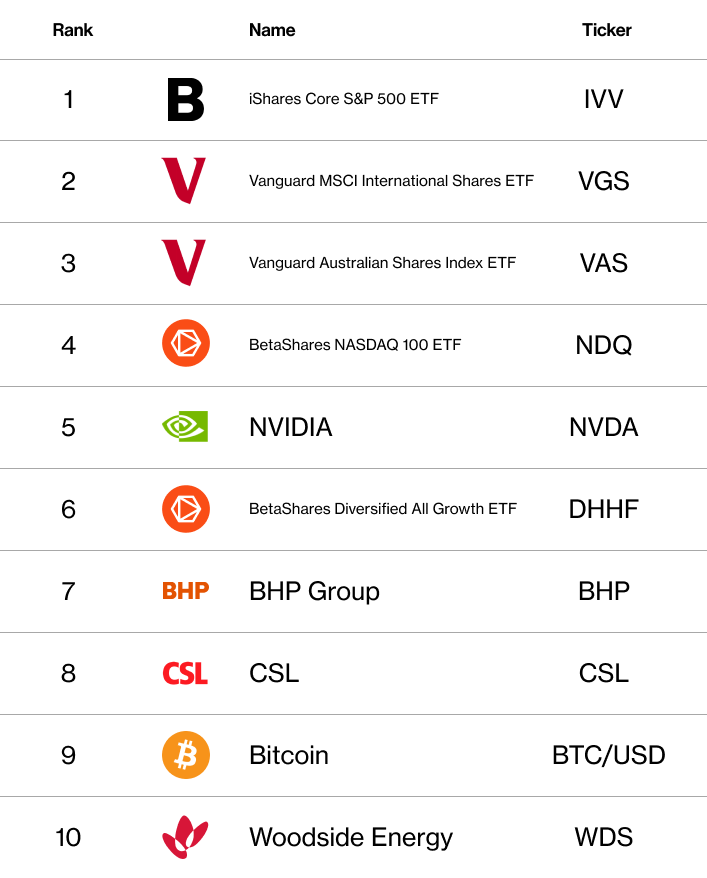

If you want a simple place to begin your research, you can check out some of the most popular investments on the CMC Invest platform in 2025 below.

Five of the top 10 were ETFs, four were individual stocks, and one was a cryptocurrency.

For more rankings and insights, see our Inside Invest Report.