The coming week will feature two US inflation readings for August, with consumer price data out on Wednesday and producer price data due on Thursday. We’ll also get the European Central Bank’s interest rate decision on Thursday, with a quarter-point cut widely expected. On the company results front, the standout report comes from software company Oracle, which will announce its Q1 earnings on Monday. And on Tuesday, Kamala Harris and Donald Trump go head-to-head in the first televised presidential debate between the two White House hopefuls.

US election update

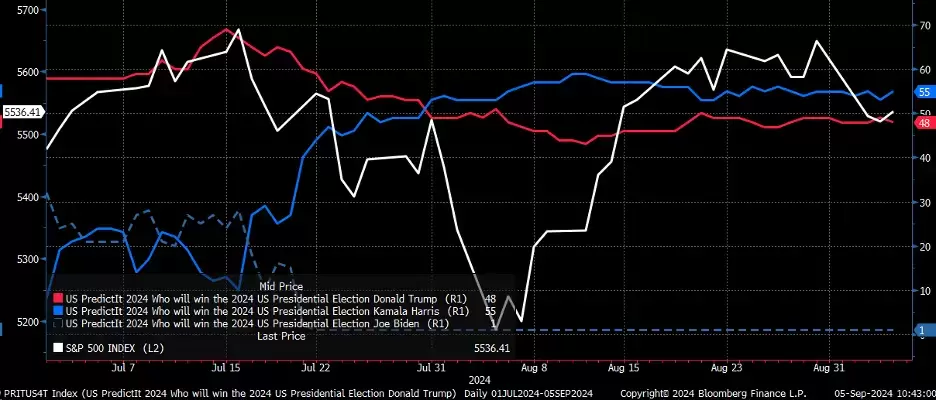

The first debate between Democratic vice-president Harris and Republican former president Trump on 10 September (at 9pm, US eastern time; 11am on Wednesday 11 September, Australian time) comes as Harris opens up a seven-point lead in the polls, according to PredictIt, an online prediction market that covers political events. Their latest polling has Harris in the lead with a 55% chance of winning the presidency, with Trump on 48%.

Since the market sell-off at the start of August, US equity indices such as the S&P 500 have bounced back. Although investors don’t appear to have been paying too much attention to the election polls so far, the upcoming debate could mark a turning point. The debate itself – a useful reminder that an election is fast approaching – and the public’s reaction to it could attract investors’ attention. Watch out for a potential spike in market volatility ahead of and around the event.

US election poll tracker, July 2024 - present