Welcome to Michael Kramer’s pick of the top three market events to look out for in the week beginning Monday, 12 August 2024. Plus, he also offers an update on the US presidential election.

The coming week will focus on inflation, with consumer price index (CPI) readings from the UK and the US on Wednesday set to confirm whether or not the cooling in price growth over the past two months is genuine and lasting. After a volatile few days for markets, the US data will be crucial, serving as a potential indicator of whether traders should prepare for a US recession, a Fed rate cut in September, or both. The UK announcement should offer clues as to whether the Bank of England, which cut its base rate by a quarter point to 5% on 1 August, will lower rates again at its next meeting on 19 September.

On the company earnings front, the key announcement to look out for comes from Walmart, which is set to report its second-quarter results on Thursday. In May, the world’s biggest retailer raised its full-year outlook after its Q1 results beat analyst forecasts, boosting its shares to a record high. Since then, the stock has risen a further 6% to current levels near $68.

With less than three months to go until the US election on 5 November, uncertainty over who will win the keys to the White House could continue to contribute to market volatility in the coming weeks. If the US really is heading for a recession, upcoming economic announcements could have a significant impact on voting intentions.

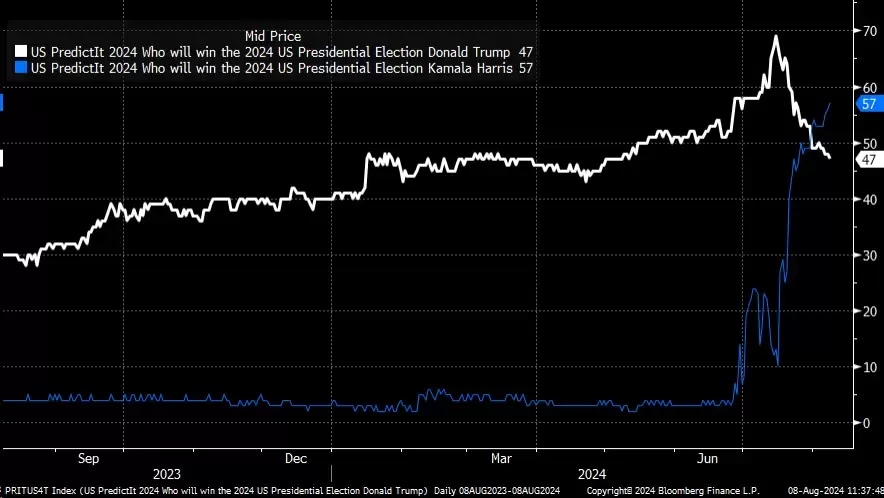

Recent polling suggests that the race for the presidency has tightened since Kamala Harris replaced Joe Biden as the Democratic candidate. Some prediction markets, including PredictIt (see the below chart), are now indicating that vice president Kamala Harris could prevail over former president Donald Trump.

Although the S&P 500 has been struggling since President Biden withdrew from the race, the causality isn’t clear, with various other factors – from Japan’s interest rate rise to a weak US jobs report – also weighing on US stock markets. For a while there was some suggestion that a Trump win could benefit US small-cap stocks, but small-caps and regional banking stocks have faded since the weak US labour report, making things unclear for the moment. Traders will be hoping for greater clarity in the coming weeks.

Data gathered by the New Zealand-based online prediction market PredictIt suggests that Kamala Harris may be on course for victory over Donald Trump in November’s US presidential election