The trading experience for serious traders

Become the trader you want to be with our Next Generation platform technology and personal client service.

The complete package for new & experienced traders

For new traders

- One of the established industry leaders

- Three decades of trading know-how

- Award-winning customer service*

- Highly-regarded trader education*

- Advanced risk management

- Tax-free spread betting profits

- No minimum deposit

For experienced traders

- Award-winning trading platform*

- Wide range of charting tools

- Fast, automated excecution

- Expert news & analysis

- Competitive spreads

- Advanced trading tools

- Tax-free spread betting profits

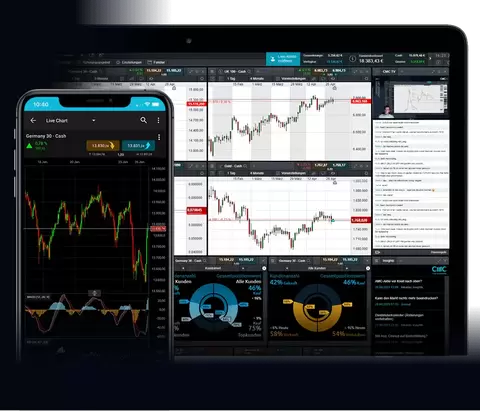

Access your account anywhere

Manage your account, analyse the markets and trade from anywhere on our award-winning platform, available across all your devices.

DESKTOP MOBILE TABLET

*Awarded No.1 Platform Technology & No.1 Web-Based Platform, ForexBrokers.com Awards 2021; Best Telephone Customer Service, Best Email Customer Service & Best Education Materials/Programmes, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, Rated Highest for Charting, Investment Trends Report 2019; Best In-House Analysts, Professional Trader Awards 2019; No.1 Most Currency Pairs, ForexBrokers.com Awards 2020.

**Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.