USD/JPY strengthens following supermajority win

The big news from Japan was that Prime Minister Takaichi won a two-thirds supermajority in the lower house following an election over the weekend. This will likely bring more stimulus-related fiscal policy, yet USD/JPY still strengthened on the headline as rates rose.

USD/JPY strengthened to 156.2, which is surprising given the market’s apparent concern about the direction of Japan’s fiscal and monetary policy in recent weeks. The strength may instead be attributable to positioning ahead of the event, with subsequent covering of those positions following the result.

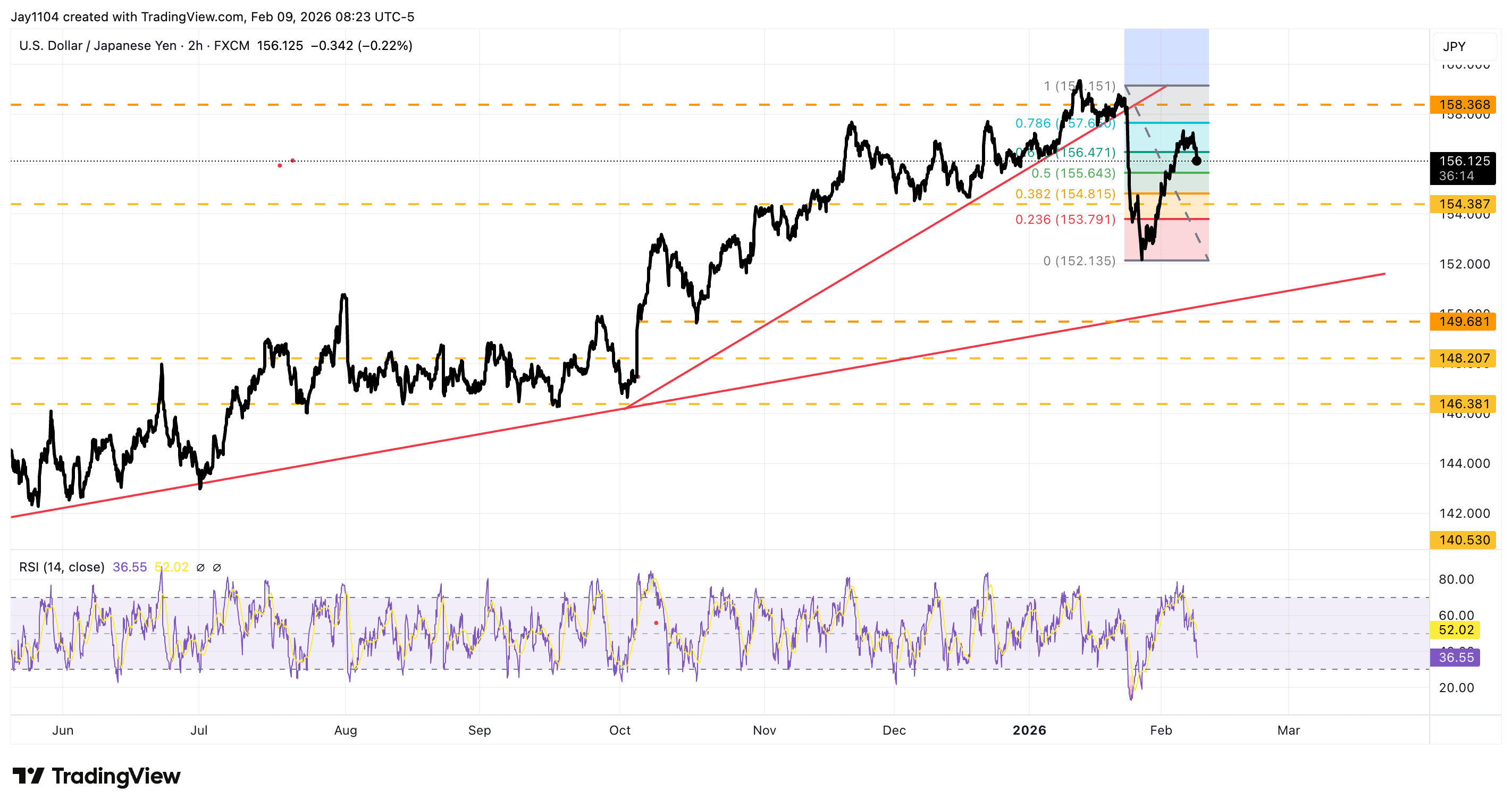

USD/JPY has recovered 78.6% of its losses following the Bank of Japan policy meeting on Friday 23 January. This suggests that the recent rise in USD/JPY may have been merely a retracement of that decline, rather than a sign of a sustained reversal, although it is still too early to say whether the longer-term trend has shifted.

Source: TradingView, 9 February 2026

A move above 159.10 would confirm that USD/JPY has further to climb and could be heading back towards the 160 area, if not higher. Meanwhile, a break below 152 would likely indicate further downside, with USD/JPY potentially heading back towards 149.70.

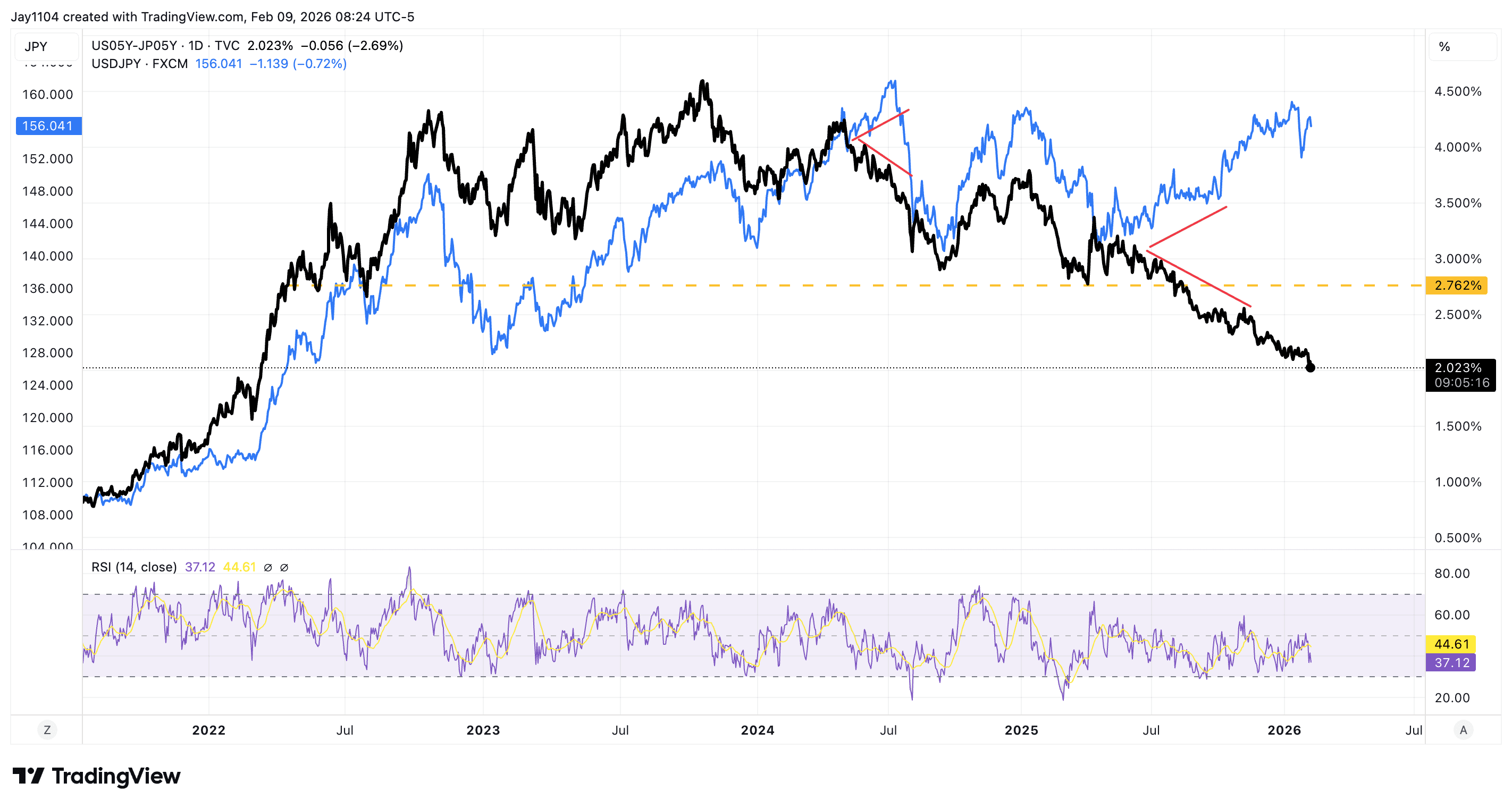

At this point, the case for the yen to strengthen against the dollar appears plausible, given how much the interest-rate differential has narrowed, especially if monetary and fiscal policy work together to calm investor concerns.

Source: TradingView, 9 February 2026

USA accelerates, the Fed returns to orthodoxy, and the USD gets a boost

The acceleration of the U.S. economy and the nomination of Kevin Warsh as Fed chair are giving fresh support to the U.S. dollar (USD). The rebound could gain strength if the pace of growth manages to offset the large fiscal deficits.