The Week Ahead: Cisco earnings, UK growth, US inflation

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 9 February.

Friday, 6 February 2026: The partial US government shutdown has ended, which means the economic data taps will be turned back on. The delayed jobs report – closely watched by traders, investors and politicians as a gauge of how the US economy is performing – has been rescheduled for Wednesday 11 February, while the consumer price index (CPI) report has been pushed back to Friday 13 February. The coming week also sees the release of UK gross domestic product (GDP) data for the final three months of last year. Meanwhile, earnings season may have passed its peak but there are still lots of big names set to report quarterly results, including Cisco, BP and Coca-Cola.

Cisco Systems Q2 earnings

Wednesday 11 February

Analysts expect the networking technology giant Cisco to report that second-quarter earnings grew 8.6% year-on-year to $1.02 a share, as revenue rose an estimated 8% to $15.1bn. Gross margins are expected to have expanded to 68.1%, up from 65.5% in Q1. Looking ahead to Q3, analysts are forecasting earnings growth of 7.3% year-on-year to $1.03 a share, with revenue projected to increase 7.3% to $15.2bn and gross margins to remain unchanged sequentially at 68.1%.

Options markets imply that traders expect Cisco shares to move by an average of 5.1% in either direction after the Q2 earnings release. Shares of the Nasdaq-listed company rose to a record high of just over $83 earlier this month. Option positioning highlights a strong resistance level at $85, with support near $78. At the same time, delta exposure indicates bullish positioning in the shares. As a result, once the company reports earnings and call-option premiums decline, hedging flows could push the shares lower.

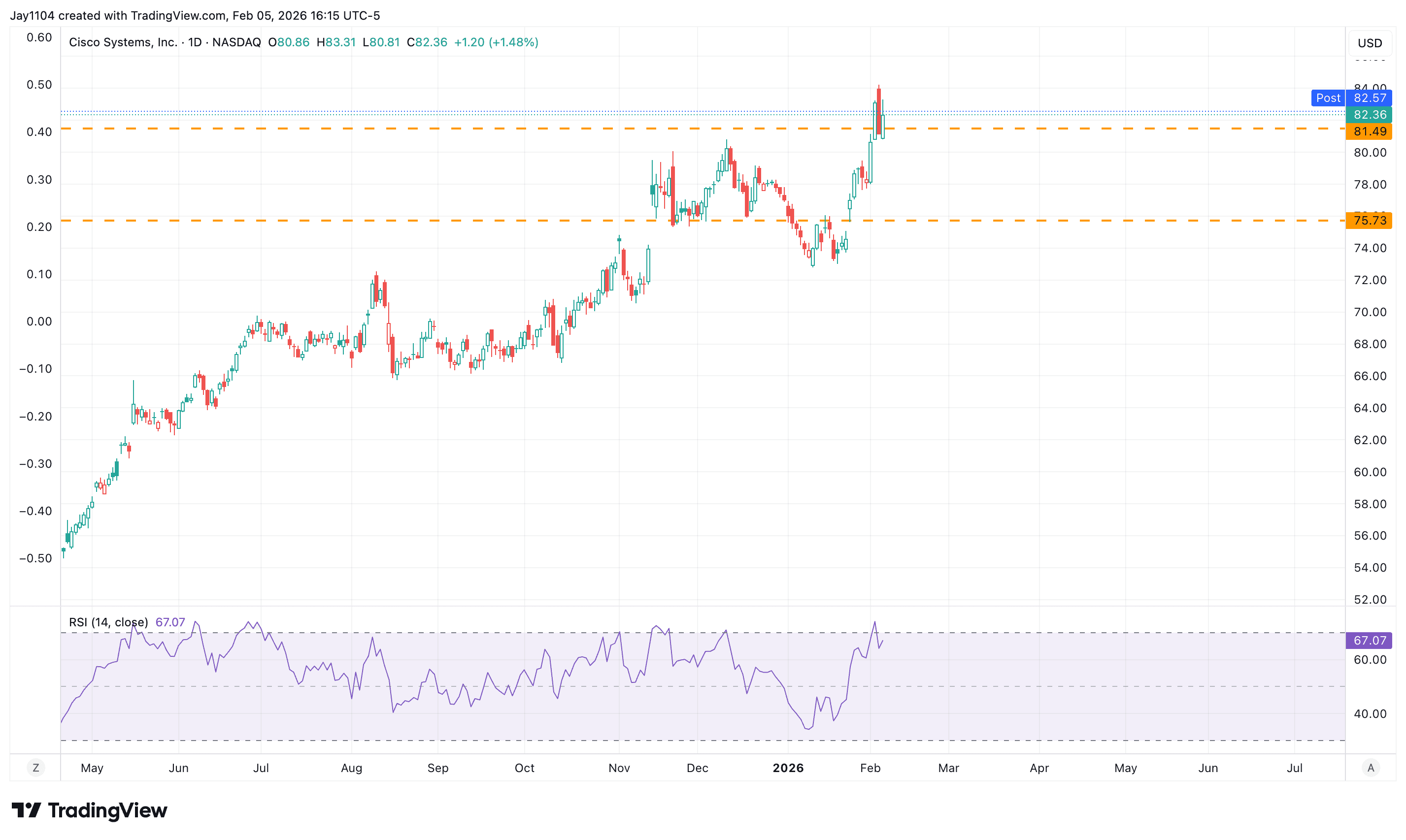

The technical chart below shows that Cisco stock has pushed through a key resistance level around $81 that dated back to the previous all-time high set in 2000. If the share price remains above $81, there may be scope for further upside; however, a dip below that historically important level could send the shares down towards $75, potentially filling a gap created on 26 January.

Taken together, the options market positioning and our technical analysis point to a potentially tight trading range for Cisco shares in the near term.

Cisco Systems share price, May 2025 - present

Sources: TradingView, Michael Kramer

UK Q4 GDP

Thursday 12 February

Economic growth in the UK has, of late, been tepid by historical standards. GDP grew 1.9% year-on-year in Q4 2024, then slowed to 1.8% in Q1 2025, 1.4% in Q2, and 1.3% in Q3. Consensus estimates point to a further slowdown to 1.2% for Q4. As a result, the market is pricing in up to two Bank of England interest rate cuts in 2026 as policymakers look to stimulate growth.

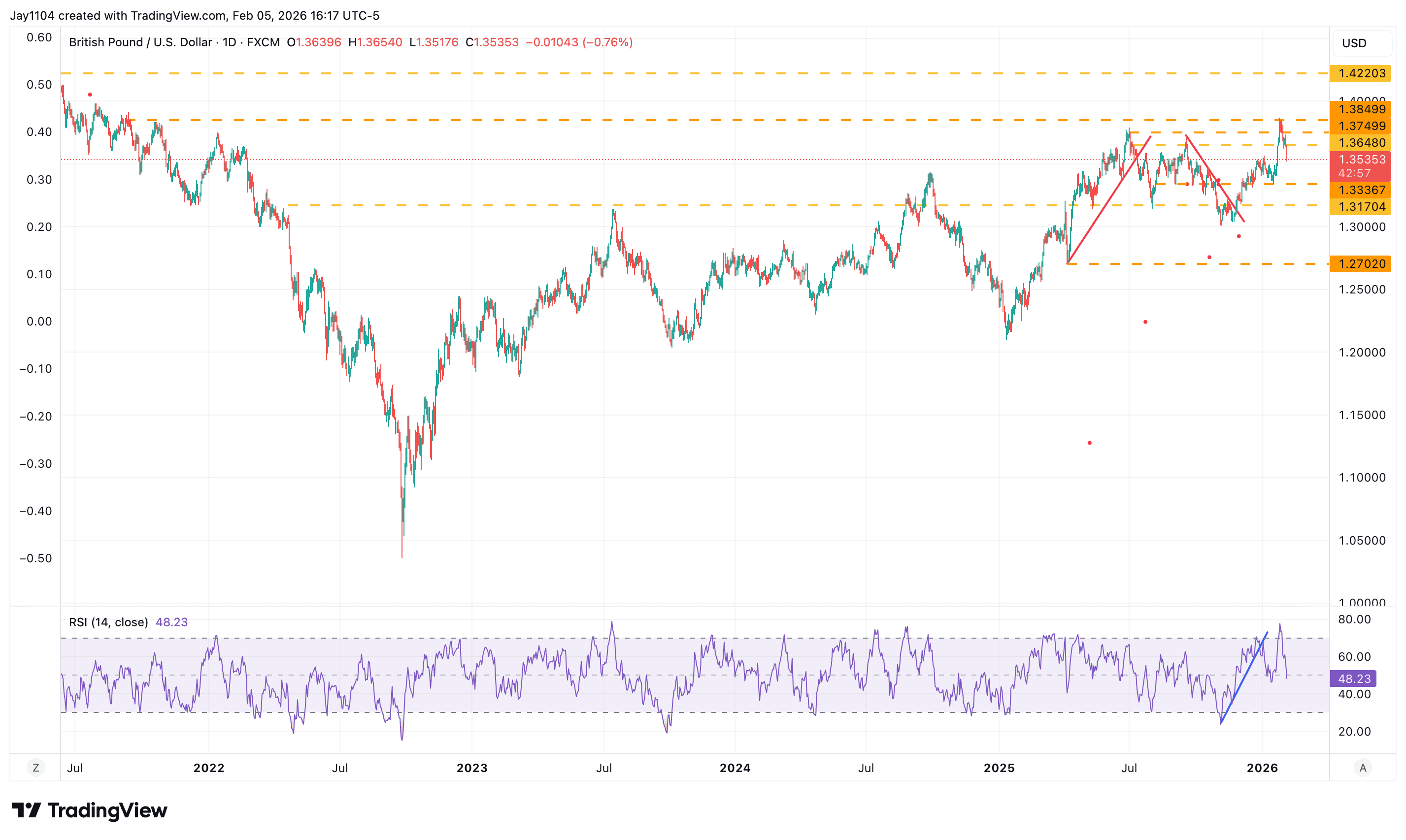

This backdrop could weigh on GBP/USD, which rose to test $1.38 in late-January before falling back towards current levels near $1.36. With the BoE having left rates unchanged at 3.75% on Thursday 5 February, and amid mounting political uncertainty over the fallout of Peter Mandelson’s links to Jeffrey Epstein, the pound could come under renewed pressure in the near term. If the GDP figures come in weaker than expected, the pound may drift back towards support near $1.33.

GBP/USD, July 2021 - present

Sources: TradingView, Michael Kramer

US January CPI

Friday 13 February

Economists estimate that US consumer prices increased 0.3% month-on-month in January, the same pace of growth as in December. Core CPI, which strips out volatile food and energy prices, is expected to have risen 0.3% in January, up from 0.2% in December. On an annual basis, inflation is expected to have eased from December’s headline measure of 2.7% and the core CPI print of 2.6%.

With the annual rate of inflation cooling towards the Federal Reserve’s 2% target, the CPI report has lost some of the market impact it carried after US inflation hit a 40-year high of more than 9% in 2022. Moreover, since the US government shutdown that ran from 1 October to 14 November 2025, which led to gaps in the inflation data, the CPI readings have not been entirely consistent with pre-shutdown trends. As a result, traders seem to be placing slightly less emphasis on the figures.

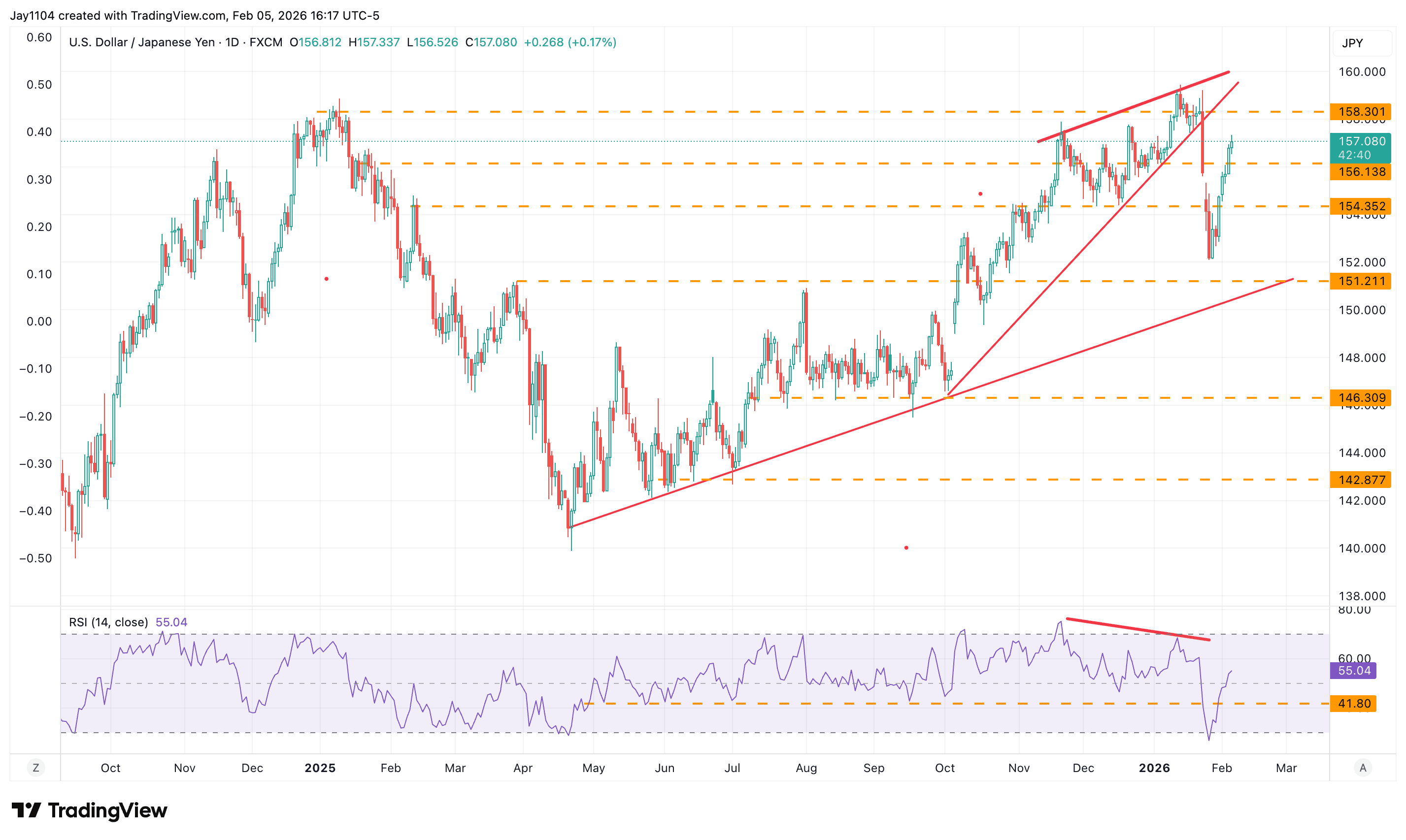

Even so, there is still scope for a high or low CPI reading to contribute to the recent volatility in forex markets, particularly USD/JPY. After a period of yen strength following the Bank of Japan’s rate hold and hawkish forecast at its meeting in January, talk of possible government intervention in the currency market has pushed the pair back up towards the ¥157 to ¥158 area, retracing much of the decline since 23 January. Given how steep and sudden the January drop was, the market may now be retesting that area to gauge both traders’ reaction and, potentially, policymakers’ response. The outcome of Japan’s general election on Sunday 8 February might also add to the yen’s recent turbulence.

USD/JPY, October 2024 - present

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Sunday 8 February

• Japan: General election

Monday 9 February

• Australia: February Westpac consumer confidence

• Eurozone: February Sentix investor confidence

• Results: Apollo Global Management (Q4), Loews (Q4), ON Semiconductor (Q4), Plus500 (FY)

Tuesday 10 February

• UK: January BRC like-for-like retail sales

• US: December retail sales

• Results: AstraZeneca (FY), Barclays (FY), BP (Q4), Cloudflare (Q4), Coca-Cola (Q4), Coca-Cola HBC (FY), CVS Health (Q4), Duke Energy (Q4), Dunelm (HY), Ecolab (Q4), Ford (Q4), Gilead Sciences (Q4), Marriott (Q4), Robinhood Markets (Q4), S&P Global (Q4), Spotify (Q4)

Wednesday 11 February

• China: January consumer price index (CPI)

• US: January jobs report, incl. non-farm payrolls and average earnings (rescheduled from Friday 6 February)

• Results: Applovin (Q4), Barratt Redrow (HY), Cisco Systems (Q2), Hilton (Q4), McDonald's (Q4), MJ Gleeson (HY), Motorola (Q4), PZ Cussons (HY), Renishaw (HY), Severn Trent (Q3), Shopify (Q4), T-Mobile US (Q4)

Thursday 12 February

• Australia: February consumer inflation expectations

• UK: Q4 gross domestic product (GDP)

• US: Weekly initial jobless claims

• Results: Airbnb (Q4), American Electric Power (Q4), Applied Materials (Q1), Arista Networks (Q4), Ashmore (HY), British American Tobacco (FY), Brookfield (Q4), CBRE (Q4), Coinbase (Q4), Expedia (Q4), Howmet Aerospace (Q4), RELX (FY), Rivian Automotive (Q4), Roku (Q4), Schroders (FY), Unilever (Q4), Vertex Pharmaceuticals (Q4), Zoetis (Q4)

Friday 13 February

• Eurozone: Q4 GDP

• New Zealand: Q1 Reserve Bank of New Zealand inflation expectations

• Switzerland: January CPI

• US: January CPI

• Results: Moderna (Q4), NatWest (FY), Wendy's (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.