USA accelerates, the Fed returns to orthodoxy, and the USD gets a boost

The acceleration of the U.S. economy and the nomination of Kevin Warsh as Fed chair are giving fresh support to the U.S. dollar (USD). The rebound could gain strength if the pace of growth manages to offset the large fiscal deficits.

U.S. accelerates and the yield curve rebounds

The U.S. economy is showing clear signs of improvement. Two data points illustrate this: first, the Citigroup economic surprises index has advanced more than 40 points so far this year, reaching levels not seen in two years. Second, the January 2026 ISM manufacturing index rose by 4.7 points, entering expansion territory and marking its best level since August 2022.

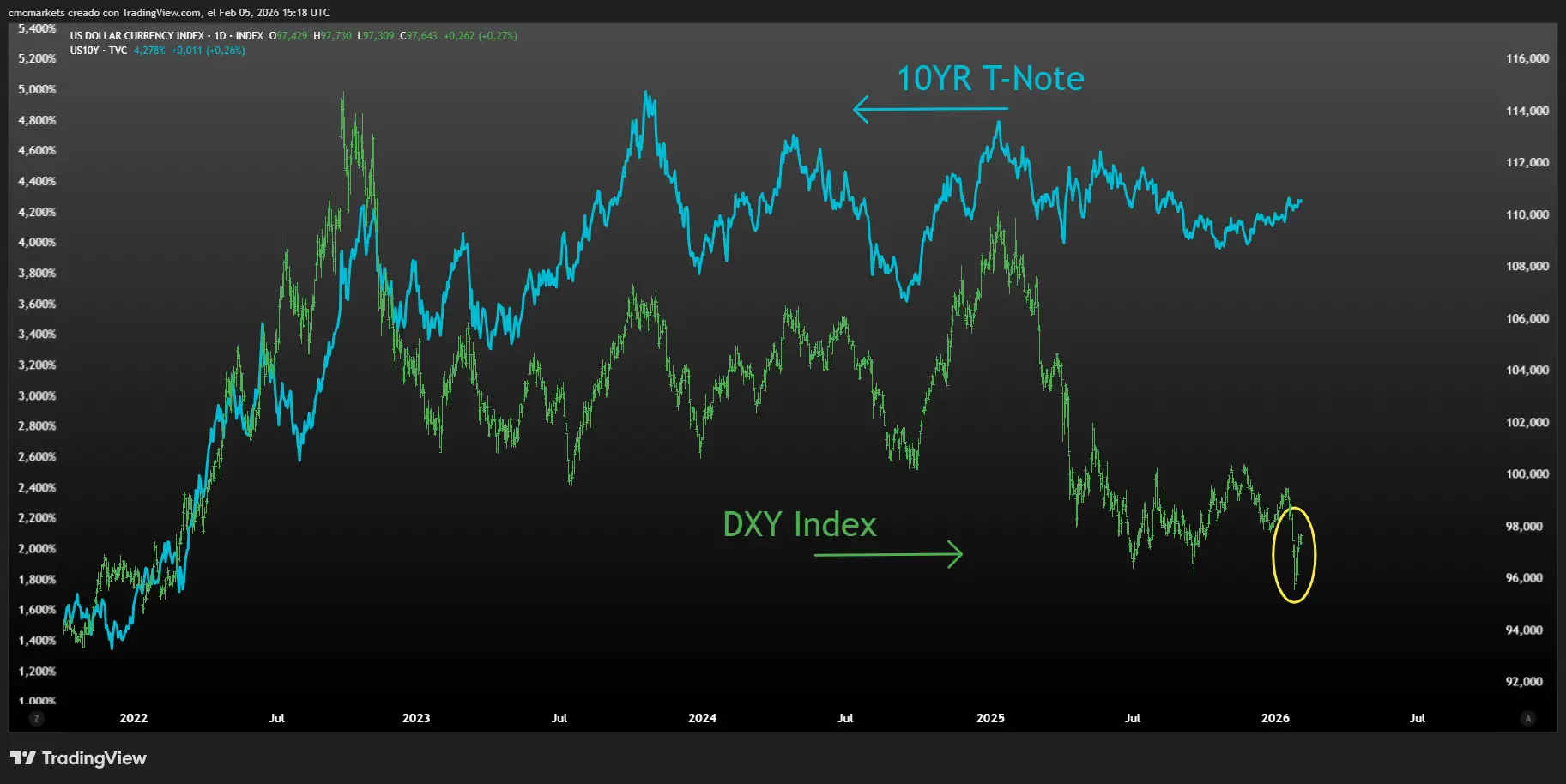

Models from the Federal Reserve banks of New York and Atlanta already reflect this momentum, signaling an acceleration of GDP in late 2025 and early 2026. In this scenario, members of the Federal Open Market Committee (FOMC) are in no hurry to cut interest rates, and the yield curve has shifted upward by about 10 basis points so far this year.

Source: TradingView, 5 February 2026

Kevin Warsh: independence and orthodoxy for the Fed

The nomination of Kevin Warsh has reduced market uncertainty. Pending Senate confirmation, Warsh’s profile suggests a Fed that will move away from the excessive market intervention seen in recent years. A proponent of monetary orthodoxy, Warsh seeks a “boring” institution that drastically reduces its balance sheet and avoids constant market intervention.

His thesis is described as disruptive: he rejects the traditional relationship between full employment and inflation, arguing that innovation and technological efficiency can help keep prices under control naturally.

The dollar’s puzzle: is it starting to take off?

The technology sector seems to support Warsh’s view. Artificial intelligence continues to boost GDP – with companies like Alphabet announcing massive capital expenditures – and its ability to improve efficiencies is transforming industries previously untouched, such as software.

However, even though the pieces of the puzzle seem to fit, the USD has not rebounded as clearly as expected. The reason appears to be a lack of structural confidence: prolonged geopolitical tension is encouraging diversification into other currencies, and the current growth, although solid, is still perceived as insufficient to offset the large U.S. fiscal deficits.