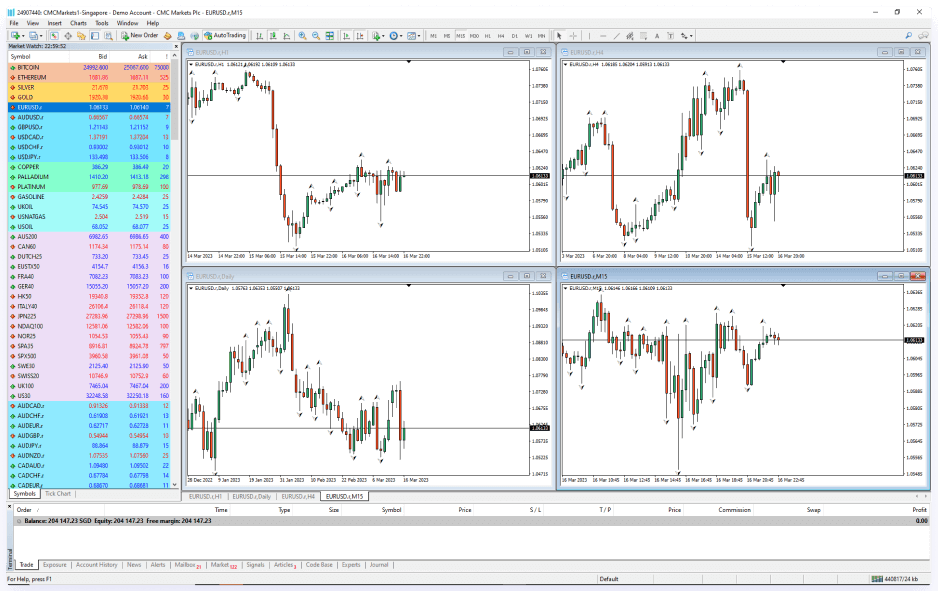

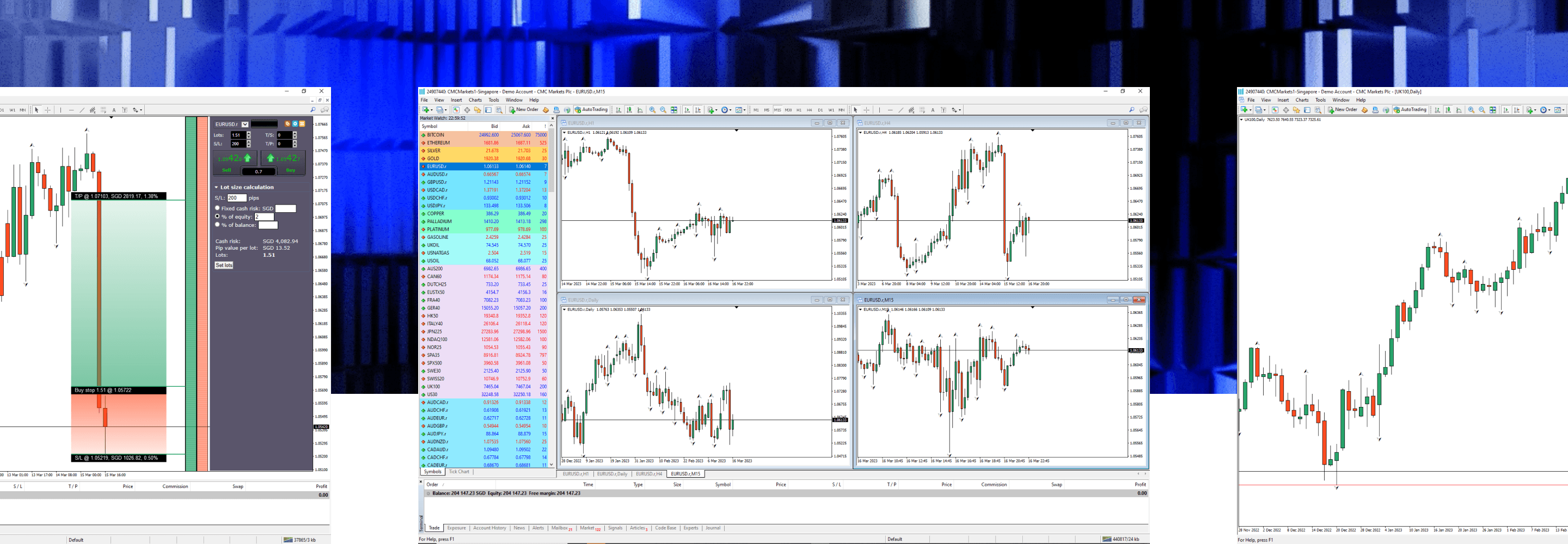

MetaTrader 4 platform

Competitive spreads on 175+ FX pairs, indices and commodities

Fast, 100% automated execution, with tier-one market liquidity

Advanced charting tools, Expert Advisors and algorithmic trading

Also available on Android, iPhone and WebTrader.

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

What is MetaTrader 4?

MetaTrader 4 (MT4) is a globally renowned online trading platform, which was originally released in 2005. While the platform is synonymous with forex trading, you can also trade CFDs on popular indices and commodities through MT4 with us.

MT4 offers automated trading though Expert Advisors (EAs), and access to thousands of analysis tools. Start MT4 trading from home and stay in touch with your trades when you’re on the go through the MT4 mobile app.

MT4 markets and costs

The minimum spread is the lowest spread we offer on an instrument. If the underlying market spread widens during the trading day, or you're trading out of hours, our spreads may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant instrument. The spread will widen for larger trade/bet sizes. You can find more information by logging in to the platform.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

Why trade on MetaTrader 4 with us?

Hone your technical analysis and tap into our suite of additional premium MT4 indicators and EAs, included at no cost.

Deposit and withdraw funds easily, and whenever you want to, with no charge.

We give clients the ability to go long and short at the same time on a specific instrument, which means there's no interruption for traders using Expert Advisors (EAs).

Superior execution and reliability

Our pioneering technology and experienced customer service, alongside the renowned MT4 platform, provides the ideal combination for serious traders.

Open a demo accountYou can be sure your trades will be filled without any dealer intervention.

We fulfil your order without off-quotes, and wherever possible at the price you see.

We consistently achieve almost 100% core platform uptime, so you can focus on your trading.

What do our customers say about trading with us?

MetaTrader 4 trading tools

Enhance your MT4 trading experience with our 12 free, premium EAs, including mini terminal and sentiment trader, and 18 indicators, such as pivot points and renko charts.

Compare our account types

MT4 spread betting

A tax-efficient way of speculating on the price movement of global financial instruments.

Trade with leverage

- No stamp duty to pay⁷

No capital gains tax on profits

Available schemes: Price+, Alpha

MT4 CFD trading

Trade on the price movement of underlying financial assets, with no stamp duty payable.

Trade with leverage

- No stamp duty to pay⁷

Profits subject to capital gains tax

Available schemes: Price+, Alpha

FX Active

Commission-based3 forex trading, designed for CFD traders who want to trade on pure price action.

- No stamp duty to pay⁷

- Spreads from 0.0 pips on 6 major pairs²

25% spread discount on all other FX pairs

Available schemes: Price+, Alpha

FAQs

MetaTrader 4 or MT4, developed by MetaQuotes, is an online trading platform used to speculate on the price movement of assets such as forex, indices and commodities.

It's one of the most popular forex trading platforms available online, and can be downloaded on Windows, Android and iOS. MT4 enables the use of Expert Advisors (EAs) to automate your trading.

Auto or algorithmic trading is one of the most powerful features on the MT4 platform, allowing you to test and apply Expert Advisors (EAs) and technical indicators that you've built or acquired.

You can learn more about our premium MT4 indicators and add-ons, and download them for free here.

1. Apply for a demo account

2. Create an MT4 password within our admin portal

3. Follow the live account login steps outlined above (but select the demo server – you can find the server name at the top of the emails we sent you during the application process)

MT4 demo accounts remain active as long as you log in to the MT4 trading platform at least once every 30 days. If you don't log in during that time, your account will automatically be closed, but you can set up a new demo account again at any time.

There's no cost to open a live trading account with us. You can also view prices and use tools such as charts, Reuters news, or Morningstar quantitative research equity reports, free of charge. You'll need to deposit funds in your account to place a trade.

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC, and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, also make a contribution to our overall revenue.

Ready to get started?

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.