Welcome to CMC Pro

Up to 500:1 leverage available

Personal account manager to support you with your trading

Cash rebates for eligible high-volume traders

Looking for a standard retail account?

ADVFN International Financial Awards

ForexBrokers.com Awards

Professional Trader Awards

Professional leverage on 12,000 markets

Professional clients have access to leverage up to 500:1. Please note that higher leverage increases the risk of rapidly losing money. Profits and losses are based on the notional value of your position, and pro clients don't benefit from negative balance protection.

For professional clients only. Capital at risk. Tax treatment depends on individual circumstances.

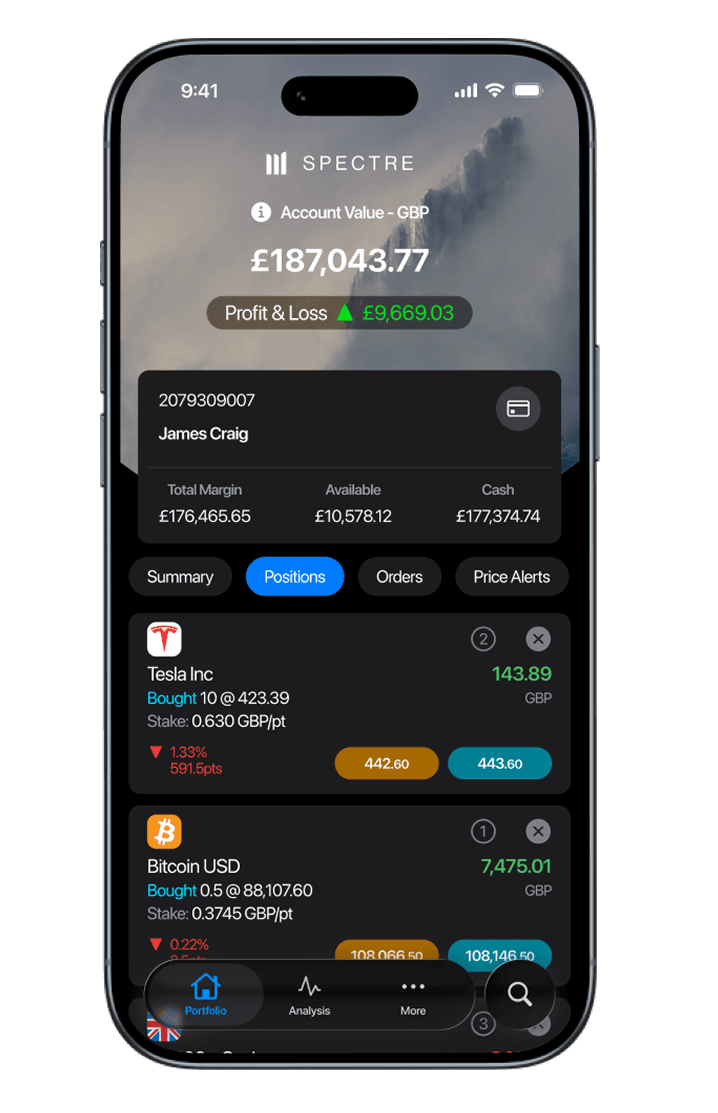

The new way to trade tax-free*

For professional clients only. CMC Spectre offers unlimited tax-free trading*, helping you keep more of your returns.

No financing costs

No capital gains tax

No margin calls

*Tax treatment depends on individual circumstances. Professional clients only. Capital at risk.

What do our customers say about trading with us?

Cash rebates for high-volume traders

Do you trade forex, indices or commodities in large volumes? If so, you could take advantage of our monthly cash rebate scheme.

The amount we paid as cash rebates to our clients globally³ in our most recent financial year (1 April 2024-31 March 2025).

Monthly rebates structure

Professional clients trading high volumes may be eligible for monthly cash rebates on CFDs and Spread Bets across selected asset classes. Some products and asset classes are excluded. This rebate scheme is subject to the Rebate Terms and Conditions available below.

Trading rebates

How it works:

To qualify for rebates on Forex CFDs, your trades on Forex CFDs must be equal to or greater than £50 million in notional value for the month. Once this threshold of £50 million has been reached, certain rebate rates as listed below are applicable for every £1 million traded per month. If your trading activity in the month meets this requirement, the following rebate rates will be available:

Note: m denotes million. Amounts shown in £.

Your total trade notional value in the month is £250m. You therefore achieve tier 2.

The tier 2 rebate rate is £7 for every £1m you trade in the month.

Your monthly volume rebate would be = £1,750 (250 x £7).

Holding cost rebates

You will receive a rebate on any forex holding costs paid based on the highest trading rebate tier achieved among all asset classes. View the forex holding cost rebate for each tier in the table below:

Trading rebates

How it works:

To qualify for rebates on Indices CFDs, your trades on Indices CFDs must be equal to or greater than £80 million in notional value for the month. Once this threshold of £80 million has been reached, certain rebate rates as listed below are applicable for every £1 million traded per month. If your trading activity in the month meets this requirement, the following rebate rates will be available:

Note: m denotes million. Amounts shown in £.

Your total trade notional value in the month is £175m. You therefore achieve tier 2.

The tier 2 rebate rate is £5 for every £1m you trade in the month.

Your monthly volume rebate would be = £875 (175 x £5).

Holding cost rebates

You will receive a rebate on any indices holding costs paid based on the highest trading rebate tier achieved among all asset classes. View the indices holding cost rebate for each tier in the table below:

Trading rebates

How it works:

To qualify for rebates on Commodities CFDs, your trades on Commodities CFDs must be equal to or greater than £10 million in notional value for the month. Once this threshold of £10 million has been reached, certain rebate rates as listed below are applicable for every £1 million traded per month. If your trading activity in the month meets this requirement, the following rebate rates will be available:

Note: m denotes million. Amounts shown in £.

Your total trade notional value in the month is £50m. You therefore achieve tier 3.

The tier 3 rebate rate is £7 for every £1m you trade in the month.

Your monthly volume rebate would be = £350 (50 x £7).

Holding cost rebates

You will receive a rebate on any commodities holding costs paid based on the highest trading rebate tier achieved among all asset classes. View the commodities holding cost rebate for each tier in the table below:

Conditions

Capitalised terms used but not defined in these rebate terms and conditions (“Rebate Terms”) have the meaning set out in the CMC Markets UK Plc (“CMC Markets”) CFD terms of business, the CMC Markets MT4 terms of business (as applicable and hereinafter referred to as “Terms of Business”).

The monthly rebates granted in accordance with these Rebate Terms are only available to Professional Clients of CMC Markets residing in the UK. To qualify for the monthly rebates, Professional Clients must fulfil the minimum trading volume requirements (notional value of trades) specified above under the section “Monthly rebate structure”.

For each calendar month that we offer the rebate to you, we will calculate the total value of trades that you place within the relevant asset class(es) on the Platform during that calendar month. Following the end of that calendar month, we will credit your Account with a rebate amount calculated in accordance with clause 3 of these Rebate Terms. Subject to these Rebate Terms, your rebate amount will usually be credited to your Account within the first few days of the following calendar month.

Although the monthly rebates are usually paid within the first few days of the following calendar month, it may take longer to process the payment. CMC Markets will not be liable for any direct or indirect loss caused by a delayed or missed rebate payment.

Rebates will be calculated daily in GBP in accordance with the provisions above under the section “Monthly rebate structure”, converted to your Account Currency (if necessary) using the Currency Conversion Rate and credited to your Account during the calendar month following the calculation period. Notwithstanding the foregoing, the rebates under these Rebate Terms shall only be due and owing at the point of crediting by CMC Markets in its sole discretion.

All rebate payments shall be inclusive of any value added taxes or similar consumption taxes as applicable.

If you achieve a certain tier in one asset class, you automatically qualify for tier 1 rebates for all other asset classes traded and listed in these Rebate Terms. Following that there will be no cross-triggering across asset classes for rebates above tier 1. Rebates for tiers above tier 1 for each asset class shall only be triggered in accordance with the monthly turnover thresholds for that particular asset class as specified in clause 3 of these Rebate Terms

The rebate amount rate for a particular asset class will be calculated based on the highest tier achieved for that asset class.

We will aggregate all monthly turnover trading value amounts for a particular asset class across all your Accounts registered to the same email address when determining the tier for rebates. The relevant portion of your rebate amounts will be credited to your respective Accounts based on the turnover generated by each individual Account.

CMC Markets reserves the right to withdraw the rebate programme or amend these Rebate Terms (including the calculation methods specified above under the section “Monthly rebate structure”) at any time without giving prior notice. Even repeated unconditional rebate payments do not constitute a commitment to make further payments in the future.

11. CMC Markets reserves the right to cancel any rebate payments where, in CMC Markets’ view, transactions are made to manipulate the rebate process.

12. Rebates are subject to, and conditional upon, your compliance with these Rebate Terms and the Terms of Business. In addition to any rights and remedies CMC Markets may have, any breach or suspected breach of these Rebate Terms and/or the Terms of Business will entitle CMC Markets to stop paying the rebates immediately and without prior written notice and/or reclaim any rebate payments already paid under these Rebate Terms.

13. Nothing in these Rebate Terms limits CMC Markets’ ability to exercise its rights in accordance with the Terms of Business.

14. The rebate payment should not form the basis of any decisions made in relation to potential trades or Account activity. Furthermore, the rebate payment is not intended to limit your liability in respect of your trades and may not be used to set off any payment obligation you have to CMC Markets.

15. A rebate payment cannot be used to satisfy your total margin requirement, until such time as the payment has been credited to your Account. Please note that normal rules and procedures in relation to an Account Close-Out will continue to apply and you should not rely on a rebate payment to prevent an Account Close-Out.

16. CMC Markets’ decisions in any matter in relation to the rebates granted under the Rebate Terms will be final and conclusive. All valuations and calculations for the purposes of the rebates hereunder will be determined by CMC Markets and are final and binding.

17. The rebate will not be payable in respect of trades that are subsequently voided, reversed or cancelled by CMC Markets in accordance with the Terms of Business and related documents. If the rebate has already been paid in respect of trades that are subsequently voided, reversed or cancelled by CMC Markets, then CMC Markets will deduct the rebates already paid in respect of such trades from your Account.

18. To the extent there is a conflict between any bespoke rebate payments you may be receiving from CMC Markets and these Rebate Terms, the terms of any bespoke rebate payments shall prevail unless CMC Markets informs you otherwise in writing.

19. CMC Markets will not be liable to you in relation to this rebate offer (including for any losses arising as a result of use of this offer) and the limitation of liability provisions of the Terms of Business shall apply to this offer as if set out here in full.

20. Countdowns are excluded from the rebate scheme across all asset classes.

21. FX Active Accounts, which are subject to the FX Active Trader Pricing Scheme Terms and Conditions or the FX Active Trader Pricing Scheme Terms and Conditions – MT4 Platform, are excluded from volume rebates on the FX asset class.

22. Spectre Accounts, which are subject to the Spectre Spreadbet Terms of Business, are also excluded from the rebate scheme across all asset classes.

23. These Rebate Terms (including any dispute arising out of or in connection with them) are subject to the laws of England and Wales and the exclusive jurisdiction of the courts of England and Wales.

Questions about CMC Pro?

Our UK-based client service team is here to support you between 8am and 8pm, Monday to Friday.

Call us on 020 3003 8587

Email us prosupport@cmcmarkets.co.uk

How to open an elective professional account

You will first need to apply for a standard spread betting or CFD account.

Apply from the platform or select the link below and complete the form to request to be treated as elective professional. We may ask you to provide supporting documentation to evidence your eligibility.

Once approved, you'll receive a notification confirming your categorisation change from retail to elective professional.⁴

FAQs

No, as a professional client you will not get the same protections afforded to retail clients when using CMC Pro.

Risk warnings: CMC Markets will not be required to provide you with the current risk warnings we must provide to retail clients or any standardised risk warning that is introduced in future in relation to transactions in complex financial products.

Communications and financial promotions: Certain BaFin (or equivalent) rules relating to the form and content of information provided by CMC Markets do not apply, including those relating to communications and financial promotions.

Negative balance protection: Retail clients benefit from negative balance protection, meaning that their losses cannot exceed deposits. This functionality is not available to professional clients.

Leverage restrictions: CMC Markets is required to restrict leverage to between 30:1 and 2:1 on the products we offer to retail clients. Higher leverage can work against investors and amplify losses.

Financial Ombudsman Service (or equivalent): Access to the Financial Ombudsman Service (the “FOS”) will not extend to all professional clients (only those that meet the FCA handbook definition of a consumer) and may therefore not extend to you. The FOS is an independent service for settling disputes between FCA-regulated firms and eligible complainants. If you are not sure whether you will be entitled to refer your complaint to FOS, we suggest you contact FOS directly.

With all CMC Markets accounts you get the same access to our award-winning trading platform, wide range of instruments and advanced trading tools. Regulatory restrictions have been placed on our standard CFD trading accounts to offer greater protection to retail clients. A CMC Pro account will not have the same investor protections that are available on a standard account. Higher leverage available on products on a CMC Pro account can work against investors and amplify losses. Professional clients with a CMC Pro account will have access to restricted products, plus an account manager, early access to new products and monthly cash rebates for high-volume traders. Conditions apply.

The European Securities and Markets Authority (ESMA) has limited the leverage available to retail clients to between 30:1 and 2:1, as CFD products are considered high risk and complex, and higher leverage rates are not suitable for the majority of retail clients. These restrictions took effect on 1 August 2018 but don't apply to CMC Pro clients, who are classified as 'Professional clients'.

Our Countdowns product is a type of binary option, available for professional clients only. Countdowns offers a fast-paced way to place fixed-odds trades, with low minimum stake sizes and competitive payouts. Countdowns are 50/50 trades based on whether an instrument's price will settle above or below its current level at the end of a range of short timeframes, from 30 seconds to one hour. There are only three possible outcomes (win, lose and occasionally, draw) and the amount you can win or lose is predetermined. You can trade Countdowns on popular forex pairs, indices and commodities.

Financial instruments that count towards your portfolio size include shares, derivatives (only available cash deposits or profits realised from investing in derivatives), debt instruments and cash deposits. It does not include property portfolios, direct commodity ownership or notional values of leveraged instruments.

Only clients that are new to CMC Markets will need to first open a standard CFD trading account before applying for a CMC Pro account. If you already have a CFD account with us, you can apply for CMC Pro (terms and conditions apply).

We'll contact you by email to notify you when your application to become a Professional client has been approved and you have switched over to CMC Pro. Your login details, account number and platform settings will remain the same. Remember, while you are waiting for your CMC Pro account, you can still trade on your standard account.

1 FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

3Volume-based rebates paid to professional, high-value retail and institutional clients and introducing brokers on selected asset classes, CMC Markets Annual Report 2024.

4You may lose protections you receive as a retail client.

6Terms & conditions apply, subject to eligibility.