USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

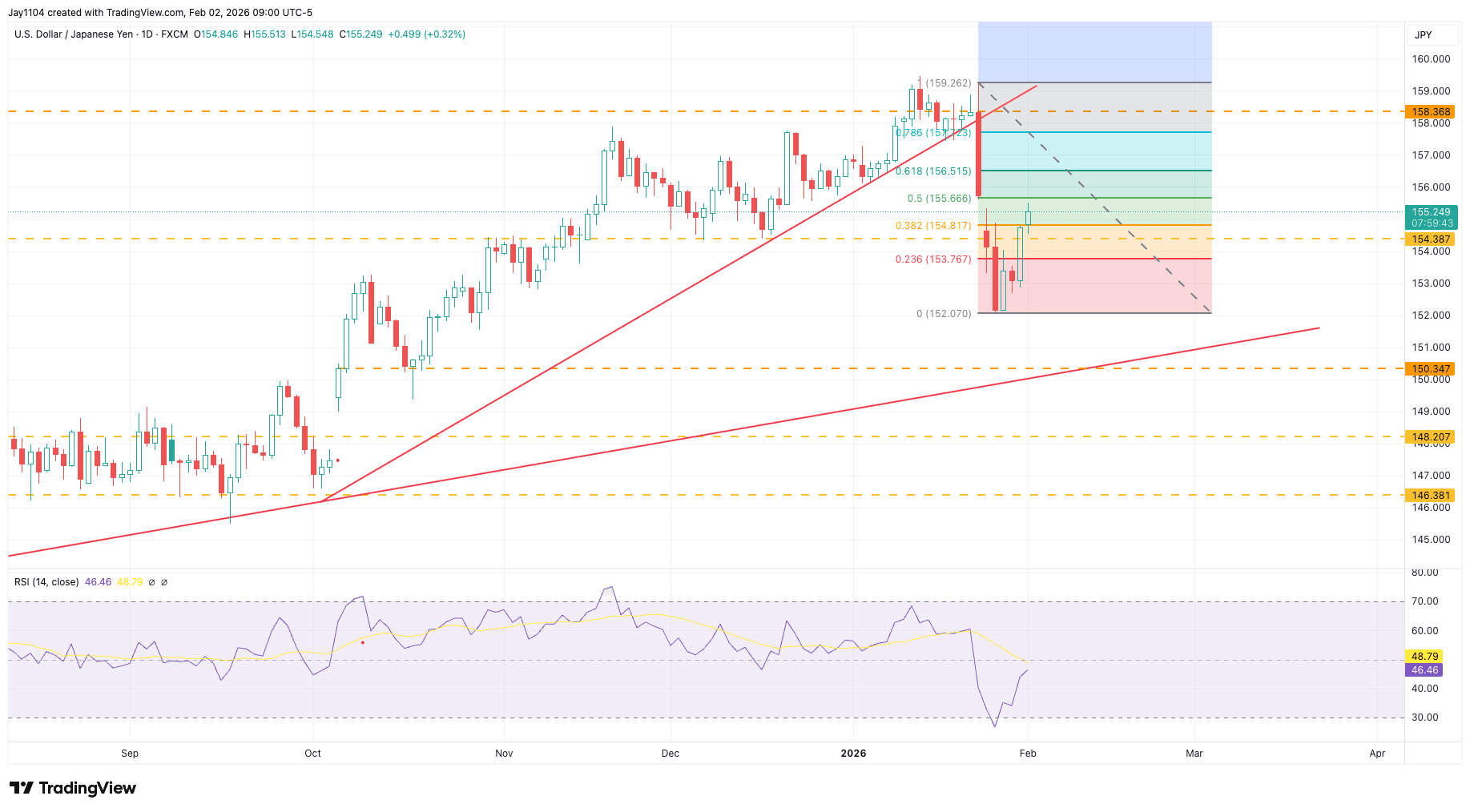

USD/JPY appears to be stabilising after a sharp sell-off late last month, when the pair fell from around 159 to near 152 between 23 and 27 January. Since then, USD/JPY has edged higher, suggesting a near-term weakening of the yen as the FX rate consolidates losses, with the pair drifting back towards the 155 area. From a technical perspective, the move has retraced roughly half of January’s decline, leaving room for a further correction toward the 61.8 per cent retracement at around 156.5, and potentially the 78.6 per cent level at 157.7, should momentum persist.

Source: TradingView, 2 February 2026

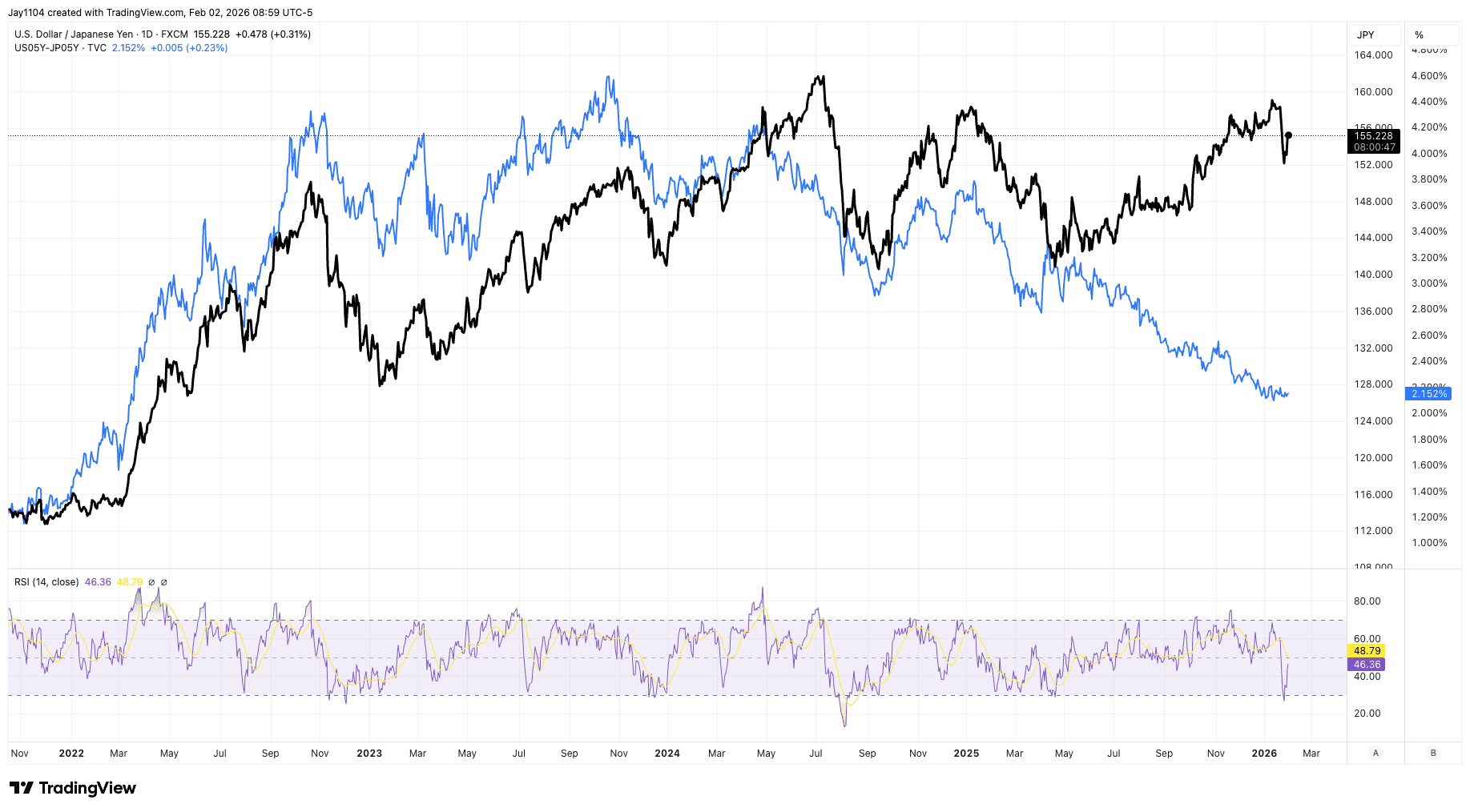

Beyond the short term, however, the balance of risks remains skewed toward a stronger yen. Japanese interest rates have risen materially, while US yields have largely stabilised, narrowing the rate differentials that have long underpinned dollar strength. On historical measures, the yen now appears undervalued, suggesting that any rebound in USD/JPY is more likely to prove corrective rather than the start of a renewed trend.

Source: TradingView, 2 February 2026

This view would run into trouble if the pair were to break back above 159, the pre-Bank of Japan meeting high. Such a move would imply that the late-January decline was not merely a retracement, but part of a broader continuation of yen weakness. For now, markets appear content to wait for confirmation, with positioning cautious and direction unresolved.

The Week Ahead: Fed rate decision; Meta, Tesla earnings

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 26 January.