Why invest with CMC Markets?

When you invest, your capital is at risk.

When you invest, your capital is at risk.

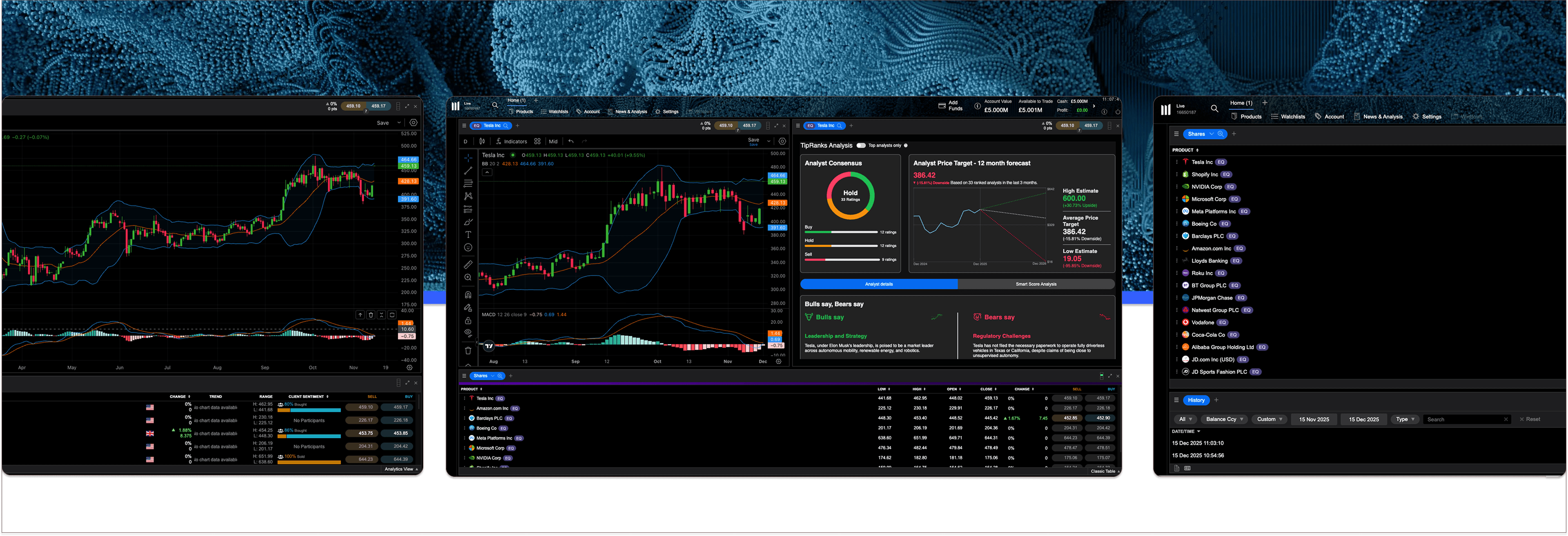

10,000+ stocks. One platform.

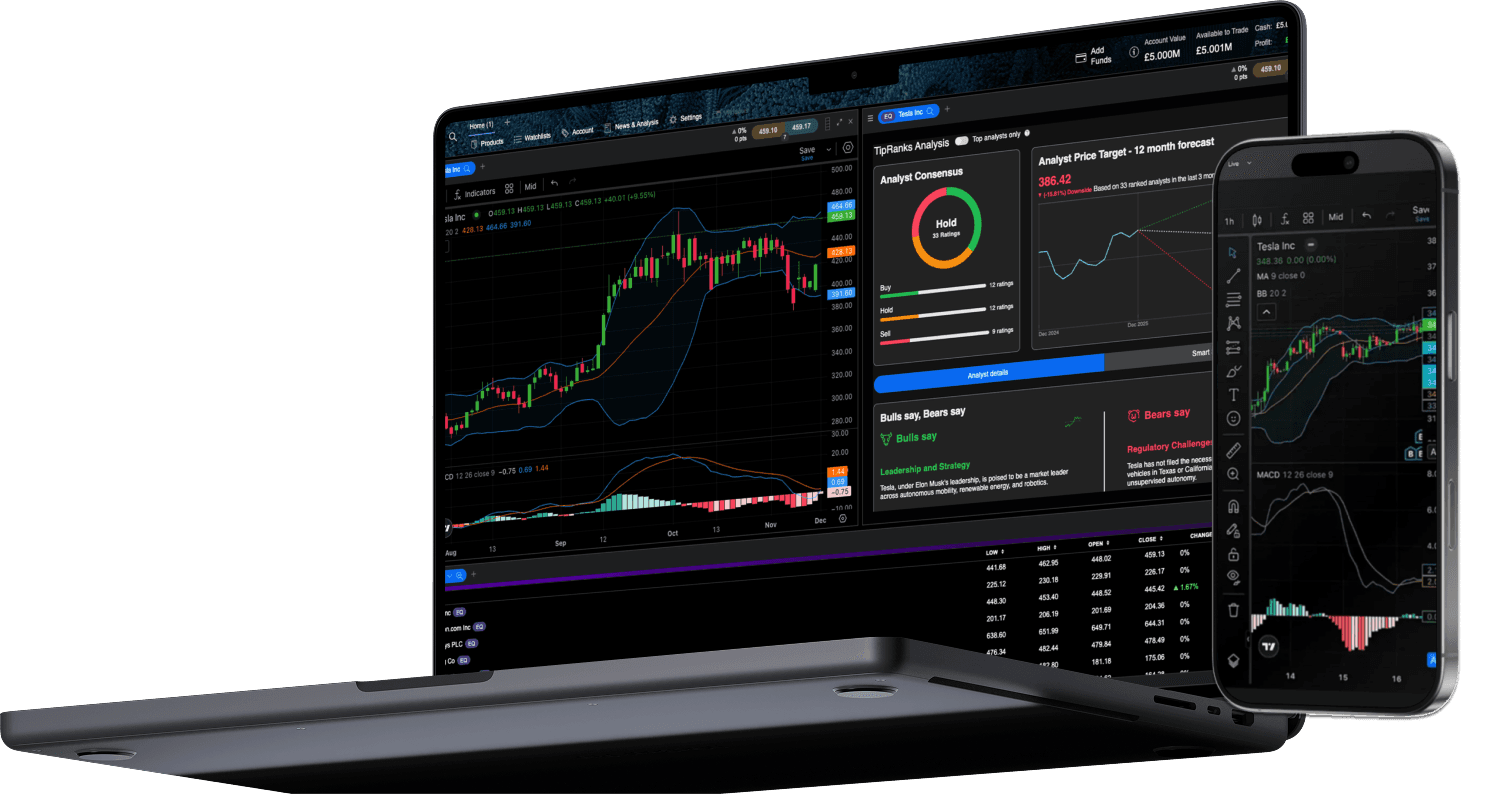

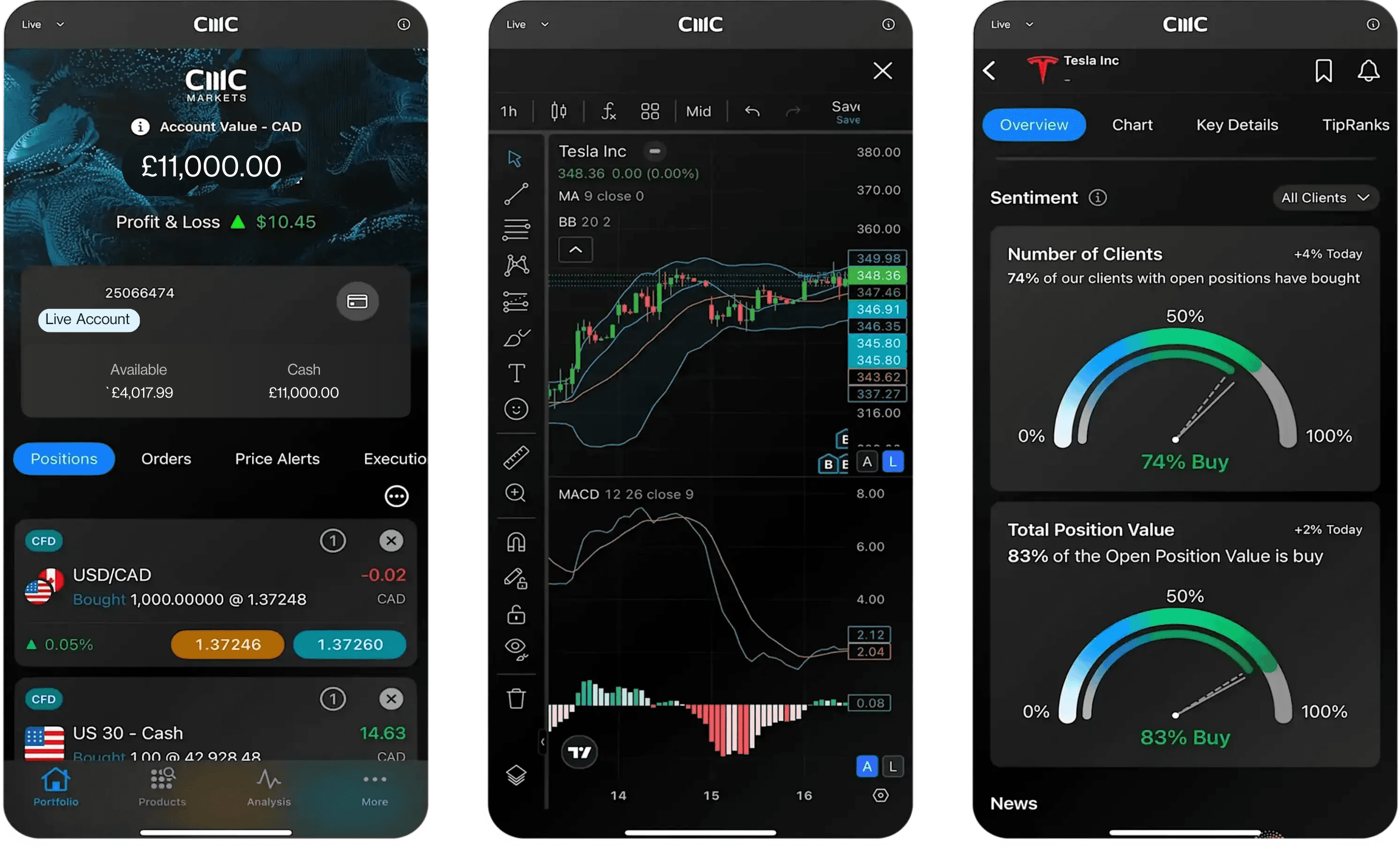

An award-winning platform & app

Advanced order execution

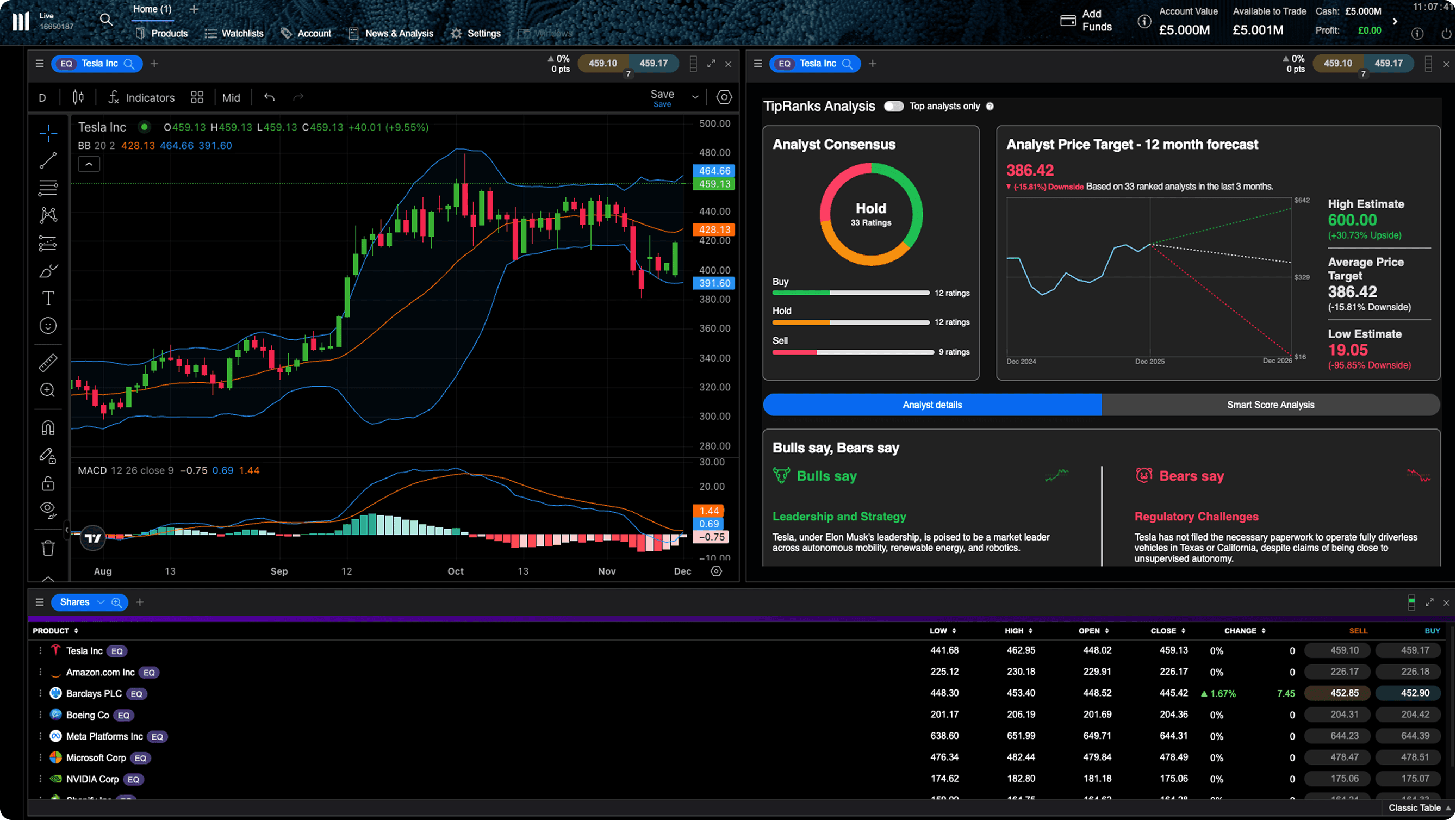

Intuitive charting, with mobile-optimised charts

Pattern recognition scanner

Gauge market sentiment

Reuters news and TipRanks analysis

When you invest, your capital is at risk

FAQs

Equities trading, also known as share trading, stock trading or investing, is the buying and selling of a portion of ownership in a publicly listed company If a company's share price rises, your investment can increase in value, and if it falls, your investment can go down.

Yes, it's free to open an account with us. You can also view prices and use tools such as charts, Reuters news and TipRanks, free of charge. You'll need to deposit funds in your account to place a trade.

There’s no minimum balance you must have in your account, but you will need to add cash to your account to start investing, and the minimum amount you can deposit at any one time is £1.

There is no commission when buying and selling shares. There are also no platform, account or custody fees for holding your investments with us. We charge a 0.50% FX fee when converting currencies.

Yes, you can set both limit orders (to buy or sell at a specific price) and stop orders (to trigger a trade when the price reaches a chosen level).

Not yet, but we're planning to release exchange-traded funds (ETFs) soon. We'll share updates as we get closer to launch.

Yes, CMC Markets UK plc (registration number 173730) is fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Under the FCA's Client Money rules, we're required to segregate client money (unless you agree with us otherwise) from CMC's own funds. The funds held in segregated bank accounts do not belong to CMC, and will be held in a way that enables it to be identified as client money. Learn more about client money regulations

In the UK, you may need to pay capital gains tax (CGT) on any profits you make from selling shares, and dividend tax on income you receive from companies. How much you pay depends on your personal tax allowance and circumstances.

Visit our contact us page for details on how you can get in touch with us.