The Week Ahead: Fed rate decision; Meta, Tesla earnings

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 26 January.

An eventful few days lie ahead as the US Federal Reserve meets to set interest rates and earnings season steps up a gear. The Fed's rate decision on Wednesday comes amid intense pressure from Donald Trump on chair Jay Powell to cut the cost of borrowing. Meanwhile, four of the ‘magnificent seven’ group of leading technology stocks are due to report results – Meta, Microsoft and Tesla on Wednesday, followed by Apple on Thursday.

US Federal Reserve interest rate decision

Wednesday 28 January

The Federal Reserve is expected to leave interest rates unchanged at a target range of 3.5% to 3.75%. Markets are pricing in a 95% probability of a rate hold, according to the CME's FedWatch tool. Most forecasts point to the next rate cut coming in June or July, after a new Fed chair takes the reins. Powell is due to step down in May when he completes his second term as chair.

Recent economic data from the US has painted a picture of resilience in the labour market and consumer spending, bolstering expectations that the Fed will refrain from cutting rates until later this year. That said, Powell’s press conference after the rate announcement still has the potential to move markets, particularly if he comes across as more hawkish (favouring higher rates to tackle inflation) than dovish. Forex markets such as EUR/USD may be especially susceptible to fluctuations based on any signals or hints from Powell.

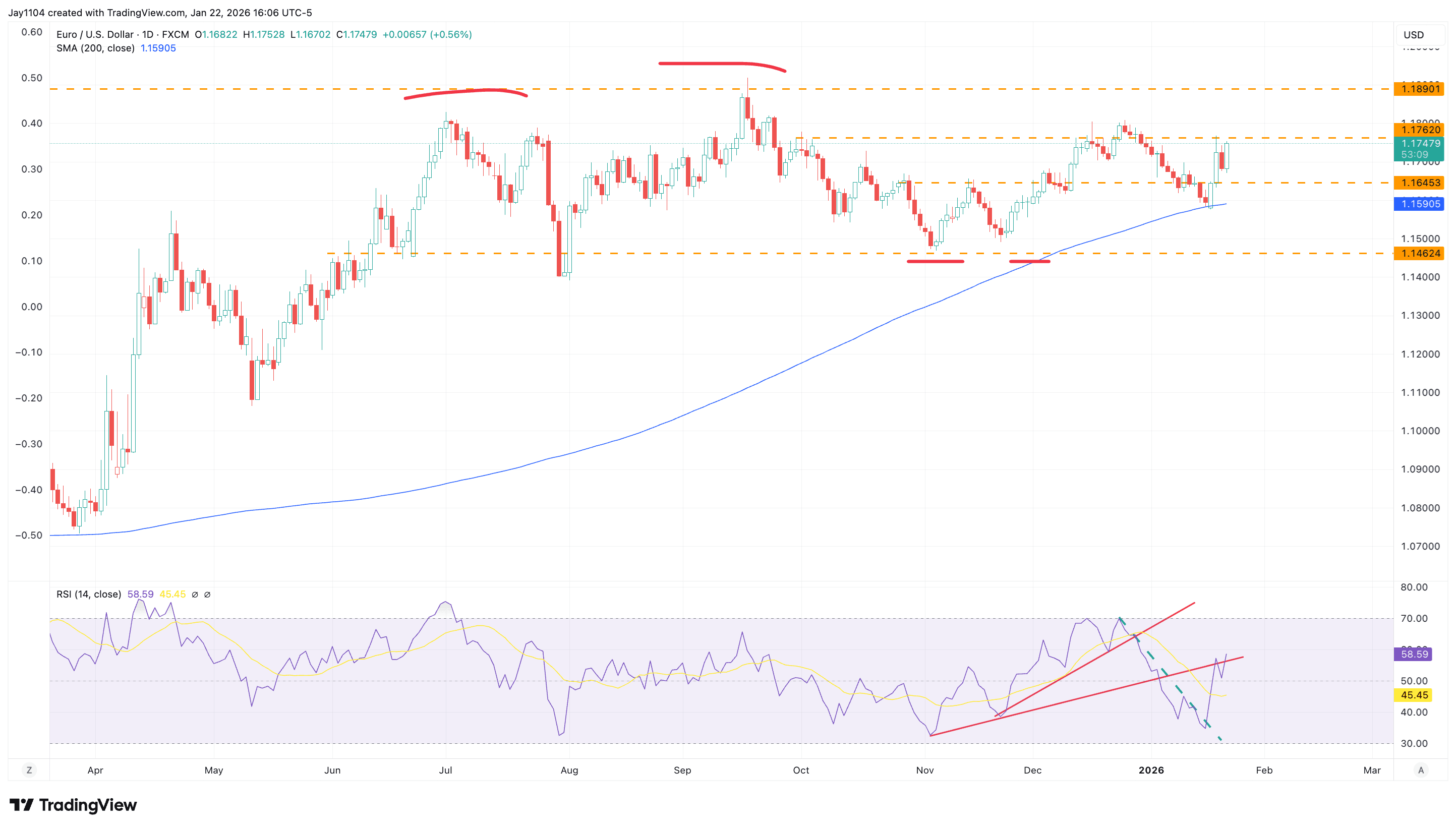

The EUR/USD technical chart, below, suggests that the euro could be poised to strengthen against the dollar. Having bounced off the 200-day simple moving average (SMA) in the past week, the pair is now running into resistance near $1.1760. This is an important area as it marks the spot where the euro’s rally stalled in December. If the euro moves past the previous highs around $1.18, it may rise towards $1.19. However, failure to break through resistance could lead to the formation of a bearish head-and-shoulders pattern, which might trigger a slide back down towards the 200-day SMA near $1.16.

EUR/USD, April 2025 - present

Sources: TradingView, Michael Kramer

Meta Platforms Q4 earnings

Wednesday 28 January

Analysts expect Meta to report that its fourth-quarter earnings grew just 2.2% year-on-year to $8.20 a share, despite revenue rising an estimated 20.5% to $58.3bn, as AI-related costs increased. Gross profit margins are expected to be around 81%, down from 82% in the previous quarter. Capital expenditure for the quarter is projected to have increased a whopping 52.4% to $22bn. Looking ahead to the next quarter, analysts expect the Nasdaq-listed parent of Facebook, WhatsApp and Instagram to guide Q1 revenue of $51.3bn, up 21.3%, alongside a warning that earnings might fall 1% to $6.36 a share. Perhaps most importantly, analysts estimate that full-year 2026 capex could rise 44.2% to $98.6bn.

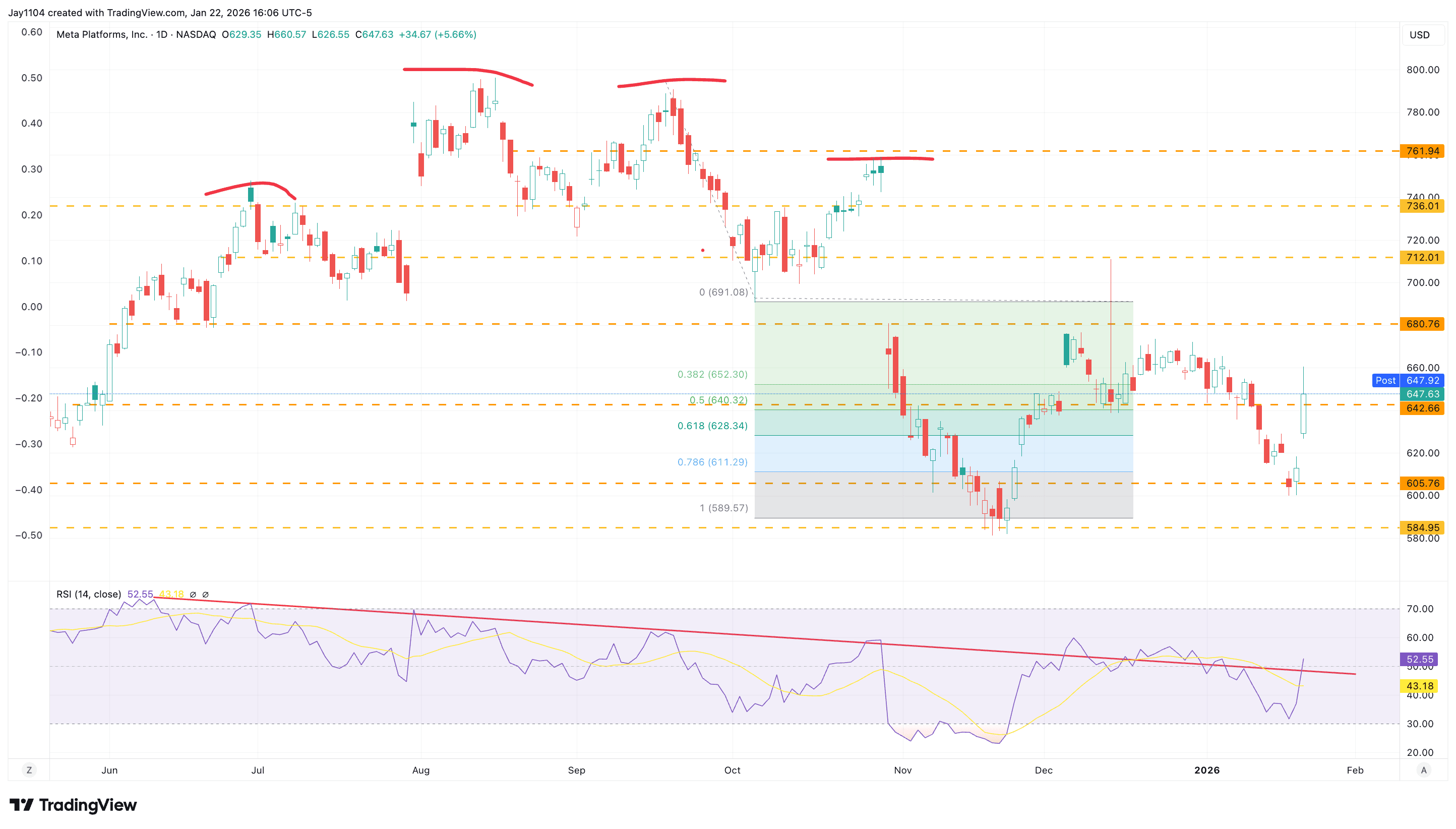

Options markets imply that traders expect Meta shares – which have slumped 18% from last August’s highs to trade at about $648 – to move by an average of 6% in either direction after the Q4 earnings release. Implied volatility is somewhat elevated at around 60% for options expiring on Friday 30 January. This figure could rise as the earnings release approaches. Options positioning is bullish, with strong resistance around $660 and a major support level near $600.

Once the Q4 results are released, implied volatility is likely to fall and call premiums could decay, potentially sending the stock price lower unless the earnings are genuinely spectacular or capex is brought under tighter control. The technical chart below echoes what the options market is telling us – namely, that there is resistance near $665 and support at $600.

Meta Platforms share price, June 2025 - present

Sources: TradingView, Michael Kramer

Tesla Q4 earnings

Wednesday 28 January

Tesla is expected to announce that Q4 earnings fell 39.1% to $0.44 a share, as revenue declined 3.6% to $24.8bn, based on analyst estimates. The electric carmaker’s gross profit margin, which is closely watched, is expected to have slipped to 17.1% from 18.0% on a sequential basis. As for forward guidance, analysts expect the Elon Musk-led company to forecast Q1 revenue growth of 19.8% to $23.2bn, with the gross profit margin tightening further to 16.7%.

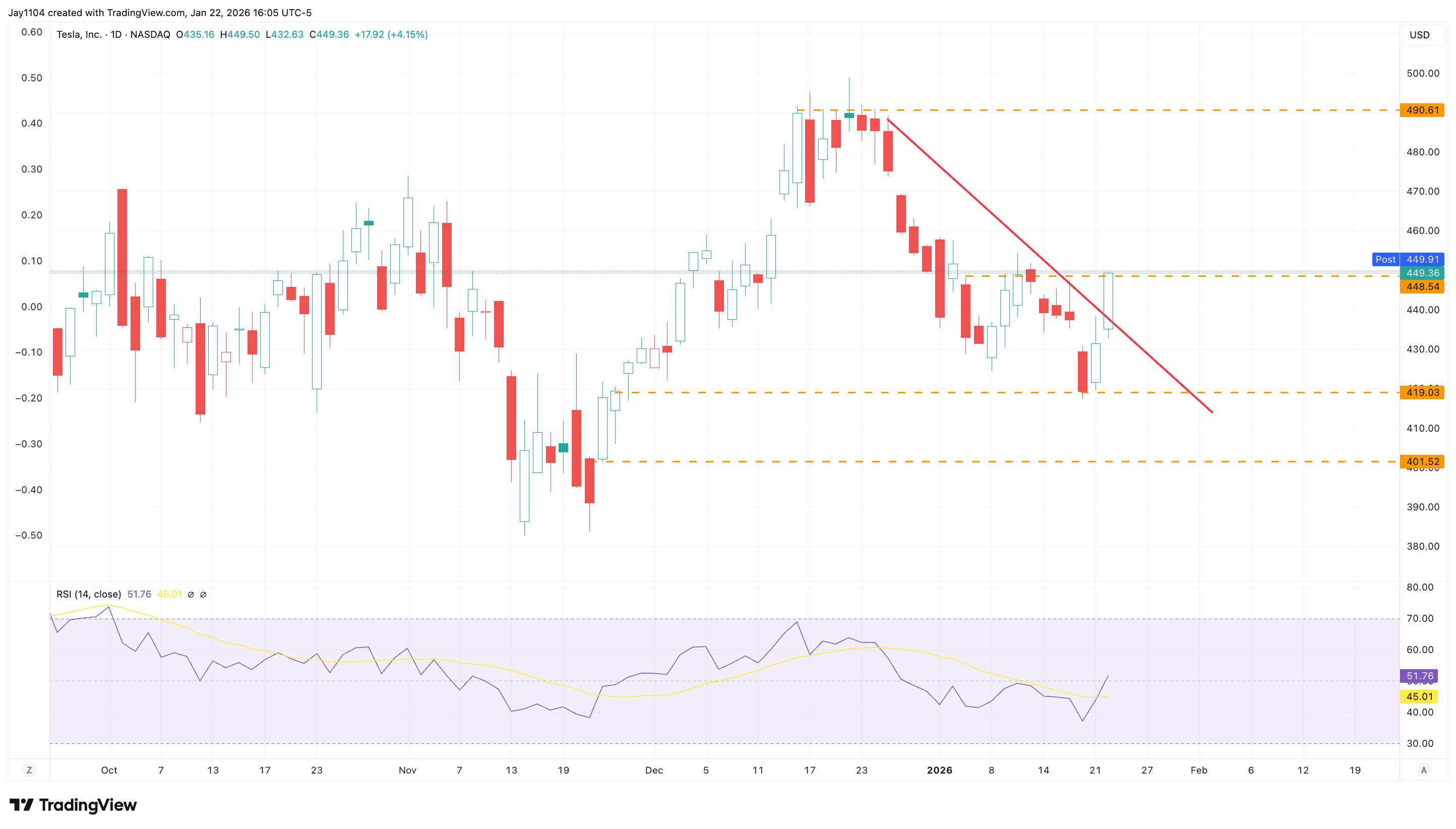

Shares of Tesla, down 7% in the past month at just below $450, are expected to rise or fall by around 6% following the results, based on options market activity. As with Meta, options positioning in Tesla is quite bullish. However, in both cases the shares may be vulnerable to a potential pullback after the earnings release. Similar to Meta’s setup, implied volatility on Tesla options expiring in the week to 30 January is tracking at around 60% and rising, but is likely to crash after the results come out when the uncertainty is resolved. Call premiums could then lose value, and the share price may fall.

The technical chart below highlights the stock’s fall since the turn of the year. The zone from around $420 down to $400 is providing support, while above $450 there’s little in the way of resistance until around $490. Despite the decline this month, the price may have bottomed out. In the past week the shares have bounced off support at $420, an uptick reflected in the relative strength index (RSI) which has climbed to about 52, signalling an improvement in momentum. Against this backdrop, it’s possible that the shares could rally ahead of Wednesday’s earnings call, then dip as traders “sell the news” afterwards.

Tesla share price, October 2025 - present

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Monday 26 January

• Germany: January IFO business climate index

• US: November durable goods orders

• Results: Steel Dynamics (Q4)

Tuesday 27 January

• Japan: Bank of Japan monetary policy meeting minutes

• US: January consumer confidence index

• Results: Boeing (Q4), Brown & Brown (Q4), General Motors (Q4), HCA Healthcare (Q4), NextEra Energy (Q4), Northrop Grumman (Q4), Nucor (Q4), RTX (Q4), SThree (FY), Texas Instruments (Q4), Time Finance (HY), Union Pacific (Q4), UnitedHealth (Q4), United Parcel Service (Q4), Velocity Composites (FY)

Wednesday 28 January

• Australia: December consumer price index (CPI)

• Canada: Bank of Canada interest rate decision

• Germany: Feb GfK consumer confidence survey

• New Zealand: December imports, exports and trade balance

• US: Federal Reserve interest rate decision

• Results: ADP (Q2), Amphenol (Q4), AT&T (Q4), Danaher (Q4), GE Vernova (Q4), Hargreaves Services (HY), IBM (Q4), Lam Research (Q4), Meta Platforms (Q4), Microsoft (Q2), Progressive (Q4), ServiceNow (Q4), Starbucks (Q1), Tesla (Q4)

Thursday 29 January

• Eurozone: January business climate, consumer confidence and economic sentiment indices

• Japan: December unemployment rate, December retail trade, January Tokyo CPI

• US: Weekly initial jobless claims

• Results: Altria (Q4), Apple (Q1), Blackstone (Q4), Caterpillar (Q4), Comcast (Q4), easyJet (Q1), Honeywell (Q4), ITM Power (HY), KLA (Q2), Lloyds Banking Group (FY), Lockheed Martin (Q4), Mastercard (Q4), Parker-Hannifin (Q2), Rank (HY), Stryker (Q4), Thermo Fisher Scientific (Q4), Visa (Q1), Wizz Air (Q3)

Friday 30 January

• Australia: Q4 producer price index (PPI)

• Canada: November gross domestic product (GDP)

• Eurozone: Q4 flash GDP, December unemployment rate

• France: Q4 flash GDP

• Germany: Q4 flash GDP, January flash CPI

• US: December PPI

• Results: Airtel Africa (Q3), American Express (Q4), Chevron (Q4), Exxon Mobil (Q4), Verizon (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

The Week Ahead: Cisco earnings, UK growth, US inflation

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 9 February.

USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.