The Week Ahead: Fed rate decision, Oracle earnings, UK GDP

Get actionable trading ideas on the key market events in the week beginning Monday 8 December, and view our economic and company reports calendar.

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 8 December.

As 2025 enters the home straight, you could be forgiven for expecting a quiet trading week ahead. In fact it will be anything but. Spread across Wednesday and Thursday we have earnings from three major players in the AI space: Adobe, Oracle and Broadcom. On top of that, the US Federal Reserve will set interest rates on Wednesday, with markets pricing in a roughly 87% probability of a quarter-point cut, according to CME FedWatch. The prospect of a rate cut is fuelling Wall Street expectations that the S&P 500 could rise roughly 10% from current levels to more than 7,500 points by the end of 2026, as reported by the Financial Times.

US Federal Reserve interest rate decision

Wednesday 10 December

Most traders expect the Federal Reserve to cut interest rates by a quarter of a percentage point to a range of 3.5% to 3.75%. The probability of a quarter-point cut has been hovering between 85-90% in recent days. However, a cut – if there is one – may not be the headline news. The most important thing could be what Fed chair Jerome Powell says in his follow-up press conference, and whether he hints at the possibility of a further cut in January. Beyond December, the market currently isn’t pricing in another cut until March.

Similarly, the dot plot – aka the Summary of Economic Projections, the survey of Fed officials which captures their expectations for where interest rates, inflation and growth will be in the coming years – will also be closely watched. That said, official expectations could shift next year after Powell’s term ends in May. The April meeting will be his last as Fed chair.

The market will also be monitoring the number of dissenters. The rate-setting committee has been split on the question of rate cuts, with some members openly stating they are not in favour of easing monetary policy. That makes the level of dissent at this month’s meeting a key factor in gauging what the Fed might do at subsequent meetings in January, March and April.

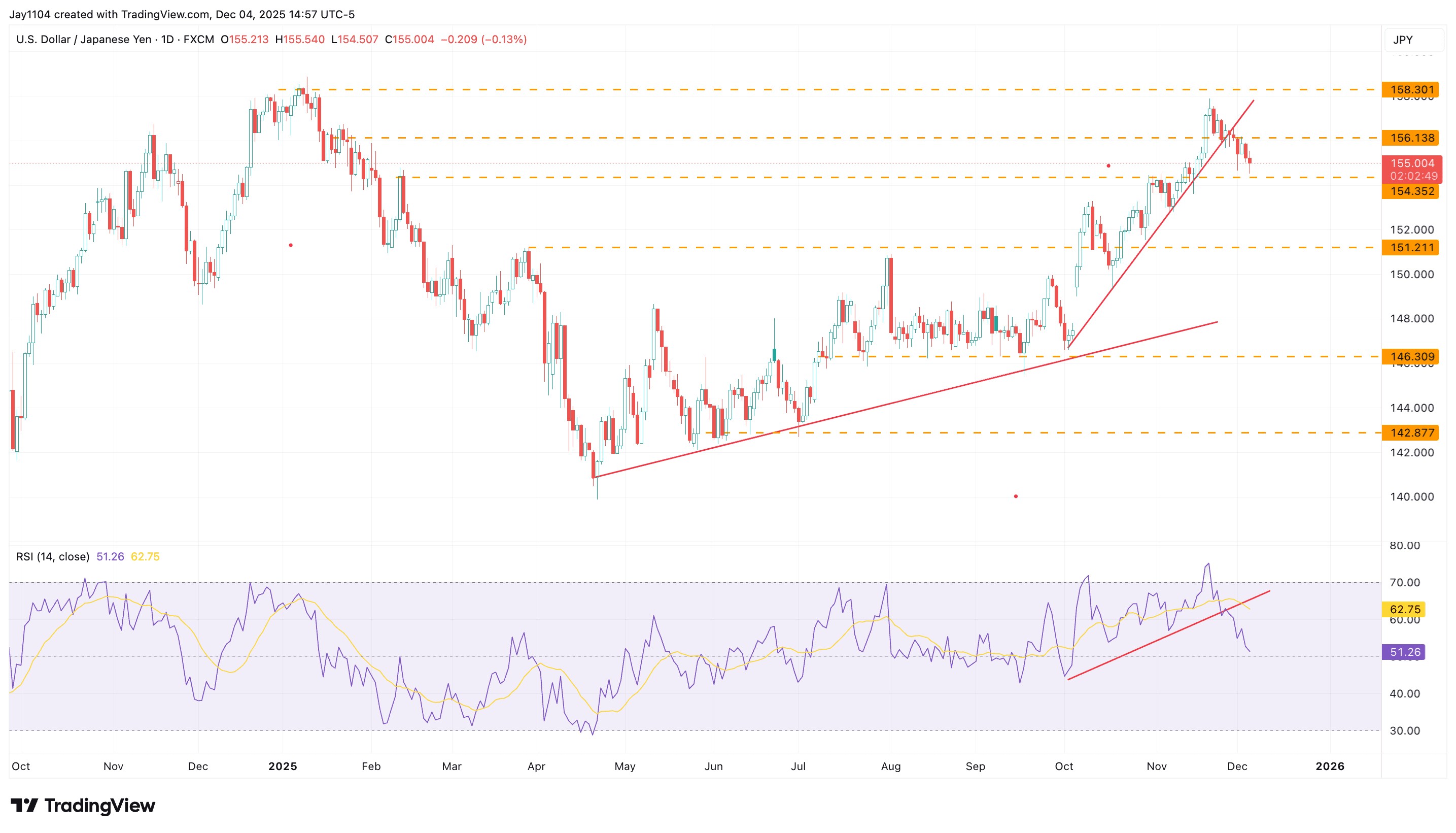

The dollar has the most to lose from this month’s meeting, especially if the Fed comes across as more dovish (pro-cuts) than expected. And with the Bank of Japan potentially set to raise rates at its meeting a week later, the yen could benefit versus the dollar. Until about two weeks ago, the yen had spent seven months weakening against the dollar. But now – with yield differentials between US treasuries and JGBs narrowing sharply, and the Fed expected to cut interest rates – the USD/JPY uptrend has broken down. The pair now appears to be sitting on support around ¥154.50 per dollar. If that support breaks any time soon, USD/JPY could fall towards ¥150.

USD/JPY, October 2024 - present

Sources: TradingView, Michael Kramer

Oracle Q2 earnings

Wednesday 10 December

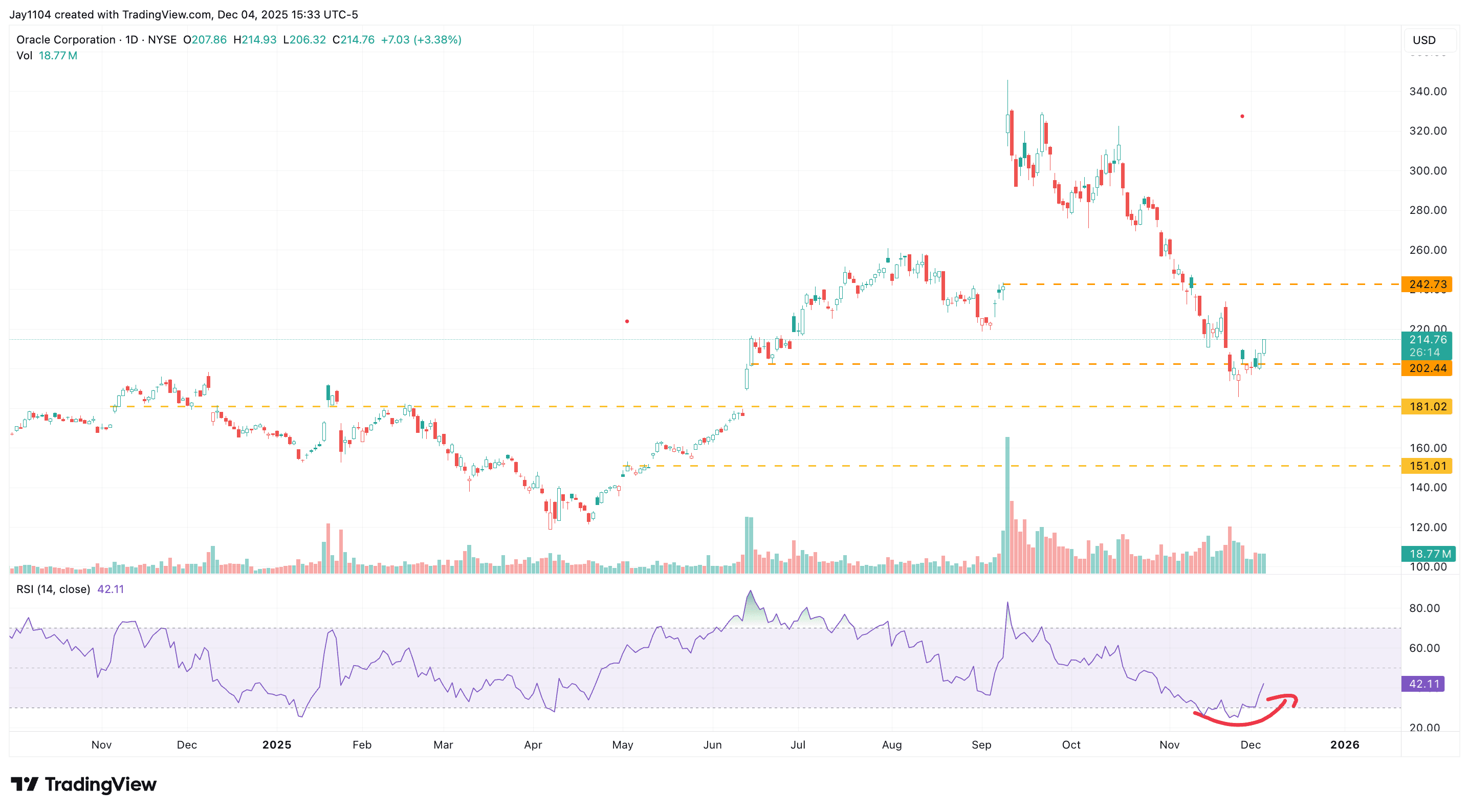

The last time Oracle released quarterly results, its shares surged by nearly 40%. Since then, however, the stock has given back almost all those gains. It now trades at roughly $215 a share – below where it was before those results were released. The shift reflects a growing focus among investors on the company’s capital expenditure and free cash flow, which makes the upcoming second-quarter results and guidance especially significant.

Analysts expect the NYSE-listed software company to report that its Q2 earnings grew 11.4% to $1.64 a share as revenue rose 15.4% to $16.2bn. Capex is projected to have more than doubled to $8.3bn, with free cash flow down $5.1bn. Looking ahead to the third fiscal quarter, analysts expect earnings growth of 16.8% to $1.72 a share on a revenue uptick of 19.3% to $16.9bn. Capex is projected to expand to $8.9bn, with free cash flow falling a further $1.8bn.

Implied volatility for Oracle options is already around 100%, and is likely to go even higher before the company reports. This setup implies that the stock could move about 10% in either direction post-earnings. Interestingly, options positioning in Oracle is very bearish, suggesting that the shares could increase following the results as implied volatility falls and put premiums decay. On the other hand, if the results are particularly poor or the company signals plans to ramp up spending, either through higher capex or weaker-than-expected free cash flow, the market could see that as a negative, potentially sending the shares lower.

If the shares were to drop below support at around $190, they could sink further to fill a gap near $175 that was created in June. If the shares were to break to the upside, they could move towards the next area of resistance at around $245.

Oracle share price, November 2024 - present

Sources: TradingView, Michael Kramer

UK October GDP

Friday 12 December

The UK has endured weak economic growth in 2025. Gross domestic product increased 0.7% in Q1, 0.3% in Q2, and just 0.1% in Q3. On a monthly basis, the economy contracted 0.1% in September. Economists expect a flat reading for October – an improvement on the previous month but hardly an encouraging one.

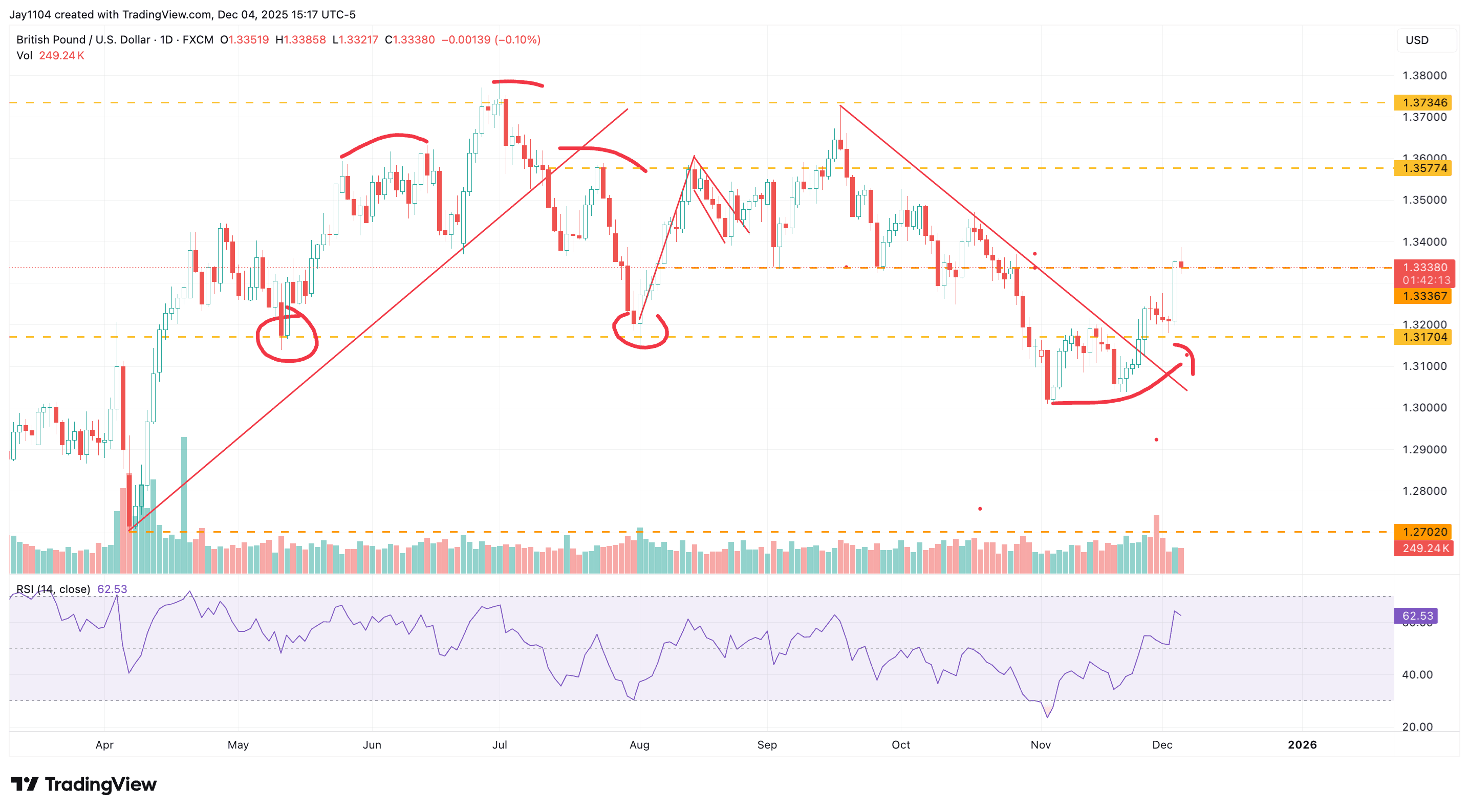

The country’s growth struggles support the case for a Bank of England rate cut at its next meeting on 18 December. The market is pricing in a more than 90% chance of a quarter-point cut to help stimulate the economy. The prospect of a rate cut has weighed on the pound, although it has recently rebounded somewhat against the dollar. A better-than-expected GDP print could push GBP/USD above resistance at $1.335, and possibly back up to $1.35 if the Fed signals an intention to keep cutting rates. However, a failure to push through resistance at $1.335 could see GBP/USD retest the recent lows around $1.305.

GBP/USD, April 2025 - present

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Sunday 7 December

• Japan: Q3 gross domestic product (GDP)

Monday 8 December

• China: November exports, imports and trade balance

• Eurozone: December Sentix investor confidence index

• Germany: October industrial production

• Results: Compass Minerals (Q4)

Tuesday 9 December

• Australia: Reserve Bank of Australia interest rate decision

• Germany: October trade balance

• UK: November like-for-like retail sales

• US: September and October JOLTS job openings

• Results: Ashtead (Q2), AutoZone (Q1), Chemring (FY), GameStop (Q3), Moonpig (FY)

Wednesday 10 December

• Canada: Bank of Canada interest rate decision

• China: November consumer price index (CPI)

• US: Federal Reserve interest rate decision

• Results: Adobe (Q4), Oracle (Q2), Synopsys (Q4)

Thursday 11 December

• Australia: November unemployment rate and employment change

• Switzerland: Swiss National Bank interest rate decision

• US: November producer price index (PPI), weekly initial jobless claims

• Results: Broadcom (Q4), Ciena (Q4), Costco (Q1), Lululemon (Q3)

Friday 12 December

• France: November CPI

• Germany: November CPI

• UK: October GDP

• Results: Johnson Outdoors (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an order execution-only service. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

USD/CAD reaches critical pivot point

USD/CAD is testing key resistance at 1.37, with a breakout potentially opening the way higher and failure risking a move back towards 1.35.