The Week Ahead: US, Germany inflation; Taiwan Semiconductor earnings

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 12 January.

There will be a slew of economic data from the US in the coming week, including updates on consumer and producer prices, as well as retail sales. Leading eurozone nations will also release consumer price index figures, with Germany’s print set to carry added significance given the low preliminary reading of 1.8% issued earlier this month. On the corporate front, US banks kick off a fresh earnings season from Tuesday, with the biggest of them all – JPMorgan – leading the charge. Meanwhile, those with an interest in the AI trade will be paying close attention to fourth-quarter results from Taiwan Semiconductor Manufacturing (TSM) on Thursday – the New York and Taipei dual-listed company is Nvidia’s primary chip supplier.

US December CPI

Tuesday 13 January

The US consumer price index (CPI) report for November surprised the market as the headline measure of annual inflation and core CPI, which excludes volatile items like food and energy, fell to their lowest levels since July 2025 and March 2021, respectively. Despite ongoing fears that tariffs could prove inflationary, headline CPI eased to 2.7% in November while core CPI cooled to 2.6%, both down from 3% in September, the last month in which data was collected before the government shutdown.

Looking ahead to the upcoming release, consensus expectations seem to be that headline CPI remained stable, up 2.7% in the year to December, while core CPI edged higher to 2.7%, based on data available on the prediction market Kalshi.

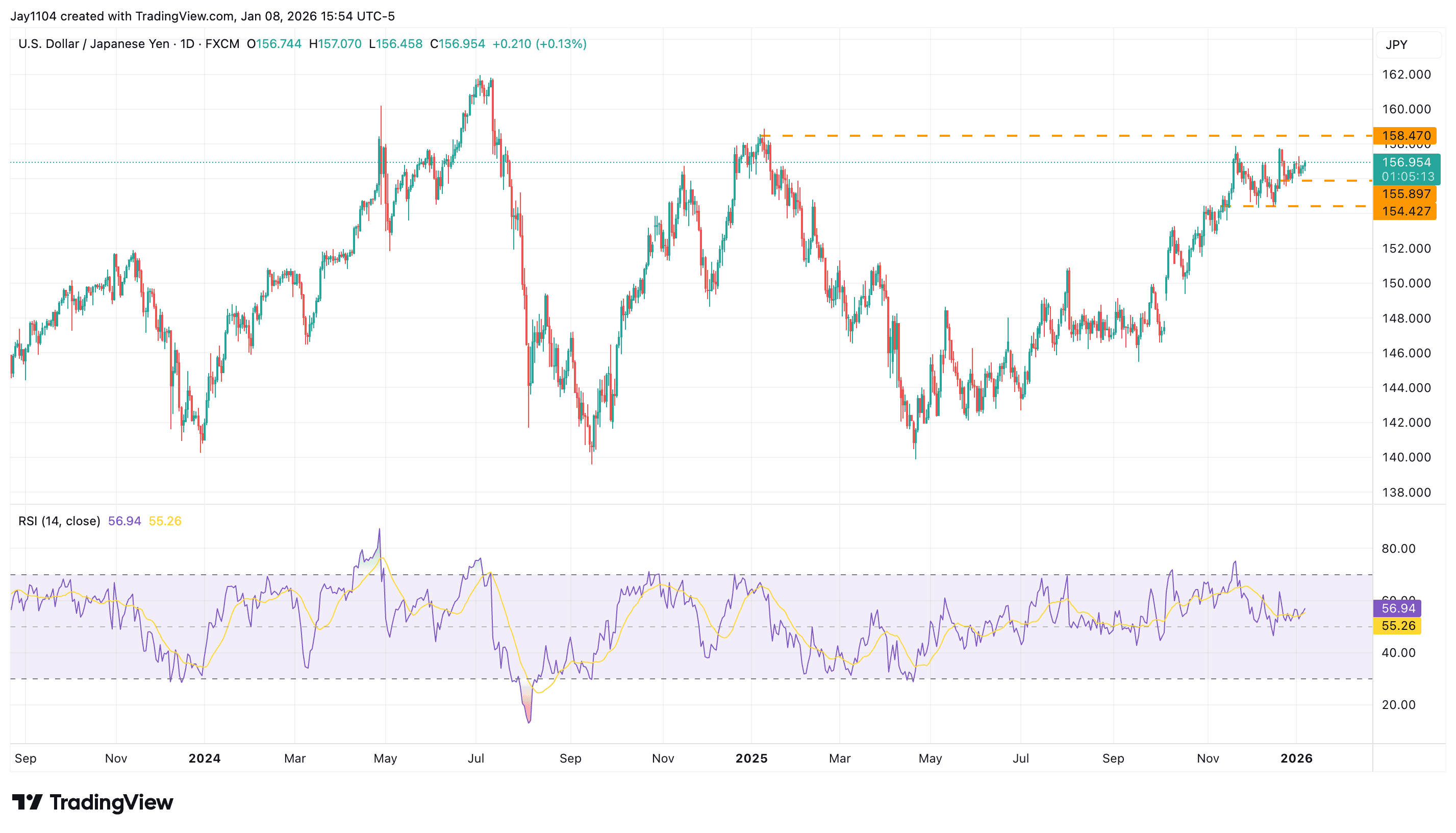

While the November readings may have been negatively affected by patchy data collection at the tail-end of the government shutdown, which ran from 1 October to 12 November 2025, the December figures ought to be based on a full month of data. This imbalance brings the risk of a surprise in the forthcoming inflation report. If the December data beats or misses estimates, currency markets may see some volatility, particularly USD/JPY.

The Japanese yen should be strengthening against the dollar, given that in December the Bank of Japan raised its benchmark interest rate to 0.75%, its highest level in 30 years, while in the same month the US Federal Reserve cut interest rates. However, the yen has remained weak against the greenback.

On Friday, the yen weakened past ¥157.50 per dollar. One factor that could drive further yen weakness, potentially pushing USD/JPY towards ¥158.50 and possibly beyond, would be a hotter-than-expected US CPI report, which could lead to a material strengthening of the dollar against its FX peers.

USD/JPY, September 2023 - present

Sources: TradingView, Michael Kramer

Taiwan Semiconductor Manufacturing Q4 earnings

Thursday 15 January

Analysts expect TSM to report that Q4 earnings grew 10.3% to $2.47 a share as revenue rose an estimated 21.2% to $32.6bn. The chipmaker’s gross profit margin is expected to have tightened to 57%, down from 59% in the year-ago period, while capital expenditure is projected to have increased 8.7% to $12.2bn.

Traders and investors will also be keeping a close eye on the New York Stock Exchange-listed semiconductor manufacturer’s Q1 guidance. Analysts currently expect earnings to rise 33% to $2.82 a share, with revenue growth accelerating to 30.1%, or $33.2bn. Gross profit margin is forecast to rebound to 59%, while capital expenditure is expected to fall to $9.4bn.

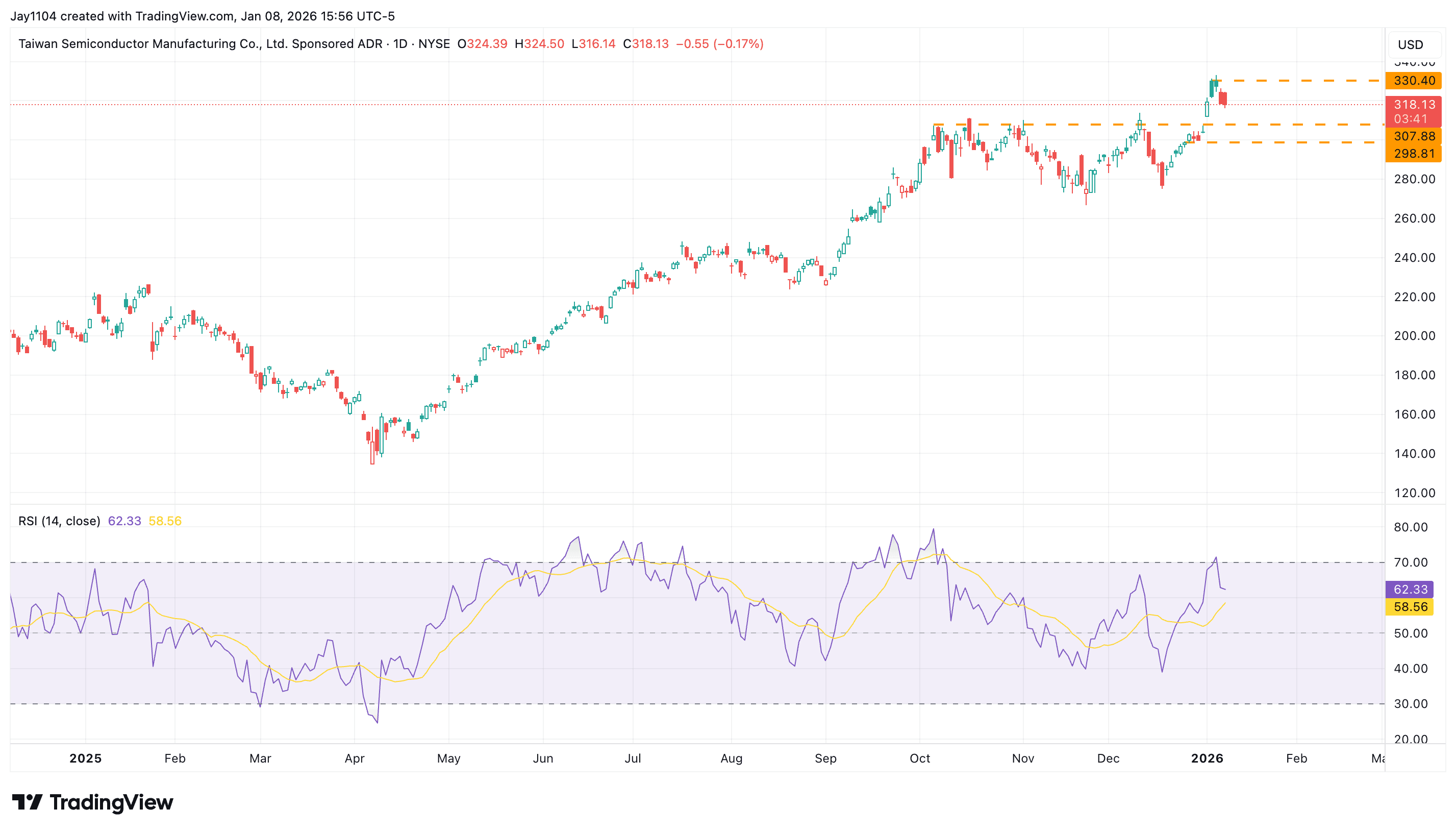

Options markets imply that traders expect TSM’s New York-listed stock to move by an average of 4.6% in either direction following the Q4 earnings release. Implied volatility is currently low at around 40% for options expiring in the trading week to 16 January. Options positioning in the stock is fairly neutral, reinforcing what the technical chart, below, shows: an area of resistance around $330 and a solid area of support near $310.

If the share price breaks above $330 following the Q4 results, the next area of resistance might be around $350, based on gamma levels. Conversely, a break below support could send the stock tumbling towards $300, filling a gap near $303 that formed on 31 December.

Taiwan Semiconductor Manufacturing share price, January 2025 - present

Sources: TradingView, Michael Kramer

Germany December CPI

Friday 16 January

Germany’s final estimate of its December CPI may be important as it could influence the European Central Bank’s thinking on interest rates. The preliminary or ‘flash’ reading that was released on 6 January indicated that inflation in Germany eased to 1.8% in December, down from 2.3% a month earlier. Germany’s harmonised CPI print, a measure of inflation designed to aid comparisons between eurozone members, fell to 2% in December, down from 2.6% in November.

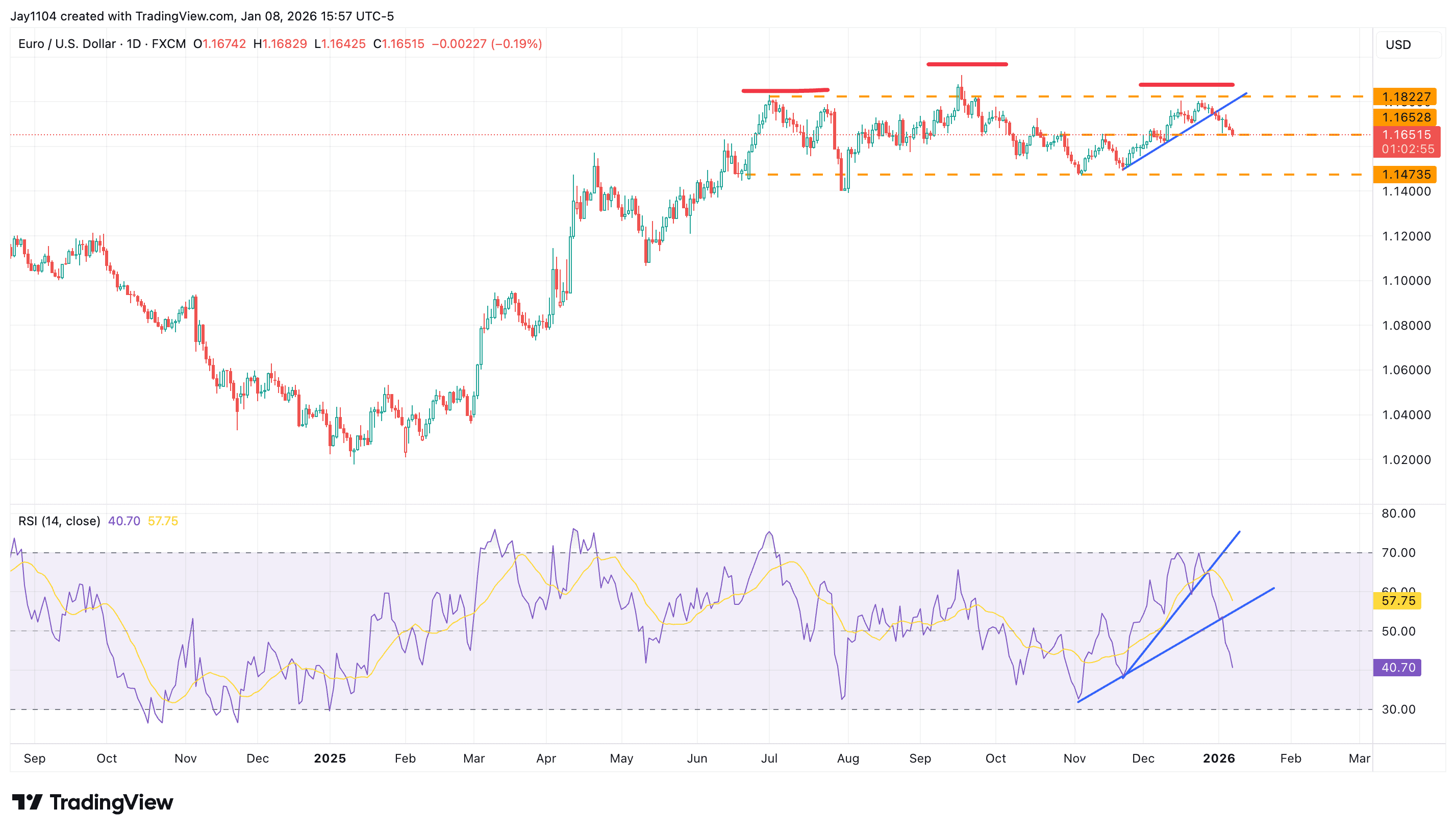

If Germany’s inflation rate officially slips below the ECB’s 2% target and fails to rise in the coming months, it may signal that ECB monetary policy is overly restrictive. That could be a negative for EUR/USD, which has slipped from around $1.18 on 24 December. On Friday the pair broke below support at $1.165. Unless the euro rebounds, it could slide back towards the early-November lows near $1.15, potentially confirming a head-and-shoulders pattern that has been forming since mid-December.

EUR/USD, September 2024 - present

Sources: TradingView, Michael Kramer

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Monday 12 January

Eurozone: January Sentix investor confidence survey

US: December budget statement

Results : Knights (FY)

Tuesday 13 January

UK: Jobs data (November unemployment rate, November employment change, November average earnings, December claimant count change)

US: November consumer price index (CPI)

Results: Bank of New York Mellon (Q4), Delta Air Lines (Q4), JPMorgan Chase (Q4)

Wednesday 14 January

China: December imports, exports and trade balance

US: October producer price index (PPI), November retail sales

Results: Bank of America (Q4), Citigroup (Q4), Wells Fargo (Q4)

Thursday 15 January

Australia: December unemployment rate, December employment change, January consumer inflation expectations

China: December industrial production, December retail sales

Eurozone: November industrial production

France: December CPI

Spain: December CPI

UK: November gross domestic product (GDP)

US: Weekly initial jobless claims

Results: BlackRock (Q4), Goldman Sachs (Q4), Morgan Stanley (Q4), Safestore (FY), Taiwan Semiconductor Manufacturing (Q4)

Friday 16 January

China: Q4 GDP

Germany: December CPI

Italy: December CPI

US: December industrial production, December housing starts

Results: PNC Financial Services (Q4), State Street (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

The Week Ahead: Cisco earnings, UK growth, US inflation

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 9 February.

USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.