The Week Ahead: UK CPI, US PCE, Walmart earnings

Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 16 February.

Published: Friday, 13 February 2026 at 14:30 (UK)

Inflation will be the focus in the upcoming holiday-shortened trading week. After US markets close on Monday for Presidents’ Day, the UK’s January consumer price index (CPI) report will come out on Wednesday, followed on Friday by the December update on the US Federal Reserve’s preferred inflation measure, the personal consumption expenditures (PCE) price index. Also on Wednesday, traders will study the minutes from the Fed’s January meeting (which resulted in a rate hold) for a clearer sense of whether policymakers might cut rates before chair Jay Powell steps down in May. Meanwhile, earnings season rumbles on with UK-listed miners – including Glencore, Rio Tinto and Anglo American – set to report full-year results. Below we preview the Q4 results of retailer Walmart, which earlier this month joined the ranks of US companies valued at $1tn or more, putting the Nasdaq-listed company in an elite club alongside the likes of Nvidia, Apple and Tesla.

UK January CPI

Wednesday 18 February

Inflation in the UK remained sticky in 2025, hovering well above 3% for the last eight months of the year. However, consensus estimates suggest that CPI eased to 3% in January, down from 3.4% in December. The market is pricing in a roughly 90% probability that the Bank of England will cut interest rates twice in 2026 in a bid to bring inflation down to the Bank’s 2% target and boost economic growth from current low levels. The UK’s GDP grew just 0.1% in the final three months of 2025, according to official data released on 12 February.

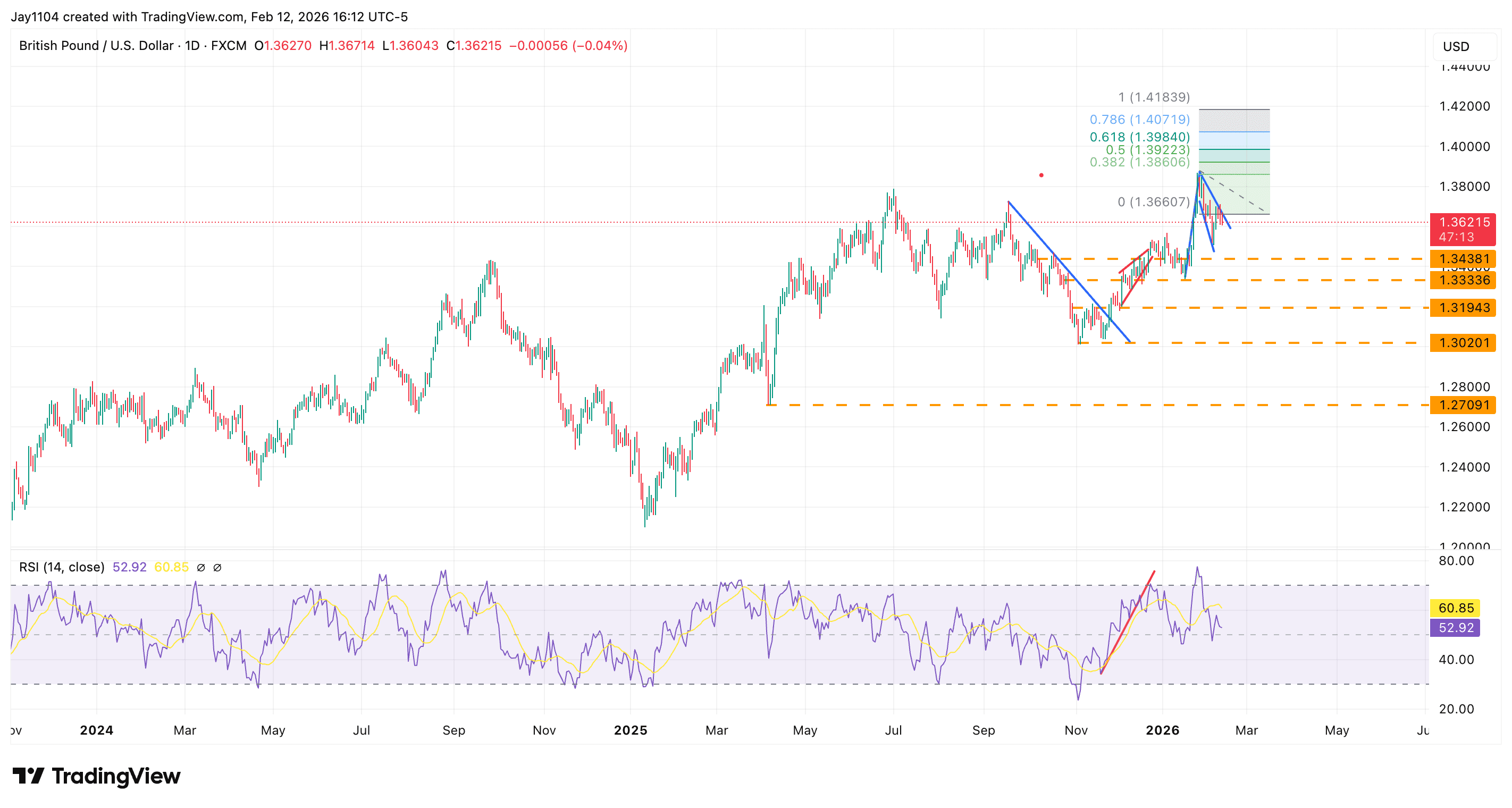

Despite the weak growth backdrop, sticky inflation and the prospect of rate cuts, the pound has strengthened against the dollar since November’s lows near $1.30. GBP/USD climbed past $1.38 in late-January, before slipping back to current levels of around $1.36. However, the pair could be on the cusp of further gains.

The technical chart below indicates that GPB/USD may have entered a bull flag – a continuation pattern that can signal further upside potential. A measured move from this bull flag could see GBP/USD rise towards $1.41 or $1.42, an area the pair last touched in 2021. To get there, though, sterling would need to pass through strong resistance at $1.38, near the January high. To the downside, support is at $1.3450.

GBP/USD, January 2024 - present

Sources: TradingView, Michael Kramer

Walmart Q4 earnings

Thursday 19 February

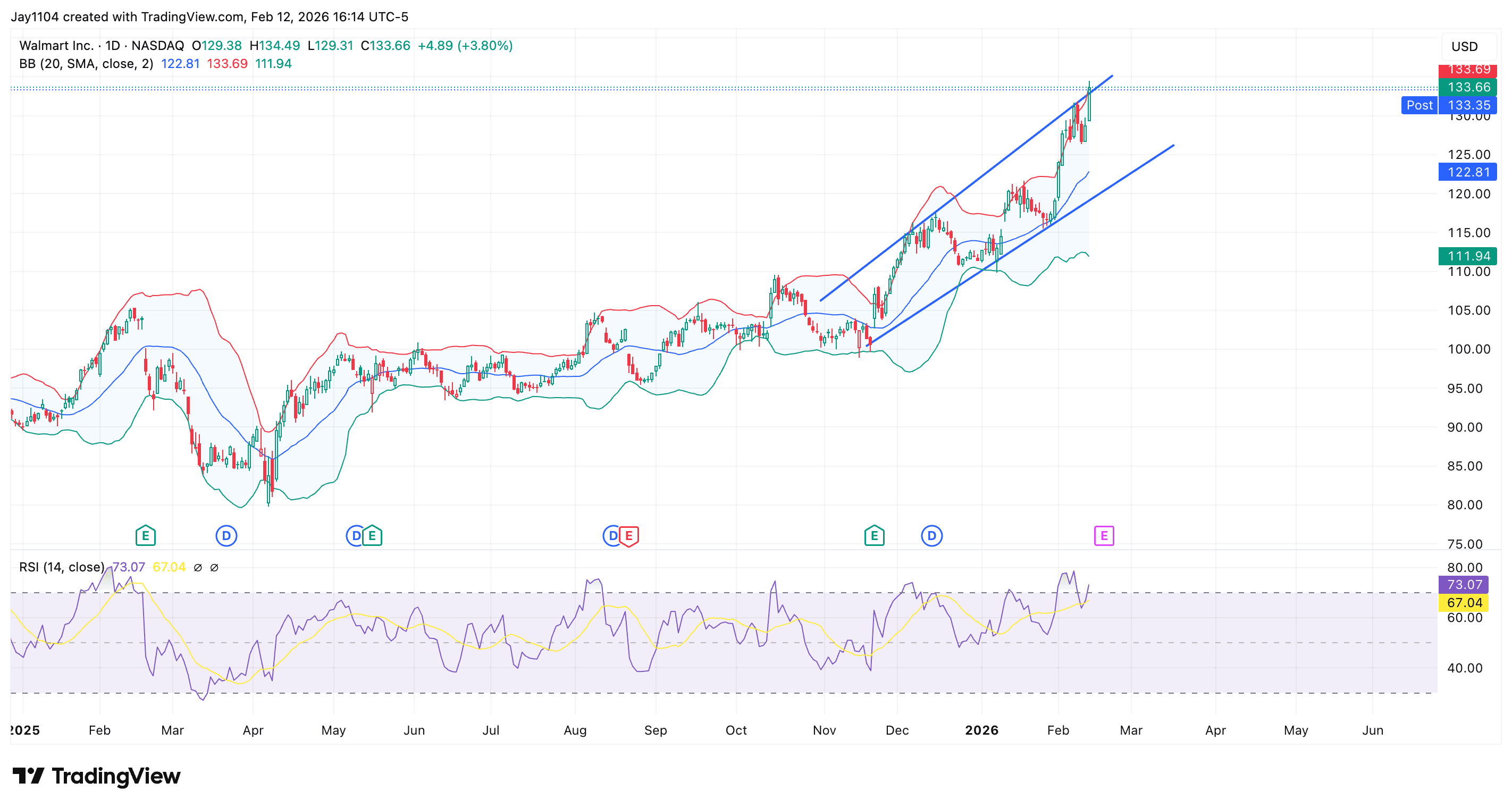

Analysts expect Walmart to report that fourth-quarter earnings grew 9.9% to $0.73 a share, as revenue rose an estimated 5.4% to $190.2bn. Looking ahead to Q1, analysts expect earnings to grow 11.3% to $0.68 a share on revenue growth of 5.1% to $173bn.

Options markets imply that traders expect Walmart shares to move by an average of 5.5% in either direction after the earnings release. Shares of the multinational retailer are up by almost a third since the November low, having closed at $133.64 on Thursday.

From an options gamma perspective, there is resistance at $135 and support at $124. However, the current setup indicates that the lower end of that range may be more likely to be tested. The stock is in a positive delta position, suggesting that once the company reports results and implied volatility declines, as is typical post-earnings, Walmart’s shares could face selling pressure as dealers adjust their hedges.

The technical chart, below, shows Walmart in overbought territory, with the relative strength index (RSI) above 70 and the share price poking above the upper Bollinger Band. In addition, the stock appears to be trading within an ascending broadening wedge, which can sometimes signal rising volatility and a potential reversal. The lower line of the wedge may provide support around $120. However, if the stock somehow rises above resistance at $135 – perhaps driven by better-than-expected results – it could climb towards $140.

Walmart share price, January 2025 - present

Sources: TradingView, Michael Kramer

US December PCE price index

Friday 20 February

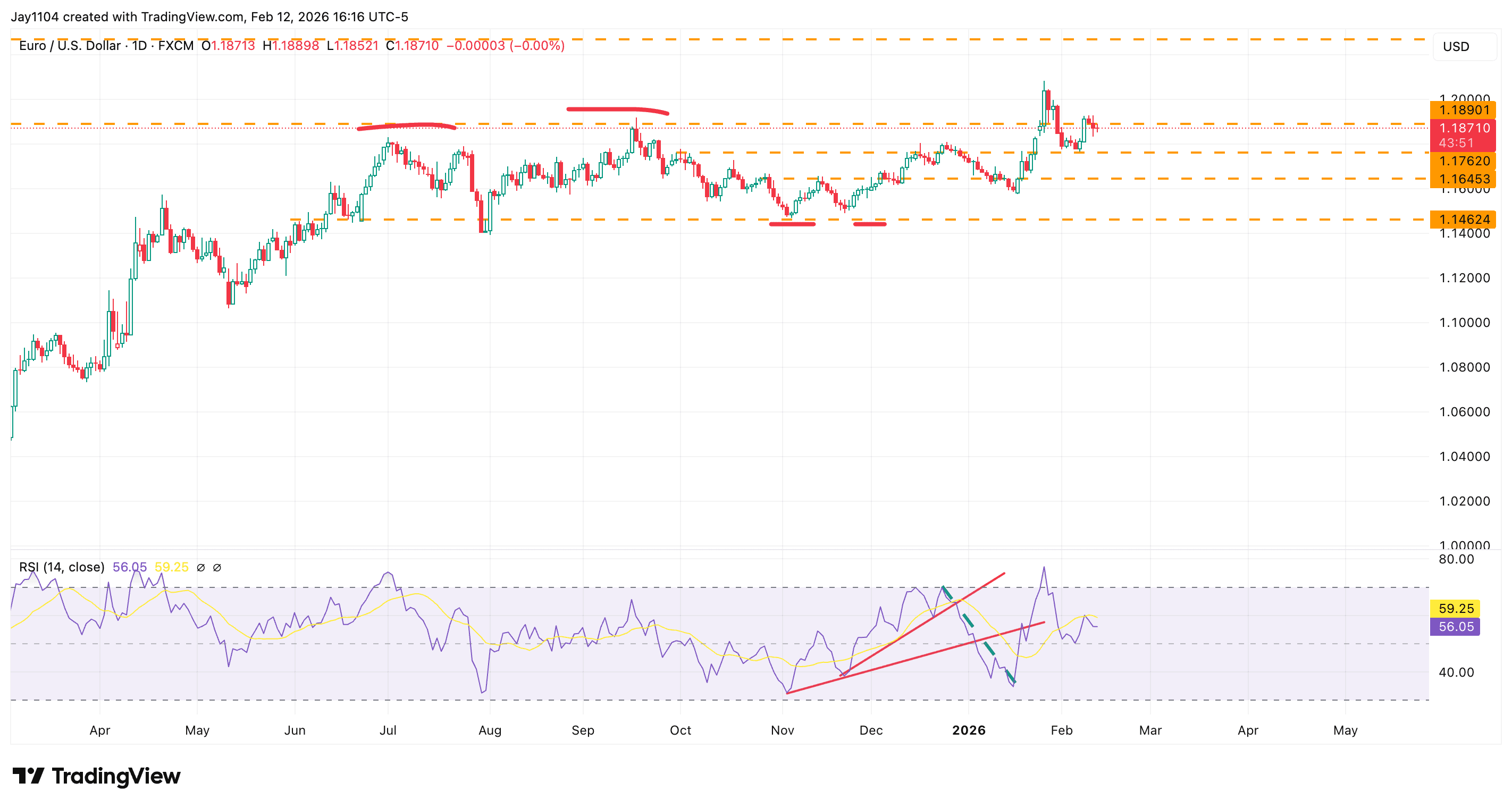

Although US inflation has cooled by most measures, the November PCE report showed core inflation – which excludes volatile food and energy prices to highlight underlying price trends – rising to 2.8% year-on-year, up from 2.7% in October. This partly explains why many Fed officials continue to express concern that inflation remains too high.

The Fed’s stance is unlikely to change unless the December core PCE print comes in significantly cooler than a month earlier. If the Fed’s favourite gauge of inflation remains stubbornly high, the dollar may strengthen in the days following the release as persistent price pressures might push rate cuts further into the future.

In that scenario, the euro may continue to face headwinds. EUR/USD, trading at around $1.1860 on Friday, needs to break decisively above the $1.20 resistance level to sustain its recent upward momentum. However, if the pair falls below $1.1820, it could signal that the current rally has failed, opening the door for a move back towards support near $1.16.

EUR/USD, April 2025 - present

Economic and company events calendar

Major upcoming economic announcements and scheduled US and UK company reports include:

Sunday 15 February

• Japan: Q4 gross domestic product (GDP)

Monday 16 February

• Eurozone: December industrial production

• US: Markets closed (Washington’s Birthday)

• Results: No major scheduled earnings announcements

Tuesday 17 February

• Australia: Reserve Bank of Australia meeting minutes

• Canada: January consumer price index (CPI)

• Germany: January harmonised CPI

• Japan: January exports, imports and merchandise trade balance

• UK: December unemployment rate, December employment change, January claimant count change

• Results: Antofagasta (FY), Cadence Design Systems (Q4), InterContinental Hotels (FY), Medtronic (Q3), Palo Alto Networks (Q2), Republic Services (Q4)

Wednesday 18 February

• New Zealand: Reserve Bank of New Zealand interest rate decision

• UK: January CPI

• US: Federal Open Market Committee meeting minutes

• Results: Analog Devices (Q1), BAE Systems (FY), Booking Holdings (Q4), Carvana (Q4), CRH (Q4), DoorDash (Q4), Garmin (Q4), Glencore (FY), Moody's (Q4), Pan African Resources (HY)

Thursday 19 February

• Australia: January unemployment rate, January employment change

• Eurozone: February consumer confidence

• Japan: January CPI

• New Zealand: January exports, imports and trade balance

• US: Weekly initial jobless claims

• Results: Centrica (FY), Deere & Co. (Q4), Mondi (FY), Newmont (Q4), Occidental Petroleum (Q4), Rio Tinto (FY), Southern (Q4), Walmart (Q4)

Friday 20 February

• Canada: December retail sales

• China: People’s Bank of China interest rate decision

• Eurozone, France, Germany, UK, US: February purchasing managers’ index (PMI) data

• UK: January retail sales

• US: Q4 GDP, December personal consumption expenditures (PCE) price index

• Results: Anglo American (FY), PPL (Q4), Segro (FY), TBC Bank (Q4)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Is inflation finished and normalisation underway?

Traders' attention is on the US consumer price index (CPI) reading, out on Friday 20 February at 1.30pm (UK time).

USD/JPY strengthens following supermajority win

The big news from Japan was that Prime Minister Takaichi won a two-thirds supermajority in the lower house following an election over the weekend. This will likely bring more stimulus-related fiscal policy, yet USD/JPY still strengthened on the headline as rates rose.

Precious metals: purge on COMEX and retail investors stand firm

Following steep recent falls in gold and silver prices, the market has gone through what can be described as a “purge” of speculative positioning on derivatives markets – particularly on COMEX. The drop in prices has effectively wiped out the high level of speculative net positions that had previously shown extreme greed.