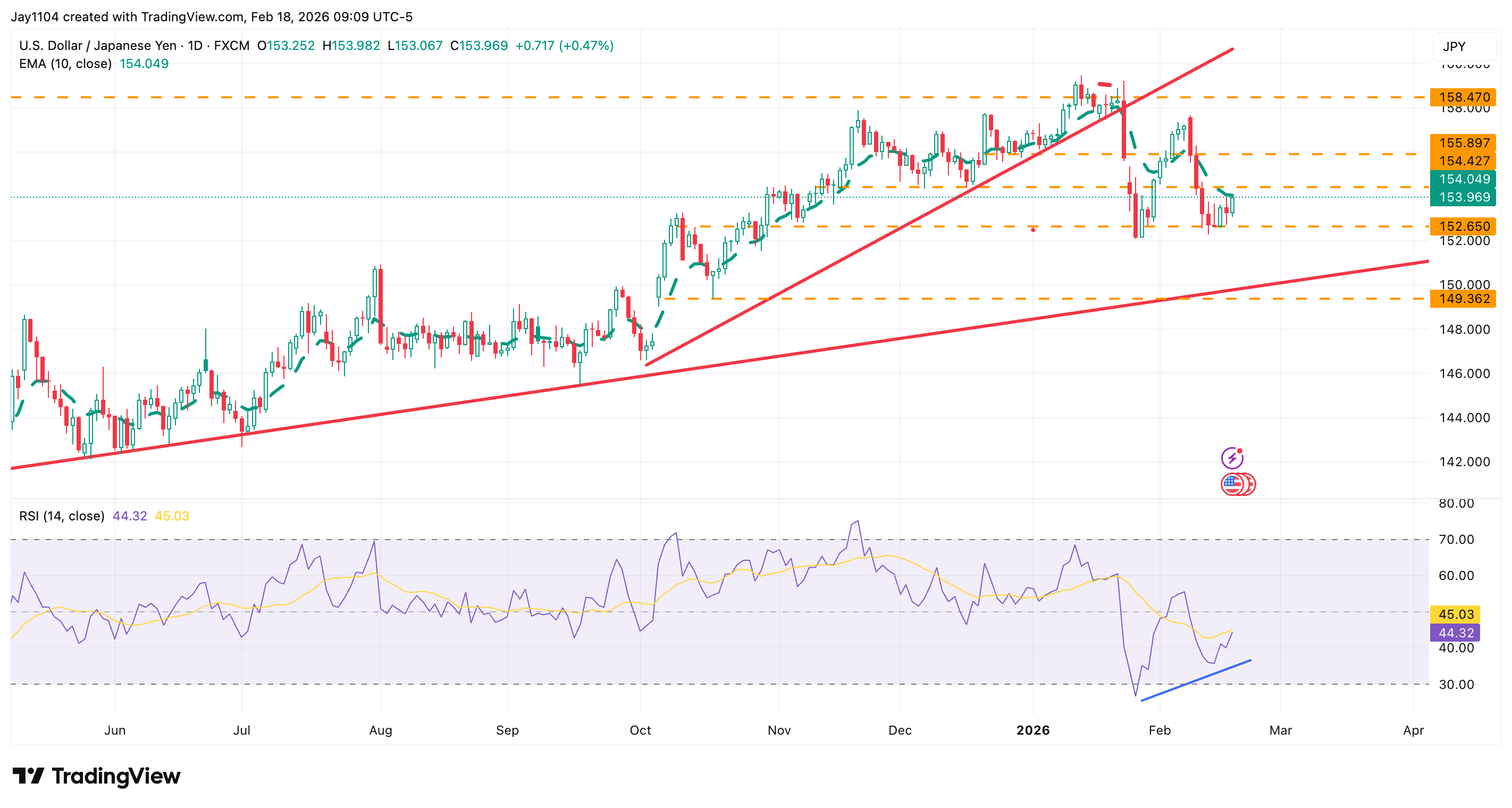

The USD/JPY Bounces Off Strong Support Level

The USD/JPY has found support at 152.65 and is now attempting to turn higher, suggesting the yen may again weaken against the dollar. The pair has been testing support for several trading sessions and has been unable to strengthen further against the dollar. This puts resistance at 154.10 back into play.

The relative strength index is rising and has formed a series of higher lows, suggesting the trend may favour further gains in USD/JPY. It suggests that momentum is shifting again and, perhaps more importantly, that a more durable change in trend is underway. This aligns with the longer-term uptrend visible on the price chart.

Source: TradingView, 19 February 2026

That is not to say USD/JPY has a clear path back to 158, as several resistance zones along the way could cap any advance. Before the pair can reach resistance at 154.10, it must also surpass the 10-day exponential moving average, currently around 154. That moving average has acted as both short-term support and resistance for USD/JPY since early October. The region around 154 to 154.20 is a strong area of resistance that could stall the yen.

However, this outlook could quickly change. Should USD/JPY break below 152.65, it would signal a decisive break of support and could lead to the yen strengthening materially against the dollar. In that case, the pair could fall towards 150 and potentially test the long-term uptrend that has been in place since late April.

Gold struggles at $5,000 as momentum fades

Gold has been consolidating below $5,000 since the beginning of February and, despite several strong attempts to break through that psychologically important level, has been unable to do so. A breakout above $5,000 would be extremely important and would likely push gold higher toward the highs around $5,400. However, that outcome is increasingly unlikely.

DAX back above 25,000 points – Wall Street turns, Fed minutes and US economic data in focus

The recovery on Wall Street has lifted the DAX back above the 25,000-point level, with investor attention now on upcoming economic data and the minutes from the most recent meeting of the United States Federal Reserve (Fed).