Has AI blown up the software industry? Palo Alto faces its first major test this Tuesday

The software industry is at its most tense in a decade. The market asks: is this a valuation opportunity, or the end of the SaaS model as we know it? Palo Alto Networks’ results will be the first test.

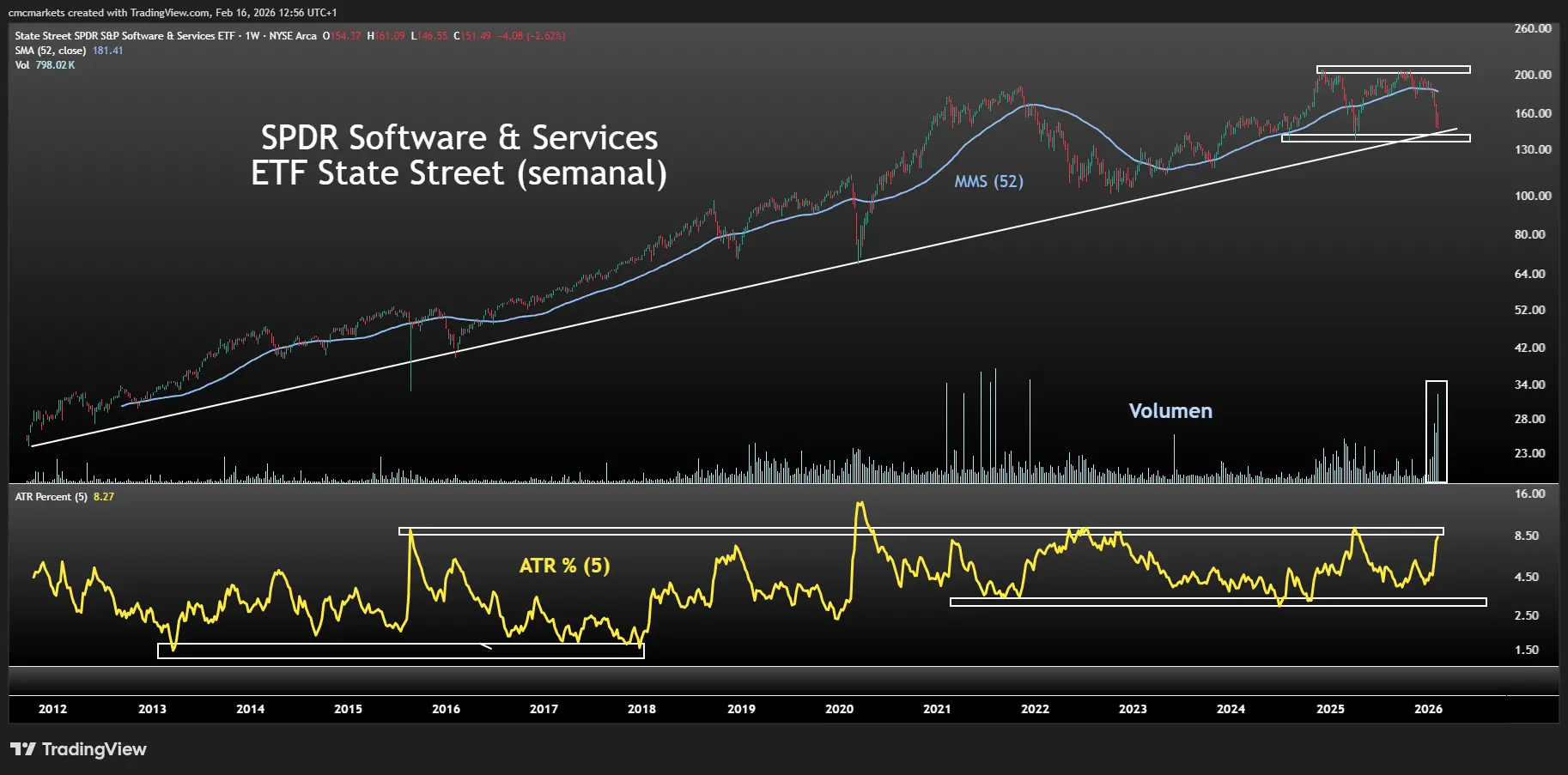

Software industry collapse down to very long-term uptrend

So far this year, the technology sector has clearly been the worst performer, and within it, the software industry has been hit the hardest. Losses in the SPDR S&P Software & Services ETF (XSW) are approaching 20%, putting to the test the very long-term upward trend that has guided the index for more than a decade.

State Street SPDR S&P Software & Services ETF weekly chart with volume and ATR%, extracted from TradingView on 16/02/26

Maximum stress and key earnings releases

The index’s approach to this technical level is happening at a point of maximum stress: volatility is at extreme levels and volume has surged. In similar situations, the industry has managed to form market bottoms. Will it happen again? Much of the answer lies in corporate earnings over the coming weeks.

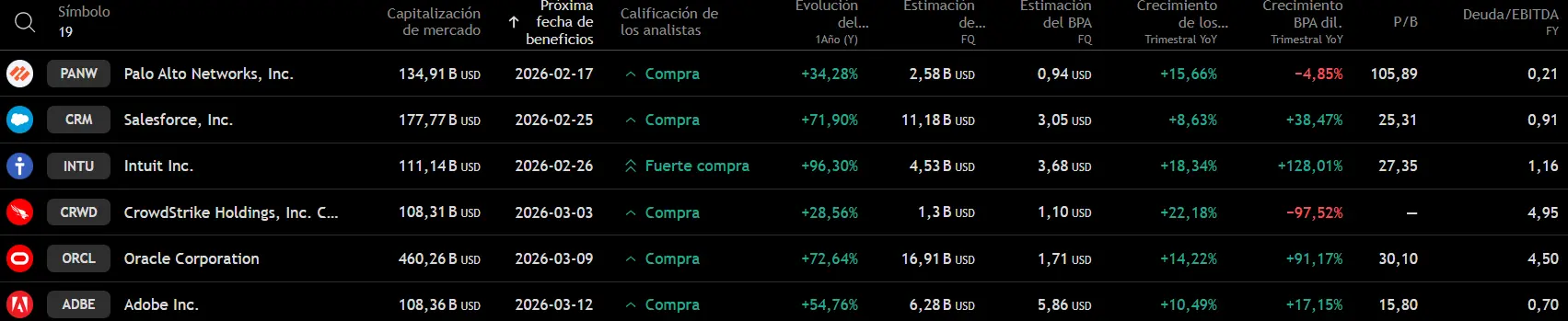

Palo Alto Networks, Salesforce, Intuit, CrowdStrike, Oracle, and Adobe will report soon. They are doing so with historically attractive valuation multiples and significant upside potential relative to analysts’ consensus price targets.

Upcoming software companies to publish results, table extracted from TradingView on 16/02/26

Is AI blowing up SaaS?

The catalyst for the decline is the emergence of AI as a disruptive force to the SaaS (Software as a Service) model, which is based on recurring subscription licenses.

AI is changing the rules of the game through “destructive efficiency”: large language models (LLMs) have begun to absorb functions that previously required multiple specialized software subscriptions.

This evolution allows capabilities that were previously outsourced to now be internalized through low-cost proprietary development or automated via AI agents. This threatens to turn traditional software into a commodity, raising questions about the sustainability of recurring revenue and profit margins.

Six giants: diagnosing the ecosystem

The upcoming earnings reports will provide a clear snapshot of the situation:

Productivity and consumer software:

Salesforce will measure corporate investment; Adobe will show whether AI enhances or replaces creators; and Intuit will reflect the health of small and medium-sized businesses.

Cybersecurity:

Palo Alto and CrowdStrike represent “must-have spending.” Their results will show whether companies prioritize defense against AI-driven attacks or focus on cost-cutting.

Infrastructure:

Oracle, which bridges traditional software and accelerated cloud infrastructure, will confirm whether demand for AI infrastructure remains strong.

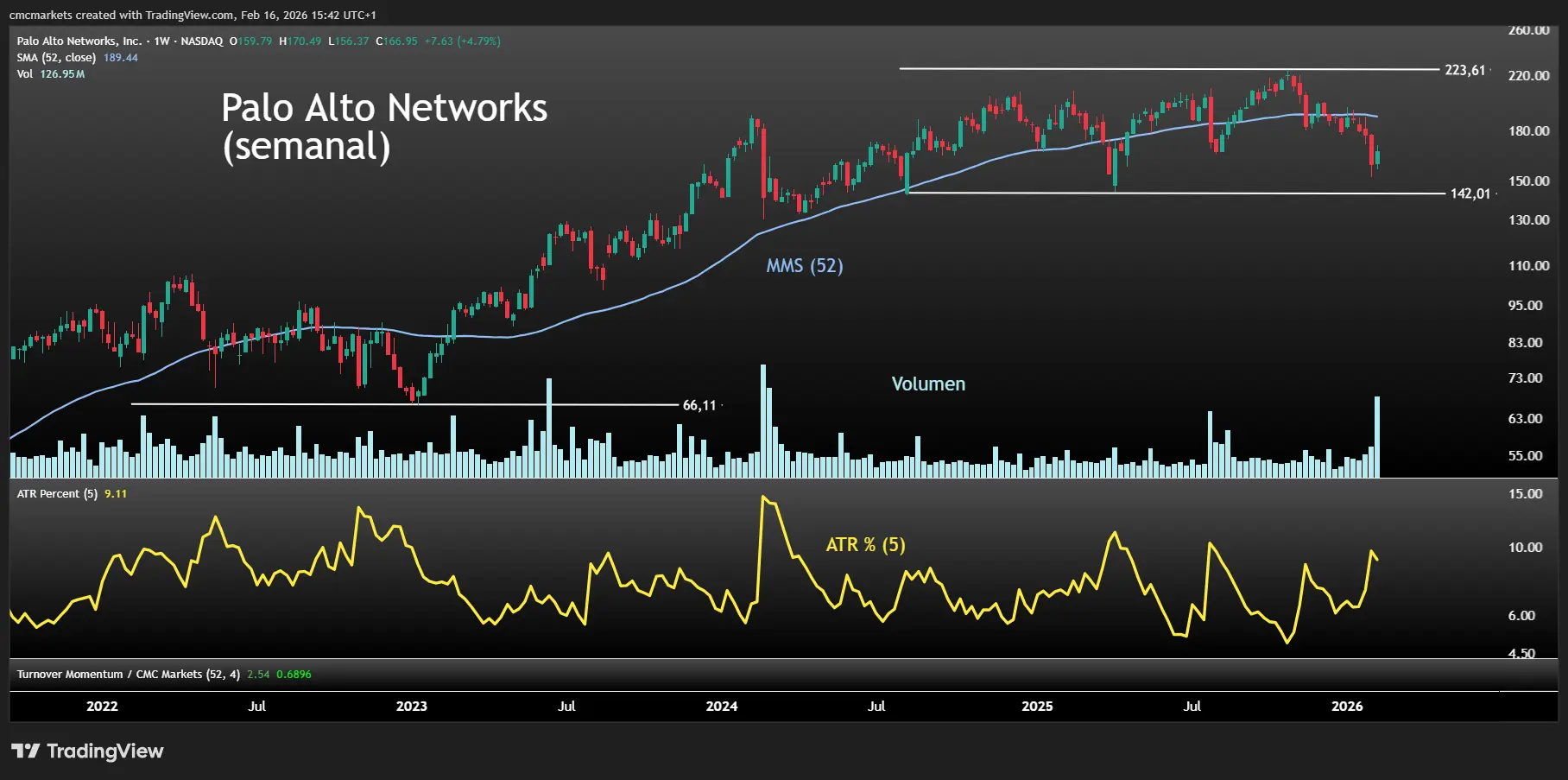

First test: what will the market evaluate in Palo Alto?

Palo Alto Networks’ earnings today after the cash market closes will be the first major test. The three key factors investors will focus on are:

1. Platform consolidation

Investors will evaluate whether its strategy of offering free products to unify customers within a single ecosystem is gaining traction. Becoming an “all-in-one” solution is critical to protecting its competitive advantage.

2. Next-Generation Security ARR (NGS ARR)

This next-generation security metric will confirm whether Palo Alto is capturing real AI budgets or losing ground to more agile, native competitors.

3. Margins and guidance

After Oracle’s disappointing results, the market will not tolerate weak guidance. The focus will be on whether spending on AI infrastructure is draining cash flow or whether profitability remains resilient.

Palo Alto Networks weekly chart with volume and ATR% extracted from TradingView on 16/02/26

Gold struggles at $5,000 as momentum fades

Gold has been consolidating below $5,000 since the beginning of February and, despite several strong attempts to break through that psychologically important level, has been unable to do so. A breakout above $5,000 would be extremely important and would likely push gold higher toward the highs around $5,400. However, that outcome is increasingly unlikely.

DAX back above 25,000 points – Wall Street turns, Fed minutes and US economic data in focus

The recovery on Wall Street has lifted the DAX back above the 25,000-point level, with investor attention now on upcoming economic data and the minutes from the most recent meeting of the United States Federal Reserve (Fed).