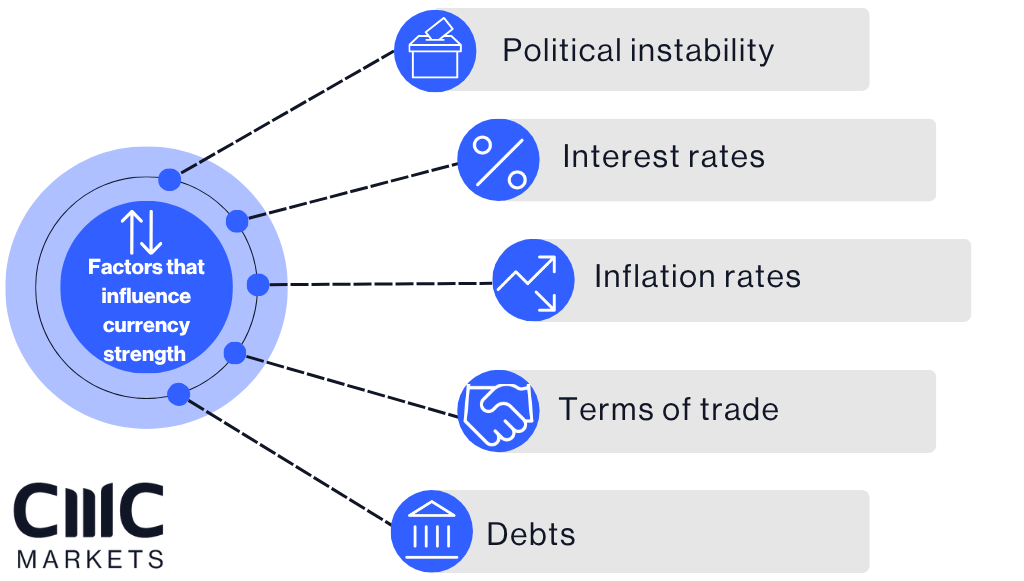

Trading currencies without understanding the factors that influence strength can result in substantial losses. Many macroeconomic forces can have a significant effect on the value of a currency.

When looking at forex markets, it's important to remember that a stronger currency makes a country's exports more expensive for other countries, while making imports cheaper. A weaker currency makes exports cheaper and imports more expensive.

Political instability and economic performance

Political instability and weak economic performance can affect the value of a currency, particularly during events such as presidential elections or recessions. Politically stable countries with strong economies are usually more appealing to foreign investors, so these countries draw investment away from nations facing greater economic or political uncertainty.

Interest rates

Interest rates, inflation and foreign currency rates are all interconnected. Central banks adjust interest rates to control inflation. When a central bank raises interest rates, borrowing becomes more expensive, typically increasing the value of the currency.

On the other hand, lower interest rates mean borrowing is cheaper, leading to increased lending and potentially inflation and currency depreciation.

Forex traders often monitor rate announcements from central banks such as the US Federal Reserve or the Bank of Canada. Some use instruments like cross-currency swaps to hedge exposure to interest rate and exchange rate risk.

Inflation rates

Inflation has a major influence on a nation’s foreign exchange rates. Rising inflation rates generally weaken a currency’s value because purchasing power declines. Low inflation rates tend to strengthen a currency as goods and services become relatively more affordable.

Terms of trade

A country’s terms of trade measure the ratio of export prices to import prices. When export prices rise and import prices fall, the terms of trade improve. Increasing the national income often leads to an increase in demand for the country’s currency.

Debts

High national debt relative to GDP can deter foreign investment, reducing demand for the currency. Without sufficient foreign capital, a country may experience higher inflation and a weaker currency over time.

Is it possible to trade forex for a living?

While some traders may profit, most retail clients lose money when trading CFDs. Trading CFDs involves significant risk of loss and is not suitable for everyone. You should only trade if you fully understand the risks involved. Consult our section on ‘what else do you need to know’ before opening a potentially risky trade.

To see whether you could make money from trading CFDs, you could try out our demo account, which allows you to practice first using $10,000 of virtual funds. Once you feel confident enough to enter the live markets using real funds, you can switch to a live trading account.

How to trade currency in Australia

Choose your product. Decide whether you want to trade CFDs via a standard trading account or an FX Active trading account.

Browse our forex offering. We offer more than 300+ pairs on our platform, including some of the most powerful mixes.

Stay up to date with market news. Currencies can fluctuate in value due to changes like the health of a country's economy, interest rates, inflation, and more.

Pick a strategy based on your research. Decide whether you want to go long (buy) or go short (sell), and monitor your position.

Implement necessary risk-management tools. We offer a range of execution and order types designed to help you manage exposure and control potential losses.

What else do you need to know?

Trading on the financial markets can be a daunting process, especially for a beginner, so it may be a good idea to brush up on your knowledge on the following topics beforehand: