Is inflation finished and normalisation underway?

Traders' attention is on the US consumer price index (CPI) reading, out on Friday 20 February at 1.30pm (UK time).

Attention is on the US consumer price index (CPI) this Friday at 1.30pm (UK time). Consensus, surveys, and models all agree that inflation will continue moderating, allowing the Federal Reserve to maintain its pause on interest rates.

With the economy in full normalisation, the focus now shifts to the impact on the US dollar and gold. This is a high-impact figure with the potential to generate immediate volatility in the dollar, stock markets, and bond markets.

US inflation expected to keep declining

Market consensus, compiled by Trading Economics, expects both core and headline inflation to reach 2.5% year-on-year in January. If confirmed, these would be the lowest core inflation levels in the past five years and annual lows for headline inflation.

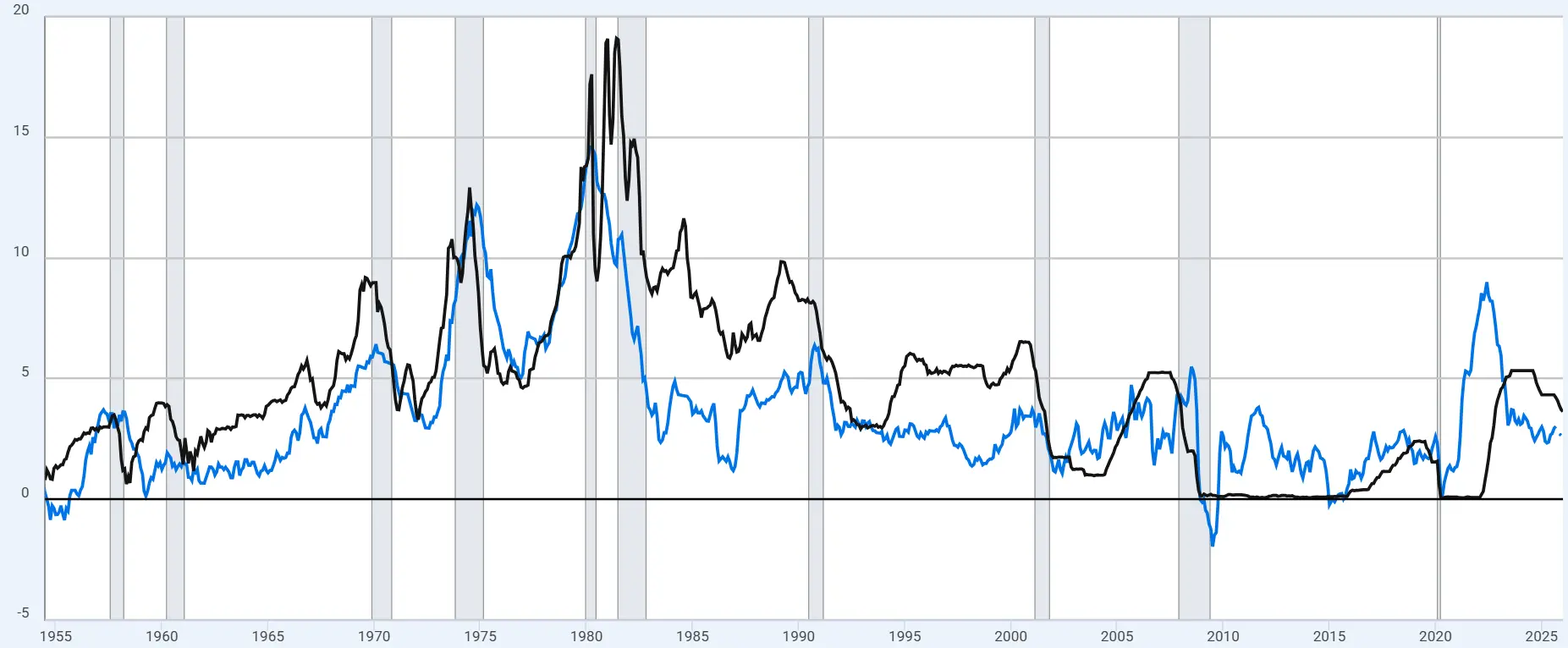

Downward trend brings inflation closer to Fed target

The disinflationary trend aligns with consumer inflation expectations measured by the New York Fed, which have also declined toward recent lows. At the same time, the Cleveland Fed’s nowcasting model suggests the surprise could be even stronger, projecting 2.36% for headline CPI and 2.45% for core CPI.

If this trend is confirmed, inflation would continue its path toward the Fed’s 2.0% target, definitively leaving behind the spike seen in September 2025 caused by tariffs introduced by the Trump administration.

Fed in no rush to cut rates, yield curve flattens significantly

Despite the cooling in prices, the market perceives an accelerating economy, with low volatility and tight interest rate spreads. This environment of loose financial conditions allows the Federal Reserve to avoid rushing back into a rate-cutting cycle.

As a result, Fed Funds futures do not price in changes at the March and April meetings. The market appears to assume that it will take a leadership change at the Fed and the arrival of Kevin Warsh to see new rate cuts.

However, the outlook is positive for long-term interest rates, which are easing significantly. Strong economic growth reduces default risk, while lower inflation reduces inflation risk premiums, allowing the yield curve to stabilize at more sustainable levels.

Accelerating economy and inflation under control?

The current situation points toward economic normalization, where efficiencies and productivity gains from AI help control inflation while boosting growth. Over the long term, this could allow a more balanced interest rate environment, with slightly lower rates and a positively sloped yield curve.

If this scenario strengthens, some dominant trends from 2025 could reverse. The US dollar could benefit from renewed confidence in the US economy and stronger relative growth, while gold could suffer as uncertainty decreases and the need for systemic risk hedging declines.

Naturally, volatility would return in the short term if inflation data surprises to the upside. In that case, the market would be caught off guard, and this could reinforce resistance at the current all-time highs being tested by the S&P 500.

Historic crash in gold and silver: bubble burst or opportunity to re-enter a bull market?

Precious metals have suffered a sharp sell-off. The key question now is whether this represents a market peak or a correction within a broader bullish trend. Movements in the US dollar and upcoming macroeconomic data will be critical in determining how far the pullback extends.

USD/JPY drop shows corrective signs amid yen strength

After a sharp January downturn, the dollar edges higher, but technical signals and tighter US-Japan rate differentials suggest gains may be short-lived.

USD/JPY strengthens following supermajority win

The big news from Japan was that Prime Minister Takaichi won a two-thirds supermajority in the lower house following an election over the weekend. This will likely bring more stimulus-related fiscal policy, yet USD/JPY still strengthened on the headline as rates rose.