CFD vs share trading: What’s the difference?

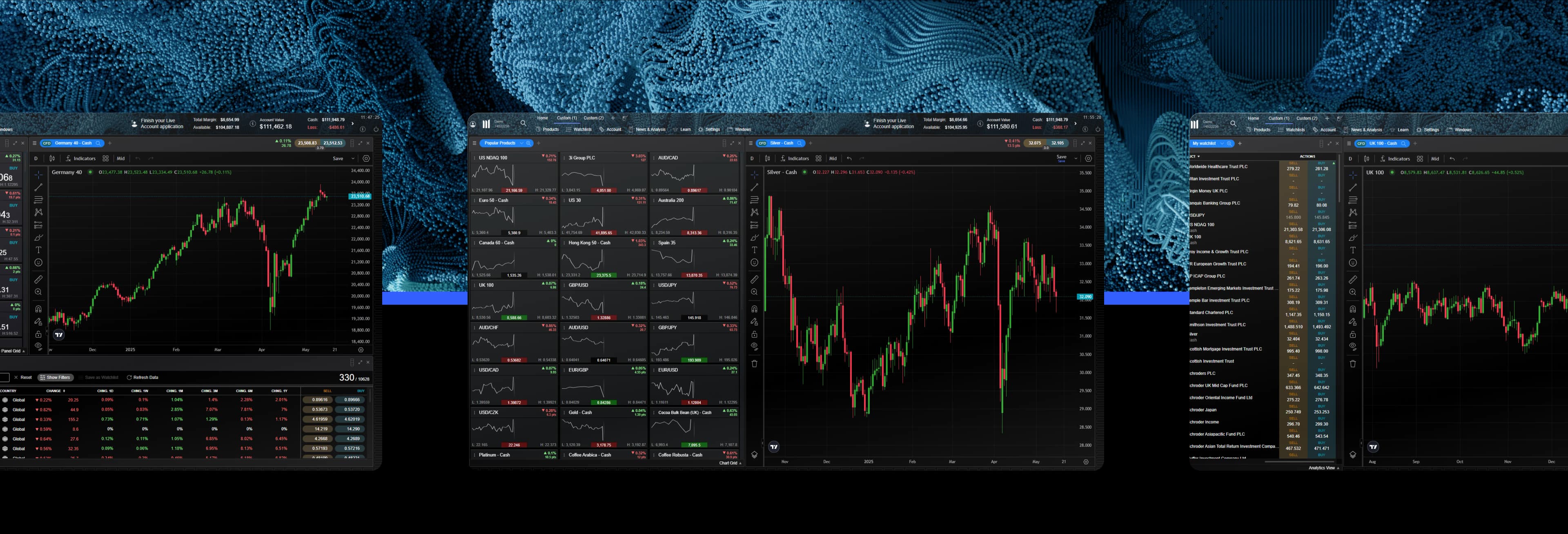

Wondering how CFD vs share trading stacks up? In short, with contracts for difference (CFDs) you speculate on price movements without owning the underlying, whereas with share trading, you’re buying the company’s stock outright and taking legal ownership. That ownership versus exposure-only distinction underpins the major differences in leverage, costs, shorting, trading hours, and investor rights.

CFD trading explained

CFDs are derivatives that track an underlying market – think shares, indices, forex pairs, commodities, etc. You can go long if you think the price will go up or short if you think it will drop. You also trade on margin, so a relatively small deposit controls a larger exposure. This can amplify potential gains and losses (funding/overnight holding, spreads, and slippage also apply).

Benefits include being able to dip into a wide range of markets from one account, the ability to trade rising and falling prices, as well as extended trading hours on many popular indices and commodities. Risks mostly centre on leverage and fast-moving markets, so it’s important to implement risk management strategies.

Open an account to get started.

Share trading explained

Share trading is the purchase and sale of company shares through a stockbroking account. You pay the full consideration (unless you use a separate margin-loan facility) and get shareholder rights like voting and potentially dividends if you hold at the record date.

Many investors use shares for potential long-term wealth building, passive income (dividends), and to diversify their portfolios. There are risks, of course, such as market volatility, company-specific events (earnings surprises, capital raisings), and sector cycles. Short-selling isn’t typically available in a standard cash equities account, so traders can potentially use derivatives (e.g., CFDs) to express bearish views.

Open an account to get started.

CFDs vs share trading: A comparison

Learn more about share trading

Bottom Line? CFD vs share trading comes down to whether you want ownership (shares) or exposure with leverage and two-way trading (CFDs). The advantages of CFDs may suit experienced traders who want potential tactical opportunities across many different markets, while shares could be preferable for investors who want to build long-term wealth and passive income. Derivatives aren’t suitable for everyone – leverage can work against you as well as for you.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.