The advantages of CFD trading

Learn about some of the advantages of CFD trading. Contracts for difference (CFDs) are a type of derivative product that allow you to trade using leverage within the financial markets, including on indices, forex, commodities and shares. Discover the main benefits of CFD trading on our online platform, and learn about the associated risks of CFD trading also before placing a trade.

What are the main benefits of CFD trading?

Trade on both rising and falling markets

With CFD trading, you can trade on the price of a product going down as well as up, so you can try and benefit from selling (shorting) as well as buying opportunities. Many investors use CFDs as a way of hedging their existing portfolios through periods of short-term volatility.

Efficient use of your capital

One of the key advantages of CFD trading is that you can trade on margin, which gives you 'leverage'. This means you can trade without having to put down the full value of a position. As your money is not tied up in one transaction, you can use it for other investments.

For example, to buy the equivalent of 10,000 telecom company share CFDs with us, you may only need to deposit 5% of the total position value that you might have to pay if you were buying physical shares from a stock broker.

If each share cost 150 cents then you would only need to deposit $2250 of position margin with us (15% of $15,000 = $2250) plus the applicable commission, which in this instance would be $100.

To complete the equivalent trade with a stockbroker you would have to pay the full value of $15,000, plus commission and taxes.

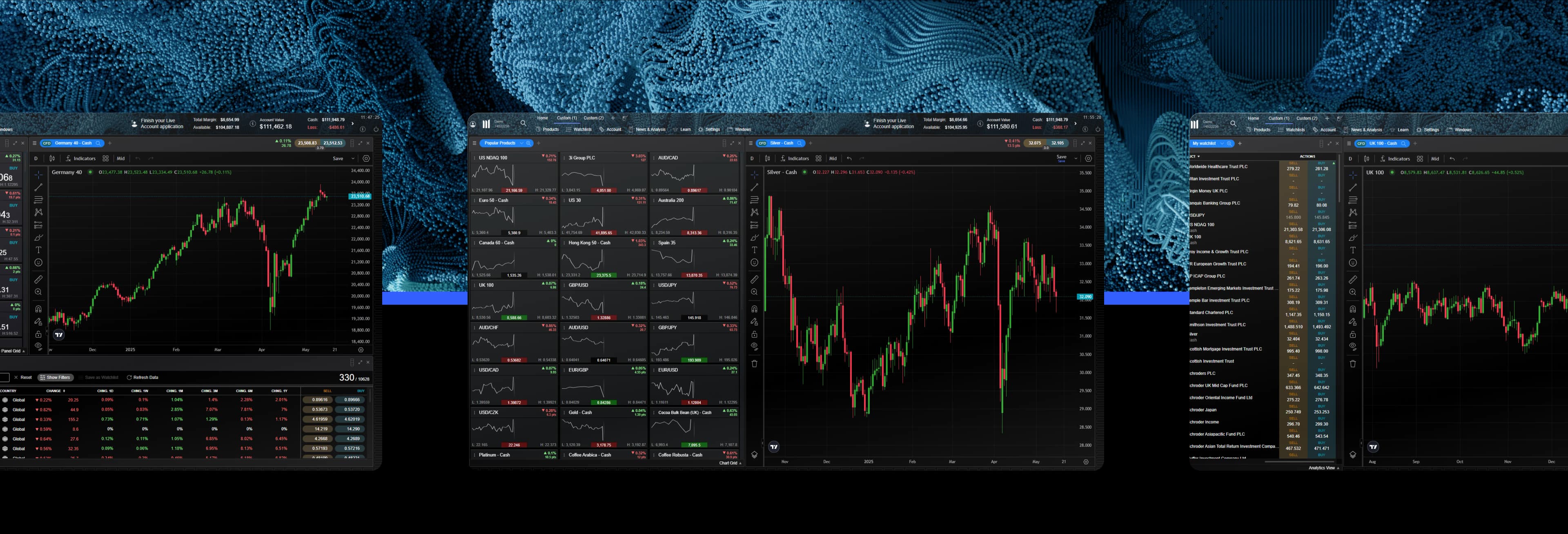

Note: trading using margin means you can magnify the returns on your investment but it is important to remember that losses will be magnified as well. There are many order types and execution tools on our platform that help you manage your risk effectively. Learn more about our software, which has been voted as best CFD trading platform¹ for several years.

CFDs are a type of derivative product that allow traders to speculate on the price movements of a financial security without taking ownership or paying the full value upfront. Instead, you buy or sell a number of units, depending on whether you think the price will rise or fall.

With CFD trading, you can take a position on both sides of the market. You would go long (or place a buy trade) if you believe the instrument will rise; or go short (place a sell trade) if you think the instrument will fall in price. Short selling is a strategy used by traders who want to take advantage of falling market prices.

Most CFD trades do not have an expiry date, meaning that you can hold positions for a long period of time. Some traders prefer to use position trading strategies to trade on instruments over the longer term, rather than investing directly.

You can hold CFD trades for any duration between a few seconds to several months. However, you will be subject to overnight holding costs if carrying any positions over, which can be positive or negative depending on the size and direction of the position.

You can lose more money than you expected when trading CFDs, as losses are based on the full value of the position, rather than just the margin deposit. This is a risk that comes with trading on leverage.

As CFDs are a derivative product and can be used to speculate on the price movements of securities, it’s not possible to trade them without leverage. However, leverage can offer benefits, such as the ability to magnify any profits made on successful positions (as well as magnifying losses). Learn how to trade with leverage carefully and efficiently.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.