Trade 9,000+ Global Shares with $0 Commission

Margins starting from 30% on US shares and 20% on Canadian shares.

High volume traders can enjoy up to 25% trading rebates.

24/5 trading on 60+ US share CFDs.

How to start trading CFDs

Complete and submit our straightforward online application form. Apply now.

Deposit funds easily using credit cards, online bill payment, or bank transfer.

Once you’ve funded your new account, you’re ready to start trading.

Trade 250+ US shares in extended hours

Trade 24/5 on 250+ US shares, including the magnificient seven tech giants. Go long or short on Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla and more from 8 PM EST on Sundays to 5 PM EST on Fridays.

React early to earnings reports, breaking market news and global events

Manage your existing positions in pre- and post-market trading

Enjoy a seamless trading experience, with access to the same order types and execution

Shares trading costs

Why trade shares with us?

Trade CFDs on over 9,000 shares, including top US and Canadian stocks, Hong Kong market leaders, European blue chips, and UK favourites.

Trade 9,000+ global shares with $0 commissions, whatever the size of your trade.

You're in safe hands - we're regulated by Canadian Investment Regulatory Organization (CIRO).

Experienced customer service available 24/5 in EN, FR, and ZH to support you in your trading.

What are other traders saying about CMC Markets?

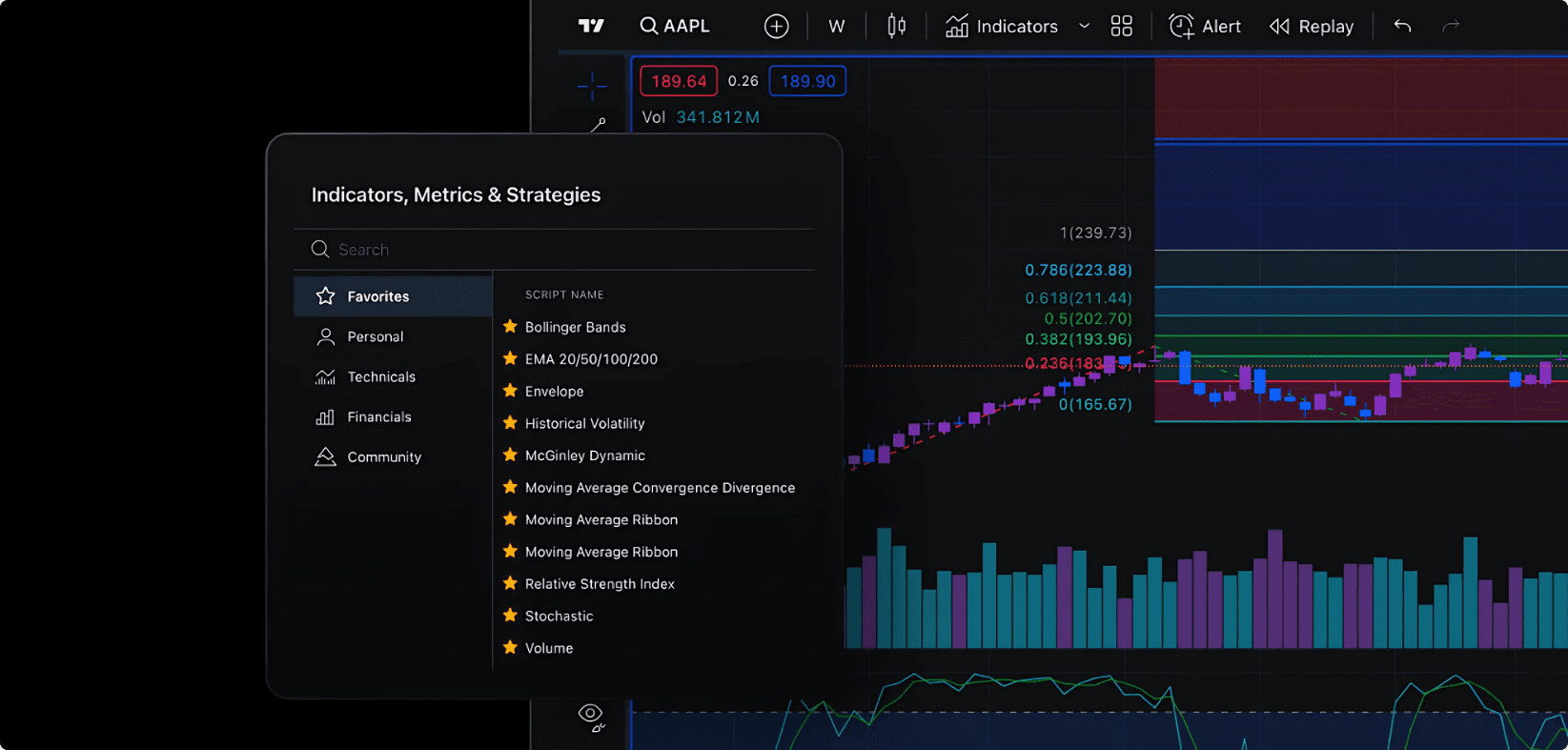

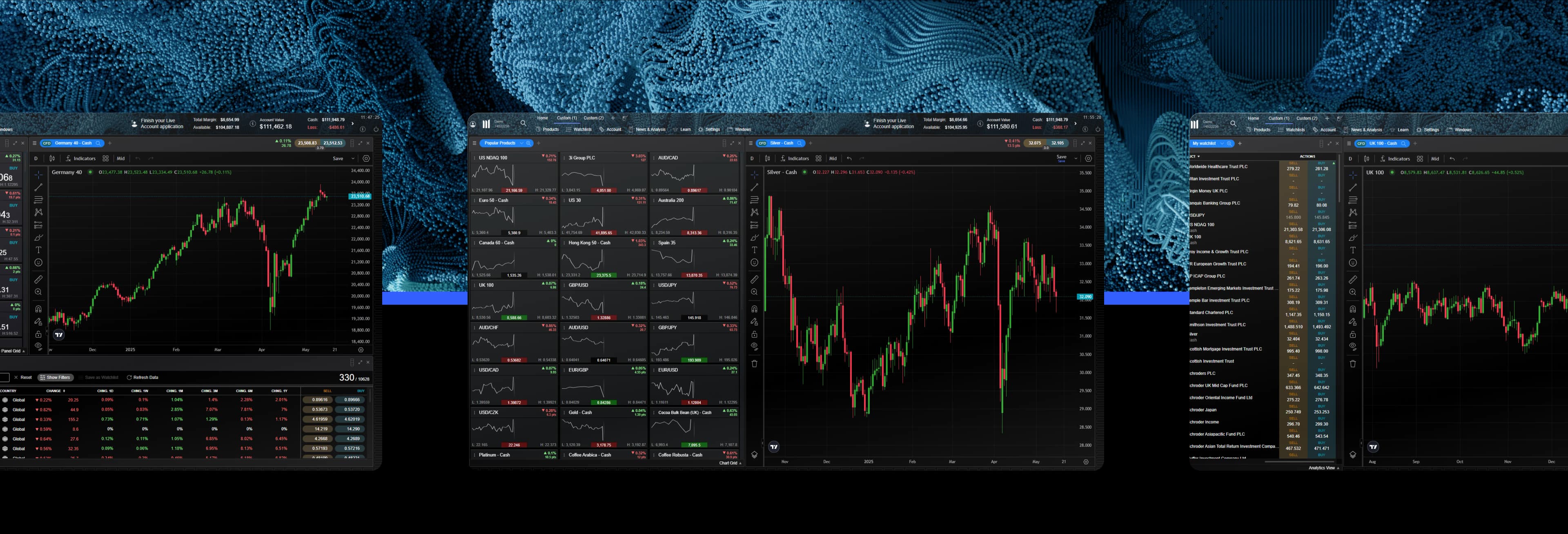

Trade with us through TradingView: Where the world does markets™

Supercharged charting

Enhance your trading experience and identify market signals with TradingView’s technical analysis features, including more than 20 interactive and responsive chart types and over 110 drawing tools.

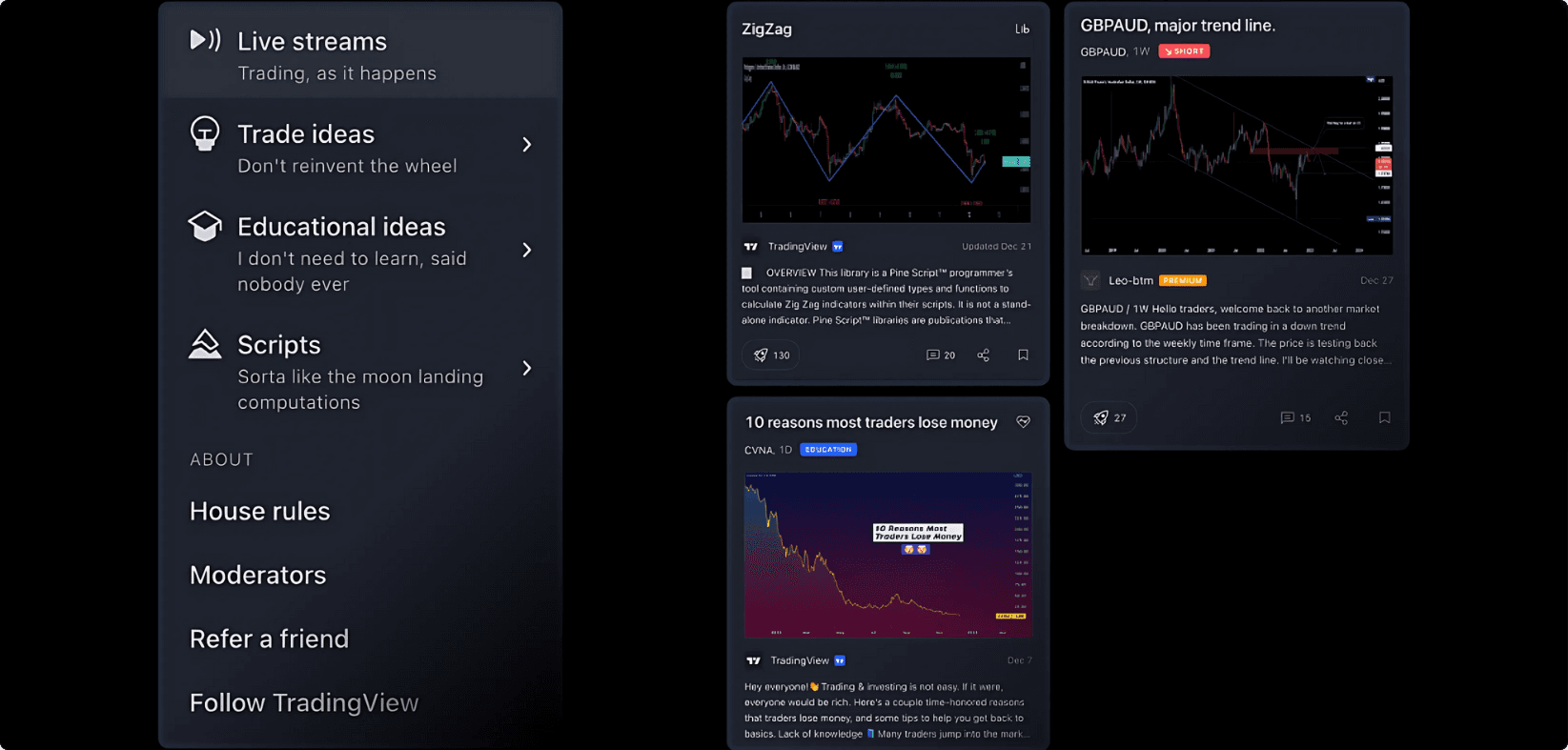

Join the community

Get inspiration and ideas from one of the world’s largest online trading communities.

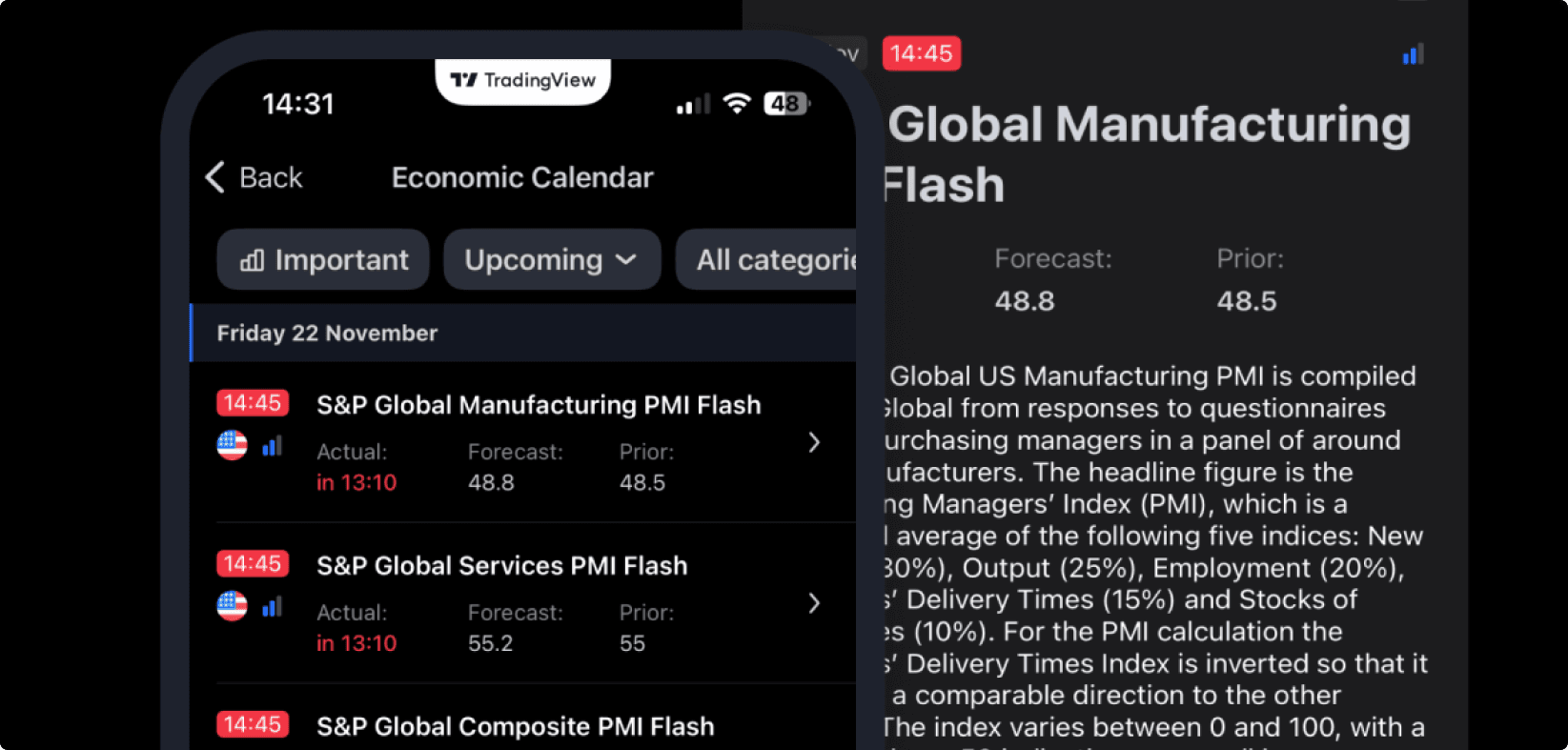

Market calendar

Prepare for key announcements with TradingView's easy-to-use financial calendar, which allows you to filter events by importance, country and category (eg, prices, GDP, etc).

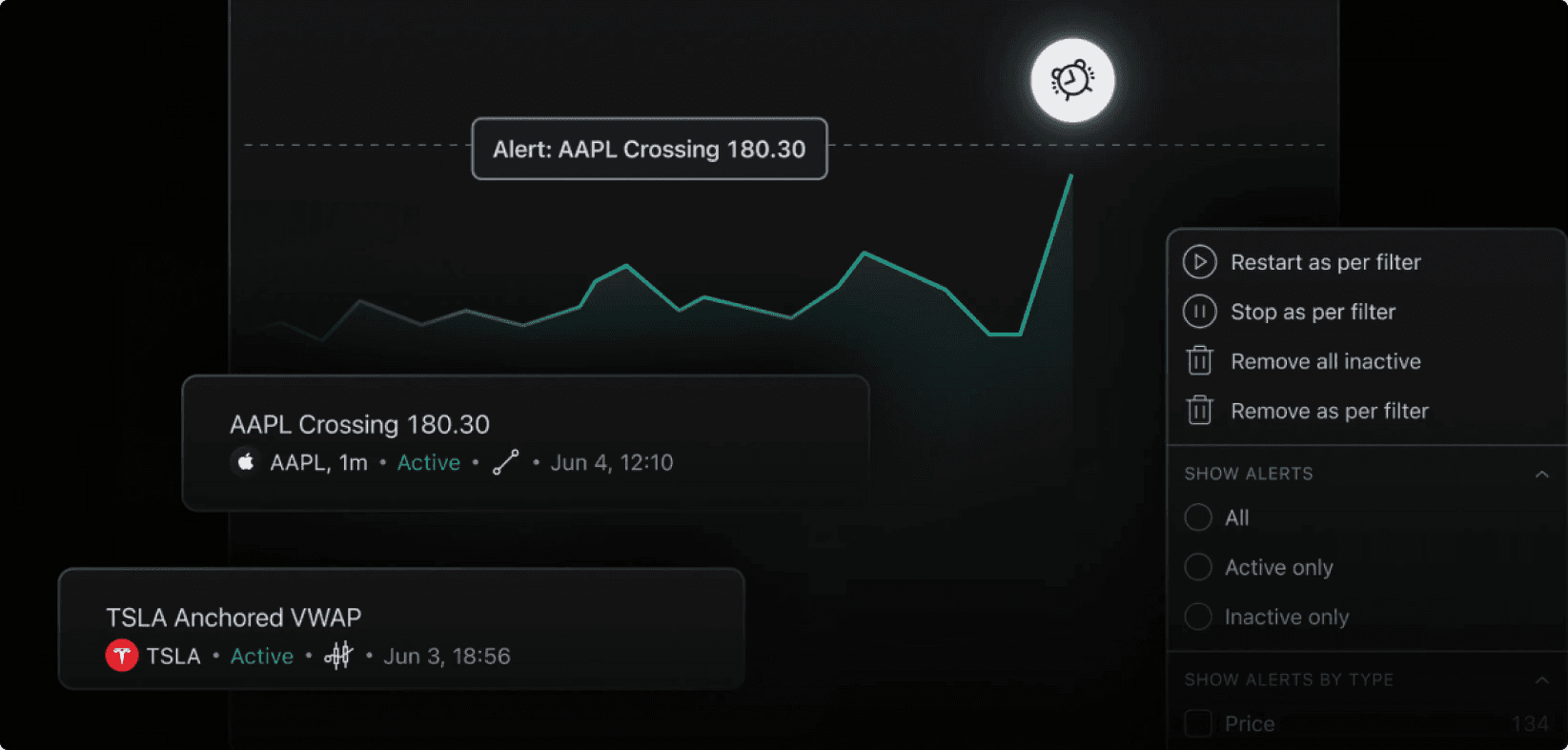

Flexible alerts

Set up personalized alerts using 13 built-in conditions based on price and volume.

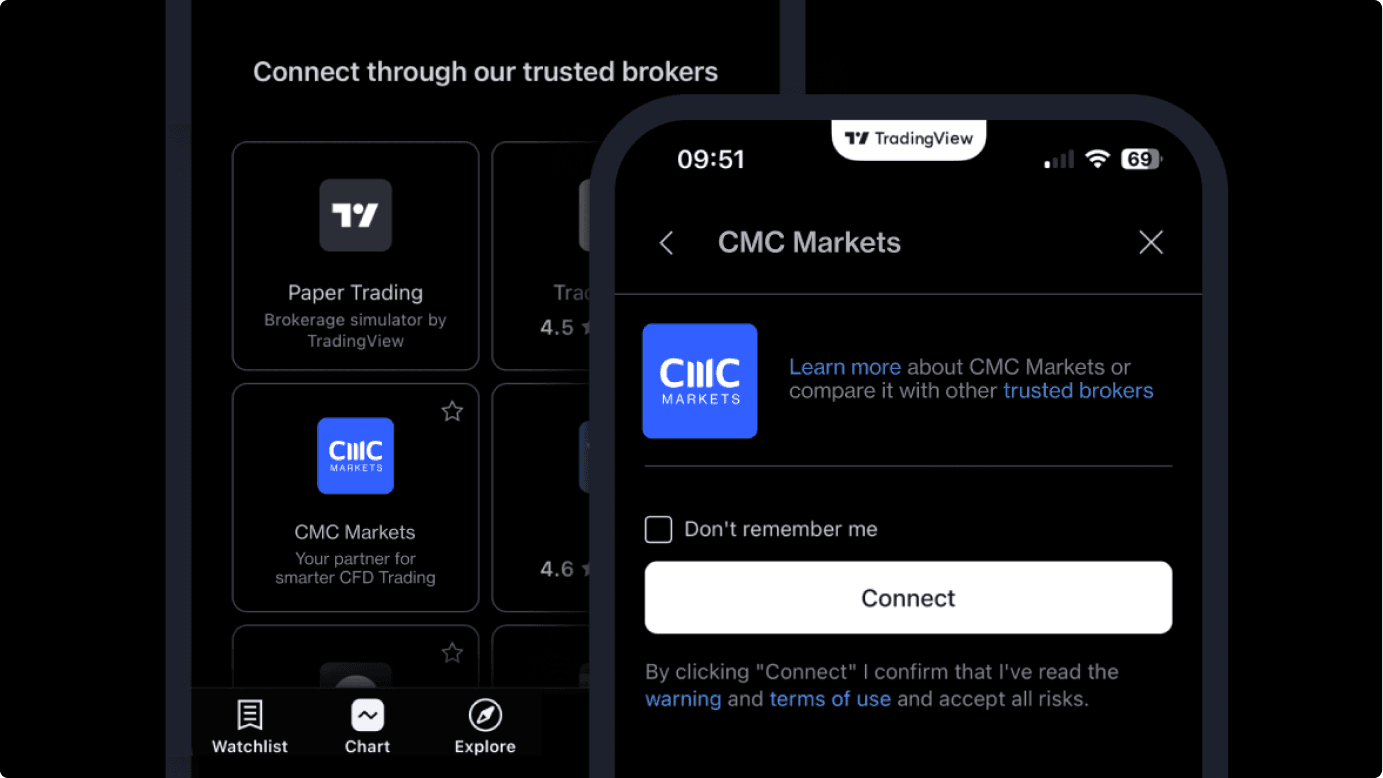

Smooth integration

Open, manage and close your trades with us in TradingView. View and modify trades placed through TradingView when you log into our platform.

Your questions answered

Everything you need to know about trading CFDs with CMC Markets. Can’t find what you’re looking for? Get in touch

New to share trading?

There’s no cost when opening a live CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports free of charge. You’ll need to deposit funds in your account to place a trade though.

Trading during extended hours (which are from 4 AM - 8 PM, Monday to Thursday, and 4 AM to 5 PM on Friday) allows you to speculate on selected US shares ahead of the underlying market open at 9:30 AM, and after market close at 4 PM.

This allows you to manage your positions and your risk with more flexibility, as you can react earlier to earnings reports, which are usually released either before or after the core underlying market hours of 9:30 AM - 4 PM. Similarly, you're also able to react to breaking market news or global events which may impact these US shares.

Our spreads may vary for instruments we offer during extended trading hours (when the underlying markets are closed), as there is less liquidity in the market due to fewer market participants, compared with the main trading session. The underlying US stock markets are open from 9:30 AM - 4 PM EST.

Our spreads reflect the underlying market conditions. This is typical in pre-market trading across global markets. This means that you may have a higher spread cost if you trade during extended hours. You can view the current spread in the platform, directly on the order ticket.

There are a number of costs to consider when trading CFDs, including spread costs, holding costs (for trades held overnight – this is essentially a fee for the funds we ‘lend you’ to cover the leveraged portion of the trade), market data fees and rollover costs (forward instruments only).

The spread is the key cost involved in CFD trading, and is the difference between the buy and sell price of an instrument. The narrower the spread, the better value you receive, because the market only has to move slightly in your favour to offer the possibility of a profit on your trade.

Some trades held open past the end of the trading day (5pm, New York time) are subject to holding costs, which can be positive or negative depending on your trade direction and the applicable holding rate. Holding rates can be found in the ‘Product Overview’ for each instrument on the platform.

If you want to trade or view our price data for certain instruments, you will need to activate the relevant market data subscription– this monthly charge is only applicable for Australian and Hong Kong share CFDs on the platform and is refunded if you execute two or more trades under the same subscription during the subscription period.

You’re also able to roll forward positions over to keep a trade open beyond its expiry date. When you roll a forward position to the next contract, your profit or loss is realized and you enter the new trade at the mid-price, saving 50% on the spread cost.

Click on the 'Login' button on the top navigation and then click on the 'Live Account' button to go to the live account online application form. Use your demo account login details to get started and then follow the step-by-step instructions to complete the additional fields to apply for your live account.

To trade a share CFD or view the price data for that share, you'll first need to activate the market data subscription for the applicable country or group of countries that the share is based in. Depending on the country, there may be a monthly fee for the market data subscription.

The monthly fee, if applicable, will be debited from your account at the time you activate a market data feed. Please note that the market data fee for the full calendar month will be charged, irrespective of whether you activate or deactivate the market data subscription part way through the calendar month.

The market data fee will be converted into your account currency at our prevailing currency conversion rate, before being debited from your account. It's your responsibility to ensure that you have sufficient funds in your account to pay any market data fee.

You can view the current market data subscription fees from the settings menu in our trading platform.

New to CMC Markets?

CFDs give you access to a wide range of financial markets 24 hours a day, from Sunday nights through to Friday nights. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage.

One of the features of CFD trading is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it's important to manage your risk.

We’re fully authorised and regulated by CIRO and are a member of the Canadian Investor Protection Fund. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Our income comes mainly from our spreads, while other fees – such as overnight holding costs – make a minor contribution to our overall revenue.

We never aim to profit from our clients’ losses – this is simply not the way we want to do business. Our aim is to build long-term relationships with our clients by providing them with the best possible trading experience, through our technology and customer service.

Our clients usually offset each other’s trades, with some going long on a particular instrument while others are short. In this way, CMC Markets isn’t exposed to the profits or losses of clients trading that instrument. Occasionally, if a large number of our clients all trade in the same direction, we hedge in the underlying market to protect our exposure to risk.

Choose from a wide range of cash and forward instruments:

300+ forex pairs – EUR/GBP, EUR/USD, AUD/USD, GBP/USD, USD/JPY and more

60+ indices – UK 100, Germany 40, US 30, US SPX 500, Australia 200 and more

90+ commodities – including Gold, Brent and West Texas crude oil, Silver, Natural Gas

9,000+ shares & ETFs - Apple, Netflix, Lloyds, Rio Tinto, BP, Tesco, Amazon, Google and more

30+ treasuries & bonds – including UK Gilt, Euro Bund, Euribor, US T-Bond, US T-Note 10 YR

View the full list on the platform

Yes, we offer a free demo account, with $10,000 in virtual funds, which allows you to try out our platform, practice placing trades, and experiment with trading strategies and techniques – all in a risk-free environment.

To open a demo account, you just need to enter your email address and a password. Once you’ve opened your demo account, we’ll send a verification link to your registered email address. Simply click or tap the link to activate your account, and that’s it. You can start using your demo account.

Ready to get started?

Start trading with a live account today or try a demo with $10,000 of virtual funds.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.

1 This data is provided for general information only and may not be current. Please refer to the product overview area of our trading platform for real-time information on the spreads, margin rates, commission (as applicable) and trading hours of a particular product.